Carbon Fiber Reinforced Plastic Market Size, Share & Trends Analysis Report By Raw Material, By Product (Thermosetting, Thermoplastic), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-378-2

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Market Size & Trends

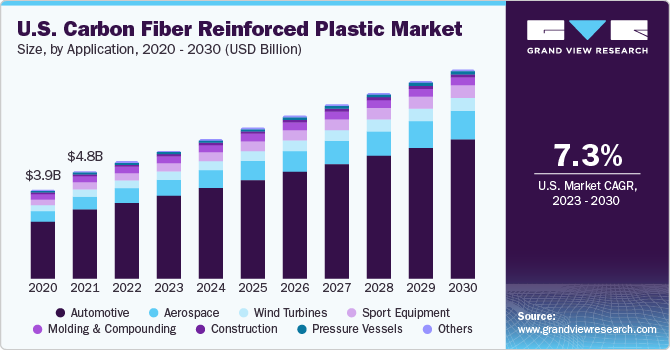

The global carbon fiber reinforced plastic market size was valued at USD 23.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. Increasing demand for carbon fiber reinforced plastic (CFRP) from the automotive and aerospace industries, growing need for fuel-efficient vehicles, and government regulations to curb vehicular pollution are expected to drive the market. The rise in demand for lightweight vehicles is projected to propel market growth in the coming years. Numerous government organizations, coupled with the favorable regulatory framework, facilitated the manufacturers to invest and enhance the research and development capabilities, quality, and automation in the process.

The mechanical qualities of CFRP are proven superior when compared to conventional industrial metals, which is boosting the market for CFRP and experiencing growth. Its advantages over aluminum and steel in the automotive and aerospace sectors are excellent fatigue strength, load-bearing strength, and most crucially, reduced weight. The CFRP increases fuel efficiency by reducing the overall weight of the vehicle, which also helps to address the requirements for reducing carbon emissions.

In addition, there is increasing demand for CF materials in a variety of industries, such as wind turbines, sports, automobiles, and aerospace & defense. The aerospace and defense industries have stringent performance product requirements for its use in commercial aircraft, satellites, engines, choppers, and other vehicles. Moreover, the luxury vehicles manufacturers are seeking to increase fuel efficiency and reduce greenhouse gas emissions (GHGs). The market for carbon fiber reinforced plastic is developing as a result of increased commercial vehicle production and expanding demand for lightweight cars.

According to the International Energy Outlook report published in October 2021 by the U.S. administration's Energy Information Administration (EIA), there were over 1.30 billion light-duty vehicles (LDVs) in use globally in 2020, and above 2.20 billion LDVs are anticipated by the year 2050.

The most commonly used raw material for CFRP production is polyacrylonitrile (PAN). CFRP properties depend on the precursor of carbon fiber used for its production. PAN has superior properties than pitch. It is projected to gain traction in the forecast period owing to its increasing application and demand as compared to pitch-based CFRP.

Demand for PAN has witnessed substantial growth as compared to pitch. The rise in the production of propylene has driven the demand for polyacrylonitrile. Extensive R&D activities by market players are anticipated to drive the CFRP market demand. Market players in the U.S. including Hexcel Corporation and Solvay S.A., along with major end users such as Boeing Co., are expected to propel the market growth in the coming years.

The market is majorly ruled by numerous standards, regulations, and policies. The industry safety standards are the major targets for the value chain participants and they are bound to follow these regulations and standards, which structure the CFRP market globally.

Product Insights

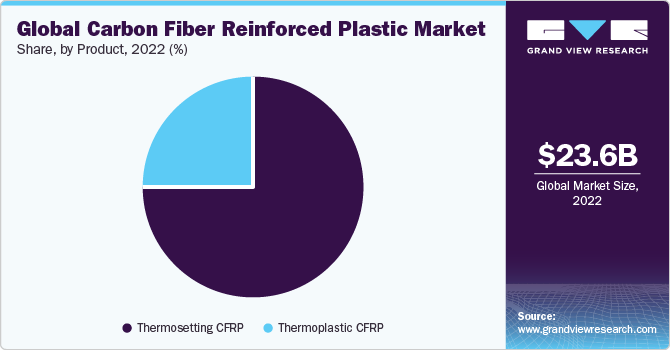

Thermosetting CFRP dominated the market with the highest revenue share of 74.7% in 2022. Through research and development activities, companies are developing various manufacturing techniques that can produce thermoplastic CFRP with properties similar to or superior to thermosetting CFRP, which is anticipated to drive the thermoplastic segment over the forecast period.

Thermoplastic CFRP is projected to grow at a CAGR of 8.3% over the forecast period. Recent advances in plastics, polymers, and resins are expected to revolutionize the industry and boost product segment growth over the forecast period. Numerous advantages offered by thermoplastic carbon fiber reinforced plastic over thermosetting including high impact resistance, short processing time, recyclability, and easy storage are anticipated to fuel demand for thermoplastic CFRP in the coming years.

