- Home

- »

- Medical Devices

- »

-

Cardiac Safety Services Market Size, Industry Report, 2030GVR Report cover

![Cardiac Safety Services Market Size, Share & Trends Report]()

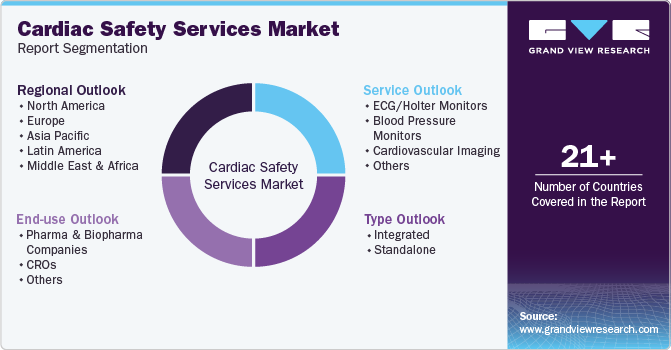

Cardiac Safety Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (ECG/Holter Monitors, Blood Pressure Monitors), By Type (Integrated, Standalone), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-449-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiac Safety Services Market Summary

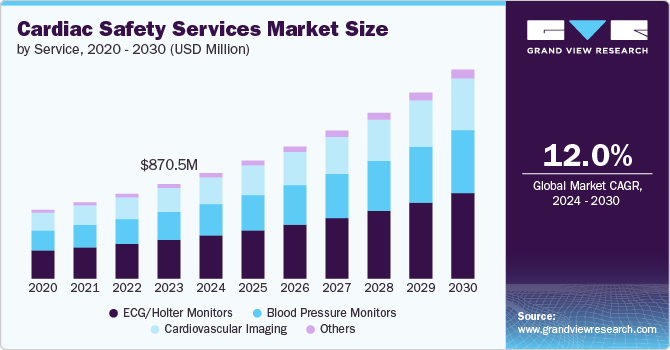

The global cardiac safety services market size was estimated at USD 972.3 million in 2024 and is projected to reach USD 1,924.3 million by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The market expansion is fueled by the rising prevalence of cardiovascular diseases, regulatory requirements, increasing complexity of clinical trials and the growing focus on personalized medicine.

Key Market Trends & Insights

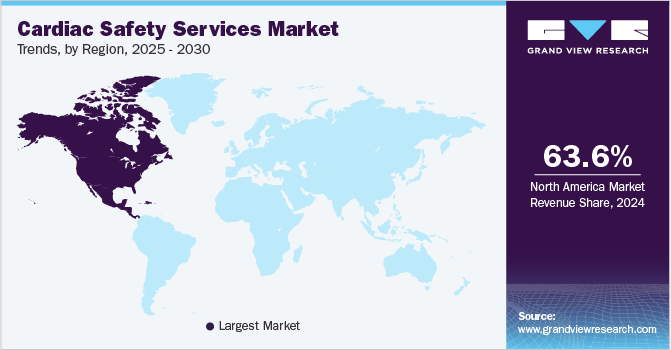

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, South Africa is expected to register the highest CAGR from 2025 to 2030.

- Based on service, the ECG/Holter monitors segment led the market with the largest revenue share of 41.0% in 2024.

- Based on type, the integrated segment led the market with the largest revenue share of 63.0% in 2024.

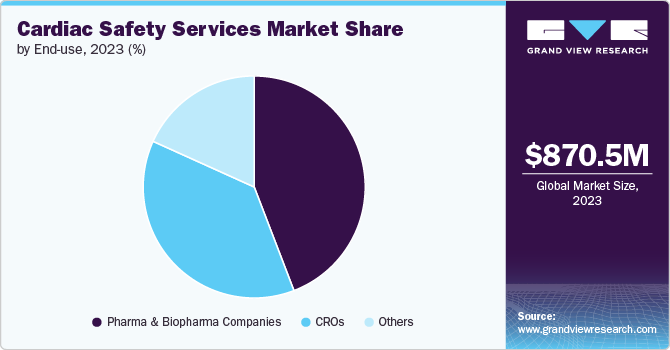

- Based on end use, the pharma & biopharma segment led the market with the largest revenue share of 44.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 972.3 Million

- 2030 Projected Market Size: USD 1,924.3 Million

- CAGR (2025-2030): 12.1%

- North America: Largest market in 2024

According to the British Heart Foundation's 2024 report, approximately 620 million people live with heart and circulatory diseases worldwide. This figure is rising due to a combination of changing lifestyles and a growing aging population.

