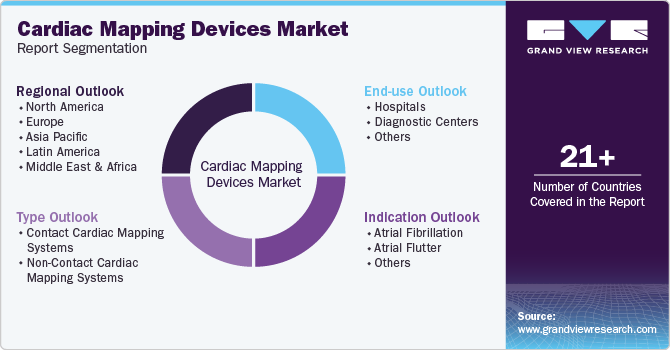

Cardiac Mapping Devices Market Size, Share & Trends Analysis Report, By Type (Contact Cardiac Mapping Systems, Non-Contact Cardiac Mapping Systems), By Indication (Atrial Fibrillation, Atrial Flutter), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-381-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cardiac Mapping Devices Market Trends

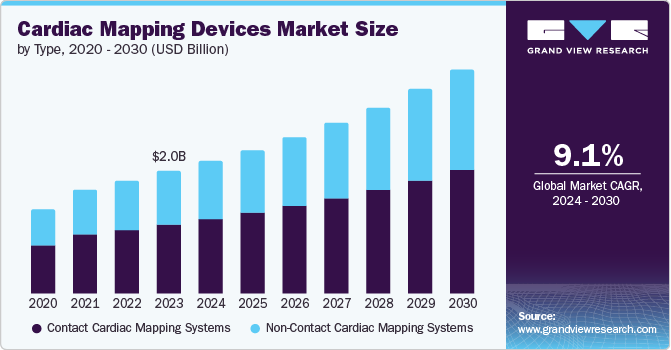

The global cardiac mapping devices market size was estimated at USD 2.02 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. The market growth is propelled by several key factors, including the increasing incidence of cardiovascular diseases (CVDs), technological advancements in mapping devices, increasing geriatric population, heightened awareness of early diagnosis, and supportive government healthcare initiatives. In August 2023, an NCBI article reported that approximately 313 million cardiac procedures are performed annually worldwide. This considerable volume underscores the substantial growth potential for the market. As healthcare systems strive to integrate advanced technologies to diagnose and treat heart rhythm disorders accurately, the demand for innovative mapping devices is expected to surge rapidly. These devices are crucial in improving procedural outcomes and expanding access to essential cardiac care globally.

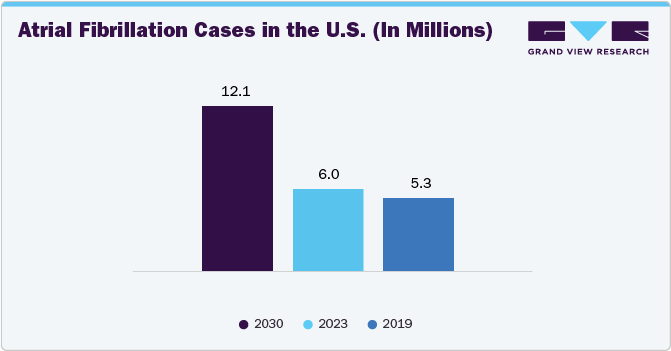

The rising arrhythmia cases fuel market growth. According to the Heart Rhythm Society article published in August 2023, the most common type of cardiac arrhythmia, AFib, significantly impacts the global population, affecting nearly 40 million individuals globally and 6 million in the U.S. alone. This high prevalence demands the urgent need for advanced diagnostic and treatment solutions. Moreover, about 1 in 4 adults over the age of 40 are at risk of developing atrial fibrillation (AFib). Despite its increasing prevalence, many individuals lack awareness of AFib symptoms, available treatment options, and the crucial importance of early intervention to prevent the condition from worsening. This highlights a need for greater education and awareness efforts to improve early detection and management of AFib, ultimately aiming to reduce its impact on individuals' health outcomes, driving demand for cardiac mapping devices.

