- Home

- »

- Healthcare IT

- »

-

Care Management Solutions Market Size, Share Report 2030GVR Report cover

![Care Management Solutions Market Size, Share & Trends Report]()

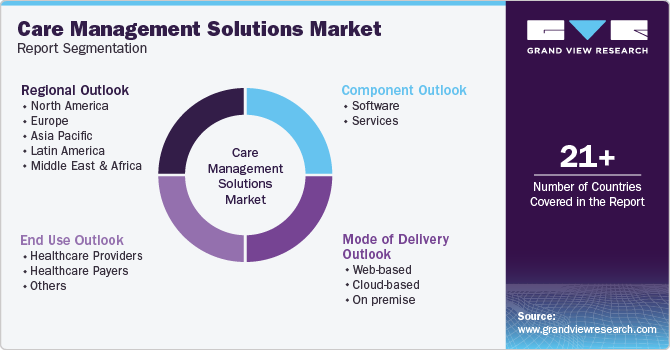

Care Management Solutions Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Mode of Delivery (Web-based, Cloud-based, On premise), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-596-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Care Management Solutions Market Summary

The global care management solutions market size was valued at USD 14.67 billion in 2024 and is projected to reach USD 33.26 billion by 2030, growing at a CAGR of 14.8% from 2025 to 2030. The rising prevalence of chronic conditions and the growing geriatric population are some of the key factors driving the market growth.

Key Market Trends & Insights

- The North America region accounted for the largest share in the care management solutions market at 51.0% in 2023.

- By component, the software segment dominated the market in 2023 with a market share of 57.7%.

- By mode of delivery, the web-based segment dominated the market in 2023 with a market share of 39.0%.

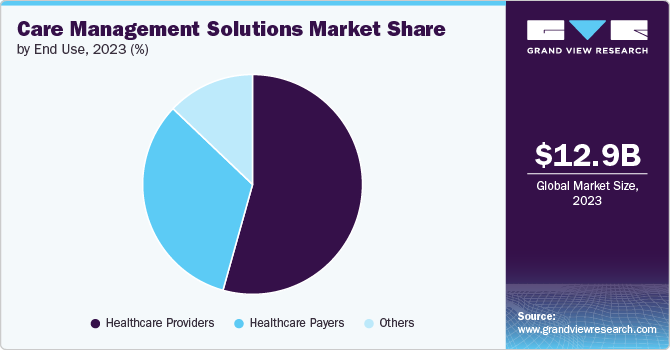

- By end use, Healthcare providers dominated the market in 2023 with a revenue share of 54.36%.

Market Size & Forecast

- 2024 Market Size: USD 14.67 Billion

- 2030 Projected Market Size: USD 33.26 Billion

- CAGR (2025-2030): 14.8%

- North America: Largest market in 2023

Furthermore, the rising adoption of technological software and services in the healthcare sector fuels industry growth. As the prevalence of various chronic diseases increases, the need for effective disease management solutions rises. For instance, according to WHO, approximately 77 million people over 18 years of age have diabetes (type 2) in India.According to the Centers for Disease Control and Prevention (CDC), 90% of the nation's USD 4.5 trillion in health expenditure is spent on individuals with mental health disorders and chronic conditions. This increasing cost of healthcare poses a huge challenge to the healthcare system. Growing healthcare expenditures lead to a need to decrease costs while enhancing the quality of care. Disease management software performs risk stratification to access patient care. This helps providers in reducing the overall healthcare cost.

Supportive government initiatives and investments boosting the adoption of healthcare information technology solutions to enhance patient experience and reduce cost are expected to drive market growth. For instance, in February 2023, the Canadian government raised USD 149 billion to aid the country's healthcare system. Thus, such investments fuel market growth.

Furthermore, smartphones have evolved from entertainment and communication devices to devices that can monitor fitness and health. Several companies are developing Chatbot services for one-time consultations and essential medical inquiries. For instance, WeChat provides Chatbot services in China for essential medical inquiries and other mobile health solutions such as paying medical bills, accessing medical records, and booking appointments. The focus on efficient and cost-effective healthcare solutions further drives the adoption of care management solutions.

As the Alliance of Community Health Plans demonstrated, patients included in care management programs have reduced hospitalizations and ER visits and improved health status and quality of life. The growing adoption of integrated health management services and other digital systems has boosted the launch of new software. For instance, in April 2022, CareCloud, Inc. introduced a new service for chronic care management. The new services for chronic disease management are part of its rising range of digital health solutions that help providers improve patient treatment and revenue streams.

