- Home

- »

- Medical Devices

- »

-

Cardiac Resynchronization Therapy Market Report, 2033GVR Report cover

![Cardiac Resynchronization Therapy Market Size, Share & Trends Report]()

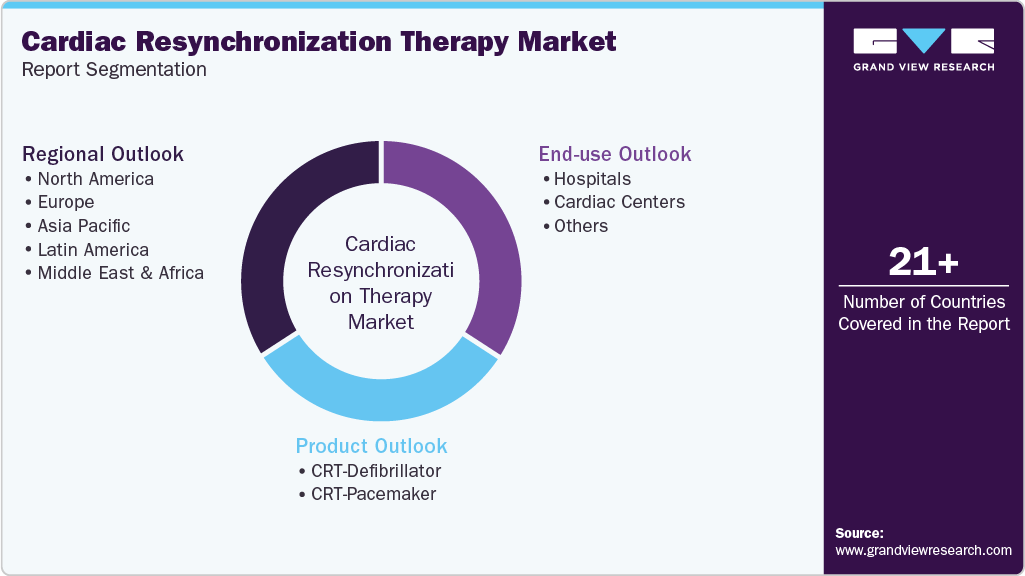

Cardiac Resynchronization Therapy Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (CRT-Defibrillator, CRT-Pacemaker), By End Use (Hospitals, Cardiac Centers, Others), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-347-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiac Resynchronization Therapy Market Summary

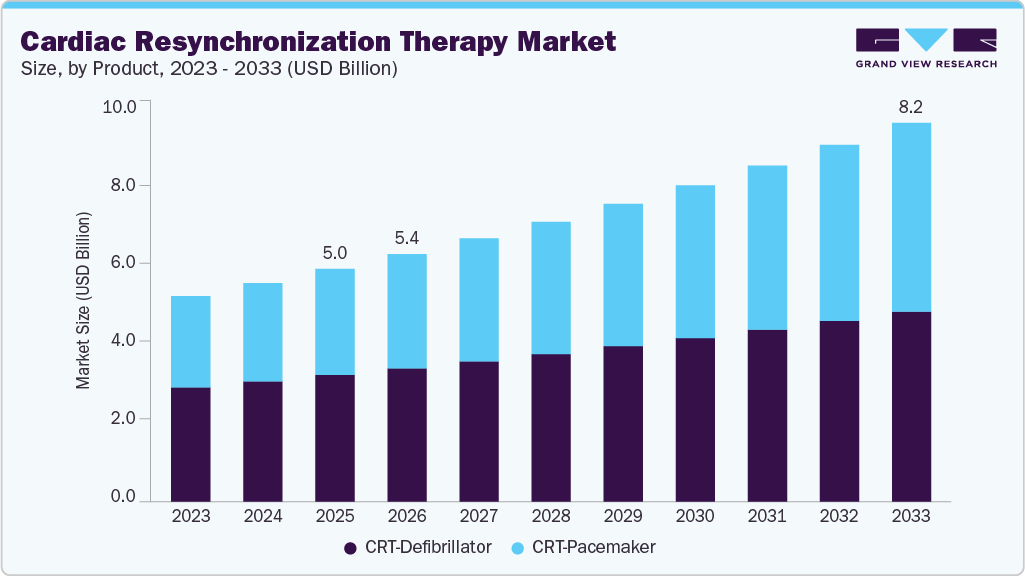

The global cardiac resynchronization therapy market size was estimated at USD 5.05 billion in 2025 and is projected to reach USD 8.21 billion by 2033, growing at a CAGR of 6.25% from 2026 to 2033. The market growth is driven by the rising prevalence of heart failure and associated conduction abnormalities, increasing adoption of advanced implantable cardiac devices, and expanding clinical evidence supporting the efficacy of cardiac resynchronization therapy (CRT) in improving survival and quality of life.