With these trends expected to continue, the global prevalence of cardiovascular conditions remains high, affecting about 1 in 13 individuals globally. High-quality data collection and reporting are essential for making informed decisions throughout all phases of drug development. Accurate cardiac safety data helps identify potential risks early, optimize clinical trial designs, and ensure the safety of new therapies. The need for reliable and precise data to support regulatory submissions and gain market approvals drives demand for specialized cardiac safety services. Companies require advanced technologies and expertise to gather and analyze cardiac data effectively, leading to a robust market for these services.

Cardiovascular diseases (CVDs) remain the leading cause of mortality worldwide, contributing to a significant burden on global health systems. According to the World Heart Federation, CVDs were responsible for 20.5 million deaths in 2021, accounting for nearly a third of all global fatalities. This high prevalence creates a substantial demand for cardiac safety services as patients and healthcare providers seek to mitigate risks associated with cardiovascular interventions and treatments. As the global population ages and lifestyle-related risk factors such as obesity and diabetes become more prevalent, the need for robust cardiac safety monitoring and management systems grows.

As clinical trials become more complex, with the introduction of innovative drugs and combination therapies, the need for detailed cardiac safety assessments grows. The complexity of trial designs and the diversity of patient populations require sophisticated cardiac monitoring solutions to manage and assess potential risks accurately. This complexity drives the demand for advanced cardiac safety services that can provide comprehensive monitoring and detailed reporting.

The efficiency of targeted screening programs for cardiovascular diseases fuels the market's growth. According to Springer Nature, in June 2024, a review of cardiology reports examines the impact of screening programs for atrial fibrillation. It emphasizes findings from multicenter studies such as AF-SCREEN and STROKESTOP, which show that targeted screening dramatically enhances the detection of AF, especially among older adults. The review strongly supports establishing national screening initiatives to address the growing burden of AF-related complications, highlighting the critical role of early detection and intervention.

Technological advancements drive the growth of the market. For instance, in November 2023, iRhythm Technologies, Inc. introduced its latest Zio monitor and enhanced Zio (LTCM) Long-term Continuous Monitoring service in the U.S. This advanced technology is designed to improve cardiac monitoring by delivering more detailed and accurate long-term evaluations. With a focus on providing deeper diagnostic insights and better patient support, the new Zio monitor and updated LTCM service represent a notable innovation in continuous heart rhythm monitoring.

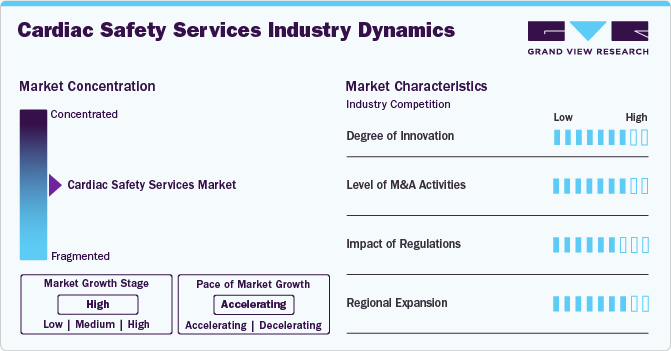

Market Concentration & Characteristics

Innovation is a significant driver for the cardiac safety services industry, as technological advancements enhance the accuracy and efficiency of cardiac monitoring.For instance, AI algorithms that analyze vast amounts of ECG data can identify arrhythmias and other cardiac issues with greater precision, improving patient safety and trial outcomes. The constant evolution of these technologies ensures that cardiac safety services remain at the forefront of clinical trial requirements.

