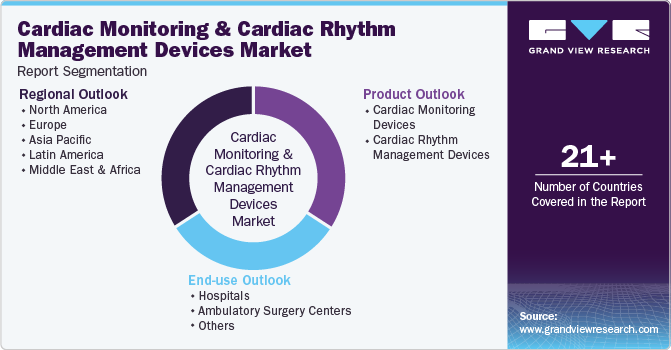

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Size, Share & Trends Analysis Report By Product (Cardiac Monitoring Devices), By End-use (Hospitals, Ambulatory Surgery Centers), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-798-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

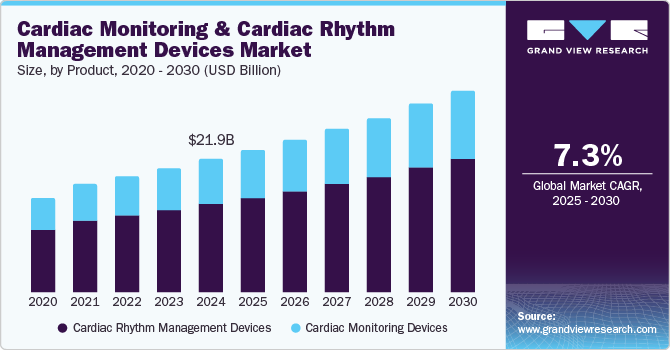

The global cardiac monitoring and cardiac rhythm management devices market was estimated at USD 21.86 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2030. The rising prevalence of cardiovascular diseases is being driven by factors such as aging populations, sedentary lifestyles, poor diets, and higher stress levels. The increasing incidence of these diseases raises the demand for cardiac monitoring devices, including ECG monitors, wearable technologies, and implantable devices. The growing age of the population contributes to this demand, as the risk of cardiovascular diseases grows with age. The increasing need for devices to monitor heart function and manage rhythms is becoming more pronounced. Therefore, the cardiac monitoring and rhythm management devices industry is rapidly expanding.

Technological advancements in cardiac devices have led to the development of smaller, more user-friendly, and affordable monitoring tools. Wearable devices such as smartwatches and patches allow individuals to track their heart rhythms and detect abnormalities more easily. The integration of cardiac rhythm management devices with smartphones, cloud-based systems, and apps has expanded the cardiac monitoring and cardiac rhythm management devices industry, enabling real-time monitoring and remote data access. This integration makes it easier to manage heart conditions outside of traditional healthcare settings. In addition, device innovations such as pacemakers, defibrillators, and loop recorders have improved their performance and lifespan, increasing their adoption and effectiveness in treating heart conditions.

The growing adoption of telemedicine and remote patient monitoring, especially after the COVID-19 pandemic, has made cardiac devices more accessible to patients, even in remote areas. Healthcare providers can now monitor heart rhythms in real-time, improving patient care and convenience. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2022, approximately 702,880 people died from heart disease, making it the leading cause of death in the U.S. This information highlights the significant impact of cardiovascular diseases and the increasing demand for cardiac monitoring devices in the cardiac monitoring and cardiac rhythm management devices industry as the population ages and the incidence of these diseases rises.

Product Insights

The cardiac rhythm management devices segment dominated the market with a revenue share of 66.0% in 2024 due to the increasing prevalence of cardiovascular diseases, particularly arrhythmias and heart failure. The rising incidence of these conditions, driven by factors such as an aging population and lifestyle changes, has led to a greater demand for effective treatment options. In addition, technological advancements, including the development of smart devices and remote monitoring capabilities, have significantly improved patient outcomes and enhanced the adoption of these devices in clinical settings.

The cardiac monitoring devices segment is anticipated to grow at a significant CAGR over the forecast period, fueled by technological innovations and the increasing focus on preventive healthcare. Integrating advanced monitoring technologies, such as mobile telemetry and wearable devices, allows for continuous patient monitoring and timely intervention. This shift toward proactive management of cardiac health is further supported by the growing awareness of cardiovascular risks and the need for early diagnosis, which drives demand for sophisticated monitoring solutions in the cardiac monitoring and cardiac rhythm management devices industry.

