Cardiovascular Health Supplements Market Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Form (Liquid, Tablet, Powder, Softgels), By Ingredient, By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-132-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

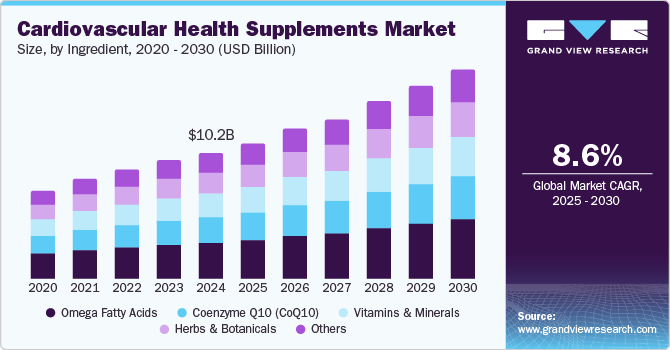

The global cardiovascular health supplements market size was estimated at USD 10.24 billion in 2024 and is projected to grow at a CAGR of 8.6% from 2025 to 2030. An aging population and an increased prevalence of heart-related diseases are driving consumers' growing awareness of the importance of cardiovascular health. This awareness has increased interest in preventive healthcare, with individuals actively seeking supplements supporting heart health.

The COVID-19 pandemic positively impacted the cardiovascular health supplements industry by increasing awareness about the importance of maintaining good health, including cardiovascular health. The coronavirus was found to have a more severe impact on individuals with pre-existing heart conditions, which led many people to become more conscious of their heart health. This increased awareness impelled the demand for cardiovascular health supplements as individuals sought ways to mitigate their heart-related problems.

According to the World Health Organization (WHO), Cardiovascular Diseases (CVDs) pose a profound threat to global health, claiming approximately 17.9 Million lives annually. This cluster of conditions affects the heart and blood vessels, encompassing coronary heart disease, cerebrovascular disease, rheumatic heart disease, and other related disorders. The WHO reports that heart attacks and stroke account for approximately 80% of CVD-related deaths, with a staggering one-third of these fatalities occurring prematurely among individuals under the age of 70. This stark reality underscores the urgent need for preventive measures to mitigate the risk of CVDs and promote cardiovascular wellness.

Stress is a known risk factor for heart disease, and many individuals turn to supplements containing stress-reducing ingredients such as adaptogens and B vitamins to manage their stress levels and support heart health. Moreover, telehealth services and virtual wellness programs gained prominence during the pandemic, enabling healthcare professionals to provide remote consultations and guidance. As part of these virtual health initiatives, doctors and nutritionists recommended dietary supplements for heart-related issues to patients, further boosting the demand.

According to the Centers for Disease Control and Prevention (CDC), in 2022, over 702,880 people in the U.S. died from heart disease, recorded as 1 out of every five deaths. A sedentary lifestyle and poor dietary habits have contributed to the rise in cardiovascular issues. As a result, people are increasingly turning to supplements to compensate for nutritional gaps and support their heart health so they can adopt healthier lifestyles. As per MJH Life Sciences in 2019, researchers studied the impact of dietary changes and nutritional supplements on cardiovascular events and death in adults. The study concluded that supplementing omega-3 long-chain polyunsaturated fatty acids and folate could reduce the risk of cardiovascular events in adults.

Several manufacturers are increasingly adding new solutions to their portfolios owing to the increasing demand for cardiovascular health supplements. For instance, in September 2023, Nutrartis launched a natural plant sterol supplement named Cardiosmile, a liquid sachet that uses water-dispersible phytosterols. A critical trial at the University of Manitoba in Canada showed Cardiosmile can reduce LDL cholesterol by 12% and triglycerides by 14% within 28 days of regular use. These factors are expected to drive the cardiovascular health supplements industry over the forecast period.

Type Insights

The natural supplements segment held the largest market share of 69.7% in 2024 and is expected to grow at the fastest CAGR of 9.0% over the forecast period. This can be attributed to the increasing awareness of the importance of health and wellness, which has driven consumers to seek natural alternatives over conventional pharmaceuticals. Many people are adopting a holistic approach to health, focusing on preventive measures and natural solutions, boosting the demand for natural supplements.

