- Home

- »

- Consumer F&B

- »

-

Carbonated Beverages Market Size, Industry Report, 2030GVR Report cover

![Carbonated Beverages Market Size, Share & Trends Report]()

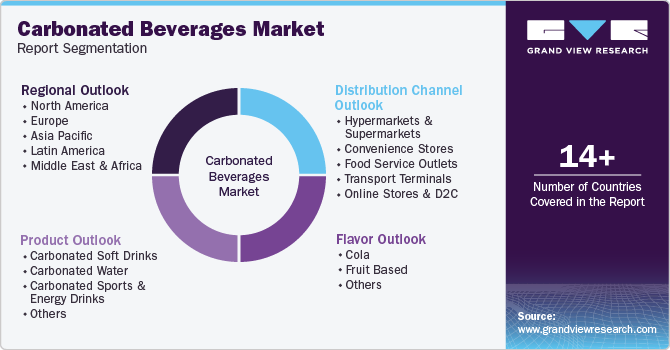

Carbonated Beverages Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Carbonated Soft Drinks, Carbonated Water), By Flavor (Cola, Fruit Based), By Distribution Channel, By Region And Segment Forecasts

- Report ID: GVR-4-68038-914-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbonated Beverages Market Summary

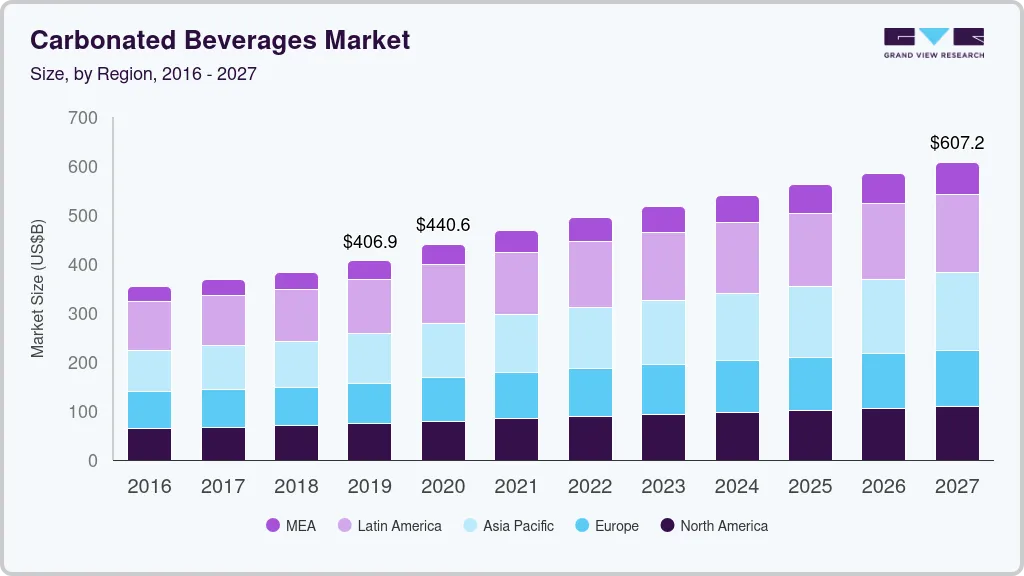

The global carbonated beverages market size was valued at USD 613.3 million in 2024 and is estimated to reach USD 895.2 million by 2030, growing at a CAGR of 6.4% from 2025 to 2030. The strong popularity of soda-based drinks among the Generation X and Generation Y age groups is expected to play a crucial role in expanding the market size.

Key Market Trends & Insights

- North America carbonated beverages market held the largest share of 32.1% in 2024.

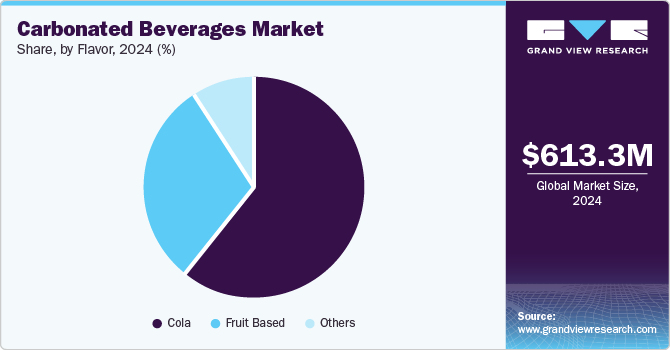

- Based on flavor, the cola flavor segment held the largest revenue share in 2024.