Raw Material Insights

On the basis of raw materials, the global market is segmented as PAN-based CFRP and pitch-based CFRP. Polyacrylonitrile (PAN) is the most commonly used raw material for CFRP production. It dominated the market with the largest revenue share of 97.1% in 2022. The properties of CFRP including high tensile strength depend on the precursor used in its production.

The carbon fiber reinforced plastics market is majorly dominated by PAN-based carbon fiber-reinforced plastic, which is anticipated to grow at a CAGR of 7.3% over the forecast period. However, raw material prices play a crucial role in the CFRP cost component. The production is an energy-intensive process that requires a large amount of energy, which further adds up to the final product cost. A lower raw material conversion rate is also responsible for higher CFRP prices.

Application Insights

Aerospace and defense dominated the market with a revenue share of 60.4% in 2022. The segment is expected to witness significant growth on account of increasing demand for lightweight and fuel-efficient aircraft. Technological developments in carbon-fiber-reinforced plastic can help reduce the high cost of aerospace-grade CFRP as compared to other grades in the market.

The automotive segment is anticipated to grow at the fastest CAGR of 8.7% over the forecast period. The automotive pollution control norms have forced automotive manufacturers to cut down automotive curb weight for reducing pollution. Rising fuel prices have driven the need for fuel-efficient vehicles, which has further compelled automotive manufacturers to incorporate carbon fiber-reinforced plastic in automotive production.

Regional Insights

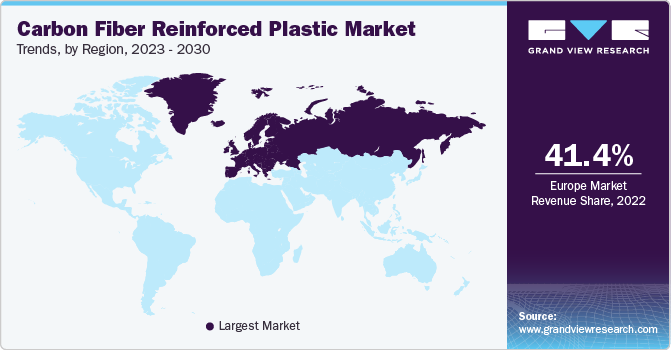

Europe emerged as the largest regional market and accounted for a 41.4% revenue share in 2022. It is anticipated to grow at the fastest CAGR of 7.9% over the forecast period. The presence of key aircraft and automotive manufacturers in the region has fueled the product demand in Europe. The upsurge in demand from aerospace, defense, wind energy, and other end-users is expected to drive market growth. Moreover, it is a homeland for various important aircraft composite producers, such as SGL Carbon and Solvay. The growing Airbus craft services are significantly increasing CFRP demand in Europe.

Governments of the U.S. and Japan have been jointly supporting CFRP development activities in both regions as carbon-fiber-reinforced plastic is the most preferred solution for automotive weight reduction.

North America held the second-largest position and accounted for a 35.7% market share in 2022. The growth of the automotive and aerospace and defense industries in the U.S., along with stringent government regulations regarding automotive pollution, is expected to drive the regional market. Technological advancements and government regulations on energy-efficient and environmentally friendly products are expected to drive product demand in this region.

Key Companies & Market Share Insights

The market is dominated by global multinational companies. It is majorly concentrated in developed regions including North America and Europe. Key manufacturers occupy a majority of the global market share. Asia Pacific provides potential opportunities for extensive business growth. Pricing and other strategic initiatives depend on the top players.

The carbon fiber-reinforced plastic industry is highly characterized by technological innovations. Prominent market participants have developed their own CFRP manufacturing technology. Europe and U.S.-based manufacturers have been using borrowed technology. However, these companies have also been working on developing their own production technology.

Every manufacturer focuses on in-house precursor production. SABIC, a major player in the petrochemical industry, has recently ventured into CFRP development. Increased usage of carbon fiber-reinforced plastic is expected to create a large amount of waste in the absence of recycling. Manufacturers in association with national governments have been investing in R&D for developing CFRP-effective recycling technology. The following are some of the major participants in the global carbon fiber reinforced plastic market:

-

DowAksa,

-

Cytec Solvay Group

-

Toray Industries, Inc.

-

SGL Group

-

Hexcel Corporation

-

Teijin Limited

-

Mitsubishi Rayon Co., Ltd.

-

Hyosung Corporation

-

Gurit Holding AG

Recent Developments

-

In September 2022, Solvay launched a carbon fiber epoxy prepreg tooling material, ‘LTM 350’, with the aim to provide carbon fiber reinforced cost reductions for segments including industrial, automotive, aerospace, and race cars.