The synthetic supplements segment is anticipated to grow significantly from 2025 to 2030. Various factors, including perceived health benefits, lifestyle choices, aging demographics, nutritional awareness, medical recommendations, and price considerations shape the segment demand. Understanding these factors is essential for supplement manufacturers and marketers to effectively meet consumer needs and preferences in the competitive cardiovascular health supplements industry.

Ingredient Insights

The omega fatty acids segment held the largest revenue share of 27.0% in 2024. Scientific research has consistently demonstrated the significant cardiovascular benefits of omega-3 fatty acids, particularly Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid (DHA). These essential fatty acids reduce triglyceride levels, lower blood pressure, and improve overall heart health. With growing awareness of these health benefits, consumer demand for cardiovascular supplements containing omega fatty acids has risen substantially. For instance, according to a study published in the Journal of the American Heart Association in June 2022, consuming 3 grams of omega-3 fatty acids daily via supplements or food decreases blood pressure.

The herbs & botanicals segment is anticipated to grow at the fastest CAGR of 10.0% from 2025 to 2030. Herbal and botanical supplements, such as garlic, hawthorn, and green tea extracts, have gained popularity for their heart health benefits. The demand for these natural ingredients continues to rise, driven by their traditional use and scientific validation. According to a study published in Rupa, Inc. in May 2023, garlic is high in allicin, an antioxidant responsible for many beneficial cardiovascular effects. Supplementation with Aged Garlic Extract (AGE) has been proven to reduce total and LDL cholesterol by 10%, reduce blood clotting, and significantly drop blood pressure in hypertensive patients by 8.4/7.3 mmHg on average.

Form Insights

The softgels segment held the largest share of 36.6% in 2024. Softgels are known for their ease of consumption and digestibility, making them a preferred choice for individuals seeking cardiovascular health support. This user-friendly format appeals to many consumers, including those with difficulty swallowing pills or capsules. The bioavailability and absorption rates of nutrients in softgel formulations are often higher than those in other supplement forms. This characteristic is especially advantageous in cardiovascular health supplements, as it can lead to quicker and more effective results. These factors are expected to drive the segment growth over the coming years.

The capsules segment is projected to exhibit the fastest CAGR of 9.6% over the forecast period. Capsules can hold well-formulated combinations of various ingredients clinically studied for their positive effects on heart health. This allows for a comprehensive supplementation approach that aligns with the growing demand for holistic and preventive healthcare solutions. In addition, capsules have an extended shelf life, ensuring the stability and potency of the supplement over time. This factor further bolsters the segment growth.

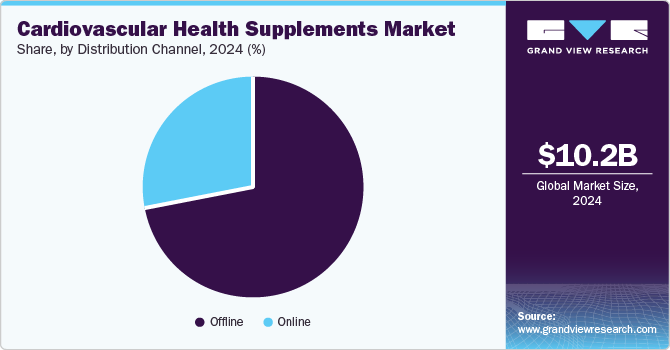

Distribution Channel Insights

The offline segment held the largest market share of 70.7% in 2024. It includes brick-and-mortar stores, pharmacies, and health food stores, which offer consumers a physical location to explore and purchase health supplements. This drives their preference among consumers. Moreover, several companies have been investing significantly in opening offline stores to reach a wider customer base. For instance, in May 2023, Nordic Naturals partnered with Walmart to offer its omega-3 supplement across 2,500 Walmart stores. The aim behind the strategy was to expand its retail footprint.

