- Home

- »

- Automotive & Transportation

- »

-

Cargo Inspection Market Size, Share & Growth Report, 2030GVR Report cover

![Cargo Inspection Market Size, Share & Trends Report]()

Cargo Inspection Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Physical Inspection, Non-Intrusive Inspection (NII), Documentation Verification), By Offering, By Inspection Phase, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-291-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cargo Inspection Market Size & Trends

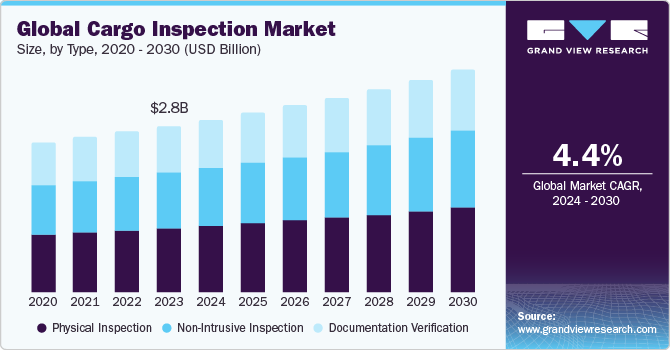

The global cargo inspection market size was estimated at USD 2,828.5 million in 2023 and is expected to register a CAGR of 4.4% from 2024 to 2030. The market is witnessing consistent expansion, propelled by several factors. Increasing global security concerns and stricter regulations on the movement of goods necessitate the implementation of comprehensive cargo screening protocols to detect contraband, explosives, and other threats. Governments across the globe are enforcing these inspections, thereby amplifying market demand. The increasing global trade volume, especially in industries like agriculture and energy, underscores the importance of robust threat detection and streamlined quality and quantity assessments. This ensures product compliance with safety and regulatory protocols, leading to increased cargo inspections.

In March 2024, the World Shipping Council (WSC) and the National Cargo Bureau (NCB) collaborated to develop a Cargo Safety Program. This program leverages a common screening tool, a verified shipper database, and a database of approved container inspection companies to proactively identify dangerous goods before shipment. This initiative is expected to enhance safety and efficiency within the shipping industry. Furthermore, increasing consumer awareness regarding product quality, especially for food and pharmaceuticals, fuels the demand for robust inspection procedures. Businesses, particularly in developed economies, rely on these services to guarantee the integrity and safety of imported goods.

In addition, technological advancements play a vital role in market growth. The integration of non-intrusive inspection technologies like X-ray scanners and advanced software streamlines the inspection process, making it faster and more efficient. This fosters market growth as efficiency becomes a key driver in the fast-paced logistics industry. However, the market faces challenges as stringent regulations can cause delays and increase costs for businesses. In addition, the global trade landscape can be volatile, with fluctuations in trade volumes impacting market growth. Despite these hurdles, the market is expected to witness continued expansion in the coming years, fueled by the growth drivers and the ever-evolving needs of the global trade ecosystem.

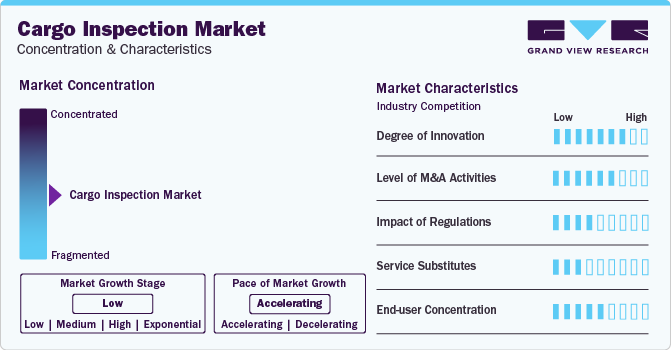

Market Concentration & Characteristics

In the cargo inspection market, the degree of innovation is a critical factor determining the competitiveness and effectiveness of inspection services. Innovation is paramount for maintaining a competitive edge and providing effective services. This encompasses technological advancements, process improvements, and novel approaches to freight assessment. Integrating Artificial Intelligence (AI) and machine learning (ML) can enhance accuracy and efficiency by minimizing human error. In addition, using Internet of Things (IoT) sensors allows real-time monitoring of cargo conditions, offering valuable insights into potential risks and deviations from established protocols. Companies prioritizing innovation stay ahead of the curve while providing clients with enhanced service reliability and robust quality assurance.