Mergers and acquisitions (M&A) in the global market reflect the sector's dynamic nature and strategic consolidation efforts. Market participants in the cardiac safety services industry are increasingly pursuing M&A to expand their technological capabilities, enhance service offerings, and increase market share. For instance, In February 2023, GE HealthCare revealed intentions to acquire Caption Health, a firm specializing in AI software for guiding cardiac imaging. The technology developed by Caption Health is aimed at simplifying and expediting ultrasound examinations, enabling a more comprehensive range of healthcare professionals to perform basic echocardiography tests.

Regulatory bodies like the U.S. FDA and the European EMA require thorough cardiac safety assessments during clinical trials to address potential cardiovascular risks. These mandates push pharmaceutical and biopharmaceutical companies to integrate advanced cardiac monitoring technologies and robust data management systems. The focus on cardiac safety enhances the demand for specialized services and encourages innovation in monitoring solutions to ensure compliance. These regulations play a crucial role in driving market growth by emphasizing the adoption of advanced safety measures and prioritizing patient well-being in the development of drugs and medical devices.

The regional expansion of the global market is influenced by disease prevalence, healthcare infrastructure, and regulatory environments. In North America and Europe, high rates of cardiovascular disease and advanced healthcare systems drive significant market growth. In the U.S., the National Heart, Lung, and Blood Institute (NHLBI) funds research to enhance cardiovascular health. At the same time, the European Union’s Horizon Europe program supports healthcare innovation, including cardiovascular disease management. These government-backed initiatives foster advancements in cardiac safety and create opportunities for market expansion by improving healthcare infrastructure and investing in disease management.

Service Insights

Based on service, the ECG/Holter monitors segment led the market with the largest revenue share of 41.0% in 2024. Electrocardiogram (ECG) and Holter monitors are crucial for continuous cardiac monitoring, enabling real-time detection of arrhythmias, ischemic episodes, and other cardiovascular conditions. Their widespread adoption is mainly due to their efficacy in providing detailed and continuous heart rate data, essential for accurate data collection. The improved sensor accuracy, enhanced battery life, and the integration of wireless data transmission have significantly increased their utility and appeal.

Innovations such as wearable ECG monitors, which offer continuous and non-invasive monitoring, are popular due to their convenience and accuracy. For instance, in October 2023, Dozee launched its advanced ambulatory monitoring system, ‘Dozee Pro Ex,’ featuring wireless wearable sensors for continuously tracking vital signs such as blood pressure, ECG rhythm, oxygen saturation, heart rate, temperature, and respiration rate. The system incorporates an AI-driven early warning mechanism that analyzes vital parameter trends and issues timely alerts for potential clinical deterioration.

The blood pressure monitors segment is anticipated to grow at a significant CAGR of 12.5% over the forecast period. This growth is driven by the increasing prevalence of hypertension, a significant risk factor for cardiovascular diseases. The World Health Organization estimates that approximately 1.28 billion adults aged 30-79 years have hypertension, highlighting a substantial market opportunity for blood pressure monitors. Blood pressure monitors are increasingly being integrated into broader cardiac safety services, which provide a holistic approach to monitoring and assessing cardiovascular health, further boosting their adoption.

Type Insights

Based on type, the integrated segment led the market with the largest revenue share of 63.0% in 2024. This prominence is primarily driven by the increasing demand for comprehensive, multi-functional cardiac monitoring solutions that offer enhanced accuracy, efficiency, and patient convenience. Integrated systems, which merge various diagnostic technologies such as ECG, blood pressure monitoring, and imaging into a single platform, are increasingly favored for their ability to provide holistic cardiac assessments and streamline workflows. Innovations such as cloud-based data management, real-time analytics, and EHR interoperability further boost the appeal of integrated solutions. These advancements enable healthcare providers to access and analyze comprehensive patient data more efficiently, leading to better-informed clinical decisions.

The standalone segment is anticipated to grow at the fastest CAGR of 12.6% over the forecast period. Standalone cardiac safety services, which focus specifically on monitoring and assessing cardiovascular health during clinical trials, are gaining prominence due to their specialized nature. These services are crucial for evaluating the safety of new drugs and devices, addressing specific cardiovascular risks, and ensuring comprehensive safety assessments. As clinical trials become more complex and the need for precise cardiac safety evaluations grows, standalone services are increasingly sought after. Innovations in standalone cardiac monitoring technologies, such as advanced ECG systems and real-time data analytics, enhance the capabilities and accuracy of these services. These advancements facilitate better monitoring, early detection of cardiac issues, and more reliable data collection, making standalone services more attractive to pharmaceutical companies and clinical researchers.