- Based on product, the carbonated soft drinks segment recorded the largest revenue share of 49.8% in 2024.

- Based on distribution channel, the hypermarkets & supermarkets segment registered the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 613.3 Million

- 2030 Projected Market Size: USD 895.2 Million

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Buyers prefer such drinks as they have an acidic bite, produce a pleasant tingling, and offer a cooling sensation with every sip. The flavor variety and competitive pricing play pivotal roles in consumers’ demand for carbonated beverages. Carbonated beverages are manufactured using clean water, flavoring elements to establish the flavor profile, sugar or other sweeteners, coloring agents, and preservatives added to extend their shelf life. The use of evolving technology for packaging carbonated beverages in glass bottles, cans, and plastic bottles and the advent of high-speed packaging lines have positively influenced the consumption of carbonated beverages among consumers.

The consumption of carbonated beverages has further increased owing to the compatibility of fizzy drinks with certain foods. Carbonated beverages are often paired by contrasting or mirroring the flavor of the snacks. Bacon, along with stinging Sriracha, is preferably served with cold cola in Western countries. Some of the other foods that are accompanied by carbonated drinks include steak, pasta, and ramen, and other fast food, including pizza, tacos, burgers, and fried chicken. The contrasting flavors of snacks and drinks complement each other. The fizz from ice-cold drinks helps in enhancing the mealtime experience. The rise in the consumption of such food products has further encouraged the consumption of carbonated beverages.

Product Insights

The carbonated soft drinks segment recorded the largest revenue share of 49.8% in 2024, fueled by its widespread popularity among consumers, diverse flavor offerings, and strong brand presence. Major companies have heavily invested in marketing and distribution, ensuring that carbonated soft drinks are accessible and appeal to a broad demographic. Furthermore, innovations such as low-calorie, sugar-free, and functional beverages have helped attract health-conscious consumers. The convenience of easy availability across multiple retail channels and consistent consumer demand further ensures the dominance of soft carbonated drinks on the global market.

The carbonated sports & energy drinks segment is anticipated to emerge as the fastest-growing segment, recording a CAGR of 7.4% over the forecast period due to increasing consumer demand for functional and convenient hydration solutions. With rising health awareness and growing fitness enthusiasts, individuals with active lifestyles are seeking beverages that offer hydration, energy, and performance-enhancing benefits. Innovations in product formulations, including lower sugar alternatives and added vitamins, are expected to drive growth over the coming years. The carbonated sports & energy drinks segment is expected to experience substantial growth, driven by heightened popularity across diverse age groups and a growing emphasis on health and wellness among consumers.

Flavor Insights

The cola flavor segment held the largest revenue share in 2024, owing to its long-established popularity and strong brand loyalty. Iconic brands, including Coca-Cola and Pepsi, have dominated the market for decades, continuously innovating their products and marketing strategies to retain consumer interest. The distinctive flavor profile of cola, combined with effective global distribution and aggressive advertising, has established it as the go-to choice for a significant number of consumers. Moreover, the cola segment benefits from strong retail partnerships with fast food chains and widespread availability, further strengthening its position in the market.

The fruit-based flavors segment is projected to record the fastest CAGR during the forecast period, driven by increasing consumer preference for natural and healthy options. With growing health consciousness, consumers are shifting toward beverages that offer a blend of indulgence and wellness. This has led to an increasing demand for fruit-flavored carbonated drinks. These drinks provide a unique combination of taste, refreshment, and perceived health benefits from fruit extracts. Moreover, innovations in exotic and organic fruit flavors, coupled with clean-label ingredients, are expected to propel the demand for this category of carbonated beverages and position the segment for significant growth in the coming years.

