- Home

- »

- Next Generation Technologies

- »

-

Cash Logistics Market Size, Share, Trends Forecast, 2030GVR Report cover

![Cash Logistics Market Size, Share & Trends Report]()

Cash Logistics Market (2022 - 2030) Size, Share & Trends Analysis Report By Service, By End Use (Financial Institutions, Government Agencies, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-945-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global cash logistics market size was valued at USD 23.03 billion in 2021 and is expected to expand at a CAGR of 8.2% from 2022 to 2030 as there is an alarming need for safety in cash handling practices. Factors such as the growing cash transactions, rise in the demand for the presence of ATMs, and surge in demand for the cash vaults are the major factors boosting the global logistics market. Additionally, an increase in the number of ATMs by banks in the urban as well as the rural areas to offer better services to the customer is also expected to create lucrative growth opportunities for the market over the forecast period. Subsequently, the cash needs to be moved periodically, and hence its safe and reliable transportation is of huge concern. Therefore, automated processes play a significant role in resolving challenges in logistics.

Companies are developing Al-based ATM security software to increase accuracy in cash replenishment services. At the same time, organizations are developing intelligent vaults for cash management solutions for improved efficiency and security. For instance, in January 2020, NatWest, in partnership with G4S, a cash management company, launched an intelligent vault to enhance the cash management process for businesses.

Customers worldwide prefer cash as a payment option owing to the convenience factor. With the technological advancements, customers are seeking reliable, faster, secure, and convenient means of accessing cash. Moreover, improved security measures, including one-time password authentication and biometric systems to prevent fraud, and the advent of Smart ATMs for users with special needs are propelling the growth of the market. The increase in demand for automation in the banking sector of several developed and emerging countries is expected to fuel the deployment of ATMs.

Several market players are focusing on integrating Artificial Intelligence (AI), biometric technology, and IoT to offer a seamless payment experience. For instance, in July 2021, CaixaBank, a financial technology company, introduced facial recognition technology in ATMs, which eliminated the need for the customer to enter the pin. CaixaBank facial recognition technology uses 16,000 different security points on the image of the face to ensure 100% accurate identification. CaixaBank is also planning to deploy the ATMs in the coming days.

Major opportunities such as the development of technological infrastructure to maintain transparency during cash handling operations are creating immense opportunities. On the contrary, security threats such as theft and robbery during transit operations have created major security challenges for these companies. In addition, high overheads occur in maintaining an efficient logistical process throughout a financial year. In another scenario, the complex nature of compliance and regulations coupled with the increasing adoption of digital money is more likely to hinder the market growth.

COVID-19 Impact Analysis

The COVID-19 pandemic has adversely impacted the market. Continuously changing travel and transportation restrictions have created uncertainty by slowing down the logistics services. An unprecedented surge in demand for contactless payments was observed, leading to a decline in cash usage. Moreover, after facing challenges such as supply chain disruption, demand fluctuations, and other pressing concerns in 2020, companies are focusing on strategies such as modifying the R&D activities and product portfolios, investing in capital expenditures, and mergers & acquisitions.

Service Insights

The Cash-in-Transit (CIT) segment dominated the market in 2021 and accounted for over 38.0% share of the global revenue. The major driving factors include lower cash transport fees for deliveries and pickup, increased cash flow security, and remote monitoring of cash with real-time reporting. The trend of outsourcing transport activities lately conducted by CIT companies is gaining a high momentum. Although the CIT segment is expected to attain maturity, it is witnessing a rise in the number of vendors offering logistics services at variable standards.

Cash management is expected to account for a high CAGR in the coming years owing to high awareness in organizations to manage and improve their liquidity. Also, these services focus on the safe management and transport of valuables and currency for banks, retailers, and financial institutions. Currency demand from business suppliers and retailers to serve day-to-day business is substantial, and there occurs a need for effective management of cash handling. Subsequently, deposit kiosks and ATMs can therefore reduce the lead time for both banks and suppliers.

End-use Insights

The financial institutions segment dominated the market in 2021 and accounted for over 41.0% share of the global revenue. Financial institutions segment accounted for the highest share owing to initiatives undertaken by organizations to strengthen the financial supply chain. Intense competition and a fast-changing business environment have a huge influence on the segment’s growth. The trend of credit and loans in form of microfinance is gaining traction in developing economies thereby driving cash demand. Hence, microfinance institutions also have a huge contribution to the mainstream.