End-use Insights

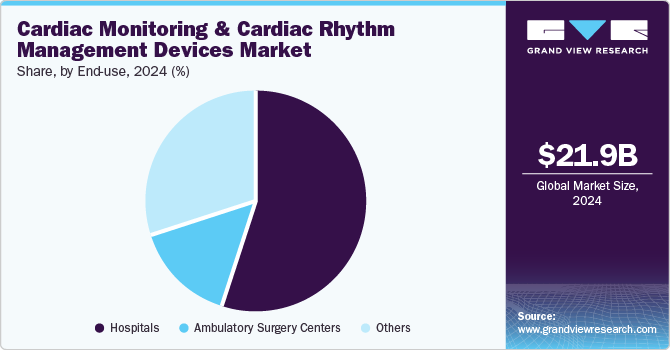

The hospitals segment dominated the market with the largest revenue share in 2024, which can be attributed to their capability to provide comprehensive care for patients with complex cardiac conditions. Hospitals have advanced diagnostic tools and specialized personnel that facilitate immediate treatment decisions, making them the preferred choice for patients requiring cardiac interventions. The high volume of procedures performed in hospital settings also contributes to their significant market share in the cardiac monitoring and cardiac rhythm management devices industry.

The ambulatory surgery centers segment is projected to grow at a significant CAGR over the forecast period due to their ability to offer cost-effective and efficient surgical procedures. These centers provide an alternative to traditional hospital settings for outpatient surgeries, which can lead to reduced healthcare costs and shorter recovery times for patients. As more patients seek less invasive procedures that allow for quicker discharge and recovery, ambulatory surgery centers are expected to see increased utilization of cardiac rhythm management devices in the cardiac monitoring and cardiac rhythm management devices industry.

Regional Insights

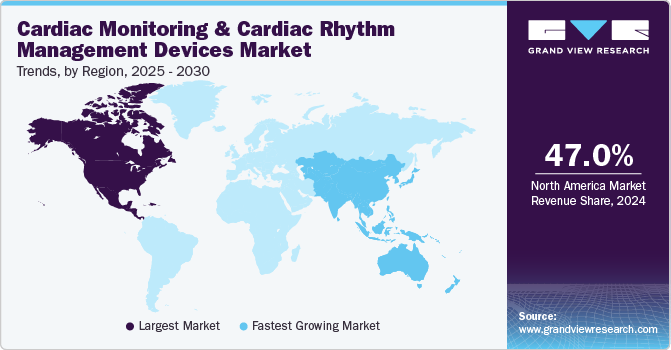

North America cardiac monitoring and cardiac rhythm management devices market held the highest revenue share of 47.0% in 2024 due to substantial healthcare spending and a well-developed medical infrastructure. The region benefits from a concentration of leading manufacturers continuously innovating and enhancing device technology, ensuring that healthcare providers can access the latest advancements. In addition, a strong reimbursement framework supports the adoption of new technologies, motivating healthcare providers to implement these devices for improved patient care outcomes. This combination of factors positions North America as a dominant player in the cardiac monitoring market.

U.S. Cardiac Monitoring And Cardiac Rhythm Management Devices Market Trends

The U.S. cardiac monitoring and cardiac rhythm management devices market dominated North America with a significant revenue share in 2024, fueled by a high prevalence of cardiovascular diseases and a robust healthcare system. Integrating cutting-edge technologies such as telehealth services and AI-driven diagnostics has further propelled market growth. The increasing focus on personalized medicine and remote patient management solutions continues to drive demand for these devices across various healthcare settings in the U.S.

Europe Cardiac Monitoring And Cardiac Rhythm Management Devices Market Trends

Europe cardiac monitoring and cardiac rhythm management devices market held a substantial market share in 2024, driven by increasing health awareness among the population and improvements in healthcare infrastructure. The rise in public knowledge regarding cardiovascular health has increased the demand for monitoring devices as individuals seek proactive measures to manage their heart conditions. In addition, enhanced healthcare facilities across Europe support the effective deployment of these technologies, ensuring better patient outcomes. This combination of health awareness and infrastructure development significantly contributes to the market's growth.

Asia Pacific Cardiac Monitoring And Cardiac Rhythm Management Devices Market Trends

Asia Pacific cardiac monitoring and cardiac rhythm management devices market is expected to register the highest CAGR of 8.1% over the forecast period, which can be attributed to rapid urbanization and a rise in lifestyle-related diseases. As more people move to urban areas, the prevalence of conditions such as obesity and diabetes increases, leading to higher rates of cardiovascular issues. Furthermore, the growing geriatric population in this region amplifies the need for effective cardiac care solutions tailored to older adults. As healthcare systems adapt to these challenges, investments in advanced medical technologies are anticipated to rise significantly.

