Carbon Thermoplastic Composites Market Size, Share & Trends Analysis Report By Raw Material, By Application (Automotive, Aerospace & Defense), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-710-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

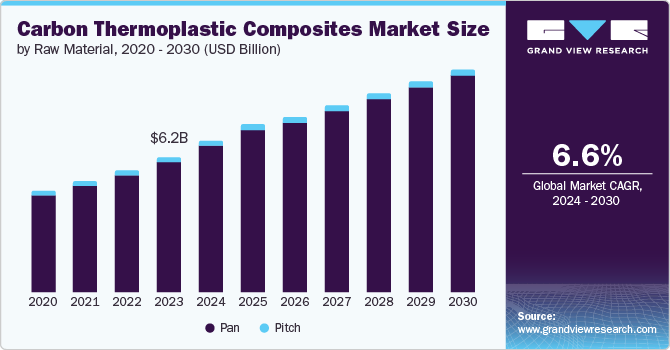

Market Size & Trends

The global carbon thermoplastic composites market size was valued at USD 9.03 million in 2023 and is projected to grow at a CAGR of 8.5% from 2024 to 2030. With advancements in technology as well as manufacturing processes, the composites industry is now focusing on the performance of the products. One of the significant properties of carbon thermoplastic is its attractive strength-to-weight ratio as well as the mechanical properties, so that durability and performance-demanding applications increase consumption and market growth.

New technological development in carbon fiber reinforced thermoplastic (CFRTP) drives cooperation across industrial stakeholders, research institutions, and governments to produce new uses, strengthening the market’s development. As there is progress in technologies alongside improvements in the manufacturing processes the composites segment is turning towards high-performance composites.

CFRTP has a higher specific strength and mechanical properties, offering applications where there is a demand for strength and overall, increasing the market demand and hence the market growth. The research on the applications of recycled carbon fiber and bio-based resins as a part of sustainable manufacturing.

Consequently, the industry is ready to provide more affordable and diverse options as new technologies appear, thus not being limited to the aerospace and defense industries only. Furthermore, investment in the research and development of CFRTP products has led the way as several industry players and institutions are collaborating and developing innovative solutions that are adopted by various industries to drive the growth of the market.

Raw Material Insights

The PAN segment dominated the market with a revenue share of 96.1% in 2023. The segment dominance witnessed is attributed to their strength and stiffness thus, they are suitable in areas where lightweight and high strength are necessary. These composites have commonly been used in the aerospace industry, automobile industry, sports equipment, and industrial tools and machinery mainly as a result of their enhanced mechanical characteristics. Although PAN-based carbon fibers are more expensive than other types of raw materials, the enhanced mechanical characteristics and performance of carbon fiber compensate for the extra costs. Thus, the essence of the cost-effectiveness of PAN-based raw materials which can offer higher strength and stiffness at lower weight making up for the overall material reduction in the later stages.

The pitch segment is expected to experience significant growth over the forecast period. Carbon fibers based on the pitch have higher parameters of mechanical properties compared to other types of carbon fibers. They exhibit high tensile strength, stiffness, and thermal conductivity and so are suited for high-performance applications. CFRTP composites made of pitch-based carbon fibers are lightweight but highly strong materials so it is suitable for those industries where light-weighted products and strength are important such as aerospace, automotive, and sports industries where less fuel consumption is important. In addition, other carbon fiber precursors require high processing temperatures which is not the case with pitch-based raw materials hence minimum energy is used during processing. These make pitch-based CFRTP composites cheaper to produce and this cost efficiency makes them suitable for different industries.