Distribution Channel Insights

The hypermarkets & supermarkets segment registered the largest revenue share in 2024, attributed to the wide product range, competitive pricing, and convenience offered by these stores. These retail outlets offer a one-stop shopping experience, providing consumers with easy access to a variety of carbonated beverages from multiple brands. Visible promotional activities, discounts, and bulk purchasing options attract price-sensitive customers. The extensive distribution network of hypermarkets & supermarkets and high consumer footfall ensure consistent sales of carbonated beverages, driving their dominance in the market.

The online stores & D2C segment is anticipated to emerge as the fastest-growing segment over the forecast period. The sales through this segment are expected to surge with the significant shift toward e-commerce as consumers prioritize convenience. Consumers are increasingly turning to online platforms for easy access to a wide variety of beverages, including niche and premium options. Direct-to-consumer (D2C) brands offer personalized experiences, direct interactions with customers, and better pricing. Furthermore, online stores provide the advantage of home delivery, catering to the demand for convenience and offering a broader reach to global markets. Consequently, these factors are expected to accelerate the sales of carbonated beverages through this segment over the coming years.

Regional Insights

North America carbonated beverages market held the largest share of 32.1% in 2024, fueled by the popularity of sparkling water due to its refreshing quality and low-calorie content. Consumers in the region are shifting toward healthier alternatives, leading to increasing interest in fruit-based, exotic, and craft-flavored carbonated drinks. In addition, the demand for unique and bold flavors, such as exotic fruits and artisanal blends, is fueling market expansion. These trends reflect a broader consumer preference for innovative, flavorful, and health-conscious carbonated beverages, boosting overall market size.

U.S. Carbonated Beverages Market Trends

The rise in popularity of functional carbonated drinks and the growing preference for premium and craft carbonated beverages are shaping the U.S. carbonated beverages industry. Consumers are increasingly seeking high-quality, artisanal drinks with unique flavors and premium ingredients, fueling demand for innovative products. Moreover, the surging demand for functional beverages that provide health benefits, such as enhanced immune systems, improved gut health, and energy-boosting properties, is significantly influencing consumer preferences. These trends are attracting wellness-oriented consumers and driving market growth as they prioritize quality and health benefits in their beverage selections.

Canada is projected to achieve a remarkable CAGR over the forecast period, attributed to the shift toward healthier alternatives and the surging demand for seasonal and novelty offerings. Consumers are increasingly opting for low sugar, sugar-free, and functional drinks, compelling brands to innovate with healthier formulations. The appeal of limited-edition, seasonal flavors, and novelty products is gaining traction, creating excitement and attracting a wider audience. These trends cater to evolving consumer preferences, boosting sales and expanding the market by appealing to health-conscious and adventurous drinkers in Canada.

Europe Carbonated Beverages Market Trends

The growth of non-alcoholic carbonated drinks and flavor innovation is set to propel the expansion of the carbonated beverages industry in Europe. As consumers increasingly seek healthier alternatives to traditional sodas, the demand for alcohol-free, refreshing options is rising. In addition, brands are focusing on flavor innovation, offering unique and exotic flavors to capture diverse consumer preferences. This combination of health-conscious choices and exciting new flavors is attracting a broader audience, including younger and health-focused demographics, ultimately contributing to the market growth in Europe.

The rise of e-commerce and direct-to-consumer (D2C) sales and growing health-conscious consumer choices are anticipated to accelerate the growth of the carbonated beverages market in Germany. E-commerce platforms offer easy access to a wide variety of beverages, including low-sugar, organic, and functional carbonated drinks, catering to the health-focused preferences of consumers. D2C sales enable brands to connect directly with consumers, offering personalized options and subscription services. As demand for healthier, innovative products continues to rise, the combination of these trends is set to propel the market expansion in Germany.

The rise of low-alcohol beverages, including hard seltzers, and the shift toward non-traditional carbonated drinks are expected to favor the growth of the carbonated beverages industry in the U.K. As consumers increasingly seek healthier and lighter alternatives to traditional alcoholic drinks, hard seltzers, with their low-calorie content and refreshing flavors, are gaining popularity. Furthermore, non-traditional carbonated drinks, such as kombucha and sparkling water, are attracting health-conscious consumers looking for functional and natural options. These evolving preferences are reshaping the market, fostering growth and innovation in various segments of the carbonated beverages market.