Key Market Trends & Insights

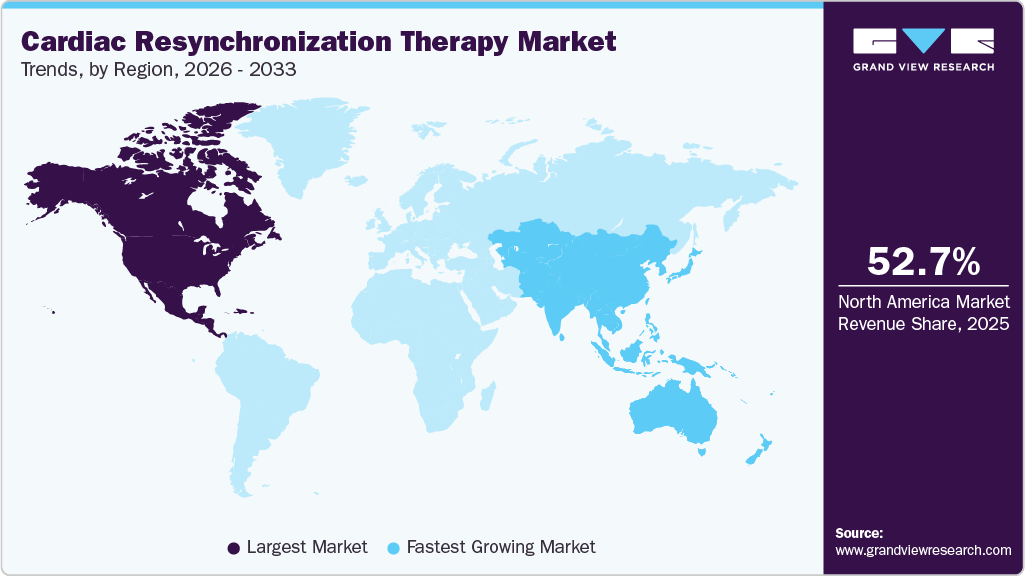

- The North America cardiac resynchronization therapy market held the largest revenue share of 52.66% in 2025.

- The U.S. cardiac resynchronization therapy industry led North America with the largest share in 2025.

- By product, the CRT-defibrillator segment held the largest market share in 2025.

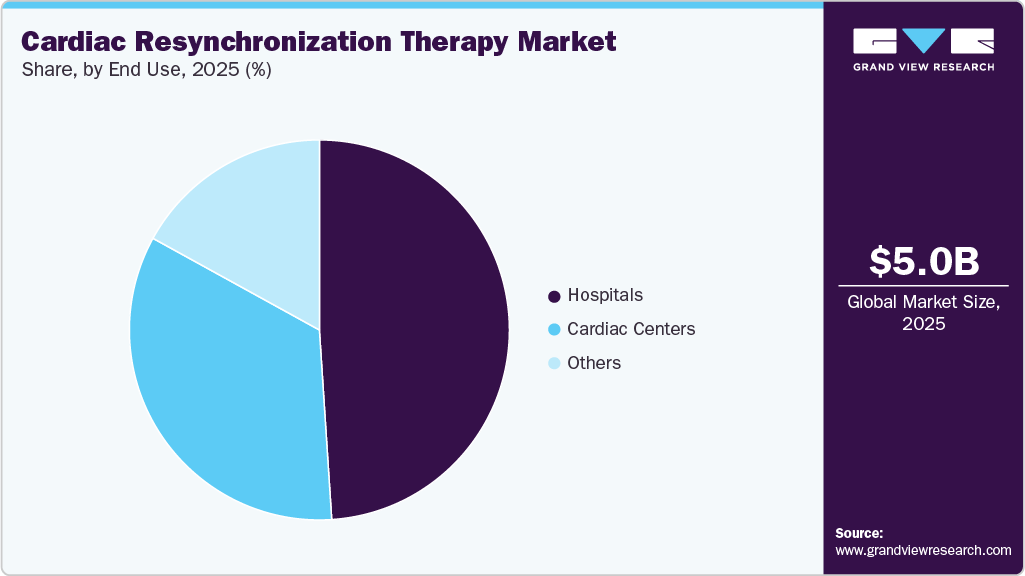

- By end use, the hospitals segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.05 Billion