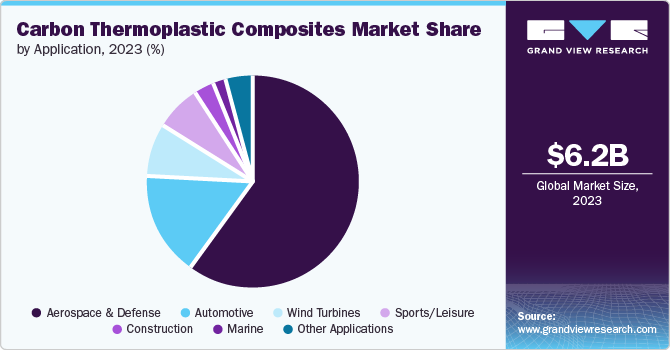

Application Insights

The aerospace & defense segment dominated the market with a revenue share of 59.6% in 2023. The aerospace & defense industry needs parts that are strong and resistant to fire. These performance criteria are easily met for CFRTP composites because of the strength-to-weight ratios and durability offered by these composites. CFRTP composites lean towards the light side and this makes the aircraft and military vehicles have better fuel efficiency without compromising on strength or safety as they will have lesser weight. A continuous research activity is seen in the aerospace and defense field that has helped in improving the manufacturing infrastructure of CFRTP composites which in turn provides improved technical features that meet the requirements of aerospace and defense applications.

The automotive segment is expected to have the fastest growth over the forecast period, registering a CAGR of 8.0%. Due to high strength and stiffness-to-weight ratios, CFRTP composites have been recognized as lightweight composites. In car manufacturing, weight is a significant factor that affects fuel consumption hence; there is usually an emphasis on weight loss. CFRTP composites are quite suitable to deal with these challenges without sacrificing performance. Moreover, CFRTP materials can be cut, molded, or fabricated into shapes and designs that other materials such as metal, cannot easily be shaped into. Such design flexibility allows the automakers to advance and distinguish their products in the market competition.

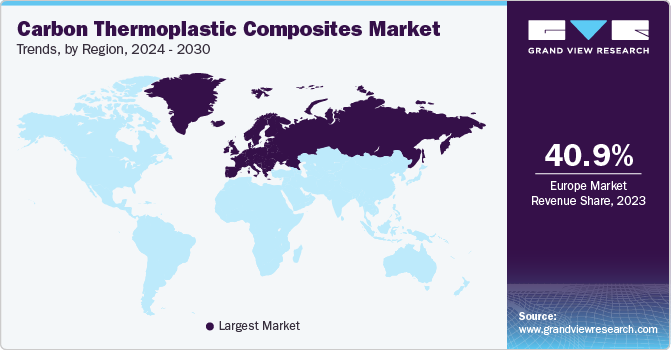

Regional Insights

North America carbon thermoplastic composites market is expected to grow lucratively over the forecast period, fueled by strict regulations in the region regarding fuel efficiency and emission control. Moreover, there is a high demand for fuel-efficient aircraft, and advancement in composite manufacturing technologies is expected to drive market growth. Furthermore, ongoing investment in research and development fueled the market growth.

U.S. Carbon Thermoplastic Composites Market Trends

The carbon thermoplastic composites market in the U.S. dominated the North America carbon thermoplastic composites market with a share of 64.2% in 2023, aided by the country’s focus on innovation and technological advancements. The industry is focusing on ways and means to improve the features of the CFRTP this is to cut down on cost and thus widen its applications in markets.

Europe Carbon Thermoplastic Composites Market Trends

The Europe carbon thermoplastic composites market dominated the global carbon thermoplastic composites market with a revenue share of 40.9% in 2023. Europe has some of the world’s largest manufacturers of automotive and aerospace and the demand for CFRTP composites in this region is very high this is expected to drive market growth. European industries have been keen on developing efficient manufacturing systems that would reduce the cycle time in manufacturing CFRTP composites.

The carbon thermoplastic composites market in the UK has a significant share in the Europe carbon thermoplastic composites market. The rise in the automotive and wind industries is driving market growth in the country. These industries require lightweight materials that are at the same time strong to enhance their efficiency.

Germany carbon thermoplastic composites market is aided by the country’s long-standing reputation of being one of the world leaders in manufacturing especially in car makers and aircraft makers. German companies have embarked on massive production of CFRTP composites due to the high performance and quality in various applications

Asia Pacific Carbon Thermoplastic Composites Market Trends

The carbon thermoplastic composites market in Asia Pacific is anticipated to witness significant growth in the global carbon thermoplastic composites market. There is a high demand for lightweight vehicles in countries such as China, India, Japan, and South Korea. Many countries in the Asia Pacific region invest heavily in research and development of CFRTP composite to have cost-effective production processes and improvement in the material driving market growth.

