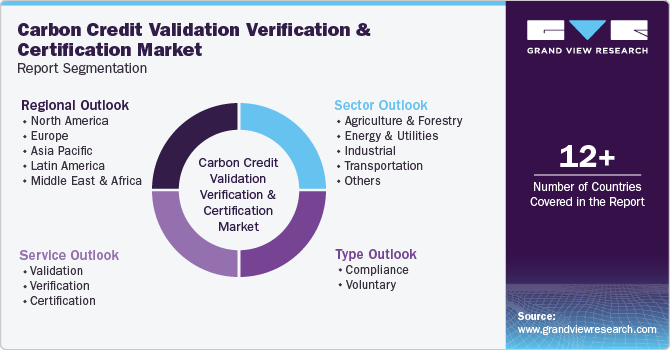

Carbon Credit Validation Verification And Certification Market Size, Share & Trends Analysis Report By Service, By Type (Compliance, Voluntary), By Sector (Agriculture & Forestry, Energy & Utilities), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-448-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

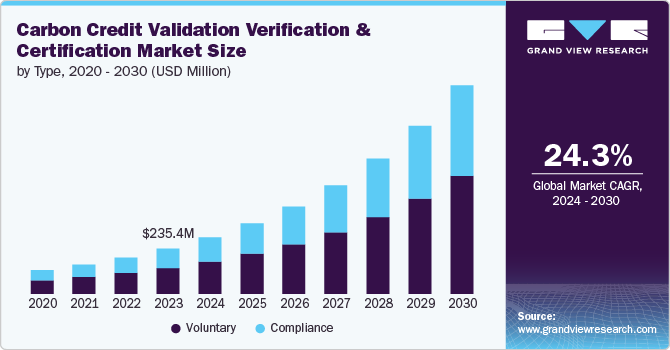

The global carbon credit validation verification and certification market size was estimated at USD 235.4 million in 2023 and is projected to grow at a CAGR of 24.3% from 2024 to 2030. Driven by stringent climate policies and rising corporate sustainability initiatives. Growing carbon markets and the adoption of nature-based solutions, such as reforestation and soil carbon sequestration, are boosting demand for reliable validation services. Technological advancements, including satellite imagery and blockchain, have enhanced the efficiency and transparency of carbon credit certification. Emerging carbon exchanges and voluntary offset programs across various global regions further fuels this expansion.

The Voluntary Carbon Markets (VCMs) are expanding rapidly as companies and individuals increasingly purchase carbon credits outside regulatory frameworks to offset emissions and meet Corporate Social Responsibility (CSR) goals. Financial incentives, such as cap-and-trade systems and carbon taxes, are driving businesses to participate in carbon markets, boosting demand for certification services. The emergence of new carbon offset projects across various industries, including carbon capture, renewable energy, and energy efficiency, further fuels the need for validation. As corporate net-zero commitments rise, companies are seeking verified carbon credits to offset unavoidable emissions, which increases the demand for credible certification services.

Growing investor interest in green finance and sustainable investments, including green bonds and ESG funds, is driving demand for certified carbon credits and related services. International collaboration on climate initiatives, such as the UN's REDD+ program, is promoting carbon offset projects in developing countries, creating a global demand for certification services. Technological advancements in AI, satellite imagery, and blockchain are enhancing the efficiency of verification processes, lowering costs, and improving access to these services. As the global carbon market expands, the need for credible, transparent validation services continues to grow, mainly across emerging and developed markets.

Service Insights

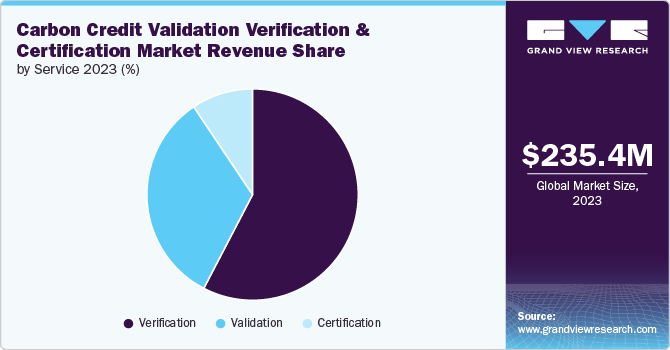

The verification segment led the market and accounted for over 57.0% of the global revenue in 2023, primarily due to its vital role in ensuring the credibility and accuracy of carbon credits. Verification is essential for confirming that emissions reductions or carbon offset projects have met the required standards and criteria, which is necessary for both compliance and voluntary carbon markets. As more organizations pursue carbon neutrality and emission reduction goals, the demand for third-party verification has surged to ensure transparency, reliability, and trust in carbon credit transactions. In addition, growing regulatory enforcement and the rise of new carbon markets have further fueled the need for verification services.

