- Home

- »

- Organic Chemicals

- »

-

Carnauba Wax Market Size, Share & Growth Report, 2030GVR Report cover

![Carnauba Wax Market Size, Share & Trends Report]()

Carnauba Wax Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Type 1, Type 3, Type 4), By Application (Cosmetics, Food, Automotive, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-178-8

- Number of Report Pages: 89

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carnauba Wax Market Size & Trends

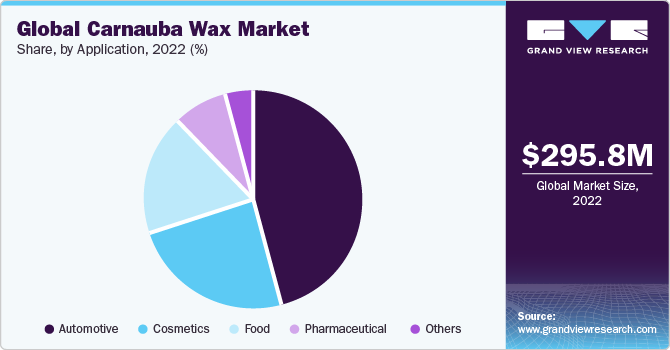

The global carnauba wax market size was valued at USD 295.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.4% from 2023 to 2030, due to the growing use of confectionery products. The demand for chewy confectionery such as jellies and chewing gums, primarily in Asia Pacific on account of increased consumption by the youth population, is expected to bolster the demand for carnauba wax over the forecast period.

The majority of manufacturers in the industry are based out of Brazil due to the abundance of raw materials in the region. The raw material suppliers are involved in the extraction of the wax from the leaves of the Brazilian palm tree at a location external to wax filtering and processing. The filtering and processing of the product are not capital-intensive, leading to low setup costs for the manufacturers in the domain. The extraction and processing are highly labor-intensive leading to a higher labor cost.

The market for carnauba wax is highly dependent on the continuous supply of raw material that is extracted from Brazilian palm trees from August to January. The raw material cost is less in the aforementioned period due to the lack of availability of other sources of employment for laborers. However, the process of crude wax extraction is primitive, with little emphasis on the deployment of advanced leaf drying techniques, leading to an increase in the overall extraction time.

The raw material suppliers incur the costs pertaining to the wages distributed to the workforce, transportation, and logistics cost, and a minimal cost of the equipment used for the extraction process. The operating cost of landholdings for the raw material suppliers varies with the type of ownership and the location of the land. The distributors in the industry operate with high distribution margins on account of price customizations in accordance with the distribution region. However, the margin shares are affected by the transportation cost accrued by the distributors.

The market for carnauba wax is expected to witness growth on account of the increasing demand for wax in food glazing and cosmetics products. The market is expected to witness sustained growth with a limited change in production levels over the forecast period.

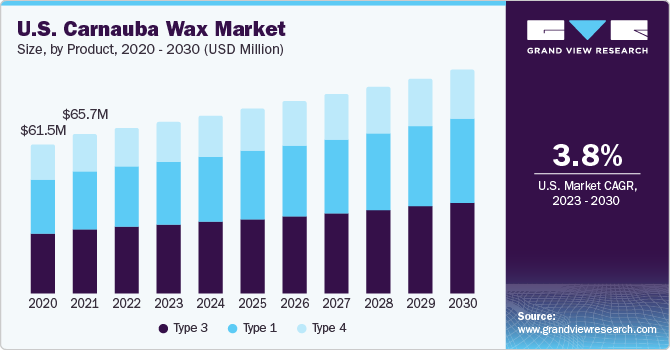

Product Insights

The market is segmented based on products into carnauba wax type 1, type 3, and type 4. The type 3 product segment dominated the market with a revenue share of 43.3% in 2022. Type 3 and type 4 wax are dark in color and find use in automotive applications, industrial polishes, and the leather tanning industry. It is also used in the cosmetics industry as an agent to impart gloss to various products such as lip colors and nail polishes. The demand for type 4 is expected to grow on account of increasing demand for the product as a mold release agent.

The type 1 product segment is expected to grow at the fastest CAGR of 3.8% over the forecast period. It is the purest form of the product and has high demand in niche applications such as pharmaceutical and food products. It is also used in the manufacturing of premium automotive wax formulations, which are used for enhancing the shine of automotive bodies and increasing their aesthetic appeal. Increasing demand for the product in fruit coatings is expected to drive the demand for the product.

Application Insights

The automotive application accounted for the largest revenue share of 45.6% in 2022 in the industry on account of high-demand premium shine wax. Carnauba wax is a natural wax that is used in car waxes to provide a high-gloss finish and protect the car's paint from UV rays, scratches, and other damage. The increasing demand for car waxes is driving the growth of the automotive application segment. The popularity of luxury cars is increasing, which is driving the demand for car waxes. Luxury cars are often made with high-quality paint that requires a special type of wax to protect them from damage. Carnauba wax is the ideal choice for protecting the paint of luxury cars.