The level of M&A activities in the market reflects the industry's dynamics and competitive landscape. Companies employ strategic mergers and acquisitions to strengthen their market presence, diversify service offerings, or access modern technologies and expertise. Larger corporations acquire smaller firms to establish a foothold in niche markets or consolidate their overall market share. Conversely, smaller players seek mergers or partnerships to leverage resources and capabilities, enhancing their competitiveness. The extent of M&A activities indicates the market's maturity and the level of consolidation within the industry, shaping the competitive landscape and market positioning of participating firms.

Regulations play a profound role in the market, as the industry operates within a highly regulated environment focused on ensuring safety, security, and compliance with international trade standards. Regulations govern various aspects of cargo inspections, including customs procedures, safety protocols, and security measures. Changes in regulations, such as stricter import/export controls or the implementation of new security protocols, directly influence assessment practices and operational procedures. Maintaining compliance with regulatory requirements is mandatory and essential for maintaining trust and credibility with clients and regulatory authorities. Companies must stay abreast of regulatory developments and adapt their inspection processes accordingly, to ensure continued compliance and market competitiveness.

Service substitutes represent alternative solutions or technologies that may fulfill similar functions as traditional cargo inspection services. These substitutes can range from emerging technologies, such as remote sensing and blockchain-enabled tracking, to alternative service providers or manual inspections. While traditional methods remain prevalent, advancements in technology and evolving customer preferences drive the adoption of alternative solutions. Companies must continuously evaluate the efficacy and feasibility of these substitutes. This involves balancing cost-effectiveness with the need for reliability and accuracy in cargo assessment. Embracing innovation and exploring innovative technologies can position companies to capitalize on emerging opportunities and stay ahead of competitors offering conventional services.

Understanding the distribution of demand across industries for cargo inspection services is crucial. Certain industries, such as logistics, pharmaceuticals, and food & beverage, exhibit a higher concentration of users requiring these services due to specific regulatory requirements, safety considerations, or the inherent nature of their products. By catering to the unique needs and preferences of these concentrated user groups, companies can effectively tailor their service offerings and forge strategic partnerships with industry stakeholders. This enhances the value proposition while providing a competitive edge in the industry. Moreover, diversifying the client base can mitigate risks associated with over-reliance on a single sector and foster resilience in the face of market fluctuations or regulatory changes.

Type Insights

The physical inspection segment dominated the market and accounted for the largest revenue share of over 38% in 2023. Physical inspection, the traditional method of manually examining shipments for damage, quality, and compliance, remains a vital segment of the market. While technological advancements are fostering growth in areas like X-ray scanning, physical inspection offers a cost-effective solution for low-risk goods and continues to be mandated for certain commodities. Moreover, the growing focus on anti-counterfeiting measures necessitates a human element to detect subtle discrepancies. As a result, the segment is expected to maintain steady growth, complementing rather than being replaced by, technological innovations in the overall market.

The non-intrusive inspection (NII) segment is expected to register the highest CAGR of 5.0% over the forecast period. NII utilizes advanced technologies like X-ray scanners and millimeter wave systems to examine shipment containers without physically opening them. NII enhances efficiency by expediting inspections and reducing congestion at ports. In addition, it minimizes potential damage to delicate goods and offers superior safety compared to physical inspections. Furthermore, with growing security concerns and stricter regulations, NII's ability to effectively detect contraband and hazardous materials is propelling its market dominance.

Offering Insights

The product inspection segment asserted its dominance in the market and accounted for the largest share of 40.7% of the overall revenue in 2023. Product inspection, a meticulous examination of individual items within a shipment, is experiencing a resurgence within the market. This growth is attributed to a confluence of factors. The rise of e-commerce and complex global supply chains necessitates stricter quality control measures to ensure product integrity and consumer safety. Furthermore, increasingly stringent regulations in various regions demand thorough product inspections to comply with safety standards and labeling requirements.

The growing prevalence of counterfeit goods underscores the need for detailed product inspections to mitigate brand reputation risks and protect intellectual property. Consequently, the segment is poised for significant expansion, playing a critical role in safeguarding product quality and brand integrity in the ever-evolving global trade landscape. The container inspection segment is expected to register the highest CAGR of 5.1% from 2024 to 2030. Container inspection involves rigorous examination of shipping containers for structural integrity, security breaches, and proper cargo stowage.

