- Home

- »

- Consumer F&B

- »

-

Cashew Nut Snacks Market Size, Industry Report, 2030GVR Report cover

![Cashew Nut Snacks Market Size, Share & Trends Report]()

Cashew Nut Snacks Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Roasted Cashew Nut Snacks, Salted Cashew Nut Snacks), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-492-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cashew Nut Snacks Market Summary

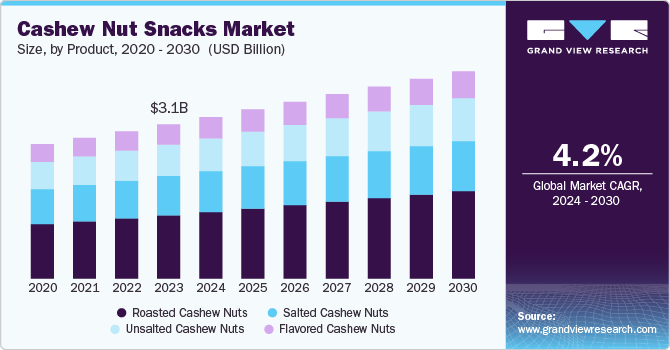

The global cashew nut snacks market size was estimated at USD 3,230.0 million in 2024 and is predicted to reach USD 4,145.0 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The increasing consumer awareness regarding health and nutrition is a significant driver of the cashew nut snacks market.

Key Market Trends & Insights

- The North America cashew nut snacks market is expected to grow at a CAGR of 3.7% over the forecast period.

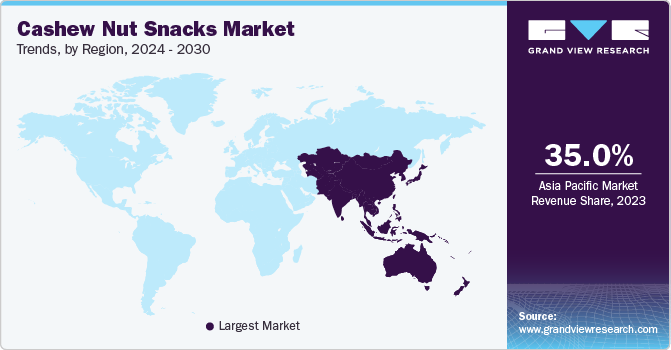

- Asia Pacific cashew nut snacks market accounted for approximately 35% of the global market in 2023.

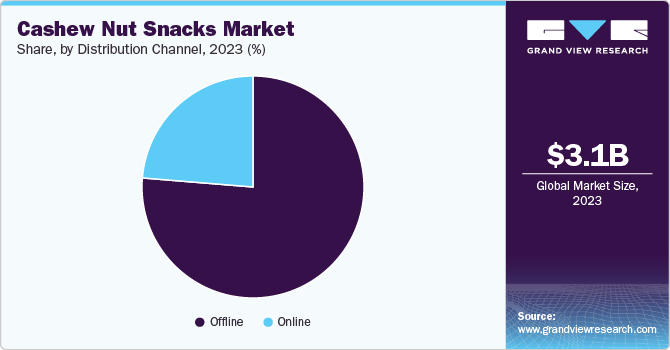

- The offline distribution of cashew nuts snacks accounted for a market revenue of USD 2354.5 million in 2023.

- The online sales of cashew nut snacks are expected to grow at a CAGR of 3.6% from 2024 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 3,230.0 Million

- 2030 Projected Market Size: USD 4,145.0 Million

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2023

Cashews are recognized for their rich nutritional profile, which includes high levels of protein, healthy fats, vitamins, and minerals. This has led to a rising demand for healthier snack options as consumers shift away from traditional snacks, often high in sugar and unhealthy fats. The health benefits of cashew nuts, such as cholesterol reduction and cardiovascular health support, further bolster their appeal as a nutritious snack choice.

The cashew nut snacks market is also benefiting from continuous product innovation. Manufacturers are diversifying their offerings by introducing flavored cashew nuts, organic varieties, and products incorporating cashews into other snack formats such as bars and trail mixes. This innovation caters to diverse consumer tastes and enhances cashews' versatility in various culinary applications. The introduction of unique flavors and combinations has attracted a broader audience, particularly among younger consumers who seek novel snacking experiences.

The expansion of distribution channels has significantly contributed to the growth of the cashew nut snacks market. With the rise of e-commerce platforms and specialty food stores, consumers have greater access to various cashew products than ever before. Retailers are increasingly stocking cashew-based snacks, making them more accessible to health-conscious consumers. This increased availability is crucial in driving sales, allowing brands to reach wider audiences across different regions.