Technological advancements in the mapping system boost the market's growth. According to an article published by the National Heart, Lung, and Blood Institute in October 2023, one remarkable advancement in cardiac mapping technology is the development of basket catheters. These catheters have electrode sensors within a spherical cage of stiff metallic filaments at the tip. Unlike traditional methods that gather electrical signals sequentially, basket catheters can simultaneously record all signals from each heart contraction, like taking a panoramic photo of the heart's electrical activity. Moreover, in May 2023, Modern EP mapping and imaging systems combine advanced technologies to provide a detailed view of the heart's electrical activity. These systems use mapping catheters with electrodes to measure electrical signals and transfer the data to advanced software. This process creates 3D heart models with color-coded overlays showing electrical waves, touchpoints, and catheter positions, aiding in precise ablation or isolation of arrhythmic tissue.

A growing number of cardiovascular diseases (CVD) drive the market's growth. According to the American College of Cardiology Foundation article published In December 2023, from 1990 to 2022, global deaths attributed to cardiovascular diseases (CVD) rose from 12.4 million to 19.8 million. Moreover, this increase highlights factors, such as population growth, aging demographics, and the impact of preventable metabolic, environmental, and behavioral risks.Subsequently, the demand for cardiac mapping devices is expected to rise significantly, as these tools are essential for accurately diagnosing and treating heart conditions, driving market growth.

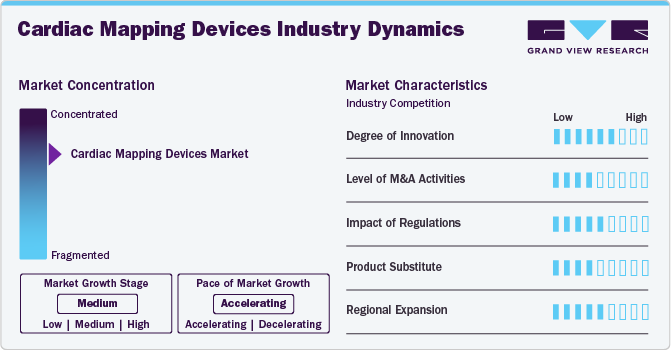

Market Concentration & Characteristics

The market is witnessing a high degree of innovation, with companies introducing devices to improve the diagnosis and treatment of cardiac arrhythmias. Innovations include developing 3D mapping systems, integrating with imaging technologies, and using sophisticated software for precise data analysis

Companies, such as Abbott, Boston Scientific Corporation, and Medtronic, are involved in merger and acquisition activities. Through M&A activity, these companies employ key strategies, such as type innovation, strategic collaborations, and geographical expansion, to strengthen their presence and address the growing demand for minimally invasive cardiovascular interventions

Regulations significantly impact the cardiac mapping devices market by ensuring safety, efficacy, and quality standards. Stringent regulatory requirements can delay product approvals, affecting market entry and innovation. However, they also enhance patient confidence and device reliability, ultimately supporting the market's growth by ensuring that only safe and effective devices are available for clinical use

There are currently no direct substitutes. Potential substitutes include alternative diagnostic tools like electrocardiograms (ECGs) and cardiac imaging modalities like MRI and CT scans. While these technologies provide valuable cardiac information, they may not offer the same detailed electrical activity mapping level as dedicated cardiac mapping devices

Market players in the cardiac mapping devices sector are expanding their presence by entering new geographical markets, forming strategic partnerships with local distributors, and tailoring their product offerings to align with specific regional healthcare requirements

Type Insights

The contact cardiac mapping systems segment held the largest share of over 57.07% in 2023 due to technological advances, strategic initiatives by key players, and increasing cardiac surgery patients. These systems typically use catheters equipped with electrodes to record precise electrical signals from the heart's surface, aiding in diagnosing and treating cardiac arrhythmias such as atrial fibrillation (AFib) and ventricular tachycardia (VT). For instance, in July 2023, Biosense Webster introduced the Optrell mapping catheter with Trueref technology in the U.S. This advanced diagnostic catheter incorporates high-density small electrodes arranged in a fixed array, allowing accurate electrophysiological mapping of challenging cardiac arrhythmias.

