- Home

- »

- Medical Devices

- »

-

Cardiac Rehabilitation Market Size, Industry Report, 2030GVR Report cover

![Cardiac Rehabilitation Market Size, Share & Trends Report]()

Cardiac Rehabilitation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Treadmill, Elliptical Trainer, Stabilization Ball, Wearable Device), By End Use (Rehabilitation Centers, Hospitals & Clinics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-661-5

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiac Rehabilitation Market Size & Trends

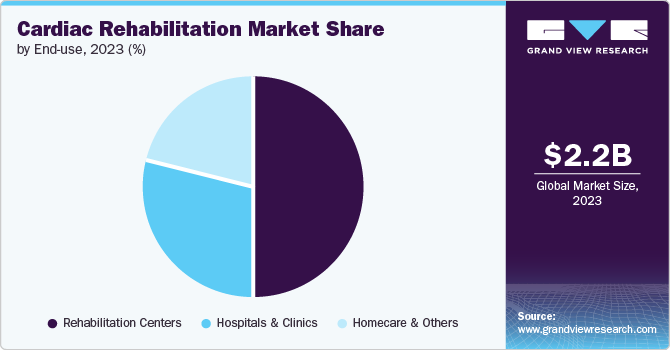

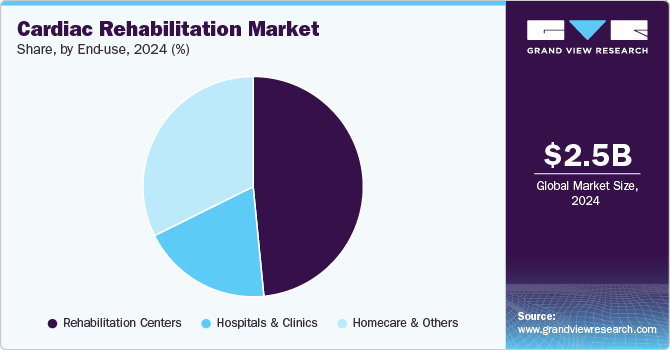

The global cardiac rehabilitation market size was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. The increasing incidence of cardiovascular diseases (CVD) is one of the primary factors driving the market's growth. According to the American College of Cardiology Foundation article published in December 2023, cardiovascular disease (CVD) has seen a significant rise globally, with deaths increasing from 12.4 million in 1990 to nearly 20 million in 2023-24. This growth is attributed to an aging population, expanding global demographics, and preventable risks linked to metabolic, environmental, and lifestyle-related issues. This underscores the importance of cardiac rehabilitation devices, which focus on managing risk factors and improving long-term patient outcomes.

The efficiency of targeted screening programs for cardiovascular diseases fuels market growth. According to Springer Nature’s article published in June 2024, a review of cardiology reports examined the impact of screening programs. It underscores findings from multicenter studies, such as AF-SCREEN and STROKESTOP, which show that targeted screening greatly enhances the detection of cardiovascular diseases, especially among older adults. The review strongly supports establishing national screening initiatives to address the growing burden of AFib-related complications, highlighting the critical role of early detection and intervention.

Increased CVD mortality in the U.S. drives the growth of the cardiac rehabilitation industry. According to a CDC article published in October 2024, the high mortality rate, with a cardiovascular-related death happening every 33 seconds, drives significant demand for advanced medical devices that aid in the prevention, early diagnosis, and effective treatment of heart conditions. The mortality rate from heart disease emphasizes the urgent need for practical solutions, driving the demand for innovative cardiac rehabilitation programs and devices aimed at improving cardiovascular health outcomes.