- 2033 Projected Market Size: USD 8.21 Billion

- CAGR (2026-2033): 6.25%

- North America: Largest Market in 2025

- Asia Pacific: Fastest growing market

Technological advancements such as conduction system pacing (CSP), left bundle branch area pacing (LBBAP), and leadless or wireless CRT systems are enhancing therapeutic precision and reducing procedural complications, driving wider adoption among physicians. Favorable reimbursement policies in key markets, growing awareness of early heart failure management, and integration of AI-enabled remote monitoring for continuous patient follow-up are further accelerating market demand. In addition, ongoing clinical trials and new product launches by leading manufacturers, including next-generation MRI-compatible and Bluetooth-enabled CRT devices, continue to expand the therapeutic scope and patient eligibility for CRT therapy globally.

The increasing prevalence of cardiovascular diseases (CVDs) remains one of the primary factors driving the growth of the cardiac resynchronization therapy market. According to Oxford Academic (January 2025), the global age-standardized prevalence of CVD is estimated at approximately 7,179 cases per 100,000 population, highlighting the persistent global burden of heart-related disorders. In the U.S., the prevalence of CVDs, including heart failure and cardiac arrhythmias, continues to rise, largely due to sedentary lifestyles, obesity, and associated metabolic comorbidities. As reported by the American Heart Association (AHA) in January 2024, there were 931,578 CVD-related deaths, an increase of nearly 3,000 compared to the previous year. The age-adjusted death rate rose by 4.0%, reaching 233.3 deaths per 100,000 population, underscoring a concerning upward trajectory. This trend reflects a growing need for effective cardiac therapies that can improve functional outcomes and reduce mortality.

Key Facts on Cardiovascular Disease and Related Events in the U.S. (2024)

Statistic

Value

Total CVD deaths per day

2,552

Deaths from heart disease per day (including heart attacks)

1,905

Average time between heart attacks

Every 40 seconds

New heart attacks each year

Approximately 605,000

Recurrent heart attacks each year

Approximately 200,000

Silent heart attacks

Estimated 170,000

Average age at first heart attack (males)

65.6 years

Average age at first heart attack (females)

72.0 years

Source: American Heart Association, Inc. in January 2024 & GVR

Cardiac Resynchronization Therapy, encompassing CRT-Pacemakers (CRT-P) and CRT-Defibrillators (CRT-D), directly addresses this clinical need by restoring synchronized ventricular contractions, improving cardiac efficiency, and reducing the risk of sudden cardiac death. The increasing incidence of advanced heart failure and arrhythmic disorders has accelerated CRT adoption, particularly across hospitals and specialized cardiac centers equipped for device implantation and long-term management. With growing awareness of guideline-directed medical therapy (GDMT), continuous technological innovation in device design (such as MRI compatibility and Bluetooth-enabled monitoring), and expanding clinical evidence supporting the efficacy of CRT, the U.S. CRT market is expected to experience robust and sustained growth over the coming years.

Technological innovations in CRT devices are one of the major factors driving market growth. For instance, in July 2025, Electrophysiologists at the Texas Cardiac Arrhythmia Institute (TCAI) within St. David's Medical Center performed the nation’s first implantation of a newly FDA-approved leadless system designed to deliver cardiac resynchronization therapy for heart failure patients. CRT helps coordinate the heart’s contractions, restoring a normal heartbeat rhythm. Dr. Robert Canby, a cardiac electrophysiologist at TCAI, performed the initial procedure.