The certification segment within the carbon credit validation verification and certification market is experiencing significant growth due to the increasing demand for verified credits, driven by both regulatory frameworks and voluntary markets. As corporate net-zero commitments rise, businesses seek certified carbon credits to meet their ESG goals and enhance their reputations, emphasizing the importance of legitimacy. The growing number of carbon projects, mainly in sectors such as renewable energy and forestry, fuels the need for certification to make credits market ready. Regulatory pressures and compliance requirements, such as those from the EU Emissions Trading System and California’s Cap-and-Trade Program, further drive demand for certified credits.

Type Insights

The voluntary segment led the carbon credit validation verification and certification market in 2023, fueled by the increasing number of companies committing to sustainability and net-zero targets. Rising awareness of climate change among consumers and investors has spurred a greater emphasis on proactive carbon footprint reduction, expanding voluntary carbon offsetting efforts. The market’s expansion is supported by new initiatives and trading platforms, providing opportunities for diverse and innovative offset projects. Global corporate commitments and consumer preferences for strong environmental safety further boost demand for voluntary credits.

The compliance segment is experiencing significant growth due to stricter regulatory frameworks and mandatory emission reduction targets. Governments and international bodies, such as the EU's Emissions Trading System and California's Cap-and-Trade Program, are enforcing more stringent regulations that require companies to purchase compliance carbon credits to meet legal requirements. The market has become more established with widespread participation and offers more stable pricing compared to voluntary markets; demanding businesses seek predictable costs for carbon reduction. Increased transparency and reporting requirements further drive demand for verified compliance credits.

Sector Insights

The energy & utilities segment accounted for the largest market revenue share in 2023 due to its significant carbon emissions from power generation, oil and gas extraction, and other utility services. Regulatory frameworks, such as emissions trading systems and cap-and-trade programs, impose stringent requirements on this sector, driving high demand for carbon credit validation and certification. The sector's numerous large-scale projects, including renewable energy initiatives and carbon capture and storage, generate a substantial volume of carbon credits that need thorough validation. Investment in cleaner energy sources and technologies further contributes to the need for certification services.

The agriculture & forestry segment is expected to grow significantly due to its vital role in nature-based solutions such as reforestation, afforestation, and soil carbon sequestration, which are essential for capturing and storing carbon dioxide. These sectors offer substantial carbon sequestration potential, attracting investment and driving demand for rigorous validation and certification of carbon credits. Increased funding and incentives from governments, NGOs, and private investors further support the development of carbon offset projects in agriculture and forestry. As companies and consumers prioritize sustainability, there is a growing demand for carbon credits from these sectors to meet environmental commitments.

Regional Insights

North America represented a significant market share of over 38.0% in 2023, driven by advanced regulatory frameworks such as the U.S. Cap-and-Trade Program and Canada's federal carbon pricing system. The region's high corporate participation, spurred by stringent regulations and voluntary sustainability goals, significantly boosts demand for validated and certified carbon credits. Established carbon markets in North America involve substantial trading volumes, necessitating rigorous validation to maintain market integrity. Further, the region's advanced technological and analytical capabilities enhance the accuracy of measurement and verification processes.

U.S. Carbon Credit Validation Verification And Certification Market Trends

The carbon credit validation verification and certification market in the U.S. is expected to grow significantly over the forecast period, driven by the strengthening of regulatory frameworks such as potential federal carbon pricing and emissions reduction targets under initiatives such as the Inflation Reduction Act. Corporate sustainability commitments are also fueling demand as U.S. companies increasingly purchase carbon credits to meet their net-zero goals. Technological advancements in monitoring and verification are enhancing the efficiency of managing carbon offset projects.

Europe Carbon Credit Validation Verification And Certification Market Trends

The carbon credit validation verification and certification market in Europe is gaining significant traction due to regulatory frameworks such as the European Union Emissions Trading System (EU ETS), which enforces strict validation and certification standards. Europe's climate goals, including carbon neutrality by 2050 and substantial emissions reductions by 2030, further drive the demand for certified carbon credits. High corporate engagement in sustainability and carbon neutrality initiatives across various industries contributes to this demand as businesses seek reliable carbon credits to meet their targets. In addition, the expansion and integration of regional carbon markets in Europe, including the development of new trading platforms, requires thorough validation and certification processes.