These include persistent atrial fibrillation, repeat AF ablation procedures, ventricular tachycardia, and atrial tachycardia. The catheter aims to improve procedural precision and efficacy in managing complex heart rhythm disorders. Furthermore, in October 2022, Biosense Webster, Inc., a Johnson & Johnson MedTech division, announced the European launch of the HELIOSTAR Balloon Ablation Catheter. This device is the first radiofrequency balloon ablation catheter designed for cardiac electrophysiological mapping and ablation procedures within the atria. The non-contact cardiac mapping systems segment is expected to show lucrative growth during the forecast period. Several key factors within the healthcare landscape drive the growth of non-contact cardiac mapping systems.

These advanced systems are favored for their ability to comprehensively map cardiac electrical activity without requiring invasive contact with the heart. This non-invasive approach significantly reduces procedural risks and patient discomfort, enhancing overall safety and patient experience during electrophysiology procedures. Moreover, the demand for non-contact mapping systems is propelled by their capability to map larger areas of the heart more quickly and efficiently than traditional contact-based methods. This efficiency is crucial in improving procedural outcomes and reducing healthcare costs associated with prolonged procedural times and complications.

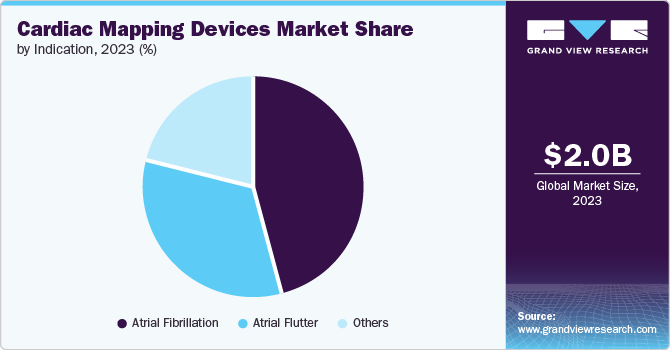

Indication Insights

The atrial fibrillation segment held the largest share of over 45.87% in 2023 due to increasing cases of arrhythmia, the rising geriatric population, increasing initiatives by key players, and technological advancements. According to the NCBI article published in March 2022, AI is now being integrated with traditional diagnostic tools like 12-lead ECGs to improve their ability to detect atrial fibrillation (AF). This integration enhances AF diagnosis accuracy, particularly in asymptomatic individuals or those with unusual symptoms, by automating ECG data analysis and identifying subtle abnormalities. This advancement marks a significant step in the diagnostic approach to AF, offering more precise and efficient detection methods.

The atrial flutter (AFL) segment is expected to witness lucrative growth during the forecast period due to the increasing geriatric population, rising cardiac arrhythmia cases, and technological advancements. Atrial flutter is a frequently occurring cardiac arrhythmia marked by rapid, well-organized contractions of the atria. According to a Verdict Media Ltd. article published in May 2024, HeartBeam has developed an AI-enhanced vectorcardiography (VCG) technology that greatly improves the detection of atrial flutter. Their device, HeartBeam AI+VECG, demonstrated a 97.3% sensitivity rate, significantly outperforming a panel of expert cardiologists, who had a sensitivity rate of 69.4% using single-lead electrocardiograms (ECGs). This advancement marks a substantial leap in the accuracy of atrial flutter detection, enabling earlier intervention and better patient outcomes. In addition, AI-driven technology simplifies the diagnostic process, making it more accessible and efficient.

End Use Insights

The hospitals segment held the largest share of 69.38% in 2023. Hospitals play a vital role in adopting and assessing new technologies, such as advanced cardiac mapping devices. For instance, in March 2022, Sunshine Hospital in Secunderabad (India) introduced several advanced cardiac systems. Among them is the Ensite Precision Cardiac 3D Mapping System, which is particularly beneficial for performing complex radiofrequency ablations in patients with supraventricular tachycardia (SVT) and ventricular tachycardia (VT). These advanced cardiac mapping devices enable hospitals to deliver state-of-the-art care for patients with cardiac arrhythmias, ensuring better outcomes and advancing the field of electrophysiology. Moreover, it emphasizes the hospital’s role in driving innovation & improving patient care through the adoption of new technologies.