Moreover, the rising prevalence of sedentary lifestyles is increasingly recognized as a significant driver of cardiovascular risk, contributing to conditions such as heart failure, myocardial infarction, and cardiovascular mortality. Recent studies have highlighted the detrimental effects of prolonged sedentary behavior, even among individuals who engage in recommended levels of physical activity. According to the Harvard Gazette article published in November 2024, research from Massachusetts General Hospital found that spending more than 10.6 hours per day in sedentary activities such as sitting, reclining, or lying down was associated with a 40-60% increased risk of heart failure and cardiovascular death. These risks persisted even among individuals who met the recommended 150 minutes of moderate-to-vigorous physical activity per week. The study highlights the importance of reducing sedentary time, regardless of exercise habits, in mitigating cardiovascular risk.

Furthermore, the Journal of the American College of Cardiology in November 2024 revealed that individuals who spent approximately 10.6 hours or more per day in sedentary behavior had a significantly higher risk of heart failure and cardiovascular death, even if they engaged in regular physical activity. This finding emphasizes that excessive sitting time can negate the protective effects of exercise on heart health. These findings underscore the crucial need for public health initiatives that promote regular physical activity and strategies to mitigate sedentary behavior. Encouraging individuals to take short breaks from sitting, engage in light physical activities throughout the day, and adopt more active lifestyles can play a key role in reducing the burden of cardiovascular diseases.

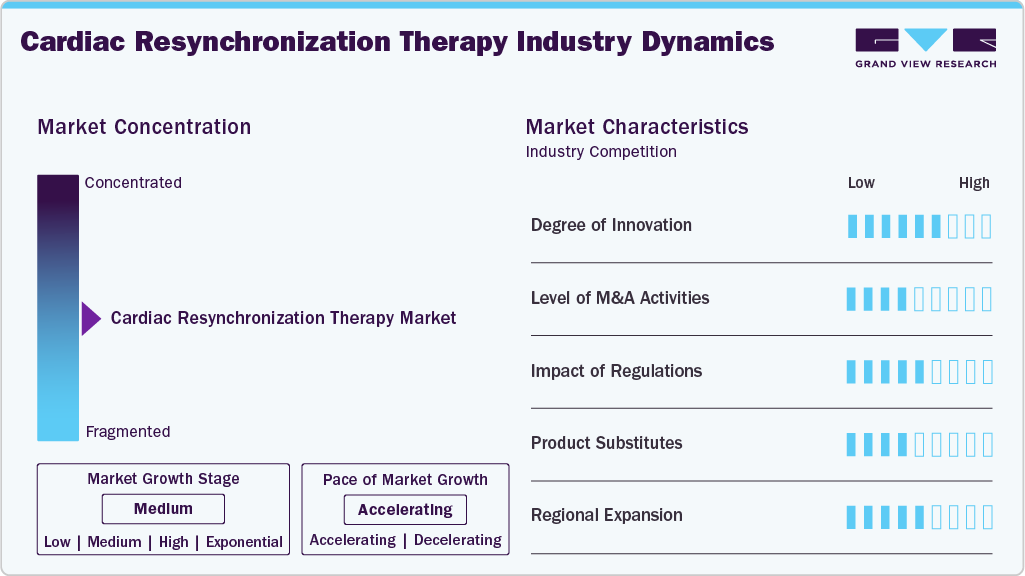

Market Concentration & Characteristics

The cardiac resynchronization therapy industry exhibits a high degree of innovation, driven by advancements in the development of multifunctional devices that combine therapeutic modalities. In September 2025, the Integra-D device was introduced, integrating cardiac contractility modulation (CCM) with defibrillation therapy. This dual-function system not only addresses the symptomatic management of heart failure with reduced ejection fraction (HFrEF) but also prevents sudden cardiac death. Clinical data from the Integra-D trial demonstrated a 100% success rate in converting ventricular arrhythmias, with 94% success on the first shock. After six months, 88% of patients showed improvement or remained stable in their NYHA class, with Class III patients experiencing the most significant benefit.

The CRT market is witnessing a moderate level of merger and acquisition (M&A) activity, as companies seek to enhance technological innovation and expand their global presence. Strategic alliances and acquisitions are primarily aimed at integrating AI-driven analytics, remote monitoring technologies, and next-generation cardiac device architectures into product portfolios. These collaborations enable faster product development cycles, strengthen clinical validation capabilities, and improve access to diverse patient segments. Additionally, partnerships with regional players offer regulatory insights and established distribution networks, facilitating smoother market entry in emerging economies. Moreover, industry consolidation and cross-sector collaborations are reshaping the competitive landscape, accelerating the adoption of connected and data-enabled CRT systems.