-

In June 2022, Mitsubishi Chemical Corporation (MCC) acquired c-m-p GmbH through its subsidiary. With this acquisition, MCC is better positioned to serve the carbon fiber composite material market and provide customers with creative solutions that take advantage of the group's overall expertise.

-

In May 2021, Braskem S.A., entered into a partnership with Vartega Inc. to launch a new, Innovative Carbon Fiber Reinforced Polypropylene Filament for 3D Printing ("CF-PP") ("FL900PP-CF") for a New 3D Printing Filament Recycling Program. With this material, users may 3D print lightweight & robust parts for applications such as aircraft, automotive, sports equipment, nautical, and more

-

In December 2020, Mitsubishi Chemicals Corp. established its new Carbon Fiber Reinforced Thermoplastic Pilot Facility (CFRTP) in Fukui Prefecture. This facility enables technology that allows for the exceedingly efficient production of CFRTP with low void content.

-

In May 2020, Toray Industries, Inc. developed a high tensile modulus carbon fiber and thermoplastic pellets that are optimal for use in injection molding. The pellets are expected to make it possible to produce intricate, stiff, and light parts quickly and effectively, thereby reducing the impact on the environment. These developments might significantly improve cost performance.

-

In December 2019, Solvay and SGL Carbon collaborated to introduce the first composite materials manufactured with large-tow IM carbon fiber to the market. These materials will be based on SGL Carbon's large-tow IM carbon fiber and Solvay's primary structure resin systems. The collaboration is aimed to comply with the requirement of reducing prices and CO2 emissions, as well as improving the production procedure and fuel efficiency of future-oriented commercial aircraft.

Carbon Fiber Reinforced Plastic Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 25.7 billion |

|

Revenue forecast in 2030 |

USD 41.8 billion |

|

Growth rate |

CAGR of 7.2% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

October 2023 |

|

Quantitative units |

Revenue in USD million, Volume in Tons, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, Material, Application, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America (CSA), MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, France, Italy, UK, Spain, Russia, China, India, Japan, Taiwan, Indonesia, Australia, Brazil, Argentina, Saudi Arabia UAE. |

|

Key companies profiled |

DowAksa; Cytec Solvay Group; Toray Industries, Inc.; SGL Group; Hexcel Corporation; Teijin Limited; Mitsubishi Rayon Co., Ltd., Hyosung Corporation; Gurit Holding AG

|

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Carbon Fiber Reinforced Plastic Market Report Segmentation

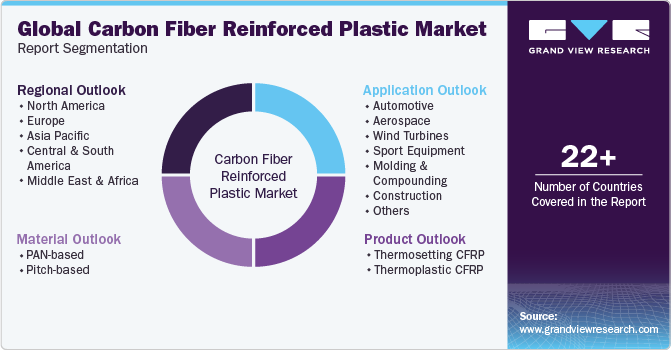

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global carbon fiber reinforced plastic market on the basis of product, material, application, and region:

-

Material Outlook (Revenue in USD Million, Volume in Tons, 2018 - 2030)

-

PAN-based

-

Pitch-based

-

-

Product Outlook (Revenue in USD Million, Volume in Tons, 2018 - 2030)

-

Thermosetting CFRP

-

Thermoplastic CFRP

-

-

Application Outlook (Revenue in USD Million, Volume in Tons, 2018 - 2030)

-

Automotive

-

Aerospace

-

Wind Turbines

-

Sport Equipment

-

Molding & Compounding

-

Construction

-

Pressure Vessels

-

Other

-

-

Regional Outlook (Revenue in USD Million, Volume in Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

Indonesia

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global carbon fiber reinforced plastic market size was estimated at USD 23.6 billion in 2022 and is expected to reach USD 25.7 billion in 2023.

b. The global carbon fiber reinforced plastic market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 41.8 billion by 2030.

b. Europe dominated the carbon fiber reinforced plastic market with a share of 41% in 2022. This is attributable to the presence of key aircraft and automotive manufacturers and the high demand for lightweight materials across the industries in the region.

b. Some key players operating in the carbon fiber reinforced plastic market include Cytec Solvay Group, Toray Industries, Inc., SGL Group, Hexcel Corporation, Teijin Limited, Mitsubishi Rayon Co., Ltd., and Hyosung Corporation.

b. Key factors that are driving the market growth include increasing demand for carbon fiber reinforced plastic (CFRP) from the automotive and aerospace industries, growing need for fuel-efficient vehicles, and government regulations to curb vehicular pollution.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."