The diagnostic centers segment is expected to grow more during the forecast period. This growth can be attributed to several factors, including the rising prevalence of cardiac arrhythmias, the rising demand for advanced diagnostic tools, and the expansion of healthcare infrastructure. For instance, in June 2023, diagnostic centers utilized advanced imaging technologies, such as equipped with an image-guided therapy platform and incorporating the most advanced, futuristic technology to support future advancements. The diagnostic centers are designed to accommodate robust 3D MRI imaging systems, enabling detailed and accurate cardiac imaging. In addition, the diagnostic centers efficiently handle increasingly complex heart procedures, ensuring precise diagnosis and effective treatment planning for cardiovascular conditions. These capabilities make it an ideal setting for cardiac mapping devices. They provide healthcare professionals with comprehensive insights necessary for effective treatment planning and managing cardiac patients.

Regional Insights

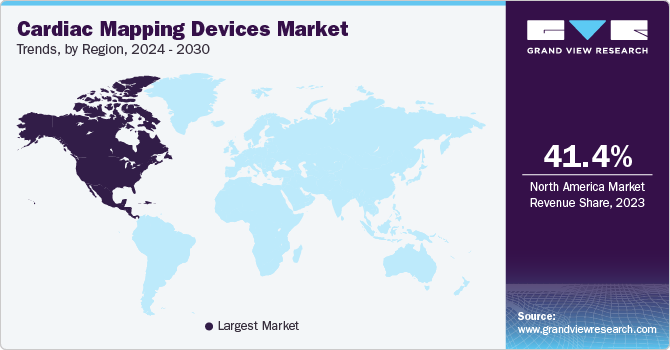

The cardiac mapping devices market in North America dominated the global industry with a share of 41.39% in 2023 owing to continuous product launches, regulatory approvals, advanced healthcare infrastructure, and rising cases of cardiovascular diseases, including arrhythmias. According to the CDC article published in May 2024, an estimated 12.1 million individuals in the U.S. are projected to be affected by atrial fibrillation (AFib). This condition leads to over 454,000 hospitalizations annually, where AFib is the primary diagnosis. In addition, AFib contributes to approximately 158,000 deaths each year in the U.S. These statistics underscore the significant healthcare burden posed by AFib, highlighting the critical need for effective management and treatment strategies to improve patient outcomes and reduce mortality associated with this prevalent cardiac arrhythmia.

U.S. Cardiac Mapping Devices Market Trends

The U.S. cardiac mapping devices market accounted for the largest share of North America's cardiac mapping devices market in 2023. The key factors responsible for market growth are the increasing prevalence of CVD cases and related conditions, the FDA's regulatory review process facilitating innovation, and advancements in cardiac mapping device technology. According to an American Heart Association article published in January 2024, daily in the U.S., cardiovascular disease (CVD) results in about 2,552 deaths, according to 2021 data. This means that, on average, one person dies from CVD every 34 seconds. These statistics highlight the significant burden of cardiovascular diseases and emphasize the ongoing need for effective strategies to combat and manage these conditions, fueling the demand for cardiac mapping devices.

Europe Cardiac Mapping Devices Market Trends

The cardiac mapping devices market in Europe held the second-largest revenue market share in 2023. This can be attributed to the increasing number of cardiac surgery patients and arrhythmia cases.

The Germany cardiac mapping devices market dominated with the highest revenue share of 23.60% in 2023. The factors contributing to this high share include the presence of key market players, a rising number of cardiac surgery patients, and advanced healthcare infrastructure. For instance, in 2022, there were 93,913 heart surgical procedures, which saw a slight increase compared to 92,838 procedures in 2021. This minor uptick in surgical interventions reflects the ongoing demand for cardiac care and treatment, indicating a continued need for advanced medical interventions to address heart-related conditions effectively.