End Use Insights

Based on end use, the pharma & biopharma segment led the market with the largest revenue share of 44.0% in 2024. This dominant position is primarily driven by the sector's extensive involvement in developing and clinically testing cardiovascular drugs and therapies, necessitating rigorous cardiac safety assessments. Personalized medicine approaches require detailed cardiac monitoring to tailor treatments to individual patient profiles, driving further demand for specialized cardiac safety services. In addition, technological advances, such as real-time data analytics and advanced cardiac imaging, enhance the capabilities of cardiac safety assessments, making them indispensable for pharmaceutical and biopharmaceutical companies

The other segments, such as hospitals, healthcare providers, and diagnostic laboratories, are anticipated to grow at the fastest CAGR of 13.6% during the forecast period. This growth is driven by the rising prevalence of cardiovascular diseases and the need for advanced patient management. Hospitals and healthcare providers increasingly adopt sophisticated cardiac safety services to handle complex cardiovascular conditions more accurately. The growing emphasis on personalized medicine and tailoring treatments based on individual patient profiles further boost the demand for cardiac safety services.

Regional Insights

North America cardiac safety services market dominated globally with the largest revenue share of 63.6% in 2024, driven by several key factors. A significant contributor is the high prevalence of cardiovascular diseases (CVDs), with the American Heart Association estimating that 82.6 million people in the U.S. are affected by one or more forms of CVD. This high incidence creates a substantial demand for advanced cardiac monitoring and safety services. In addition, the U.S. benefits from a sophisticated healthcare infrastructure and considerable investments in healthcare technology. Government initiatives, such as research programs funded by the National Heart, Lung, and Blood Institute, fuel the demand for cardiac safety services. These factors collectively enhance the market’s growth prospects in North America.

U.S. Cardiac Safety Services Market Trends

The cardiac safety services market in the U.S. stands out due to its advanced healthcare infrastructure, high incidence of cardiovascular diseases, and significant investments in medical research and technology. The American Heart Association highlights that heart disease remains the leading cause of death in the U.S., driving the need for comprehensive cardiac safety solutions. They projected that more than 61.0% of American adults will have some CVD by 2050 due to obesity and unhealthy lifestyles. The FDA’s rigorous regulatory standards for cardiovascular diagnosis further ensure high safety and efficacy, fostering innovation and market expansion. In addition, federal initiatives, such as those by the Centers for Disease Control and Prevention (CDC) aimed at enhancing heart disease prevention and control, significantly contribute to the dynamic growth of the U.S. cardiac safety services industry.

Europe Cardiac Safety Services Market Trends

Europe's cardiac safety services market is experiencing significant growth, fueled by the high prevalence of CVD and advanced medical technology. The high mortality rate from cardiovascular diseases boosts demand for cardiac safety services in Europe. According to the WHO article published in May 2024, cardiovascular diseases (CVDs) are the leading cause of premature death and disability in the European Region, responsible for over 42.5% of all deaths annually.

The UK cardiac safety services market is anticipated to grow at the fastest CAGR during the forecast period. The high prevalence of cardiovascular diseases and advancements in healthcare technology significantly bolster the market growth in the UK. According to a Guardian News & Media Limited article published in January 2024. the premature death rate from cardiovascular disease in the UK rose to 80 per 100,000 individuals in 2022. This represents a significant uptick from 2011, when the rate was 83 per 100,000.

The cardiac safety services market in Germany is thriving due to high cardiovascular disease prevalence, strong emphasis on healthcare innovation and growing incidence of AFib. According to the European Society of Cardiology, in February 2024, AFib affects about 2 million people, and the growing incidence of AFib. According to the European Society of Cardiology, in February 2024, AFib affected individuals in Germany, representing a significant health concern characterized by increasing prevalence, especially among the elderly. This common arrhythmia poses substantial challenges in healthcare management and emphasizes the growing demand for effective treatment options.