Moreover, heart disease remains the leading cause of death for both men and women in the U.S., yet awareness levels among women have declined. According to the NHLBI article published in February 2024, to combat this trend, the National Heart, Lung, and Blood Institute (NHLBI) is intensifying its educational efforts through programs like The Heart Truth, explicitly targeting younger women, who often have lower awareness of their cardiovascular health risks. The new initiative, “Yes, YOU!” aims to engage women in their 20s, 30s, and 40s with information about heart disease and modifiable risk factors, such as hypertension and obesity. Leveraging various media resources, including fact sheets and video public service announcements, these programs seek to empower women with knowledge, ultimately encouraging earlier detection and management of cardiovascular conditions. This proactive approach is expected to drive growth in the cardiac rehabilitation market as increased awareness leads more individuals to seek comprehensive rehabilitation programs alongside diagnostic and treatment options for heart disease.

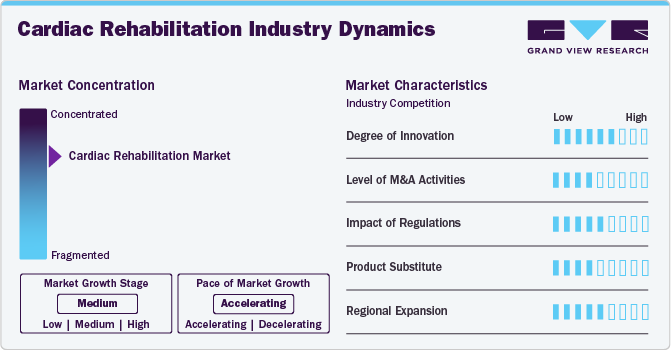

Market Concentration & Characteristics

The cardiac rehabilitation industry is experiencing notable innovation, with a strong focus on personalized treatment plans, advanced monitoring devices, and the integration of telehealth solutions. Companies are developing cutting-edge rehabilitation technologies that provide real-time tracking of patients' progress, improve patient engagement, and enhance recovery outcomes. Adopting wearable devices, virtual platforms, and AI-driven analytics transforms rehabilitation protocols, offering patients tailored rehabilitation plans that cater to their needs. These innovations drive improved patient recovery, better long-term cardiovascular health, and more efficient use of healthcare resources, positioning the market for continued growth and expansion.

Key players in the cardiac rehabilitation industry, such as Ball Dynamics International, LLC, Core Health & Fitness, LLC, and Honeywell International, Inc., are strengthening their positions through strategic mergers and acquisitions. In addition to these efforts, these companies focus on enhancing their product portfolios, forming strategic alliances with rehabilitation centers, and expanding their reach in emerging markets. They aim to address the growing demand for comprehensive cardiac rehabilitation solutions, improve patient outcomes, and stay at the forefront of technological advancements in cardiovascular care. These strategies ensure that companies are well-positioned to meet the evolving needs of the global healthcare landscape.

Regulatory frameworks in the cardiac rehabilitation industry are essential for ensuring the safety, efficacy, and quality of rehabilitation devices and therapies. While stringent regulations can extend the approval process for new products and technologies, they are critical in safeguarding patient health and ensuring that only effective and high-quality rehabilitation solutions reach the market. These regulations help maintain the integrity of cardiac rehabilitation treatments by ensuring that devices, wearables, and therapeutic programs meet established safety standards, ultimately supporting better patient outcomes and promoting the long-term success of rehabilitation programs.

There are no direct substitutes for cardiac rehabilitation. However, alternative approaches or treatments may be considered based on individual patient needs and clinical conditions. These alternatives could include pharmacological interventions, lifestyle modifications, or other medical therapies. While these options can support cardiovascular health, they do not replace the necessity for specialized cardiac rehabilitation programs that provide structured exercise, counseling, and education, essential for optimal recovery and long-term heart health.

Key players in the industry are expanding their reach by entering new geographical regions, forming strategic alliances with local healthcare providers, and customizing their rehabilitation programs to suit the unique healthcare needs of different populations. This strategy enables companies to cater to diverse healthcare systems, improve accessibility to rehabilitation services, and ensure that patients receive tailored solutions for their recovery. Aligning their offerings with regional requirements, these companies enhance their market presence and promote the widespread adoption of cardiac rehabilitation programs, ultimately supporting better heart health outcomes across various regions.