It is a crucial and continuously growing segment in the market. The ever-increasing volume of global trade necessitates a robust system to ensure container safety and prevent potential accidents during transport. Rising security concerns necessitate thorough container inspections to deter smuggling and other illegal activities. In addition, proper container inspection minimizes cargo damage by identifying potential issues with weight distribution and securing cargo within the container. As a result, the segment is projected to experience significant growth, remaining a cornerstone of safe and secure global trade practices.

Inspection Phase Insights

The destination inspection (DI) segment dominated the target market in 2023 and accounted for a revenue share of 43.0%. DI is a post-shipment verification process where goods are physically examined upon arrival in the importing country. Governments are setting up DI programs to prevent fraud and ensure they get the right amount of money in taxes. Safety and security worries are also making DI more popular, especially for things like dangerous materials or food. Furthermore, advancements in technology, such as non-intrusive imaging scanners, are expediting the DI process, making it a more viable option for businesses. This confluence of factors positions DI as a key growth driver within the market.

The during-shipment inspection (DSI) segment is expected to grow at the fastest CAGR of 5.1% over the forecast period.The inspection of goods before their international journey, known as DSI, entails a thorough examination at their starting point. This segment is experiencing a surge in popularity within the market, driven primarily by its proactive cost-saving advantages. DSI helps manufacturers avoid the delays and expenses of fixing issues upon arrival by identifying and correcting defects before shipping. In addition, it reduces the risk of shipments being rejected at the destination port, safeguarding the reputation of importers and the profits of exporters. Moreover, advancements in mobile screening technology make on-site DSI more efficient, making it a more accessible and attractive option for businesses.

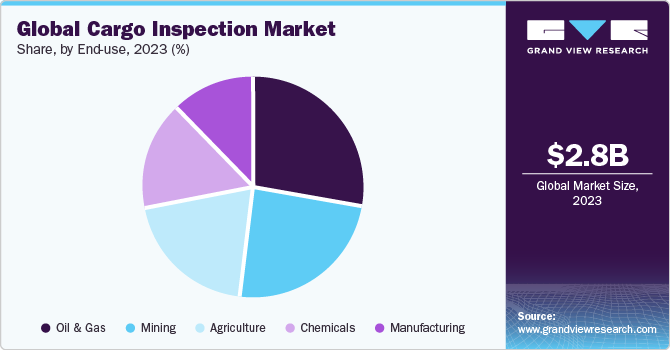

End-use Insights

The oil & gas segment dominated the market in 2023 and accounted for a revenue share of 28.1%. The rising global energy needs, especially in developing countries like India, China, and Brazil, necessitate the secure & efficient transport of crucial resources like hydrocarbons, emphasizing the significance of specialized inspections to ensure the quality, quantity, and safety of these valuable shipments. Moreover, stringent environmental regulations are driving the need for inspections to validate compliance with emission standards and minimize environmental risks. In addition, the growing complexity of global supply chains necessitates independent verification of cargo specifications to prevent fraud and ensure smooth transactions. Collectively, these factors establish the oil & gas sector as a pivotal growth segment within the evolving landscape of cargo inspections.

The agriculture segment is expected to grow at the fastest CAGR of 5.2% over the forecast period. Increasing demand for safe and high-quality food necessitates stricter regulations and inspections for compliance with food safety standards. Rising concerns about biosecurity, particularly regarding the spread of pests and diseases, are prompting more stringent import controls on agricultural products. Furthermore, the growing complexity of global food supply chains, characterized by extensive product transportation, necessitates independent verification of both quality and quantity to mitigate the risks of spoilage and fraud. These factors define the growth of the agriculture segment in the market.

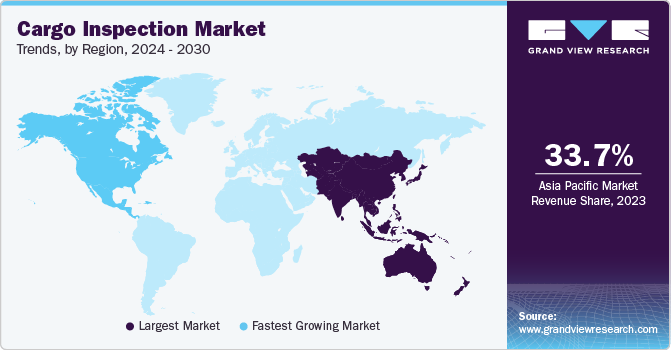

Regional Insights

The North America cargo inspection market recorded the fastest CAGR of 5.3% from 2024 to 2030. Strict import and export regulations require robust inspection procedures to guarantee compliance. This drives the demand for cargo inspection services in North America that ensure product safety, quality, and origin. Furthermore, technological advancements like digital cargo documentation and non-intrusive inspection tools are optimizing processes and boosting efficiency. These factors eventually bolster the growth of inspection services in the region.