On the contrary, the online segment is projected to register the fastest CAGR of 10.9% from 2025 to 2030. The online distribution channel experienced steep growth during the COVID-19 pandemic. Moreover, to increase the reach of products, companies are collaborating with e-commerce platforms or focusing on digital distribution channels. For instance, as per a report in November 2020, Amway Corp. has witnessed significant growth in online sales, which doubled to more than 70% from 33.6% in February 2020.

Regional Insights

North America cardiovascular health supplements market held a significant share of the global cardiovascular health supplements industry in 2024. The region’s health-conscious population, coupled with increased spending on preventive healthcare, has fueled demand for cardiovascular health supplements. Moreover, many American brands have established a strong global presence, leveraging successful marketing campaigns to highlight the numerous health benefits associated with these supplements. North America is also a notable exporter of cardiovascular health supplements, catering to a global consumer base. The region’s supplements are generally priced at a premium, reflecting the substantial investments in research and development that underpin product innovation.

U.S. Cardiovascular Health Supplements Market Trends

The U.S. cardiovascular health supplements market held a significant share of North America. The country has a substantial presence in the global cardiovascular health supplements market, driven by factors such as a high incidence of CVDs, an aging population, and a growing emphasis on preventive healthcare. Key ingredients such as omega fatty acids, Coenzyme Q10 (CoQ10), and plant sterols are in high demand in the country.

Moreover, endorsements from reputable organizations such as the American Heart Association and widespread public health initiatives focused on heart health have further boosted the market. According to an article published by Cison U.S. Inc. in November 2024, Healthycell has launched a groundbreaking product, Heart and Vascular Health, an ultra-absorbable gel supplement. This innovative formulation combines plant-based ingredients to help reduce cholesterol, triglyceride, and blood pressure levels.

Europe Cardiovascular Health Supplements Market Trends

Europe cardiovascular health supplements market is expected to grow at a significant CAGR of 8.2% from 2025 to 2030. This can be attributed to the growing aging population in Europe. This demographic trend has created a substantial market for cardiovascular health supplements, as older individuals often turn to dietary supplements to complement their heart-healthy lifestyle choices. Moreover, regulatory agencies in many European countries have approved nutritional supplements and functional foods, which has boosted industry growth. The process of approving such supplements has been simplified due to reforms and adjustments in the regulations.

Germany cardiovascular health supplements market is expected to experience significant growth, driven by escalating demand for organic and natural products. German consumers, known for being discerning and well-informed, opt for organic and natural alternatives due to growing awareness of product ingredients and production processes. This shift in consumer behavior has prompted manufacturers to expand their portfolios to include organic and natural options, thereby driving market growth. Furthermore, rising awareness of the health benefits associated with supplement consumption is expected to fuel market expansion as consumers seek to enhance their overall well-being.

Asia Pacific Cardiovascular Health Supplements Market Trends

Asia Pacific cardiovascular health supplements market dominated the market in 2024 with a revenue share of 38.6%, which can be attributed to the rising awareness of heart health and the increasing prevalence of CVDs in the region, which have fueled the demand for supplements to promote cardiovascular well-being. Consumers are becoming more health-conscious and proactive in managing their heart health, leading to a surge in the consumption of dietary supplements containing ingredients such as omega-3 fatty acids, coenzyme Q10, and antioxidants believed to support heart health. Moreover, the increasing focus of market players on developing nations such as India and China is anticipated to support regional growth over the forecast period.

China cardiovascular health supplements market is witnessing rapid growth, fueled by a combination of traditional values and modern health awareness. The COVID-19 pandemic has accelerated this trend, with Chinese consumers seeking dietary supplements to support their health and wellness. CVDs pose a significant healthcare burden in China due to their rising prevalence and incidence rates. According to a research article, “Cardiovascular Disease Mortality And Potential Risk Factor in China: A Multi-Dimensional Assessment by a Grey Relational Approach,” published in April 2022, CVD is a major healthcare concern in China, affecting a substantial population. Alarmingly, China accounts for 40% of total CVD-related mortality worldwide. This considerable burden and persistent risk of CVD in China are expected to drive demand for cardiology medical devices, ultimately boosting market growth.