The food application segment is expected to register the fastest CAGR of 3.7% during the forecast period due to the growing use of carnauba wax in confectionery and fruit coatings. Increasing demand for such products on account of growing disposable income is expected to drive the demand over the forecast period. The demand in the pharmaceutical industry is limited to its use in coating tablets and capsules for the timed release of drugs.

Regional Insights

Asia Pacific dominated the carnauba wax industry with a revenue share of 34.6% in 2022 and is also expected to witness the fastest CAGR of 4.0% over the forecast period. The growth is expected to be driven by increasing consumption of the product in Asia Pacific owing to rapid industrialization, which is leading to the development of various application industries in the region. Increasing demand for food glazing agents in the developing food and confectionery industry in China is expected to drive market growth in this region.

The demand for the product in North America and Europe is expected to be driven by the increasing use of automotive care waxes. The growth of the automotive care industry on account of increasing automotive sales coupled with the rising sales of pre-used cars is likely to translate into a high demand for the product.

Key Companies & Market Share Insights

The market has witnessed a gradual price increase on account of the attempts to increase the margins and revenues of the major manufacturers. Carnauba wax produced by the company is supplied and exported to the global markets through multiple distribution channels comprising wholesalers, suppliers, and distributors.

Recent Developments

-

In September 2022, Turtle Wax, a Chicago-based auto care company, announced its partnership with Carxotic & opened a co-branded automobile care studio in Mumbai. The store is located on Bhulabhai Desai Marg in Breach Candy and features a service crew as well as the latest Turtle Wax detailing tools.

-

In July 2021, Akrochem Corporation announced the acquisition of Bech Chem, a renowned worldwide chemical supplier. The new acquisition will aid the company's expansion into the coatings, paint & lubricant areas.

The following are some of the major participants in the global carnauba wax market:

-

FONCEPI- Comercial Exportadora Ltda.

-

Carnauba do Brasil Ltda

-

Brasil Ceras

-

Tropical Ceras Do Brasil Ltda.

-

Natural Wax

-

Pontes Industria de Cera ltda.

-

Strahl & Pitsch, Inc.

-

Kahl GmbH & Co. KG

-

Norevo GmbH.

-

Koster Keunen Holland

-

The International Group, Inc.

-

Frank B. Ross, Inc.

-

Poth Hille

-

Ter Hell & Co. GmbH

-

J. Allcock & Sons Ltd.

Carnauba Wax Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 305.3 million

Revenue forecast in 2030

USD 385.8 million

Growth rate

CAGR of 3.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2023 to 2030

Report coverage

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America (CSA); MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Russia; Netherlands; China; Japan; India; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

FONCEPI- Comercial Exportadora Ltda.; Carnauba do Brasil Ltda; Brasil Ceras; Tropical Ceras Do Brasil Ltda.; Natural Wax; Pontes Industria de Cera ltda.; Strahl & Pitsch, Inc.; Kahl GmbH & Co. KG; Norevo GmbH.; Koster Keunen Holland; The International Group, Inc.; Frank B. Ross, Inc.; Poth Hille; Ter Hell & Co. GmbH; J. Allcock & Sons Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

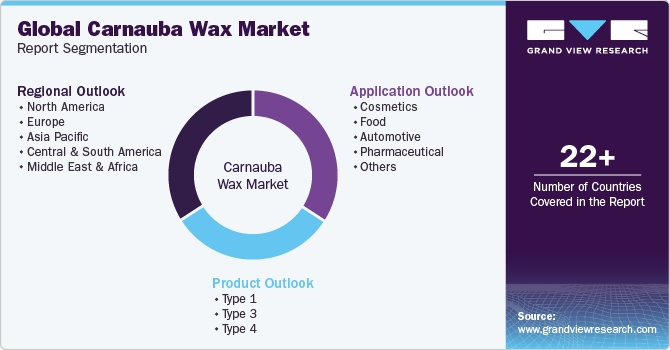

Global Carnauba Wax Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carnauba wax market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Type 1

-

Type 3

-

Type 4

-

-

Application Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Cosmetics

-

Food

-

Automotive

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global carnauba wax market size was estimated at USD 295.8 million in 2022 and is expected to reach USD 305.3 million in 2023.

b. The global carnauba wax market is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 385.8 million by 2030.

b. Asia Pacific dominated the carnauba wax market with a share of 34.6% in 2022. This is attributable to the rapid development of application industries such as food, cosmetics, automotive care, and industrial in the region. The demand for carnauba wax is expected to grow owing to an increase in the demand for sugar-based confectionery products coupled with growth in the demand for the cosmetics industry.

b. Some key players operating in the carnauba wax market include Foncepi comercial exportadora ltda, Brasil Ceras, Carnauba do Brasil, Pontes industria de Cera ltda., and Tropical Ceras do Brasil Ltda.

b. Key factors that are driving the carnauba wax market growth include the growing use of coating products such as confectionery, fruits, and automotive waxes, and increasing demand for glazed food products in developing economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.