The cardiac resynchronization therapy market is moderately regulated, with devices requiring FDA approval in the U.S., CE marking in the European Union, and compliance with local medical device standards globally. These regulations ensure product safety, performance, and clinical reliability, but also affect development costs and approval timelines. Authorities are increasingly updating frameworks to accommodate AI integration, software-based diagnostics, and remote monitoring features, supporting innovation while maintaining strict patient safety standards.

The cardiac resynchronization therapy market is experiencing rapid expansion of products, driven by targeted device launches and technological advancements. Manufacturers are focusing on innovations that enhance therapy outcomes, improve patient comfort, and optimize clinical performance. In May 2023, MicroPort CRM introduced the GALI SonR Cardiac Resynchronization Therapy and Defibrillation (CRT-D) device along with the NAVIGO 4LV left ventricular pacing leads in Japan. This launch highlights the industry’s focus on expanding device portfolios, optimizing CRT, and promoting connected, patient-centered cardiac care.

The cardiac resynchronization therapy industry is experiencing moderate regional expansion, with leading manufacturers expanding their presence across the Asia-Pacific, the Middle East & North Africa (MENA), and Latin America to capitalize on the growing demand driven by the rising incidence of heart failure and cardiac disorders. Companies are focusing on building local distribution partnerships, clinician education programs, and remote monitoring infrastructure to enhance therapy accessibility and patient management. These initiatives not only improve device adoption and treatment adherence in underserved areas but also strengthen global market reach and support long-term growth in emerging healthcare systems.

Product Insights

The CRT-defibrillator segment led the cardiac resynchronization therapy market, accounting for the largest revenue share of 54.43% in 2025. The CRT-Defibrillator (CRT-D) is intended to resynchronize the right & left ventricles in patients with congestive heart failure, providing ventricular cardioversion/defibrillation & ventricular antitachycardia pacing. Moreover, the demand for defibrillators is expected to rise due to the rising prevalence of sudden cardiac arrest. Cardiac arrests are generally severe or fatal, and the survival rate is very low in some countries, but it is much higher in out-of-hospital arrests. According to the Sudden Cardiac Arrest Foundation article published in 2025, 137,119 out-of-hospital cardiac arrests (OHCA) were reported in the U.S. in 2024, with an estimated 263,711 EMS-treated, non-traumatic OHCA cases based on census data extrapolation. Moreover, as per the Scottish Sun article published in October 2025, the situation in the UK is similarly dire, with over 300,000 out-of-hospital cardiac arrests reported annually. The survival rate is under 10%, underscoring the need for prompt and effective emergency responses. Hence, the increasing prevalence of cardiac arrest is anticipated to boost demand for various treatment options, including CRT-D. Defibrillators are the devices used to revive someone from sudden cardiac arrest.

The CRT-pacemaker segment is expected to grow at the fastest CAGR over the forecast period. The CRT-Pacemaker (CRT-P) system consists of a pulse generator device and leads that are implanted in the patient’s chest and heart. The device runs on a battery and software that monitors heart rhythm, stores information, and delivers electrical energy. Moreover, technological advancements, such as smaller device sizes and enhanced features, are expected to improve patient outcomes and increase device adoption, thereby propelling segment growth. The rising prevalence of cardiovascular diseases, especially heart failure, is expected to improve the demand for effective treatment options, such as CRT-Ps. In July 2023, BIOTRONIK announced that the U.S. FDA approved its Amvia Edge pacemakers and CRT-Ps. This significant milestone for CRT highlights the importance of government approval, as it ensures safety and efficacy and fosters trust among healthcare providers and patients. Consequently, this FDA approval promotes the wider adoption of CRT devices, contributing to the market expansion of CRT as a crucial treatment option for heart failure patients worldwide.