The cardiac mapping devices market in the UK held the second-largest market share in 2023. The rise in cardiovascular disease-related deaths and the increasing geriatric population highlight the need for continued innovation and advancements in healthcare technology to effectively reduce this trend.

The France cardiac mapping devices market is anticipated to witness a significant CAGR of 9.3% during the forecast period. The rising number of CVD cases and increased demand for cardiac mapping systems are boosting the market's growth. According to the Foundation De France article published in March 2022, In France, a cardiovascular event happens every four minutes, increasingly affecting the younger population. These conditions are now the country's second leading cause of death.

Asia Pacific Cardiac Mapping Devices Market Trends

The cardiac mapping devices market in Asia Pacific is expected to grow fastest during the forecast period. Increasing research and development (R&D) investments, rising geriatric population, and advanced cardiac care technologies are significant market expansion drivers. The growing geriatric population in the Asia Pacific region is another major factor contributing to the market growth. According to the United Nations Economic and Social Commission for Asia and the Pacific, in 2023, approximately 697 million individuals aged 60 years or older live in Asia and the Pacific region, constituting approximately 60% of the global older population.

The Japan cardiac mapping devices market held the largest market share in the Asia Pacific region. The market will expand further at a steady CAGR from 2024 to 2030 due to the increasing number of cardiac surgery patients, technological advancements, and the high geriatric population, which is more susceptible to CVDs. According to the BBC article published in September 2023, Japan has hit a demographic milestone, with over 10% of its population aged 80 or older. By 2040, the 65 and older population will be around 34.8%. This growing elderly population, which is more prone to cardiovascular disease (CVD), is increasing the demand for cardiac mapping devices.

The cardiac mapping devices market in China accounted for the second-largest share of the APAC regional market revenue in 2023 due to the launch of new types and collaborations between industry players, increased adoption of advanced medical technologies, rising CVD cases, and increasing atrial fibrillation cases. According to the NCBI article published in June 2023, it is estimated that around 330 million people in China are impacted by cardiovascular disease (CVD), with approximately 4.87 million cases of atrial fibrillation among them. These figures highlight the significant prevalence of CVD and its various symptoms, underscoring the substantial healthcare burden and the need for effective management and treatment strategies in China.

The India cardiac mapping devices market is experiencing significant growth, driven by growing awareness of advanced cardiac care options, increasing incidence of CVDs, and expanding healthcare infrastructure. According to an article published in the Economic Times in February 2024, the study indicates that India has a higher burden of cardiovascular disease (CVD) compared to the global average. Specifically, the age-standardized CVD death rate in India is estimated at 272 per 100,000 population, whereas the global average stands at 235 per 100,000 population.

Latin America Cardiac Mapping Devices Market Trends

The cardiac mapping devices market in Latin America is growing due to several factors. The growing awareness about cardiovascular-related mortality & increasing regulatory frameworks and support fuels the market's growth.

The Brazil cardiac mapping devices market is expanding due to several distinct growth drivers. Rising healthcare expenditure and government initiatives aimed at improving cardiac care infrastructure. For instance, in September 2023, the Brazilian government and various institutions launched initiatives to enhance care and outcomes for cardiovascular disease (CVD) patients. An important example includes Mount Sinai's collaboration with the Brazilian Clinical Research Institute to advance cardiovascular disease research and medical education. These efforts reflect a concerted push towards improving healthcare standards, fostering innovation, and expanding knowledge in managing CVD within Brazil.

MEA Cardiac Mapping Devices Market Trends

The cardiac mapping devices market in MEA is expected to grow at a lucrative rate, driven by the rising prevalence of CVDs and the increasing adoption of advanced medical technologies in the region.

The South Africa cardiac mapping devices market held a share of 30.75% in 2023. Increasing arrhythmia cases, rising healthcare expenditures, and the increasing number of hospitals in the country contribute to the market expansion. For instance, in December 2021, the Netcare Property Holdings Joint Venture established a 400-bed multispecialty hospital in South Africa. Moreover, strategic collaborations between international medical device manufacturers and local healthcare providers aim to enhance treatment outcomes and expand access to advanced cardiac care solutions.