The global demand for cashew nuts is notably strong in Europe and North America. Countries such as Germany lead in European consumption due to a growing preference for organic and health-oriented products. The presence of major companies involved in processing and packaging cashews enhances market dynamics, contributing to steady consumption growth. In North America, healthier snacking options continue to drive up demand for cashew nuts as consumers seek alternatives that align with their dietary preferences.

The COVID-19 pandemic has also accelerated trends toward healthier eating habits. During this period, many consumers have shifted their focus toward natural ingredients and functional foods that support overall well-being. This shift has increased interest in snacks made from nuts, including cashews, as they are perceived as healthier options than processed snacks.

A key challenge for the cashew nut snacks market is the intense competition from alternative plant-based snacks. As consumer preferences shift towards healthier options, other nuts like almonds and peanuts are gaining popularity due to their lower price points and perceived health benefits. This competition can limit the market share for cashew snacks, especially in price-sensitive regions where consumers may opt for more affordable alternatives. In addition, the cashew processing industry often struggles with limited access to raw materials and financing, which can hinder production capabilities and innovation in product offerings. These factors combined create a challenging environment for the cashew snacks market, necessitating strategic adaptations from producers to maintain competitiveness and profitability.

Product Insights

Roasted cashew nut snacks were the most significant product in the market and accounted for 1265.5 million in 2023. Roasted cashew snacks have gained traction as they offer a satisfying crunch and enhanced flavor compared to raw varieties. The roasting process improves taste and increases the product's shelf life, making it a popular choice among consumers looking for long-lasting snacks. In addition, roasted cashews can be seasoned with various spices and coatings, catering to diverse palates and dietary preferences. This adaptability has made roasted cashews a staple in many households and snack brands, contributing to their robust market growth.

Salted cashew nut accounted for a little over 20% of the market in 2023. As busy lifestyles lead individuals to seek quick snacks, salted cashews provide a portable, ready-to-eat option that seamlessly fits into on-the-go routines. In addition, the rich flavor profile of salted cashews enhances their appeal as a versatile ingredient in various culinary applications, from party mixes to gourmet dishes, further driving demand in retail and food service channels. This combination of convenience, taste, and versatility positions salted cashews as a popular choice among consumers, contributing significantly to the overall growth of the cashew nut snacks market.

Unsalted cashew nut snacks are expected to grow at a CAGR of 4.5% from 2024 to 2030. The versatility of unsalted cashew nuts snacks contributes to their market growth. They are increasingly used as ingredients in various culinary applications, from salads and trail mixes to baked goods and dairy alternatives. This adaptability allows consumers to incorporate unsalted cashews into their meals and snacks without the added flavoring that might overwhelm other ingredients. Furthermore, the demand for clean-label products containing minimal processing and no artificial additives has surged, positioning unsalted cashews favorably within this market segment. Consumers prioritize transparency and quality in food choices, so unsalted cashews are well-positioned to meet these evolving preferences.

Flavored cashew nut snacks have been gaining some traction in the past decade. The demand for flavored cashew snacks increases as consumers seek novel and healthful options. This segment benefits from the trend toward unique taste experiences, with manufacturers introducing a variety of flavors, including spicy, sweet, and savory profiles. As consumers become more adventurous in their snacking choices, flavored cashews provide an appealing alternative to traditional snacks. This diversification not only attracts a broader audience but also allows brands to differentiate themselves in a competitive market, driving overall growth in this category

Application Insights

Household consumption of cashew nut snacks accounted for a market of USD 1714 million in 2023. In households, the demand for cashew nut snacks is driven by consumers' increasing health and wellness awareness. As families seek nutritious snack options, cashews are often favored for their rich nutritional profile, which includes healthy fats, protein, and essential vitamins. The convenience of ready-to-eat cashew snacks appeals to busy households looking for quick yet healthy alternatives to traditional snacks. In addition, the versatility of cashews allows them to be used in various culinary applications, from baking and cooking to snacking, further enhancing their appeal in everyday meal preparation.

Foodservice usage of cashew nut snacks is expected to grow at a CAGR of 3.8% from 2024 to 2030. The food service industry is witnessing growth in the use of cashew nut snacks as restaurants and cafes increasingly incorporate them into their menus. The rising consumer preference for healthy dining options and plant-based ingredients fuels this trend. Cashews are often used in salads, as toppings for desserts, or blended into sauces and dressings, providing a rich flavor and texture. Moreover, the growing popularity of vegan and vegetarian diets has led many food service establishments to seek plant-based ingredients such as cashews to cater to these dietary preferences. This shift towards healthier menu offerings attracts a broader customer base and enhances the overall dining experience.