Product Insights

Based on product, the wearable device segment dominated the market and accounted for a share of 29.0% in 2024. Increased CVD disease and technological advancements drive the growth of the market. In cardiac rehabilitation, wearable devices refer to portable, patient-friendly devices that monitor or support heart health, aiding in disease management and recovery. For instance, in January 2024, Kestra Medical Technologies announced that its ASSURE Wearable Cardioverter Defibrillator (WCD) is now available to over 200 million health plan members across the U.S. This milestone was reached within 18 months of its national commercial launch. The device is now covered by major insurers, including Cigna, Florida Blue, and multiple Blue Cross Blue Shield (BCBS) plans, expanding its accessibility to many patients, including those enrolled in traditional Medicare and state Medicaid programs.

Treadmill is expected to witness a significant CAGR during the forecast period. The growing number of CVD cases and technological advancements drive the market's growth. A treadmill is an exercise machine that allows individuals to walk, jog, or run in place. It is commonly used in cardiovascular rehabilitation and fitness training, providing a controlled environment for patients to improve cardiovascular health, endurance, and overall fitness. For instance, in June 2023, SupeRun introduced its flagship product, the 2-in-1 Folding Treadmill, designed to offer both versatility and convenience. The treadmill features a solid and durable build, which is ideal for home use. Its flexible design ensures space-saving storage and easy portability. Additionally, it can be synced with the PitPatant online competition platform, allowing users to track and record their performance data while running, adding a competitive and engaging element to their fitness routine.

End Use Insights

Based on end use, the rehabilitation centers segment dominated the market and accounted for a share of 48.4% in 2024. Increasing CVD cases and strategic initiatives by key players drive the market's growth. Rehabilitation centers are facilities that offer structured programs to help patients recover from heart conditions, focusing on exercise, education, and lifestyle changes to improve cardiovascular health. For instance, in May 2024, the Hearts Cardiac Rehabilitation Collaborative launched efforts to increase participation rates in cardiac rehabilitation programs from 20% to 70%. This initiative focuses on improving awareness of the benefits of cardiac rehabilitation (CR), enhancing referral processes, and addressing barriers that prevent eligible patients from engaging in these vital programs. The collaborative meets quarterly to share best practices and strategies for implementation across the nation.

The homecare & others segment is projected to grow significantly over the forecast period. Rising heart cases and technological advancements drive the growth of the market. Homecare healthcare services are provided at home, including exercise programs and monitoring for cardiac rehabilitation. Furthermore, non-traditional options like outpatient clinics, community programs, and virtual rehabilitation platforms for cardiac care are some of the other facilities for providing rehabilitation services. For instance, the Cleveland Clinic offers a home-based cardiac rehabilitation option that allows patients to continue their recovery in a familiar environment. This program is designed for individuals who cannot attend in-person sessions due to distance or health issues. Patients receive guidance on exercises and lifestyle changes through telehealth consultations, ensuring they maintain progress post-discharge.

Regional Insights

North America cardiac rehabilitation market held a dominant share of 44.9% in 2024 owing to improved healthcare infrastructure, technological advancements, and increasing prevalence of CVDs in the U.S. & Canada. According to an (AHA) American Heart Association article published in January 2024, every day in the U.S., cardiovascular disease (CVD) is responsible for approximately 2,552 deaths. This substantial impact on public health underscores the urgent need for effective cardiac rehabilitation programs. As a result, there is a growing demand for comprehensive rehabilitation solutions aimed at improving patient outcomes, enhancing recovery, and reducing the long-term effects of CVD. This increasing need is driving the expansion of the cardiac rehabilitation industry.

U.S. Cardiac Rehabilitation Market Trends

The cardiac rehabilitation market in the U.S. dominated the North American industry in 2024 owing to the increasing prevalence of cardiovascular disease due to unhealthy lifestyles and lack of physical activity. For instance, as per the American Heart Association article published in June 2024, cardiovascular disease (CVD) is projected to affect over 184 million Americans by 2050, accounting for more than 61% of the population. Alongside this significant rise in prevalence, healthcare costs related to CVD are anticipated to surge, potentially reaching USD 1.8 trillion. This growing burden underscores the critical need for expanding and enhancing cardiac rehabilitation programs, as they play a key role in managing CVD, improving patient recovery, and reducing long-term healthcare costs.