Asia Pacific Carbonated Beverages Market Trends

Asia Pacific is projected to emerge as the fastest-growing region from 2025 to 2030 due to rising disposable income and the influence of Western brands. As consumers' purchasing power increases, there is a higher demand for premium, branded carbonated drinks. Western brands, such as Coca-Cola and Pepsi, continue to have a strong presence and engage in extensive marketing and innovation. The growing preference toward Western lifestyle trends and flavors is leading to increased adoption of carbonated beverages in the region.

The growing demand for premium carbonated beverages in China is anticipated to drive market expansion as consumers seek higher-quality, unique, and imported products. With rising disposable incomes and a preference for distinctive flavors, premium options are becoming increasingly popular. Also, the integration of traditional Chinese tea culture into carbonated drinks is attracting health-conscious consumers looking for innovative, refreshing alternatives. Tea-based carbonated beverages combine the health benefits of tea with the fizzy appeal of sodas, aligning with local tastes and fueling further growth in China's carbonated beverages industry.

The focus on eco-friendly packaging and cultural and regional preferences are expected to accelerate the market growth across Japan. As environmental awareness grows, consumers and brands are prioritizing sustainable packaging solutions, such as recyclable cans and bottles, to reduce plastic waste. In addition, the strong cultural emphasis of Japan on unique, locally inspired flavors is boosting demand for region-specific carbonated drinks that cater to local tastes. These trends, along with growing interest in eco-conscious products, are fueling innovation, attracting a broader consumer base, and contributing to market expansion in Japan.

Key Carbonated Beverages Company Insights

Some of the key companies in the carbonated beverages industry include Anadolu Group, Danone, JONES, Keurig Dr PepperKDP, Monster Energy Company, National Beverage Corp., PepsiCo, Refresco Group, SodaStream Inc., SUNTORY BEVERAGE & FOOD LIMITED.; and The Coca‑Cola Company.

-

PepsiCo provides a diverse portfolio of beverages, snacks, and nutrition products, including well-known brands such as Pepsi, Mountain Dew, Gatorade, Lay’s, Tropicana, and Quaker. Its products cater to a wide range of consumer preferences globally.

-

The Coca-Cola Company offers a comprehensive range of non-alcoholic beverages, including carbonated soft drinks, juices, bottled waters, teas, and energy drinks. Its portfolio includes iconic brands such as Coca-Cola, Sprite, Fanta, Minute Maid, and Dasani.

Key Carbonated Beverages Companies:

The following are the leading companies in the carbonated beverages market. These companies collectively hold the largest market share and dictate industry trends.

- Anadolu Group

- Danone

- JONES

- Keurig Dr Pepper

- Monster Energy Company

- National Beverage Corp.

- PepsiCo

- Refresco Group

- SodaStream Inc.

- SUNTORY BEVERAGE & FOOD LIMITED

- The Coca‑Cola Company

Recent Developments

-

In February 2025, Coca-Cola introduced a new Orange Cream soda flavor, expanding its range of creative flavors. This launch follows the success of nostalgic flavors such as strawberry and Oreo, further diversifying the brand offerings in the soda market.

-

In January 2023, Jones Soda Co revealed plans to expand into the UK and European markets. The craft soda brand introduced its range of products to several European countries through a partnership with American Fizz, the UK’s leading distributor of American food and beverages.

Carbonated Beverages Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 655.0 million

Revenue forecast in 2030

USD 895.2 million

Growth Rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; South Africa

Key companies profiled

Anadolu Group; Danone; JONES; Keurig Dr Pepper; Monster Energy Company; National Beverage Corp.; PepsiCo; Refresco Group; SodaStream Inc.; SUNTORY BEVERAGE & FOOD LIMITED; and The Coca‑Cola Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbonated Beverages Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global carbonated beverages market report based on product, flavor, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbonated Soft Drinks

-

Carbonated Water

-

Carbonated Sports & Energy Drinks

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Cola

-

Fruit Based

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Food Service Outlets

-

Transport Terminals

-

Online Stores & D2C

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.