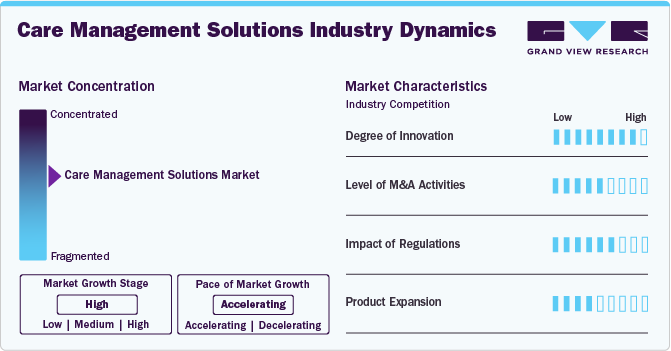

Market Concentration & Characteristics

The market has been characterized by a high degree of innovation due to the integration of machine learning (ML) and artificial intelligence (AI) in healthcare solutions. These technologies empower healthcare practitioners to investigate patient data remotely, allowing them to offer effective and personalized care. For instance, in March 2023, Royal Philips, a health technology company, launched Philips Virtual Care Management, a portfolio of flexible services and solutions to help health sectors, payers, providers, and employer groups connect with patients from virtually anywhere.

The market is characterized by a medium level of merger and acquisition (M&A) activity. This strategy enables access to complementary expertise, technologies, and distribution channels, allowing companies to improve operational efficiency and capture a larger market share. For instance, in July 2024, ACKO, a general insurance company, acquired OneCare, a digital chronic care management company, to create a healthcare ecosystem regarding customers’ health insurance needs, from protection and prevention to care and recovery.

Regulations play a crucial role in shaping the market and ensuring the safety, efficacy, and quality of implants available to patients. The Health Information Technology for Economic and Clinical Health (HITECH) Act, particularly the Health Insurance Portability and Accountability Act (HIPAA) of 1996 and its amendments, positively impacts market growth. These regulations ensure the privacy and secure handling of digital health information, creating the operational framework and compliance standards for healthcare solutions, especially in the U.S.

Several market players are expanding their business by introducing new care management platforms to strengthen their market position and expand their product portfolio. For instance, in January 2023, Cadence Solutions, Inc. partnered with Ardent Health Management Services and introduced a responsive virtual care and remote patient monitoring program across Ardent’s operations, including 30 hospitals and 200 care sites in six U.S. states.

Component Insights

By component, the software segment dominated the market in 2023 with a revenue share of 57.72% and is expected to record the fastest growth over the forecast period owing to the multiple application-specific software available in the market that caters to specific patient care services. For example, Greenway Care Coordination Services is a chronic care management solution that offers patients integrated behavioral health services. Software solutions provide coordinated and efficient care. They help providers monitor patients' vitals and medications, effectively diagnose patients, generate digital records for clinical research, and minimize errors during surgery. Key players' increasing focus on enhancing their existing software, growing demand for patient-centric software, and rising spending on IT solutions by healthcare facilities are driving segment growth. For instance, in July 2022, VirtualHealth, a care management solutions provider, launched an updated version of its Utilization Management (UM) module as part of its cloud-based care management platform, HELIOS, to offer value-based and high-quality care.

However, the services segment is expected to grow significantly over the forecast period. The rising number of service providers and providers outsourcing care managers fuel the segment's growth. Furthermore, government incentive programs to ensure coordinated healthcare for patients are expected to boost segment growth. For instance, the Centers for Medicare and Medicaid Services (CMS) allows providers to use chronic care management codes and participate in incentive programs.

Mode of Delivery Insights

Web-based dominated the market in 2023 and accounted for the largest revenue share of 39.02%. Web-based solutions are delivered to users through web servers that leverage internet protocol. These solutions incorporate four essential components: an internet connection, a web server, a data manager, and a software coding system. Internet and web-based applications enable access to the most remote places using a single computer or a monitoring device. For instance, IQVIA Inc. offers IQVIA Connection, a web-based Software-as-a-Service (SaaS) platform that provides real-time patient data and access to in-depth analytics, which drives patient engagement, retention, and unmatched insight and understanding.