Key Cardiovascular Health Supplements Company Insights

To retain their market presence, the key participants in the market are implementing various strategic initiatives, such as new product launches, geographical expansion, mergers and acquisitions, and collaborations. Some key companies operating in the market are Nestlé Health Science (Pure Encapsulations, LLC.), Amway Corp., and NOW Foods.

-

Nestlé Health Science, through its brand Pure Encapsulations, LLC, offers various cardiovascular supplements to support heart health. These products include omega-3 fatty acids, CoQ10, and other plant-based compounds commonly used to help maintain healthy cholesterol levels, promote circulation, and support overall cardiovascular function. The supplements are designed to be free from common allergens and additives, providing options for those looking to incorporate specific nutrients into their diet for heart health management.

-

Amway Corp. offers a range of cardiovascular supplements through its Nutrilite brand designed to support heart health. These products include omega-3 fatty acids, plant sterols, and other nutrients commonly associated with cardiovascular wellness. The supplements are formulated to help maintain healthy cholesterol levels, support circulation, and provide heart health benefits. Nutrilite products are marketed as being produced with plant-based ingredients and are designed to meet the needs of individuals seeking additional nutritional support for their cardiovascular system.

Key Cardiovascular Health Supplements Companies:

The following are the leading companies in the cardiovascular health supplements market. These companies collectively hold the largest market share and dictate industry trends.

- NOW Foods

- Bright Lifecare Private Ltd (Truebasics.com)

- Natural Organics, Inc.

- DaVinci Laboratories of Vermont

- Nordic Naturals

- Thorne.

- Nestlé Health Science (Pure Encapsulations, LLC.)

- Amway Corp.

- InVite Health

- GNC Holdings, LLC

View a comprehensive list of companies in the Cardiovascular Health Supplements Market

Recent Developments

-

In October 2023, Nordic Naturals expanded its reach through a significant partnership with Sam’s Club. This collaboration made two of Nordic Naturals’ best-selling omega-3 supplements available in bulk sizes, increasing accessibility and affordability for a wider consumer base. Brian Terry, director of U.S. retail sales for Nordic Naturals, said the deal was more than just growing distribution and supply.

Cardiovascular Health Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.06 billion |

|

Revenue forecast in 2030 |

USD 16.72 billion |

|

Growth Rate |

CAGR of 8.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, ingredient, form, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

NOW Foods; Bright, Lifecare Private Ltd (Truebasics.com); Natural Organics, Inc.; DaVinci Laboratories of Vermont; Nordic Naturals; Thorne, Inc.; Nestlé Health Science(Pure Encapsulations, LLC) ; Amway Corp.; InVite Health; GNC Holdings, LLC |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cardiovascular Health Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global cardiovascular health supplements market based on type, ingredient, form, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Supplements

-

Synthetic Supplements

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins & Minerals

-

Herbs & Botanicals

-

Omega Fatty Acids

-

Coenzyme Q10 (CoQ10)

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Tablet

-

Capsules

-

Softgels

-

Powder

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular health supplements market size was estimated at USD 10.24 billion in 2024 and is expected to reach USD 11.06 billion in 2025.

b. The global cardiovascular health supplements market is expected to grow at a compound annual growth rate of 8.61% from 2025 to 2030 to reach USD 16.72 billion by 2030.

b. Asia Pacific dominated the cardiovascular health supplements market with a share of 38.58% in 2024. This is attributable to rising healthcare awareness and increasing prevalence of cardiovascular diseases in the region.

b. Some key players operating in the cardiovascular health supplements market include NOW Health Group, Inc., Bright, Lifecare Pvt Ltd (Truebasics.com), Natural Organics, Inc., DaVinci Laboratories of Vermont, Nordic Naturals, Thorne HealthTech, Inc., Nestle (Pure Encapsulations, LLC.), Amway, InVite Health, GNC Holdings, LLC.

b. Factors such as the rising awareness about healthcare, growing population suffering from cholesterol, obesity, and others diseases, and poor dietary habits are driving the demand for cardiovascular supplements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."