U.S. Cargo Inspection Market Trends

The cargo inspection market in the U.S. held the largest revenue share of 72.8% in 2023 propelled by a confluence of factors. The increasing adoption of advanced technologies, such as AI and ML, in cargo inspection processes, enables more efficient and accurate inspections. The region also witnesses a growing emphasis on sustainability and environmental protection, leading to a rise in inspections aimed at verifying compliance with eco-friendly standards. Furthermore, the emergence of e-commerce and online shopping has spurred the need for enhanced compliance requirements to address the challenges posed by the rapid growth of parcel shipments.

Asia Pacific Cargo Inspection Market Trends

The cargo inspection market in Asia Pacific dominated the global market in 2023 and captured the largest share of 33.7% of the overall revenue. This expansion is driven by several factors, including the region's robust economic growth, growing international trade activities, and increasing investments in infrastructure and logistics. As economies in the region continue to develop and urbanize, there is a growing demand for efficient and reliable cargo surveying services to ensure compliance with regulatory standards and mitigate risks associated with international trade. Moreover, the emergence of new industries and the expansion of existing ones are fueling the demand for these services. With its strategic geographical location and growing prominence in global trade, Asia Pacific presents lucrative opportunities for market players to expand their operations and capitalize on the growing demand for their services.

The China cargo inspection market is experiencing staggering growth propelled by the nation's expanding international trade volume and stringent regulatory mandates. As a dominant force in global trade, China encounters an increasing need for trustworthy inspection services to uphold quality and safety standards, safeguarding both domestic consumers and international trade partners. In addition, the government's efforts to enhance trade efficiency and combat counterfeit activities underscore the importance of stringent compliance requirements. These combined factors, aligned with China's aspirations to excel in global trade, establish a favorable environment for the market. Consequently, this presents substantial growth prospects for service providers capable of delivering efficient and dependable inspections tailored to the evolving demands of this dynamic market.

The cargo inspection market in India is expected to witness significant growth from 2024 to 2030. A flourishing manufacturing sector and rising exports necessitate stricter quality control measures to ensure compliance with international trade regulations. However, rising concerns about product safety and counterfeiting are prompting the Indian government to tighten regulations and inspections. As the government prioritizes improving trade infrastructure and streamlining logistics, robust inspection procedures become increasingly crucial.

Latin America Cargo Inspection Market Trends

The Latin America cargo inspection market is expected to register a significant growth rate of 4.8% from 2024 to 2030. One prominent trend in the region is the increasing adoption of mobile inspection technologies, allowing for more flexible and efficient inspection processes. The region also experiences a growing focus on enhancing border security measures, leading to the implementation of stricter compliance requirements for imported and exported goods. Moreover, increased cross-border e-commerce has spurred the need for specialized inspections to ensure the safety and authenticity of online purchases, further driving growth across Latin America.

The cargo inspection market in Brazil is growing at a notable pace.In Brazil, meeting international standards demands stricter quality control, driven by mounting safety and counterfeiting apprehensions, prompting the government to enforce tighter regulations. Infrastructure and logistics enhancements compel the implementation of robust assessment procedures. The adoption of advanced X-ray scanners and automation gains momentum for increased efficiency and accuracy. Furthermore, the varied spectrum of Brazilian exports, spanning agriculture to manufactured goods, underscores the necessity for specialized inspections. Finally, the government's crackdown on smuggling reinforces inspections at ports and borders, profoundly influencing Brazil’s domestic market.

Key Cargo Inspection Company Insights

Some of the key companies operating in the cargo inspection market include SGS Group, Bureau Veritas, and Intertek Group, among others.