The cloud-based segment in the market is anticipated to witness the fastest CAGR over the forecast period. Cloud-based software provides greater flexibility, is easy to scale up depending on the patient base, and is comparatively more affordable than other modes of delivery. These factors are responsible for the segment's growth. The rising adoption of cloud-based EHR by healthcare providers to enhance security, accessibility, and storage capabilities and the introduction of new cloud-based software are driving industry growth. For instance, in March 2023, Fujitsu introduced a cloud-based platform that enables users to gather and leverage health-related data to facilitate digital transformation in the healthcare sector.

End Use Insights

Healthcare providers dominated the market in 2023 with a revenue share of 54.36% and is anticipated to grow at the fastest CAGR over the forecast period. Factors such as improved quality of healthcare, rising demand for patient-centric care, increasing need for faster services, and growing patient base boost the segment's growth. The presence of well-developed hospitals and increased strategic initiatives by key players are set to drive segment growth. For instance, in February 2022, MyHealthcare, a digital healthcare company, introduced the MyHealthcare Enterprise Application (MHEA) for healthcare facilities. This MHEA ecosystem is constructed on a configurable workflow engine that lets hospital teams and clinicians manage hospital operations and patient care.

The healthcare payers segment in the market is anticipated to register a significant growth rate over the forecast period. This segment includes insurance companies, health plan sponsors (employers and unions), and third-party payers. Payers are increasingly adopting care management solutions to ensure their members receive the proper care at the right time and place. Furthermore, the rise in the launch of healthcare payer solutions fuels market growth. For instance, in August 2024, VirtualHealth , in collaboration with Itiliti Health, introduced HELIOS+ Itiliti Health SaaS Solution, a single solution supporting healthcare payers’ needs for CMS compliance, prior authorization, and FHIR APIs.

Regional Insights

North America dominated the care management solutions market in 2023 and accounted for the largest revenue share of 51.0% owing to the growing adoption of patient care solutions that assist in succeeding healthcare goals of lower costs and improved quality by healthcare providers. In addition, the increasing adoption of cloud-based software, technological advancements, and growing investments are boosting the region's industry growth. For instance, in February 2024, HealthSnap, a provider of Chronic Care Management (CCM) and Remote Patient Monitoring (RPM) solutions, raised a funding of USD 25 million in a Series B funding round. Acronym Venture Capital, Florida Opportunity Fund, and Sands Capital led the round.

U.S. Care Management Solutions Market Trends

The care management solutions market in the U.S. held the largest share in 2023. Factors such as advanced healthcare management, several market players operating across segments, and innovative software development drive market growth. Furthermore, growing awareness regarding the availability of care management solutions boosts market growth in the country.

Europe Care Management Solutions Market Trends

The care management solutions market in Europe is anticipated to register the fastest growth rate during the forecast period. Factors such as higher healthcare IT expenditures, a significant shortage of primary caregivers, rapid smartphone adoption, a growing geriatric population, advancements in coverage networks, a rise in chronic disease prevalence, rising healthcare costs, and a rising need for enhanced prevention and management of chronic conditions boost the market's growth.

Germany care management solutions market is anticipated to register the fastest growth rate during the forecast period. The rise in the launch of novel and advanced solutions and favorable reimbursement policies for health apps drives market growth. For instance, health apps such as Mindable: Soziale Phobie, actensio, Untire, and glucura Diabetestherapie were added to the Directory of Digital Health Applications (DiGAs) by the Federal Office for Drugs and Medical Devices (BfArM), making them reimbursable.

The care management solutions market in the UK is anticipated to grow considerably during the forecast period. Technological advancements, research and development in the healthcare IT industry, and the rise in the adoption of various strategies by market players fuel the market's growth. For instance, in May 2024, Loughborough's Centre for Lifestyle Medicine and Behaviour (CLiMB) collaborated with Wolfson School of Engineering to develop an innovative digital health app to help people with multiple chronic disorders manage their health care better.

Asia Pacific Care Management Solutions Market Trends

The care management solutions market in Asia Pacific is anticipated to grow significantly over the forecast period. Improvement of healthcare facilities due to rapid economic development witnessed in emerging countries, such as Japan, China, India, and South Korea, is one of the high-impact rendering drivers. Rising interest and investments by prominent industry players and ongoing collaborative efforts are responsible for regional growth.

