- Home

- »

- Medical Devices

- »

-

Caspofungin Market Size, Share And Growth Report, 2030GVR Report cover

![Caspofungin Market Size, Share & Trends Report]()

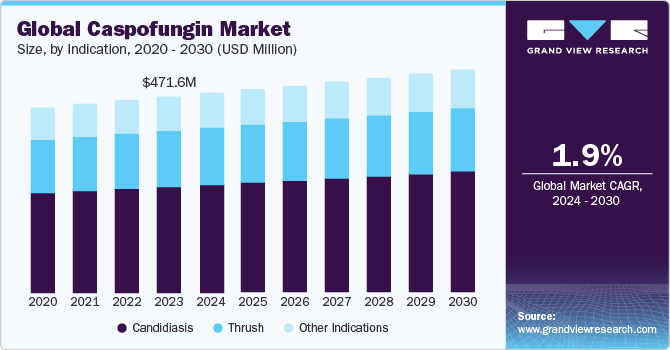

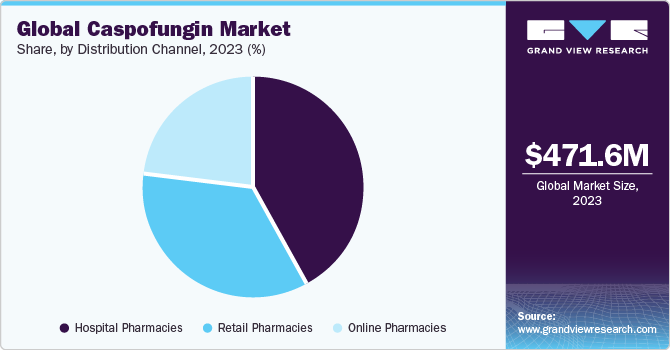

Caspofungin Market Size, Share & Trends Analysis Report By Indication (Candidiasis, Thrush, Other Indications), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-176-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Caspofungin Market Size & Trends

The global caspofungin market size was valued at USD 471.57 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 1.9% from 2024 to 2030. The rising prevalence of candidiasis, usage of echinocandins, public awareness regarding preventive measures for various microbial infections, and demand for effective anti-fungal therapies are expected to drive the global caspofungin market. Moreover, rising geriatric population base highly susceptible to candidemia and severe aspergillosis is further expected to fuel market growth.

According to research from the Centers for Disease Control and Prevention (CDC) that was released in February 2021, over one-third of people with advanced HIV infection also had oral and throat candidiasis. A similar source's post on vaginal candidiasis from July 2022 estimates that 1.4 million visits to hospitals for vaginal candidiasis take place in the US each year. As a result, the market is expected to expand due to the increasing incidence of candidiasis infection.

The COVID-19 pandemic disrupted healthcare systems around the globe since resources had to be shifted to concentrate on combating and curing COVID-19. The caspofungin market was also affected by the pandemic. For instance, according to a National Center for Biotechnology Information (NCBI) article from July 2022, patients with COVID-19 have a fungal co-infection at a rate ranging from 3.2% to 69%, and patients with underlying hematological conditions are more likely to get the infection. Patients with severe COVID-19 as well as those with COVID-19 with an underlying hematological condition may benefit from treatment with caspofungin. As a result, the COVID-19 epidemic raised the need for caspofungin medications. In the current situation, the demand for caspofungin therapeutics might decline compared to the early stages of the pandemic owing to the widespread availability of other medications for COVID-19 treatment; nevertheless, due to the increasing incidence of numerous chronic diseases, the market is anticipated to have a considerable rise during the forecast period.

The market is expected to increase at a faster rate after caspofungin was approved as a first line of treatment for people with invasive candidiasis that seems resistant to other antifungal medications. The Infectious Diseases Society of America published a study in February 2020 stating that Candida auris is antibiotic-resistant and is now a global health problem. Serious C. auris epidemics can be managed using caspofungin. For instance, caspofungin (70 mg dose) may be used to treat adult C cruise infection, according to a July 2021 article about Candida auris from the Centers for Disease Control and Prevention (CDC). Thus, the rising usage of caspofungin to treat diabetes as well as other forms of candidiasis, including peritonitis, intra-abdominal abscesses, and pleural space, is expected to drive segment growth throughout the forecast period.

Indication Insights

Based on the indication, the caspofungin market is segmented into candidiasis, thrush, and other indications. The candidiasis segment held the largest market share in 2023. The Centers for Disease Control and Prevention (CDC) reported in 2022 that among individuals aged 60 and up, Candida is the fourth most common source of bloodstream infection. Moreover, a rise in the incidence of esophageal candidiasis in males and vaginal yeast infections in women is responsible for the lucrative growth of the market.

For instance, according to a study published in the Asian Journal of Medical Sciences in October 2021, non-albicans candida prevalence was 08.89% and was steadily rising in India. According to a Journal Metrics article from August 2021, there has also been a rise in the number of senior Brazilians who have oral candidiasis. thus, it is anticipated that the incidence of candidiasis infection would increase globally.

Distribution Channel Insights

The market is categorized into hospital pharmacies, retail pharmacies, and online pharmacies based on the distribution channels used. Hospital pharmacies are expected to hold the largest share of the market in 2023.

The number of hospital visits has increased as mycosis prevalence in the senior population has grown. This in turn is projected to accelerate the segment's growth.

Regional Insights

North America will remain the leader in the global caspofungin market throughout the forecast period. This dominance is mostly caused by growing rates of vulvovaginal, vaginal, and fungal infections (candidiasis caused by changes in lifestyles and an increase in stress). Owing to the massive geriatric population in the US, there is an increase in the prevalence of candidemia and invasive aspergillosis. In the mouth and throat candidiasis afflicted almost one-third of patients with advanced HIV infection, according to a Centers for Disease Control and Prevention (CDC) study released in February 2021. In the US, an estimated 1.4 million outpatient visits for vaginal candidiasis take place each year, according to a piece on the condition written by the same source and released in July 2022.

Key Companies & Market Share Insights

Key players operating in the market are Fresenius SE & Co. KGaA (Fresenius Kabi), Cipla Inc., Juno Pharmaceuticals, Merck & Co., Inc., Sanofi S.A., Athenex, Inc., Stanex Drugs and Private Limited, Gland Pharma Limited, Alvogen Inc., and Sun Pharmaceutical Industries Ltd. The key players in the market undertake various strategic initiatives, such as new product launches, partnerships, mergers, and acquisitions.

-

In March 2023, Cidara Therapeutics and Melinta Therapeutics got FDA approval for rezzayo, a rezafungin for injection for the management of candidemia and severe candidiasis.

-

In July 2022, Cidara Therapeutics, Inc. proposed a New Drug Application to the U.S. FDA for rezafungin for the management of candidemia and invasive candidiasis. This study concluded that the current standard of therapy, caspofungin, dosed once daily, was statistically superior to rezafungin dosed once weekly.

-

In April 2022, Cidara Therapeutics, Inc. and Mundipharma released the results of the Phase 3 ReSTORE clinical trial of rezafungin for the treatment of candidemia and severe candidiasis, it showed that the drug had a favorable safety and effectiveness profile.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."