Case Management Software Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Mode, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-439-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Case Management Software Market Trends

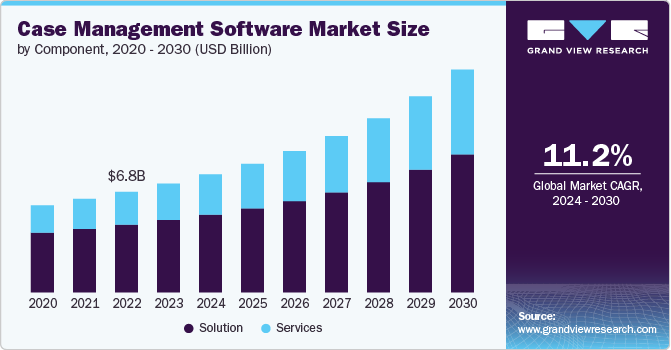

The global case management software market size was estimated at USD 7.32 billion in 2023 and is anticipated to grow at a CAGR of 11.2% from 2024 to 2030. The market is experiencing significant growth, driven by the increasing adoption of digital tools in healthcare and the rise in demand for streamlined workflow solutions across industries. The growing need for efficient healthcare case management solutions to handle complex patient cases and regulatory compliance and the surge in demand from enterprises for automated workflows to enhance customer service and reduce operational costs are pushing organizations to adopt advanced case management software, raising innovation and expansion in the global market.

The increasing integration of artificial intelligence (AI) and machine learning (ML) in case management solutions is improving decision-making processes and boosting efficiency. Rising regulatory pressures across sectors such as banking, insurance, and government are pushing organizations to adopt case management systems for better compliance and risk management.

The market in the public sector is witnessing substantial growth, driven by the increasing need for efficient and transparent management of complex cases such as social services, legal matters, and public administration. Public sector organizations, often dealing with large volumes of citizens’ requests, welfare cases, and compliance requirements, are adopting case management solutions to streamline their operations and ensure timely service delivery. The pressure to improve accountability, enhance citizen engagement, and meet regulatory demands is pushing governments to implement digital tools that centralize case information and facilitate seamless communication across departments. In December 2023, in partnership with the U.S. Department of State’s Bureau of International Narcotics and Law Enforcement Affairs (INL), the Judiciary of Guyana introduced the Court Case Management System (CCMS). Developed by the National Center for State Courts in collaboration with Guyana's Judiciary, this system aims to modernize court operations by shifting from manual to automated case management. Implementing CCMS will enhance magistrates' courts' efficiency, transparency, and effectiveness, reducing case backlogs and delays while boosting public trust and confidence in the justice system.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 66.7% in 2023, due tothe increasing demand for customized case management software tailored to specific industries. Organizations across sectors such as legal, healthcare, insurance, and government need solutions that address unique case types, workflows, and compliance requirements. These tailored solutions allow businesses to streamline processes according to their specific operational needs, leading to greater efficiency and accuracy in case handling.

The services segment is anticipated to grow at the fastest CAGR over the forecast period.The integration of artificial intelligence (AI) and automation into case management software has led to increased demand for consulting services focused on implementing these technologies. Service providers specializing in AI-driven automation help organizations streamline repetitive tasks, optimize workflows, and introduce intelligent case routing and resolution. Companies in sectors like customer service and legal are particularly interested in leveraging AI for tasks such as document review, case triaging, and chatbot-driven customer interactions, creating a growing market for AI-related services in the case management space.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 60.1% in 2023.Advancements in data security and compliance have strengthened the appeal of cloud solutions. Cloud providers are enhancing their security protocols, offering encrypted data storage, automated backups, and compliance with industry regulations, such as GDPR and HIPAA. These improvements are addressing concerns that once held organizations back from adopting cloud-based case management systems, allowing for wider adoption across sectors such as healthcare, legal, and government services. For instance, in October 2023, Clarra, Inc, a U.S.-based practice management software provider unveiled its flagship legal case management SaaS application, specifically tailored for docket-driven litigation. This cloud-based platform offers a user-friendly solution aimed at helping law firms streamline the litigation lifecycle. Clarra, Inc addresses the need for accessible and cost-effective legal technology that aligns with the workflows of litigation.