Asia Pacific Carbon Credit Validation Verification And Certification Market Trends

The Asia Pacific carbon credit validation and certification market is poised for significant growth. In China, the national carbon market and climate goals fuel the demand for rigorous validation services. India's investment in renewable energy and participation in the voluntary carbon market creates a strong need for certification. Japan's carbon pricing initiatives and corporate sustainability targets, along with South Korea's comprehensive emissions trading scheme and Green New Deal, drive market expansion.

Key Carbon Credit Validation Verification And Certification Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in June 2024, VERRA introduced the VM0049 Verified Carbon Standard (VCS) Methodology for Carbon Capture and Storage (CCS). This new methodology provides a universally applicable framework for technology-driven CCS projects, which produce Carbon Dioxide Removals (CDRs) and emission lowerings. Carbon Dioxide Removals (CDRs) are viewed as a crucial component of corporate strategies aimed at achieving net zero emissions.

Key Carbon Credit Validation Verification And Certification Companies:

The following are the leading companies in the carbon credit validation verification and certification market. These companies collectively hold the largest market share and dictate industry trends.

- ACR

- AENOR

- Bureau Veritas SA

- CarbonCheck

- Gold Standard

- SGS SA

- SustainCERT.

- The ERM International Group Limited

- TÜV SÜD

- VERRA

Recent Developments

-

In March 2024, Kotyark Industries Limited became the first Indian company in the bio-diesel sector to be accredited under VERRA, a globally recognized carbon certification standard. By implementing eco-friendly practices, the company earned 57,874 carbon credits for the period from September 2020 to March 2022, as per the Verra registry dated March 2, 2024.

-

In February 2024, the Ministry of Power Govt. of India, in partnership with the Bureau of Energy Efficiency (BEE), revised the Carbon Credit Trading Scheme (CCTS), adding an offset mechanism to the compliance regime. The revised scheme enables non-obligated entities to voluntarily register projects across designated sectors, earning tradable carbon credit certificates with the goal of decarbonizing the economy. These certificates are issued after evaluation by BEE-accredited agencies, recognizing efforts to reduce, remove, or avoid greenhouse gas emissions.

-

In January 2024, the CMA-India partnered with the Voluntary Carbon Markets Integrity Initiative to support stakeholders in carbon credit trading. The partnership aims to guide industry players through project registration, monitoring, and transparent carbon credit trading while promoting a high-integrity voluntary carbon market aligned with India's climate and socioeconomic policies.

Carbon Credit Validation Verification And Certification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 293.5 million |

|

Revenue forecast in 2030 |

USD 1,085.3 million |

|

Growth rate |

CAGR of 24.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered Application |

Service, type, sector, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

ACR; AENOR; Bureau Veritas SA; CarbonCheck; Gold Standard; SGS SA; The ERM International Group Limited; SustainCERT ; TÜV SÜD; VERRA |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Carbon Credit Validation Verification And Certification Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global carbon credit validation verification and certification market report based on service, type, sector, and region.

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Validation

-

Verification

-

Certification

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Compliance

-

Voluntary

-

-

Sector Outlook (Revenue, USD Million, 2017 - 2030)

-

Agriculture & Forestry

-

Energy & Utilities

-

Industrial

-

Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global carbon credit validation verification and certification market size was estimated at USD 235.4 million in 2023 and is expected to reach USD 293.5 million in 2024.

b. The global carbon credit validation verification and certification market is expected to grow at a compound annual growth rate of 24.3% from 2024 to 2030 to reach USD 1,085.3 million by 2030.

b. North America dominated the carbon credit validation verification and certification market with a share of 38.7% in 2023. The region's high corporate participation, spurred by stringent regulations and voluntary sustainability goals, significantly boosts demand for validated and certified carbon credits. Established carbon markets in North America involve substantial trading volumes, necessitating rigorous validation to maintain market integrity.

b. Some key players operating in the carbon credit validation verification and certification market include ACR; AENOR; Bureau Veritas SA; CarbonCheck; Gold Standard; SGS SA; The ERM International Group Limited; SustainCERT ; TÜV SÜD; VERRA

b. Key factors that are driving the carbon credit validation verification and certification market growth include investment in carbon offset projects, and implementation of emission regulations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."