The government agencies segment is expected to witness lucrative growth in the years to come. Government agencies are focused on adopting cash logistics solutions to provide improved customer experience by incorporating innovative technologies such as artificial intelligence and machine learning capabilities. In addition, the high rate of cash influx occurring on a day-to-day basis triggers the growth of government agencies segment.

Regional Insights

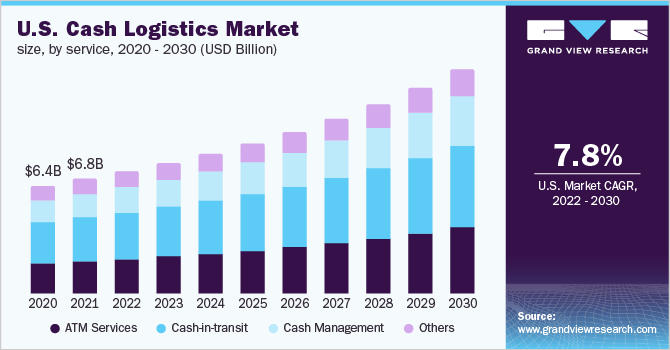

North America dominated the buy now pay later market in 2021 and accounted for over 32.0% of the global revenue. For instance, in May 2020, according to the Federal Reserve System of the U.S., there was USD 1.87 trillion worth of Federal Reserve notes in circulation. This increased circulation of cash in prominent economies such as the U.S and Canada has created the need for cash logistics services such as cash-in-transit, cash management, and ATM services among others which is fueling the growth of the cash logistics market.

Asia Pacific is an emerging market and is expected to maintain rapid growth in the years to come owing to consumer focus on cash for day-to-day purchases such as food, petrol, groceries, etc. The demand for cash logistics solutions is increasing in the region owing to the emerging banking facilities in India, China, and Japan. Various factors such as growing cash usage, increased ATM installation, and increased purchasing power is expected to drive the market. Mergers and acquisitions under a centralized banking system are expected to create several opportunities to maintain a steady cash flow, particularly in Indian markets.

Key Companies & Market Share Insights

Companies are focusing on implementing strategies, such as the development of new formulations, partnerships & distribution agreements, and regional expansion to increase their revenue share. Vendors are consistently focusing on innovations to differentiate and personalize their service offerings for potential customers. The vendors are investing in R&D activities for innovating and updating their services.

The companies are focusing on designing customized services to meet the cash and valuables supply chain needs of their customers. Cash management solution providers are acquiring ATM service-providing companies to expand their reach. For instance, in April 2021, Brink's Company, a cash management solution company, announced the acquisition of PAI, Inc., a U.S.-based privately-owned ATM services provider, for USD 213 million to expand its reach in the U.S. Some prominent players operating in the cash logistics market include:

-

Brink's Incorporated

-

Cash Logistik Security AG

-

CMS Info Systems Ltd.

-

G4S Limited

-

GardaWorld

-

Global Security Logistic Co.

-

Security and Intelligence Services Ltd.

-

Loomis AB

-

Prosegur

-

Cash in Transit Solutions Pty Ltd

Cash Logistics Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 24.63 billion

Revenue forecast in 2030

USD 46.36 billion

Growth rate

CAGR of 8.2% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; China; India; Japan; Brazil

Key companies profiled

Brink's Incorporated; Cash Logistik Security AG; CMS Info Systems Ltd.; G4S Limited; GardaWorld; Global Security Logistic Co.; Security and Intelligence Services Ltd.; Loomis AB; Prosegur; Cash in Transit Solutions Pty Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at regional and country levels, and provides an analysis on the latest industry trends in each of the sub-segments from 2022 to 2030. For this study, Grand View Research has segmented the global cash logistics market report based on service, end use, and region.

-

Service Outlook (Revenue, USD Billion; 2017 - 2030)

-

ATM Services

-

Cash-in-transit

-

Cash management

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Financial Institutions

-

Government Agencies

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global cash logistics market size was estimated at USD 23.03 billion in 2021 and is expected to reach USD 24.63 billion in 2022.

b. The global cash logistics market is expected to grow at a compound annual growth rate of 8.2% from 2022 to 2030 to reach USD 46.36 billion by 2030.

b. North America dominated the cash logistics market with a share of 32.03% in 2021. This is attributable to the availability of logistical infrastructure supplementing the financial supply chain and bank productivity.

b. Some key players operating in the cash logistics market include Loomis AB, Cash Logistics Security AG, Brink’s Incorporated, CMS Info Systems Ltd, Global Security Logistics Co., and G4S Limited.

b. Key factors that are driving the cash logistics market growth include growth in circulation of cash and increasing deployment of ATMs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.