The on-premise segment is anticipated to grow at the fastest CAGR over the forecast period.Many businesses prioritize data sovereignty, especially in regions where data localization laws are stringent. By keeping their case management software and data in-house, organizations can maintain full control over access and storage, minimizing the risk of data breaches.

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 57.9% in 2023. The growing emphasis on regulatory compliance and governance across industries such as healthcare, finance, and legal services is propelling the demand for advanced case management systems. Large enterprises often operate in highly regulated environments, where adherence to industry standards and legal requirements is critical. Case management software assists in ensuring compliance by automating processes, providing audit trails, and offering secure data management features. For instance, in August 2023, YoCierge, a U.S.-based provider of record retrieval services integrated with Neos, Assembly Software's legal case management platform, responds to the increasing demand for quick and comprehensive access to client medical records while enhancing staff productivity. This collaboration merges the strengths of both platforms, streamlining the connection between the medical and legal sectors. By enabling faster access to medical records, legal teams can accelerate case processing and achieve improved results for their clients.

The SMEs segment is anticipated to grow at the fastest CAGR over the forecast period, due to the growing adoption of cloud-based solutions. Cloud-based case management software offers scalability and cost-effectiveness, which are particularly attractive to SMEs with limited IT infrastructure and budgets. These platforms also enable remote access, allowing SMEs to operate more flexibly and accommodate modern workforce trends such as remote work.

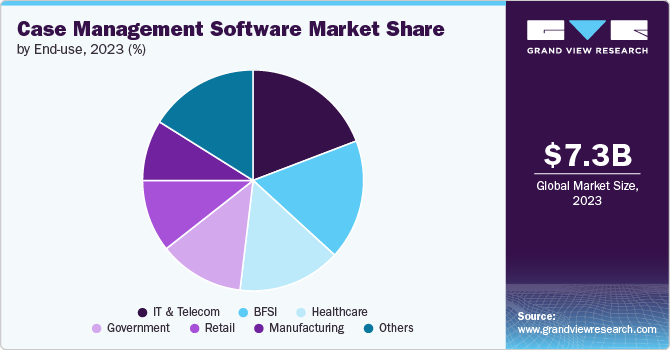

End-use Insights

Based on end use, the telecom and IT segment led the market with the largest revenue share of 19.2% in 2023.As telecom companies continue to expand their services and reach, managing a growing volume of customer interactions, complaints, and service requests becomes critical. Case management software offers a structured approach to streamline these processes, enabling faster issue resolution, improved customer satisfaction, and reduced operational costs.

The manufacturing segment is anticipated to grow at the fastest CAGR over the forecast period.The integration of AI and IoT into manufacturing processes is boosting the demand for advanced case management solutions. The combination of these technologies enables predictive maintenance, real-time monitoring, and automatic generation of cases for potential equipment failures or production issues. Therefore, manufacturers can prevent downtime, reduce operational risks, and improve overall efficiency. The growing trend toward smart factories and Industry 4.0 is expected to continue driving the adoption of case management software as manufacturers leverage technology to optimize operations and enhance decision-making processes.

Regional Insights

North America dominated the case management software market with the revenue share of 40.9% in 2023, owing to the increasing focus on regulatory compliance and risk management. North American industries such as healthcare and financial services, face stringent regulations and compliance requirements. Case management software plays a crucial role in ensuring adherence to these regulations by providing tools for tracking, managing, and documenting compliance-related activities. The need to mitigate risks and avoid costly penalties has led many organizations to adopt case management solutions that offer robust compliance tracking and reporting features.

U.S. Case Management Software Market Trends

The case management software market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030.The widespread digital transformation across various sectors, including healthcare, legal services, and government agencies is driving market growth. Organizations are increasingly adopting case management software to automate and streamline their processes. This shift toward automation helps reduce manual tasks, minimize errors, and improve overall efficiency.

Europe Case Management Software Market Trends

The case management software market in Europe is expected to grow at a significant CAGR of 10.6% from 2024 to 2030.European governments and public sector organizations are investing in case management software to modernize public services, improve efficiency, and enhance transparency. The push for digital transformation in the public sector is driving the adoption of case management solutions that support better case handling, data management, and citizen engagement.