Europe Cardiac Rehabilitation Market Trends

The cardiac rehabilitation market in Europe was identified as a lucrative region in 2024. The increased death rate of CVDs is driving the need for cardiovascular devices in Europe. According to a World Health Organization article published in May 2024, cardiovascular diseases (CVDs) are the leading cause of disability and premature death in Europe, responsible for over 42.5% of all deaths annually, equating to around 10,000 deaths every day. The widespread impact of CVD emphasizes the critical need for enhanced cardiac rehabilitation programs. The mortality rate remains high, and the demand for effective rehabilitation solutions is expected to grow, driven by the need to improve patient recovery, enhance long-term health outcomes, and alleviate the broader impact of CVD on the healthcare system across Europe.

Germany cardiac rehabilitation market dominated the region with the highest revenue share in 2024. The growing number of CVD and technological advancements drives the market's growth. According to the Springer article published in March 2024, with 11,314 deaths attributed to CHD in Germany, it highlights the significant burden of cardiovascular diseases (CVDs) in the country. This concerning scenario emphasizes the urgent need for advanced treatment options, particularly for managing chronic cardiovascular conditions. The high mortality rates linked to cardiovascular diseases underline the crucial importance of enhancing patient outcomes through innovative rehabilitation methods. As the number of individuals requiring effective cardiac rehabilitation rises, the demand for advanced rehabilitation techniques and other therapeutic solutions in Germany is anticipated to grow, driving the expansion of the cardiac rehabilitation market in the region.

The cardiac rehabilitation market in the UK is expected to grow rapidly in the forecast period due to better accessibility to healthcare infrastructure and the presence of key players in the country. The rising deaths due to cardiovascular disease and the aging population are fueling the market growth. Moreover, the favorable government policies and ongoing research in medicine and drugs to reduce the burden of CVDs in the country are likely to fuel the growth. The German cardiac rehabilitation market held a substantial market share in 2023 due to the region's high burden of cardiovascular disease and technological advancements.

France cardiac rehabilitation market is anticipated to witness a significant CAGR during the forecast period. The growing number of CVD cases and rising incidence of ischemic heart disease drives the growth of the market. According to the Elsevier B.V. article published in November 2024, In France, ischemic heart disease (IHD) continues to impose a significant strain on public health, with over 242,000 hospitalizations and 31,000 related deaths annually. This growing prevalence of cardiovascular conditions, affecting nearly 3 million adults, highlights the escalating need for comprehensive cardiac rehabilitation programs. As the population ages and the number of patients requiring rehabilitation post-cardiac events increases, there is a rising demand for effective rehabilitation solutions. This demand is further fueled by the need for long-term recovery and improved outcomes following complex coronary conditions. Moreover, the cardiac rehabilitation market's growth in France is driven by the increasing need for tailored rehabilitation services and innovative approaches to patient care.

Asia Pacific Cardiac Rehabilitation Market Trends

The cardiac rehabilitation market in Asia Pacific is anticipated to witness the fastest CAGR of 6.9% during the forecast period. The increasing number of CVD cases and rising R&D activities, along with the growing geriatric population in the Asia Pacific region, proliferates the market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, the Asia-Pacific region has approximately 697 million people aged 60 years and older, making up about 60% of the global elderly population. This age group is more vulnerable to cardiovascular diseases, and the growing number of older individuals in the region is driving an increased demand for treatments related to cardiac rehabilitation.

China cardiac rehabilitation market held a substantial share in 2024 owing to the rise in prevalence of cardiovascular disease and increasing developments in healthcare infrastructure. According to the NCBI article published in December 2023, China faces a significant challenge with cardiovascular diseases (CVD), affecting approximately 330 million people in 2022. This large patient population highlights the growing need for effective cardiac rehabilitation services. The prevalence of CVD continues to rise, and the demand for comprehensive and reliable rehabilitation programs is expected to increase, driven by the need to improve heart health outcomes and enhance recovery for millions of individuals across the country.