-

SGS Group, a global leader in inspections, verifications, testing, and certifications, is one of the prominent players in the market. Renowned for its extensive experience and international presence, SGS offers a comprehensive suite of cargo inspection services. This includes pre-shipment inspections to verify quality and quantity, during-shipment inspections to monitor consignment condition, and post-shipment inspections to ensure arrival as specified. Their services encompass various shipment types, from bulk commodities to manufactured goods, ensuring compliance with international trade regulations, and minimizing risk throughout the supply chain

-

Bureau Veritas, a global leader in testing, inspection, and certification, is a major force within the market. Their reputation is built on expertise across various industries and a global network of qualified inspectors. Bureau Veritas offers a diversified range of services, encompassing pre-shipment checks for quality and compliance, in-transit monitoring to safeguard shipment integrity, and post-shipment inspections to verify delivery conditions. They cater to several cargo types, from oil & gas to consumer goods, ensuring adherence to international regulations and mitigating risks throughout the supply chain

-

Intertek Group, a renowned player in the market, boasts a global presence and a proven record in quality assurance solutions. They offer a comprehensive suite of services, including pre-shipment checks to ensure quality and compliance with regulations. During shipment, Intertek monitors consignment condition to minimize risk, and upon arrival, post-shipment inspections verify delivery as specified. Their expertise covers a diverse range of cargo types, from food and agricultural products to industrial goods, ensuring smooth trade flows and mitigating risk throughout the supply chain

Eurofins Scientific and AIM Control Inspection Group are some of the emerging companies in the target market.

-

Eurofins Scientific is challenging established players through strategic innovation. They focus on specific sectors with growing inspection needs, like pharmaceuticals or environmentally sensitive commodities. This specialization allows them to develop deep industry expertise. Furthermore, Eurofins Scientific invests in innovative technologies like AI-powered image recognition for faster, more precise inspections. By offering these specialized services and leveraging advanced technology, Eurofins Scientific carves a niche within the competitive landscape

-

AIM Control Inspection Group distinguishes itself through strategic positioning, targeting growing sectors where specialized inspections hold enhanced significance. Moreover, they harness digital solutions, such as cloud-based inspection platforms to augment efficiency and facilitate accessible data for clients. In addition, AIM places a premium on responsiveness and delivering exceptional customer service, cultivating robust relationships within the industry. These tactics enable them to effectively compete with established competitors in this evolving market landscape

Key Cargo Inspection Companies:

The following are the leading companies in the cargo inspection market. These companies collectively hold the largest market share and dictate industry trends.

- SGS Group

- Bureau Veritas

- Intertek Group

- TÜV SÜD

- DEKRA SE

- DNV GL

- AmSpec Group

- Eurofins Scientific

- Core Laboratories

- AIM Control Inspection Group

Recent Developments

-

In May 2021, DNV GL launched a Mobile Inspection App designed to assist ship owners and managers in digitizing and optimizing the workflow, recording, and follow-up of safety inspections conducted onboard. This application offers onshore personnel immediate access to inspection results. Integrated with ShipManager Analyzer, the Mobile Inspection App enables ship managers to efficiently monitor their company's safety performance and pinpoint areas for enhancement using advanced dashboards

Cargo Inspection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,935.8 million

Revenue forecast in 2030

USD 3,790.4 million

Growth rate

CAGR of 4.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, offering, inspection phase, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; UAE; KSA; South Africa

Key companies profiled

SGS Group; Bureau Veritas; Intertek Group; TÜV SÜD; DEKRA SE; DNV GL; AmSpec Group; Eurofins Scientific; Core Laboratories; AIM Control Inspection Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cargo Inspection Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global cargo inspection market report based on type, offering, inspection phase, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Physical Inspection

-

Non-Intrusive Inspection (NII)

-

Documentation Verification

-

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Product Inspection

-

Container Inspection

-

Weighbridge Inspection

-

-

Inspection Phase Outlook (Revenue, USD Million, 2017 - 2030)

-

Destination Inspection (DI)

-

Pre-Shipment Inspection (PSI)

-

During Shipment Inspection (DSI)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Mining

-

Oil & Gas

-

Chemicals

-

Agriculture

-

Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cargo inspection market size was estimated at USD 2,828.5 million in 2023 and is expected to reach USD 2,935.8 million in 2024.

b. The global cargo inspection market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 3,790.4 million by 2030.

b. The oil and gas end use segment dominated the global cargo inspection market, accounting for the largest market share of 28.1% in 2023.

b. Some prominent players in the cargo inspection market include SGS Group, Bureau Veritas, Intertek Group, TÜV SÜD, DEKRA SE, DNV GL, AmSpec Group, Eurofins Scientific, Core Laboratories, and AIM Control Inspection Group.

b. The cargo inspection market is propelled by several driving factors, such as increased international trade volumes, rising concerns about product safety and quality, growing prevalence of counterfeit goods and intellectual property theft, concerns about biosecurity, growing complexity of supply chains, and advancements in inspection technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.