Asia Pacific Case Management Software Market Trends

The case management software market in Asia Pacific is anticipated to grow at a significant CAGR of 13.6% from 2024 to 2030.The APAC region is undergoing significant digital transformation across various sectors, including healthcare, financial services, and public administration. Organizations are increasingly adopting case management software as part of their digital transformation strategies to improve efficiency, streamline operations, and enhance service delivery. For instance, in October 2023, SymphonyAI, a U.S.-based enterprise AI company launched the Sensa Investigation Hub, a platform designed to advance financial crime management for institutions in the Asia Pacific (APAC) region. The SENSA Investigation Hub leverages generative AI to offer a precise and accelerated approach to investigation and reporting. It provides an entity-centric view of risk and integrates seamlessly with existing financial crime detection systems, offering a unified risk overview, regulator-friendly auditing, and comprehensive transparency throughout the investigative process.

Key Case Management Software Company Insights

Key players operating in the global market includeIBM, Appian, Newgen Software Technologies Limited, and Pegasystems Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Case Management Software Companies:

The following are the leading companies in the case management software market. These companies collectively hold the largest market share and dictate industry trends.

- IBM

- AINS, LLC, DBA OPEXUS

- Appian

- Hyland Software, Inc.

- Microsoft

- Newgen Software Technologies Limited

- Pegasystems Inc.

- Salesforce, Inc.

- SAS Institute Inc.

- ServiceNow

Recent Developments

-

In March 2024, Appian, a U.S.-based cloud computing and enterprise software company announced the launch of Appian Case Management Studio. This AI-powered, modular designer enables users to build case management applications tailored to their business needs quickly. This tool helps teams integrate case data, systems, and personnel to streamline internal operations, customer service, employee onboarding, and regulatory compliance workflows. Offering features like drag-and-drop form creation, simplified data modeling, and easy workflow controls, the Case Management Studio allows for rapidly developing custom case management applications on the Appian Platform, supporting case management as a service (CMaaS) approach.

-

In November 2023, ServiceNow, a U.S.-based software company, partnered with AWS to enhance case management by integrating its Customer Service Management (CSM) platform with Amazon Connect. This collaboration aims to help businesses streamline contact center operations by leveraging AWS AI technology in ServiceNow workflows. Moreover, the partnership offers solutions for automotive manufacturing, cloud transformation, and supply chain management.

Case Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.94 billion |

|

Revenue forecast in 2030 |

USD 15.00 billion |

|

Growth rate |

CAGR of 11.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

IBM; AINS, LLC; DBA OPEXUS; Appian; Hyland Software, Inc.; Microsoft; Newgen Software Technologies Limited; Pegasystems Inc.; Salesforce, Inc.; SAS Institute Inc.; ServiceNow |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Case Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global case management software market report based on component, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Service

-

Managed Services

-

Professional Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Telecom and IT

-

Retail

-

Government

-

Healthcare

-

BFSI

-

Manufacturing

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global case management software market size was estimated at USD 7.32 billion in 2023 and is expected to reach USD 7.94 billion in 2024.

b. The global case management software market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 15.00 billion by 2030.

b. The case management software market in North America held the share of 40.9% owing to the increasing focus on regulatory compliance and risk management. North American industries such as healthcare and financial services, face stringent regulations and compliance requirements. Case management software plays a crucial role in ensuring adherence to these regulations by providing tools for tracking, managing, and documenting compliance-related activities.

b. Some key players operating in the case management software market include IBM; AINS, LLC, DBA OPEXUS; Appian; Hyland Software, Inc.; Microsoft; Newgen Software Technologies Limited; Pegasystems Inc.; Salesforce, Inc.; SAS Institute Inc.; ServiceNow

b. The market is experiencing significant growth, driven by the increasing adoption of digital tools in healthcare and the rise in demand for streamlined workflow solutions across industries. The growing need for efficient healthcare case management solutions to handle complex patient cases and regulatory compliance and the surge in demand from enterprises for automated workflows to enhance customer service and reduce operational costs are pushing organizations to adopt advanced case management software, raising innovation and expansion in the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."