The France cardiac safety services market is growing over the forecast period. The rising incidence of arrhythmia in France is expected to boost the market. According to a CardioSignal by Precordior article published in December 2023, atrial fibrillation (AFib) impacts more than a million individuals in France, representing a significant health concern. This common arrhythmia interferes with the heart's normal rhythm and increases the risk of complications such as stroke and heart failure. The growing prevalence of AFib highlights the urgent demand for cutting-edge diagnostic technologies and innovative treatment solutions to manage the condition effectively across different patient groups within France's cardiac safety services industry.

Asia Pacific Cardiac Safety Services Market Trends

The cardiac safety services market in the Asia Pacific region is expanding rapidly due to the rising prevalence of cardiovascular disease and increasing healthcare investments. The World Health Organization reports that CVDs are a leading cause of death in many Asia Pacific countries, including China and India, creating a strong demand for advanced cardiac monitoring services. Government initiatives, such as the Indian government’s National Program for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases & Stroke, and China’s Healthy China 2030 initiative, also support market growth by emphasizing cardiovascular health and expanding access to advanced healthcare technologies and clinical trials.

China cardiac safety services market is anticipated to grow over the forecast period. The growing cardiovascular disease burden and government initiatives for CVD cases in China fuel the growth of the market. According to the NCBI article published in December 2023, China faces a high prevalence of cardiovascular diseases (CVD), with approximately 330 million individuals affected in 2022. This large patient base underscores the pressing need for efficient monitoring systems. As the incidence of CVD continues to increase, the demand for advanced and dependable monitoring devices in China is anticipated to rise, fueled by the need to enhance cardiovascular health management and outcomes for a vast number of people.

Japan's cardiac safety services market is anticipated to grow over the forecast period. Increasing CVD cases among the geriatric population and government initiatives drive market growth. Japan ranks among the topmost nations with the fastest-aging populations worldwide. According to the World Economic Forum, in September 2023, In Japan, almost a 3rd of the population is above the age of 65, adding approximately 36.23 million individuals. Japan has a remarkable number of centenarians, underscoring its position as the world's oldest population. It surpasses Italy, the second oldest nation, with a notably higher percentage of individuals aged 65 and above. The risk of heart-related conditions grows with age, making this demographic trend a significant driver of Japan's cardiac safety services market. It underscores the growing need for advanced diagnostic and therapeutic solutions to manage cardiac rhythm disorders effectively.

The India cardiac safety services market is experiencing rapid growth, fueled by the increasing prevalence of cardiovascular diseases and significant investments in healthcare infrastructure. According to the Economic Times article published in February 2024, the study reveals that India faces an important cardiovascular disease (CVD) burden, with an age-consistent CVD death rate of 272 per 100,000 population. This rate surpasses the global average of 235 per 100,000 population, indicating a higher prevalence of CVD in India. This elevated burden emphasizes the urgent need for advanced monitoring and management solutions to address the growing challenges in cardiovascular health across the country.

Latin America Cardiac Safety Services Market Trends

The cardiac safety services market in Latin America is expanding due to increasing cardiovascular disease prevalence and improving healthcare infrastructure. Cardiovascular diseases are a significant health concern in this region, with the Pan American Health Organization highlighting their impact on public health. This region is experiencing growth in cardiac safety services as healthcare providers invest in advanced diagnostic and monitoring technologies.

The Brazil cardiac safety services market is driven by rising healthcare spending and government initiatives aimed at enhancing cardiac care infrastructure. For instance, in September 2023, the Brazilian government, alongside various organizations, introduced initiatives to improve care and outcomes for cardiovascular disease (CVD) patients. Mount Sinai has partnered with the Brazilian Clinical Research Institute to promote advancements in CVD research and medical education. These efforts highlight a unified commitment to raising healthcare standards, driving innovation, and enhancing expertise in CVD management across Brazil.

Middle East & Africa Cardiac Safety Services Market Trends

The cardiac safety services market in the Middle East and Africa is expanding significantly due to the rising prevalence of cardiovascular diseases and investments in healthcare infrastructure. Cardiovascular diseases are becoming increasingly prevalent in the region, driven by lifestyle changes and urbanization.