End Use Insights

The hospitals segment led the cardiac resynchronization therapy industry, accounting for the largest revenue share of 48.97% in 2025. Hospitals serve as central hubs for cardiac care, encompassing heart failure management and CRT device implantation, thereby driving market demand. Investments in advanced technologies and innovations such as leadless pacing systems and conduction system pacing techniques, including Left Bundle Branch Area Pacing (LBBAP), are enhancing hospital capabilities and supporting growth in CRT device adoption. For instance, in June 2025, Eastern India witnessed its first dual heart pacing procedure, combining Bachmann's Bundle (BB) Pacing and Left Bundle Branch Area Pacing, at Medica Superspecialty Hospital. This advanced technique, which supports the heart’s natural electrical rhythm, helps prevent arrhythmias and improve cardiac efficiency. The procedure was performed on a 33-year-old male patient from Agartala, Tripura, marking a significant milestone in heart rhythm management in the region. These advancements drive the growth of the CRT market by expanding the scope and effectiveness of hospital-based treatments.

The cardiac centers segment is expected to grow at the fastest CAGR over the forecast period. The adoption of CRT devices in cardiac centers is rising steadily, as these facilities combine advanced medical technologies with specialized expertise to improve patient outcomes. This trend is expected to further fuel market growth, as cardiac centers continue to expand their capabilities in rhythm management and heart failure therapies. For instance, in April 2025, Cone Health inaugurated a 156,000-square-foot, five-story heart and vascular center in Greensboro. This comprehensive facility consolidates various heart services, including diagnostics, consultations, and treatments, under one roof, enhancing patient convenience and care efficiency.

Regional Insights

The North America cardiac resynchronization therapy market dominated with a share of 52.66% in 2025. Rising cases of CVD drive the market's growth. According to the CDC article published in October 2024, in the U.S., cardiovascular disease remains a key public health concern, claiming a life approximately every 34 seconds. This shocking frequency highlights the growing burden of cardiac conditions such as heart failure, arrhythmias, and coronary artery disease, which collectively place immense pressure on the healthcare system. While these conditions often lead to electrical and mechanical dysfunctions of the heart, the need for advanced therapies such as CRT has become increasingly vital.

U.S. Cardiac Resynchronization Therapy Market Trends

The U.S. CRT industry accounted for the largest share of North America in 2025. Growing awareness and government initiatives are driving market growth. According to a CDC article published in May 2024, the U.S. Centers for Disease Control and Prevention (CDC) launched the Heart Disease Communications Toolkit to support public health professionals and clinicians in educating communities about heart disease, its risk factors, treatments, and preventive strategies. This heightened public and clinical awareness contributes to earlier diagnosis of heart failure and conduction abnormalities, expanding the eligible patient pool for Cardiac Resynchronization Therapy and fueling market growth.

Europe Cardiac Resynchronization Therapy Market Trends

The Europe cardiac resynchronization therapy industry is expected to grow over the forecast period. According to a World Heart Federation article published in December 2024, cardiovascular disease (CVD) remains the leading cause of death in Europe and worldwide, affecting over 60 million Europeans. This significant patient population represents a major healthcare burden and highlights the increasing need for effective interventions to manage heart-related conditions, particularly heart failure. In this context, CRT has emerged as a vital treatment option, offering improved cardiac function, reduced hospitalizations, and enhanced quality of life for patients with symptomatic heart failure.

The UK cardiac resynchronization therapy market is projected to grow over the forecast period. Increasing CVD cases drive the market growth. According to a British Heart Foundation (BHF) article published in September 2025, cardiovascular diseases (CVDs) continue to pose a major public health challenge in the UK, accounting for approximately 26% of all deaths nationwide. Nearly 480 fatalities every day, or one every three minutes. The significant burden of CVD highlights the urgent need for effective treatment strategies and advanced cardiac care technologies. In this context, Cardiac Resynchronization Therapy (CRT) plays a crucial role by improving heart function and quality of life among patients with heart failure and conduction abnormalities.

The cardiac resynchronization therapy market in Germany is expected to grow over the forecast period, driven by the rising prevalence of heart failure cases. According to a Gesundheitsatlas article published in 2023, approximately 2.93 million individuals in Germany were living with heart failure, reflecting the growing burden of cardiovascular disease in the country. The high prevalence of heart failure underscores a substantial patient population that could potentially benefit from advanced therapies such as Cardiac Resynchronization Therapy. Regions with larger populations, including Nordrhein-Westfalen, Bayern, and Baden-Württemberg, report the highest number of cases, indicating concentrated demand for specialized heart failure interventions. This epidemiological landscape underscores the urgent need for timely diagnosis and the adoption of CRT devices to enhance cardiac function, reduce hospitalizations, and improve the quality of life for patients across Germany.