China carbon thermoplastic composites market is anticipated to witness significant growth in the Asia Pacific carbon thermoplastic composites market. China invests heavily in the infrastructure to manufacture the CFRTP and other materials with advanced capabilities. In addition, china's cost-effective production makes them competitive in the market.

The carbon thermoplastic composites market in India is expected to grow rapidly in the coming years due to industrialization and infrastructure development driving the demand for superior substances like CFRTP composites. Industries such as aerospace, automotive, construction, and wind electricity are increasingly adopting CFRTP solutions for lightweight, high-strength properties.

Key Carbon Thermoplastic Composites Company Insights

Some of the key companies in the carbon thermoplastic composites market include DowAksa; Solvay; TORAY INDUSTRIES, INC.; SGL Carbon; Hexcel Corporation; TEIJIN LIMITED.; Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

DowAksa specializes in the production and commercializing of carbon fibers and derivatives for various markets consisting of strength, infrastructure, and transportation. DowAksa operates global-class production centers geared up with high-tech technology.

-

Toray Industries, Inc. is a global company that specializes in the development and manufacturing of innovative materials, chemical compounds, and excessive-performance fibers. The company’s product portfolio consists of a wide range of materials, carbon fibers, synthetic fibers, plastics, and chemical compounds, which can be utilized in numerous industries, inclusive of aerospace, automotive, energy, and textiles.

Key Carbon Thermoplastic Composites Companies:

The following are the leading companies in the carbon thermoplastic composites market. These companies collectively hold the largest market share and dictate industry trends.

- DowAksa

- Solvay

- Toray Industries, Inc.

- SGL Carbon

- Hexcel Corporation

- Teijin Limited

- Mitsubishi Chemical Corporation

- Gurit Holding AG

- Plasan Carbon Composites

Recent Development

-

In October 2023, Toray Industries, Inc. announced the expansion of its French subsidiary Toray Carbon Fibers Europe S.A.’s manufacturing facilities for certain carbon fibers, starting production in 2025 to increase the plant’s annual capacity significantly.

-

In June 2023, Solvay and Spirit AeroSystems (Europe) Limited collaborated to enable Solvay to become a strategic partner of Spirit's Aerospace Innovation Centre. They aimed to develop innovative composite manufacturing ideas, automate fabrication, and assembly technologies to reduce the development cycle.

Carbon Thermoplastic Composites Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.97 billion |

|

Revenue forecast in 2030 |

USD 10.21 billion |

|

Growth rate |

CAGR of 8.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in tons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Raw material, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Taiwan, Argentina, Brazil, and Saudi Arabia |

|

Key companies profiled |

DowAksa; Solvay; Toray Industries, Inc.; SGL Carbon; Hexcel Corporation; Teijin Limited; Mitsubishi Chemical Corporation; Gurit Holding AG; Plasan Carbon Composites |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Carbon Thermoplastic Composites Market Report Segmentation

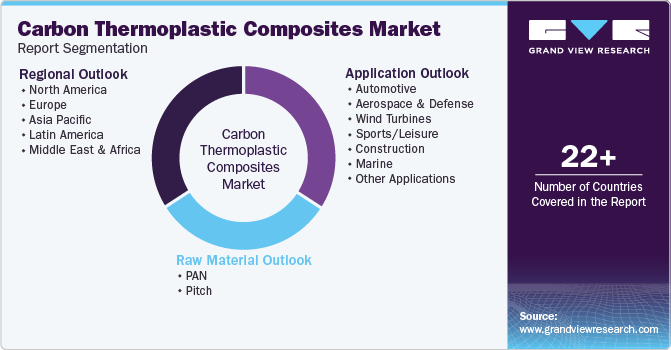

This report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon thermoplastic composites market report based on raw material, application, and region:

-

Raw Material Outlook (Revenue, USD Billion, 2018 - 2030) (Volume in Tons)

-

PAN

-

Pitch

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030) (Volume in Tons)

-

Automotive

-

Aerospace & Defense

-

Wind Turbines

-

Sports/Leisure

-

Construction

-

Marine

-

Other Applications

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030) (Volume in Tons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Taiwan

-

-

Latin America

-

Argentina

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."