Key Cardiac Mapping Devices Company Insights

Acutus Medical, Inc. and Microport Scientific Corp. are some of the emerging players in cardiac mapping devices. Some of the key players operating in the industry include Medtronic, Abbott, Johnson & Johnson, and Boston Scientific Corporation. To gain higher market share, these companies undertake several key strategies, including understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences.

Key Cardiac Mapping Devices Companies:

The following are the leading companies in the cardiac mapping devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Abbott

- Boston Scientific Corporation

- Johnson & Johnson

- Koninklijke Philips N.V.

- BIOTRONIK

- MicroPort Scientific Corporation

- APN HEALTH

- Acutus Medical, Inc.

- Kardium

- BioSig Technologies, Inc.

Recent Developments

-

In July 2024, Johnson & Johnson’s Biosense Webster launched the Optrell mapping catheter, incorporating TrueRef technology. Designed in Irvine, California, by Biosense Webster, Optrell is a high-density diagnostic catheter that integrates with the Carto 3 system. It utilizes small electrodes in a fixed array configuration to provide accurate electrophysiological mapping for complex cardiac arrhythmias

-

In May 2024, Biosense Webster, a Johnson & Johnson MedTech company specializing in cardiac arrhythmia treatment, introduced the CARTO 3 System Version 8. This updated 3D heart mapping system includes innovative modules such as CARTO ELEVATE and CARTOSOUND FAM, designed to enhance efficiency and precision during catheter ablation procedures for patients with atrial fibrillation (AFib) and other arrhythmias

-

In March 2024, Wellysis and Artella partnered to launch a new remote cardiac monitoring service in the U.S. This service will provide patients with effective monitoring options for cardiac conditions, contributing to improved management and early detection of heart-related issues through innovative remote monitoring technology

-

In October 2023, Boston Scientific introduced the LUX-Dx II+ Insertable Cardiac Monitor (ICM) System, specifically designed for prolonged monitoring of arrhythmias associated with conditions, such as atrial fibrillation (AF), cryptogenic stroke, and syncope

-

In July 2023, Biosense Webster, Inc., a division of Johnson & Johnson MedTech, introduced the OPTRELL Mapping Catheter with TRUEref Technology in the U.S. This advanced diagnostic catheter is equipped with a high-density array of small electrodes designed to deliver precise electrophysiological mapping for challenging cardiac arrhythmias like persistent atrial fibrillation, redo AFib ablation, atrial tachycardia, and ventricular tachycardia

Cardiac Mapping Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.19 billion |

|

Revenue forecast in 2030 |

USD 3.69 billion |

|

Growth rate |

CAGR of 9.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, indication, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Abbott; Medtronic; Acutus Medical; APN Health, LLC; Johnson & Johnson; Biosig Technologies, Inc.; Boston Scientific Corporation; Kardium, Inc.; Koninklijke Philips N.V; Microport Scientific Corp.; BIOTRONIK |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cardiac Mapping Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cardiac mapping devices market report based on type, indication, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Contact Cardiac Mapping Systems

-

Non-Contact Cardiac Mapping Systems

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Atrial Fibrillation

-

Atrial Flutter

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The market for cardiac mapping devices is propelled by several key factors, including the increasing incidence of cardiovascular diseases, technological advancements in mapping devices, an aging population, heightened awareness of early diagnosis, and supportive government healthcare initiatives.

b. The global cardiac mapping devices market size was estimated at USD 2.02 billion in 2023 and is expected to reach USD 2.19 billion in 2024.

b. The global cardiac mapping devices market is expected to grow at a compound annual growth rate of 9.1% from 2024 to 2030 to reach USD 3.69 billion by 2030.

b. North America dominated the cardiac mapping devices market with a share of 41.39% in 2023. This is attributable to the growing geriatric population, increasing adoption of advanced cardiovascular devices, and rising disabled population.

b. Some of the players operating in this market are Abbott; Medtronic; Acutus Medical; APN Health, LLC; Johnson & Johnson; Biosig Technologies, Inc.; Boston Scientific Corporation; Kardium, Inc.; Koninklijke Philips N.V; Microport Scientific Corporation; BIOTRONIK.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."