The cardiac rehabilitation market in Japan held a significant share in Asia Pacific. The increased number of CVD procedures and technological advancements drive the market's growth. According to the NCBI article published in February 2024, in Japan, a significant number of cardiovascular surgeries, totaling 63,054 annually, increases the need for rehabilitation services whilst reflecting the rising incidence of cardiovascular diseases. This increasing surgical demand underscores the need for specialized cardiac rehabilitation services, especially for patients recovering from complex procedures. The incidence of cardiovascular conditions continues to grow, and the cardiac rehabilitation market in Japan is expected to expand, driven by the need for comprehensive rehabilitation programs that improve patient recovery and long-term heart health outcomes.

India cardiac rehabilitation industry is experiencing significant growth. Growing healthcare expenditures, government initiatives, and rising CVD cases drive the market's growth. According to the Apollo Hospital article published in September 2024, In India, approximately 150,000 to 200,000 children are born each year with congenital heart disease, leading to a growing need for advanced cardiac rehabilitation services. As the prevalence of heart conditions, including complex cases, increases, there is a rising demand for effective rehabilitation programs to aid recovery and improve long-term health. The increasing incidence of both congenital and acquired heart diseases in India is expected to drive the growth of the cardiac rehabilitation market as healthcare providers focus on comprehensive rehabilitation therapies to enhance patient recovery and overall cardiovascular health.

Latin America Cardiac Rehabilitation Market Trends

The cardiac rehabilitation market in Latin America is witnessing growth due to the increasing prevalence of cardiovascular diseases (CVDs) and government initiatives. The region faces a higher burden of heart disease, intrinsically increasing the demand for effective rehabilitation programs. These programs focus on improving patient recovery, reducing mortality rates, and enhancing the quality of life for individuals recovering from heart conditions. Healthcare systems in countries like Brazil and Argentina are investing in advanced rehabilitation technologies and services, driving market expansion and improving cardiovascular health outcomes across the region.

Brazil cardiac rehabilitation market growth is represented by increasing CVD cases and strategic initiatives taken by the key players. For instance, in September 2023, the Brazilian government and healthcare institutions announced to make significant strides that enhanced cardiovascular care and outcomes in the country. Collaborative efforts, such as the partnership between Mount Sinai and the Brazilian Clinical Research Institute, focus on advancing research and medical education in cardiovascular diseases are some of the factors advancing cardiac rehabilitation services in the country. These initiatives underscore the growing need for effective cardiac rehabilitation solutions in the country. As Brazil addresses the rising prevalence of cardiovascular conditions, including complex cases, the demand for comprehensive cardiac rehabilitation programs is expected to increase.

Middle East and Africa Cardiac Rehabilitation Market Trends

The cardiac rehabilitation market in the Middle East and Africa is experiencing growth due to the increasing prevalence of cardiovascular diseases (CVDs) and the rising demand for effective rehabilitation services. With many countries in the region facing challenges related to lifestyle diseases, the need for cardiac rehabilitation to aid recovery and prevent further complications is critical. Rehabilitation programs in MEA focus on improving recovery outcomes, reducing heart disease-related mortality, and promoting overall cardiovascular health. Governments and healthcare providers in countries like Saudi Arabia, South Africa, and the UAE are increasingly investing in rehabilitation facilities and services to address these growing health concerns.

Saudi Arabia cardiac rehabilitation market is expected to grow at a CAGR of 4.8% over the forecast period. The rising number of surgeries and increasing incidence of CVD cases drive the market's growth. According to the article published by BMC Cardiovascular Diseases in March 2024, nearly 1.6% of individuals aged 15 and older are affected by cardiovascular diseases (CVD), including heart conditions and related disorders in Saudi Arabia. This growing prevalence underscores the increasing demand for effective cardiac rehabilitation solutions. As the need for comprehensive rehabilitation programs rises, there is a stronger focus on improving patient recovery and long-term cardiovascular health, driving the expansion of the cardiac rehabilitation market in Saudi Arabia.