Asia Pacific Cardiac Resynchronization Therapy Market Trends

The Asia Pacific CRT industry has witnessed a growing demand for cardiac resynchronization therapy devices, driven by the rising prevalence of cardiovascular diseases and heart failure across countries such as China, India, Japan, and South Korea. The adoption of advanced CRT-D and CRT-P devices is increasing as healthcare infrastructure improves, hospitals expand specialized cardiac care units, and awareness of heart failure management rises. Leading global companies, including Medtronic, Abbott, Biotronik, and MicroPort Scientific Corporation, are strengthening their presence through hospital collaborations, clinical programs, and technology transfers, aiming to improve access to CRT therapies across urban and semi-urban areas.

The China cardiac resynchronization therapy market accounted for the largest market share in the Asia Pacific region in 2025. Increasing CVD cases drive the growth of the market. According to the Beijing Renhe Information Technology Co. Ltd article published in August 2025, in China, cardiovascular disease (CVD) remains a major public health concern, impacting an estimated 330 million individuals nationwide. Within this population, approximately 13 million people are affected by stroke, while nearly 11.4 million suffer from coronary heart disease (CHD). The growing prevalence of these cardiovascular conditions has led to a surge in heart failure cases, creating a substantial need for advanced cardiac treatment solutions.

The cardiac resynchronization therapy market in Australia is expected to grow at a significant CAGR over the forecast period.Rising HF incidence drives the market growth. According to the Australian Institute of Health and Welfare article published in December 2024, in Australia, heart failure affects a significant portion of the adult population, with an estimated 144,000 individuals aged 18 and above living with the condition in 2022. This accounts for approximately 0.7% of the adult population, highlighting a substantial patient pool in need of effective management. The growing prevalence of heart failure is driving demand for advanced therapeutic interventions, such as Cardiac Resynchronization Therapy, which can improve cardiac function, reduce hospitalizations, and enhance quality of life. As awareness and diagnosis of heart failure increase, the adoption of CRT devices is expected to expand, leading to improved outcomes for patients across Australia.

Latin America Cardiac Resynchronization Therapy Market Trends

The CRT market in Latin America is expected to witness significant growth over the forecast period, driven by the increasing cases of heart failure and other cardiovascular conditions, particularly in Brazil and Argentina. Hospitals and specialized cardiac centers are expanding their capabilities, and awareness of advanced heart failure management is growing. Key players, including Abbott, Medtronic, Biotronik, and MicroPort Scientific Corporation, actively engage in local partnerships, clinical research, and the introduction of next-generation CRT-D and CRT-P devices to strengthen their market presence.

The Brazil cardiac resynchronization therapy market is expected to grow over the forecast period. Increasing CVD incidence drives the growth of the market. According to the Elsevier Ltd. article published in July 2025, in Brazil, cardiovascular diseases (CVDs) remain a leading public health concern, accounting for approximately 30% of all deaths. Over recent decades, CVDs have consistently been the primary cause of mortality, surpassed only by COVID-19 during the pandemic years of 2020 and 2021. This persistent high prevalence of heart disease has directly influenced the demand for advanced CRT solutions.

Middle East & Africa Cardiac Resynchronization Therapy Market Trends

The MEA cardiac resynchronization therapy industry is growing significantly, driven by the rising prevalence of heart failure, cardiovascular diseases, and key risk factors such as obesity, diabetes, and high blood pressure. Countries including South Africa, Saudi Arabia, UAE, and Kuwait are investing in cardiac care infrastructure, with hospitals and specialty centers expanding capabilities to provide advanced CRT-D and CRT-P devices. Major players, including Medtronic, Abbott, Biotronik, and MicroPort Scientific Corporation, are introducing next-generation devices, remote monitoring technologies, and clinician training programs to enhance procedural expertise and improve patient outcomes.