Australia care management solutions market is anticipated to grow considerably during the forecast period. The country's market growth is fueled by enhanced network coverage, increased smartphone penetration, app launches, and favorable government initiatives. A new partnership between CSIRO, Australia's national science agency, and Telstra Health is expected to boost the adoption of digital health solutions and improve the Australian healthcare systems.

Latin America Care Management Solutions Market Trends

The care management solutions market in Latin America is witnessing steady growth due to increasing awareness among both patients and healthcare professionals regarding the availability and benefits of healthcare apps. Moreover, the region's growing geriatric population and a rise in chronic diseases such as diabetes and cancer, which can lead to the adoption of various chronic disease management apps, are further driving market growth.

Argentina care management solutions market is anticipated to register a considerable growth rate during the forecast period. The government is partnering with public and private players to strengthen healthcare and digital healthcare infrastructure. Moreover, growing funding from international organizations such as the Inter-American Development Bank, which approved a USD 100 million loan to improve digitization and internet access across the country, is also driving market growth.

MEA Care Management Solutions Market Trends

The care management solutions market in the Middle East and Africa is experiencing considerable growth over the forecast period. Improving internet connectivity, rising investments, increasing smartphone penetration, and developing healthcare infrastructure support the digitalization of healthcare in this region. Moreover, market participants are undertaking various growth strategies to expand their businesses into this region.

Saudi Arabia care management solutions market is anticipated to register the fastest growth rate during the forecast period. The country's aging population, coupled with a high prevalence of chronic conditions, is fostering market growth. For instance, in February 2023, the Ministry of Health in Saudi Arabia launched a new version of the Sehhaty app to improve the experience of reviewing prescriptions and appointments, promote walking, and improve women's health.

Key Care Management Solutions Company Insights

Key market participants are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and business footprints.

Key Care Management Solutions Companies:

The following are the leading companies in the care management solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Veradigm LLC (Allscripts Healthcare, LLC)

- Epic Systems Corporation

- Cognizant

- Koninklijke Philips N.V.

- Oracle (Cerner Corp.)

- ZeOmega

- Medecision

- IBM

- ExlService Holdings, Inc.

- HealthSnap, Inc.

Recent Developments

-

In March 2024, Inova Health System, a healthcare organization, partnered with ChartSpan, a Chronic Care Management (CCM) solutions provider, to enhance chronic care management services delivery to patients in the Washington, DC metropolitan area and Northern Virginia.

-

In April 2024, the Indian government launched the 'myCGHS' application for iOS devices, allowing individuals covered under the Central Government Health Scheme (CGHS) to access their electronic health records and other resources and information.

Care Management Solutions Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.67 billion

Revenue forecast in 2030

USD 33.26 billion

Growth rate

CAGR of 14.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast data

2025 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, mode of delivery, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Veradigm LLC (Allscripts Healthcare, LLC); Epic Systems Corporation; Cognizant; Koninklijke Philips N.V.; Oracle (Cerner Corp.); ZeOmega, Medecision; IBM; ExlService Holdings, Inc.; HealthSnap, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Care Management Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes industry trends in each sub-segment from 2018 - 2030. For this study, Grand View Research, Inc. has segmented the global care management solutions market report based on component, mode of delivery, end use, and region:

-

Component Outlook (Revenue USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Mode of Delivery Outlook (Revenue USD Million, 2018 - 2030)

-

Web-based

-

Cloud-based

-

On premise

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

Others

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

- Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global care management solutions market size was estimated at USD 12.96 billion in 2023 and is expected to reach USD 14.67 billion in 2024.

b. The global care management solutions market is expected to grow at a compound annual growth rate of 14.61% from 2024 to 2030 to reach USD 33.26 billion by 2030.

b. North America dominated the care management solutions market with a share of 51.0% in 2023. The growth of the market is attributed to the growing adoption of patient care solutions that assist in succeeding healthcare goals of lower costs and improved quality by healthcare providers.

b. Some key players operating in the care management solutions market include Allscripts Healthcare Solutions, Inc., Epic Systems Corporation, Cognizant, ExlService Holdings, Inc, Koninklijke Philips N.V., Cerner Corporation (Oracle), ZeOmega, Medecision, and IBM

b. Key factors that are driving the market growth include increasing focus on patient-centric care, rising need for solutions to reduce healthcare costs, and strong government support

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.