In industrial applications, cashew nut snacks are gaining traction due to their versatility as an ingredient in various processed food products. The rise in demand for plant-based protein sources has prompted manufacturers to incorporate cashew nuts into snack bars, dairy alternatives, and baked goods. In addition, using cashew nut derivatives in non-food industries-such as cosmetics and pharmaceuticals-further drives their market growth. The increasing focus on sustainability and clean-label products among consumers has encouraged manufacturers to explore innovative uses for cashews in food processing, expanding their application scope across different sectors. This multifaceted demand from industrial users positions cashew nuts as a valuable ingredient in both food and non-food markets.

Distribution Channel Insights

The offline distribution of cashew nuts snacks accounted for a market revenue of USD 2354.5 million in 2023. Offline distribution channels, mainly supermarkets, and hypermarkets, remain vital for the cashew nut snacks market due to their extensive reach and ability to provide consumers with a tactile shopping experience. These retail formats allow customers to explore various product offerings, compare brands, and take advantage of promotional deals that encourage bulk purchases. Supermarkets often feature dedicated sections for healthy snacks, including cashews, enhancing product visibility and accessibility. In addition, convenience stores are essential in catering to on-the-go consumers seeking quick snack options. As manufacturers expand their presence in these physical retail spaces, they can leverage attractive packaging and in-store marketing strategies to capture consumer attention, ultimately contributing to the sustained growth of cashew nut snacks.

The online sales of cashew nut snacks is expected to grow at a CAGR of 3.6% from 2024 to 2030. The growth of online distribution channels is a major driver for the cashew nut snacks market, largely fueled by the increasing penetration of e-commerce and changing consumer shopping habits. As more consumers turn to digital platforms for their grocery needs, online retailers provide a convenient way to access a wide variety of cashew products, including flavored, unsalted, and organic options. This shift is particularly appealing to health-conscious consumers who prefer to read product labels and compare nutritional information before making a purchase. In addition, the ability to offer subscription services and bulk purchasing options enhances customer loyalty and encourages repeat purchases. The rise of social media marketing and influencer partnerships further amplifies brand visibility online, attracting a broader audience and driving sales growth in the cashew snack segment.

Regional Insights

The North America cashew nut snacks market is expected to grow at a CAGR of 3.7% over the forecast period. This substantial share is driven by a strong demand for healthy snack options, with consumers increasingly looking for nutritious alternatives to traditional snacks. The popularity of cashew nuts in various forms, including whole, roasted, and flavored varieties, has contributed to this growth. In addition, the rising awareness of the health benefits of cashew nuts, such as their high levels of healthy fats and essential nutrients, has further fueled consumption in this region.

U.S. Cashew Nut Snacks Market Trends

The U.S. cashew nut snacks market is expected to exceed USD 750 million in 2023. The expansion of plant-based diets in the U.S. has significantly boosted the demand for cashew nuts, particularly in dairy alternatives and vegan products. As more consumers adopt vegetarian or vegan lifestyles, cashews serve as an excellent source of plant-based protein, offering a nutritious alternative to animal products. This shift towards plant-based eating enhances the appeal of cashews and positions them as a staple ingredient in various food products, contributing to the overall market growth.

Asia Pacific Cashew Nut Snacks Market Trends

Asia Pacific cashew nut snacks accounted for approximately 35% of the global market in 2023. The Asia Pacific region is projected to experience the fastest growth in the cashew nut snacks market, with expectations for a significant increase in market share over the coming years. This growth can be attributed to the rising use of cashew nuts in various cuisines across countries like India, China, and Thailand. The increasing incorporation of roasted cashews in baked goods and other culinary applications is also driving demand. As more consumers embrace plant-based diets and seek nutritious snack options, the Asia Pacific region is poised to capitalize on these trends, enhancing its position in the global market.

Europe Cashew Nut Snacks Market Trends

Europe is another key player in the cashew nut snacks market, with countries such as Germany leading in consumption. The European market is anticipated to grow due to a rising intake of healthy snacks and an increasing application of cashews in food and beverage products. The demand for organic and clean-label products is particularly strong in this region, driving manufacturers to innovate and expand their offerings. As consumers continue to prioritize health and wellness, Europe is expected to see a notable surge in cashew nut consumption.