The South Africa cardiac resynchronization therapy market is expected to grow over the forecast period. The increasing incidence of CVD in South Africa drives the growth of the market. According to an NCBI article published in May 2024, in South Africa, cardiovascular disease continues to exert a heavy toll on public health, accounting for approximately 17.3% of all deaths, or nearly one in six fatalities. Data further reveal that an average of 215 individuals die each day due to heart disease or stroke, emphasizing the persistent burden of cardiovascular conditions. This rising prevalence of heart-related illnesses is driving the demand for advanced interventions such as CRT, which can help improve heart function, reduce hospitalizations, and enhance the quality of life for patients with severe heart failure across the country.

Key Cardiac Resynchronization Therapy Company Insights

Leading players in the CRT market such as Abbott, Biotronik and Medtronic, have strategically employed innovative approaches, including mergers and acquisitions, market penetration initiatives, partnerships, and distribution agreements. These strategies aim to enhance their revenue streams by leveraging collaborative efforts, expanding market reach, and fostering synergies within the dynamic landscape of cardiac resynchronization therapy. Emerging market entrants such as Schiller and, MEDICO S.R.L. are directing their efforts toward broadening their market presence, creating inventive technologies, and establishing strategic partnerships as part of their strategy to contend with established industry leaders.

Key Cardiac Resynchronization Therapy Companies:

The following are the leading companies in the cardiac resynchronization therapy market. These companies collectively hold the largest Market share and dictate industry trends.

- Abbott

- Biotronik

- Medtronic

- Boston Scientific Corporation

- MicroPort Scientific Corporation

- OSYPKA MEDICAL

- MEDICO S.R.L.

- Schiller

Recent Developments

-

In September 2025, BIOTRONIK launched the Amvia Sky HF-T QP pacemaker and CRT-P in Canada, marking the first implant at the Centre Hospitalier de l’Université de Montréal by Dr. Fadi Mansour. The device is a triple-chamber system designed with patient-centered features, offering streamlined workflows and advanced capabilities, making it one of the most comprehensive CRT-P solutions available.

-

In February 2025, Teleflex Incorporated announced it had entered into a definitive agreement to acquire substantially all of the Vascular Intervention business of BIOTRONIK for an estimated cash payment of approximately EUR 760 million (USD 892.15 million).

-

In April 2025, the FDA approved EBR Systems' leadless WiSE CRT system for heart failure treatment. This innovative system allows left ventricular endocardial pacing without conventional leads, offering a less invasive and more physiological pacing option for patients.

Cardiac Resynchronization Therapy Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 5.37 billion

Revenue forecast in 2033

USD 8.21 billion

Growth rate

CAGR of 6.25% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Biotronik; Medtronic; Boston Scientific Corporation; MicroPort Scientific Corporation; OSYPKA MEDICAL; MEDICO S.R.L.; Schiller

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Resynchronization Therapy (CRT) Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cardiac resynchronization therapy market report based on product, end use, and region:

-

Product Outlook (Unit Volume in ‘000 Units; Average Selling Price [USD per Unit]; Revenue in USD Million, 2021 - 2033)

-

CRT-Defibrillator

-

CRT-Pacemaker

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Cardiac Centers

-

Others

-

-

Regional Outlook (Unit Volume in ‘000 Units; Average Selling Price [USD per Unit]; Revenue in USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac resynchronization therapy market size was estimated at USD 5.05 billion in 2025 and is expected to reach USD 5.37 billion in 2026.

b. The global cardiac resynchronization therapy market is expected to grow at a compound annual growth rate of 6.25% from 2026 to 2033 to reach USD 8.21 billion by 2033.

b. North America dominated the cardiac resynchronization therapy market with a share of 52.66% in 2025. This is attributable to well-established healthcare infrastructure, the increasing prevalence of cardiac diseases, and the geriatric population susceptible to cardiac dysfunction.

b. Some key players operating in the cardiac resynchronization therapy market include Abbott, Biotronik, Medtronic, Boston Scientific Corporation, MicroPort Scientific Corporation, OSYPKA MEDICAL, MEDICO S.R.L., and Schiller.

b. The growth of the market is driven by the rising prevalence of heart failure and associated conduction abnormalities, increasing adoption of advanced implantable cardiac devices, and expanding clinical evidence supporting the efficacy of CRT in improving survival and quality of life.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.