The Japan cardiac monitoring and cardiac rhythm management devices market dominates the Asia Pacific with a significant revenue share in 2024, driven by its advanced healthcare infrastructure and high adoption rates of innovative medical technologies. The country's strong emphasis on research and development adopts continuous device design and functionality improvements. This focus ensures that healthcare providers can effectively meet the needs of a growing patient population suffering from cardiovascular diseases. Hence, Japan remains a leader in the cardiac device market in Asia Pacific, benefiting from technological advancements and a robust healthcare system.

Key Cardiac Monitoring And Cardiac Rhythm Management Devices Company Insights

Some key companies operating in the market are Stryker, Medtronic, Abbott, Boston Scientific Corporation, and Koninklijke Philips N.V. Companies are undertaking strategic initiatives, such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands in cardiac monitoring and cardiac rhythm management devices market.

-

Stryker offers a variety of products and solutions in the cardiac monitoring and cardiac rhythm management devices market. Its offerings include the LIFEPAK 15 V4+ monitor/defibrillator for advanced ECG monitoring, the LIFEPAK 35 monitor/defibrillator for emergency services, and the LUCAS 3 chest compression system for effective CPR. In addition, the company provides digital healthcare solutions such as LIFENET Care, which facilitates data sharing and improves collaboration among healthcare teams.

-

Medtronic offers a range of products in the cardiac monitoring and cardiac rhythm management devices market. Its products include the LINQ II insertable cardiac monitor, which provides long-term heart monitoring for up to 4.5 years, and the Reveal LINQ insertable cardiac monitor, known for its small size and accuracy.

Key Cardiac Monitoring And Cardiac Rhythm Management Devices Companies:

The following are the leading companies in the cardiac monitoring and cardiac rhythm management devices market. These companies collectively hold the largest market share and dictate industry trends.

- Stryker

- Medtronic

- Abbott

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- ZOLL Medical Corporation.

- GE HealthCare

- MicroPort Scientific Corporation

- NIHON KOHDEN CORPORATION

- BioTelemetry

Recent Developments

-

In June 2024, Stryker launched the LIFEPAK 35 monitor/defibrillator, designed to enhance emergency response and patient care. This device featured intuitive controls and advanced technology, allowing healthcare providers to deliver effective defibrillation and continuous monitoring in critical situations.

-

In January 2024, Medtronic announced a partnership with Cardiac Design Labs to launch innovative heart rhythm monitoring technology. This collaboration is intended to enhance cardiac monitoring capabilities by integrating advanced design and engineering solutions. The new technology is expected to improve patient outcomes by providing more accurate and reliable heart rhythm data, enabling healthcare providers to make informed decisions.

Cardiac Monitoring And Cardiac Rhythm Management Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 23.36 billion |

|

Revenue forecast in 2030 |

USD 33.29 billion |

|

Growth rate |

CAGR of 7.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Stryker; Medtronic; Abbott; Boston Scientific Corporation; Koninklijke Philips N.V.; ZOLL Medical Corporation.; GE HealthCare; MicroPort Scientific Corporation; NIHON KOHDEN CORPORATION; BioTelemetry. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cardiac Monitoring And Cardiac Rhythm Management Devices Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global cardiac monitoring and cardiac rhythm management devices market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Monitoring Devices

-

ECG

-

Implantable Cardiac Monitors

-

Holter Monitors

-

Mobile Cardiac Telemetry

-

-

Cardiac Rhythm Management Devices

-

Cardiac Resynchronization Therapy (CRT)

-

CRT-Defibrillator

-

CRT-Pacemakers

-

-

Defibrillator

-

Implantable Cardioverter Defibrillators (ICD)

-

Single Chamber

-

Dual Chamber

-

-

External Defibrillator

-

Manual External Defibrillator

-

Automatic External Defibrillator

-

Wearable Cardioverter Defibrillator

-

-

-

Pacemakers

-

Conventional

-

Leadless

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac monitoring and cardiac rhythm management devices market size was estimated at USD 21.86 billion in 2024 and is expected to reach USD 23.36 billion in 2025.

b. The global cardiac monitoring and cardiac rhythm management devices market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 33.29 billion by 2030.

b. North America dominated the cardiac monitoring and cardiac rhythm management devices market with a share of 47.0% in 2024. This is attributable to rising healthcare awareness coupled with the presence of key players and constant research and development initiatives.

b. Some key players operating in the cardiac monitoring and cardiac rhythm management devices market include Boston Scientific, Nihon Kohden Corporation, GE Healthcare, Welch Allyn, Zoll Medical Corporation, Schiller, Spacelabs Healthcare, Scottcare Corporation, Ecardio Diagnostics, St. Jude Medical CardioNet, Phillips Healthcare, Cardiac Science Corporation, Life Watch, Mortara Instruments, and Medtronic.

b. Key factors driving the cardiac monitoring and cardiac rhythm management devices market growth include increasing influx of established players, rising patient awareness levels, favorable government regulation, and technological advancements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."