Key Cashew Nut Snacks Company Insights

Key companies in the cashew nut snacks market include Nestlé S.A., Kraft Heinz Company, Archer Daniels Midland Company, and Olam International. These companies leverage their extensive distribution networks and brand recognition to capture significant market shares. For instance, Nestlé's Planters brand is well-known for its nut products, while Olam International plays a critical role in sourcing and processing cashews globally. In addition to established brands, numerous emerging companies and local producers are gaining traction in the market. Brands such as Kalbavi Cashews, Delicious Cashew Co., and Nutty Yogi focus on niche segments such as organic or health-focused products. The rise of e-commerce has allowed these smaller brands to reach broader audiences by selling directly to consumers online.

Key Cashew Nut Snacks Companies:

The following are the leading companies in the cashew nut snacks market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- Archer Daniels Midland Company

- Bunge Limited

- The Kraft Heinz Company

- John B. Sanfilippo & Son Inc.

- Vietnam Cashew Corporation (VINACAS)

- Lien Anh Co. Ltd

- Haldiram Foods International Private Limited

- Alphonsa Cashew Industries

- Diamond Foods LLC

- Emerald Nuts LLC

- Aurora Products Inc.

- Aryan Food Ingredients Limited

- CBL Natural Foods Private Limited

- Nutsco Inc.

Cashew Nut Snacks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,382.5 million

Revenue forecast in 2030

USD 4,145.0 million

Growth rate (revenue)

CAGR of 4.2% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Nestlé S.A.; Archer Daniels Midland Company; Bunge Limited; The Kraft Heinz Company; John B. Sanfilippo & Son Inc.; Vietnam Cashew Corporation (VINACAS); Lien Anh Co. Ltd; Haldiram Foods; International Private Limited; Alphonsa Cashew Industries; Diamond Foods LLC; Emerald Nuts LLC; Aurora Products Inc.; Aryan Food Ingredients Limited; CBL Natural Foods Private Limited; Nutsco Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

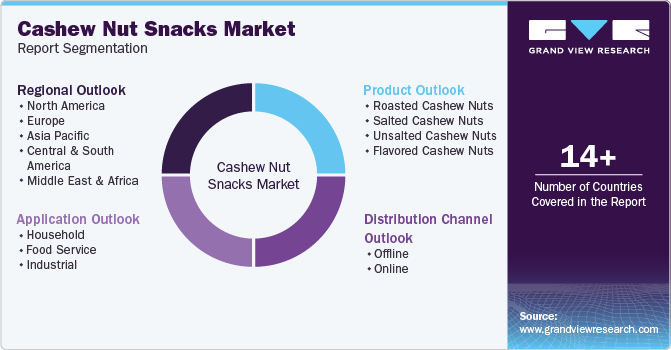

Global Cashew Nut Snacks Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cashew nut snacks market report based on product, application, distribution channel, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Food Service

-

Industrial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Roasted Cashew Nuts

-

Salted Cashew Nuts

-

Unsalted Cashew Nuts

-

Flavored Cashew Nuts

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cashew nut snacks market was valued at USD 3,085 million in 2023.

b. The global cashew nut snacks market is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030.

b. Roasted cashew nut snacks were the most significant product in the market and accounted for 1265.5 million in 2023. Roasted cashew snacks have gained traction as they offer a satisfying crunch and enhanced flavor compared to raw varieties. The roasting process improves taste and increases the product's shelf life, making it a popular choice among consumers looking for long-lasting snacks. Additionally, roasted cashews can be seasoned with various spices and coatings, catering to diverse palates and dietary preferences.

b. • Nestlé S.A. • Archer Daniels Midland Company • Bunge Limited • The Kraft Heinz Company • John B. Sanfilippo & Son Inc. • Vietnam Cashew Corporation (VINACAS) • Lien Anh Co. Ltd • Haldiram Foods International Private Limited • Alphonsa Cashew Industries • Diamond Foods LLC • Emerald Nuts LLC • Aurora Products Inc. • Aryan Food Ingredients Limited • CBL Natural Foods Private Limited • Nutsco Inc.

b. The increasing consumer awareness regarding health and nutrition is a significant driver of the cashew nut snacks market. Cashews are recognized for their rich nutritional profile, which includes high levels of protein, healthy fats, vitamins, and minerals. This has led to a rising demand for healthier snack options as consumers shift away from traditional snacks, often high in sugar and unhealthy fats. The health benefits of cashew nuts, such as cholesterol reduction and cardiovascular health support, further bolster their appeal as a nutritious snack choice.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.