The Saudi Arabia cardiac safety services market is experiencing rapid growth due to a high prevalence of cardiovascular diseases and significant investments in healthcare infrastructure. According to the article published by BMC Cardiovascular Diseases in March 2024, In Saudi Arabia, cardiovascular diseases (CVD), such as heart disease and other related conditions, affect 1.6% of individuals aged 15 and older. This figure highlights a significant health concern, offering valuable insight into the prevalence of cardiovascular issues within the country's population. The prevalence rate underscores the continued need for effective interventions and strategies to manage and address CVD in the region drives the growth of the cardiac safety services industry.

Key Cardiac Safety Services Company Insights

The market is dominated by several companies that collectively account for a significant market share. These leading players established themselves through extensive research and development efforts, resulting in the introduction of innovative services. They also expanded their service portfolios through strategic collaborations, mergers, and acquisitions.

Key Cardiac Safety Services Companies:

The following are the leading companies in the cardiac safety services market These companies collectively hold the largest market share and dictate industry trends.

- Medpace

- IQVIA

- PPD Inc.,

- Charles River Laboratories

- Wuxi AppTec

- Eurofins Scientific

- Celerion

- Nova Research Laboratories

- Laboratory Corporation of America Holdings

- Koninklije Philips N.V.

- ICON Plc.

- SGS S.A.

- Clario

- Certara

- Richmond Pharmacology

- Biotrial

Recent Developments

-

In May 2024, Vivalink launched a cutting-edge technology solution for Holter monitoring and Mobile Cardiac Telemetry (MCT). This innovative solution combines remote patient monitoring (RPM) technologies with advanced arrhythmia detection algorithms.

-

In March 2024, Wellysis, a digital healthcare firm originating from Samsung, has partnered with Artella Solutions to introduce a remote cardiac monitoring service in the U.S. The service incorporates the FDA-approved S-Patch ExL device, which enables continuous monitoring for up to 14 days using a single coin battery. This partnership enhances Wellysis' portfolio in Extended Holter and Mobile Cardiac Telemetry (MCT) solutions.

-

In November 2023, Wellysis signed a supply agreement with a prominent U.S. ECG service provider, facilitating the initial rollout of ‘S-Patch’ in Texas, with plans to expand to Arizona and Louisiana.

Cardiac Safety Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,087.1 million

Revenue forecast in 2030

USD 1,924.3 million

Growth rate

CAGR of 12.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medpace; IQVIA; PPD Inc.; Charles River Laboratories; Wuxi AppTec; Eurofins Scientific; Celerion; Nova Research Laboratories; Laboratory Corporation of America Holdings; Koninklije Philips N.V.; ICON Plc.; SGS S.A.; Clario; Certara; Richmond Pharmacology; Biotrial

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country; regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Safety Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cardiac safety services market report based on service, type, end use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

ECG/Holter Monitors

-

ECG Patch

-

Holter Monitors

-

-

Blood Pressure Monitors

-

Aneroid Blood Pressure Monitors

-

Digital Blood Pressure Monitors

-

Ambulatory Blood Pressure Monitors

-

-

Cardiovascular Imaging

-

CT

-

MRI

-

Ultrasound

-

Nuclear Medicine

-

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharma & Biopharma Companies

-

CROs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac safety services market size was valued at USD 972.3 million in 2024 and is projected to reach USD 1,087.1 million by 2025.

b. The global cardiac safety services market is projected to grow at a compound annual growth rate (CAGR) of 12.1% from 2025 to 2030 to reach USD 1,924.3 million in 2030.

b. ECG/Holter monitors segment led the market with the largest revenue share of 41.0% in 2024. Their widespread adoption is mainly due to their efficacy in providing detailed and continuous heart rate data, essential for accurate data collection.

b. Some of the key players operating in the market incudes Medpace; IQVIA; PPD Inc.; Charles River Laboratories; Wuxi AppTec; Eurofins Scientific; Celerion; Nova Research Laboratories; Laboratory Corporation of America Holdings; Koninklije Philips.

b. The market expansion is fueled by the rising prevalence of cardiovascular diseases, regulatory requirements, increasing complexity of clinical trials and the growing focus on personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.