Key Cardiac Rehabilitation Company Insights

Some of the key companies in the cardiac rehabilitation industry include Omron Corporation; Ball Dynamics International, LLC; Core Health & Fitness, LLC; Koninklijke Philips N.V. (BioTelemetry Inc); and GE Healthcare. These companies collectively hold key market share and dictate industry trends.

Key Cardiac Rehabilitation Companies:

The following are the leading companies in the cardiac rehabilitation market. These companies collectively hold the largest market share and dictate industry trends.

- Ball Dynamics International, LLC

- Core Health & Fitness, LLC

- Honeywell International, Inc.

- Omron Corporation

- Koninklijke Philips N.V. (BioTelemetry Inc)

- ICU Medical (Smiths Group)

- Halma plc

- GE Healthcare

- Technogym

- Johnson Health Tech

Recent Developments

-

In July 2024, the National Heart Institute (IJN) made a significant advancement in cardiac care by launching Asia's first rehabilitation center equipped with cutting-edge pneumatic exercise technology.

-

In April 2024, The Virtual Cardiac Rehabilitation (VCR) Program was launched at Northern Health. The program is expected to help patients recover after a heart condition, procedure, or event.

-

In January 2024, North Suffolk Cardiology launched the Pritikin Intensive Cardiac Rehabilitation Program (ICR). The program, at every patient’s visit, offers patients detailed lifestyle education and access to the cardiac care team in the state-of-the-art location.

Cardiac Rehabilitation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.7 billion

Revenue forecast in 2030

USD 3.6 billion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Ball Dynamics International, LLC; Core Health & Fitness, LLC; Honeywell International, Inc.; Omron Corporation; Koninklijke Philips N.V. (BioTelemetry Inc); ICU Medical (Smiths Group); Halma plc; GE Healthcare; Technogym; Johnson Health Tech;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

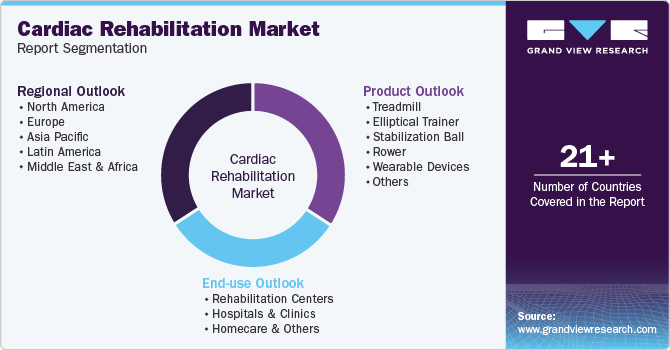

Global Cardiac Rehabilitation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cardiac rehabilitation market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Treadmill

-

Elliptical Trainer

-

Stabilization Ball

-

Rower

-

Wearable Devices

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Rehabilitation Centers

-

Hospitals & Clinics

-

Homecare & Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac rehabilitation market size was valued at USD 2.5 billion in 2024 and is expected to reach USD 2.7 billion in 2025.

b. The global cardiac rehabilitation market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD billion 3.6 billion by 2030.

b. North America's cardiac rehabilitation market held a dominant share of 44.9% in 2024 owing to improved healthcare infrastructure, technological advancements, and increasing prevalence of CVDs in the U.S. & Canada.

b. Some of the key players operating in the cardiac rehabilitation market are Ball Dynamics International, LLC, Honeywell International, Inc., Core Health & Fitness, LLC, LifeWatch, Philips, Amer Sports, Smiths Group, OMRON Corporation, Halma plc, and Brunswick Corporation.

b. Key factors that are driving the market growth include increasing adoption of tele-cardiac rehabilitation solutions and awareness amongst the end users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.