Carbon Credit Trading Platform Market Size, Share & Trends Analysis Report By Product Type (Voluntary, Regulated), By End-use (Industrial, Utilities, Energy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-384-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Market Size & Trends

The global carbon credit trading platform market size was estimated at USD 129.2 million in 2023 and is expected to grow at a CAGR of 18.2% from 2024 to 2030. The market is driven by the increasing global focus on reducing carbon emissions and mitigating climate change. As governments and international bodies are implementing stricter environmental regulations and carbon pricing mechanisms, businesses are incentivized to reduce their carbon footprints. This regulatory push is creating a growing demand for carbon credits, which can be traded on specialized platforms, providing companies with a cost-effective means to comply with emissions targets.

Furthermore, the integration of block-chain and digital ledger technologies enhances the transparency, security, and efficiency of carbon credit transactions. These technologies help prevent fraud and double counting, ensuring that carbon credits are accurately tracked from issuance to retirement. Additionally, the development of sophisticated analytics and AI-driven platforms allows for better price forecasting and risk management, attracting more participants to the market.

Consumers are more likely to support businesses that actively participate in reducing their carbon emissions, thus driving companies to engage in carbon trading as part of their sustainability strategies. This increased awareness and demand for carbon credits from both corporations and consumers create a favorable environment for the growth of trading platforms. However, variations in carbon pricing policies, emission targets, and regulatory frameworks across different countries are projected to create market volatility and affect the predictability of carbon credit prices.

This uncertainty can discourage companies from participating in carbon trading or investing in long-term carbon reduction projects, thereby limiting the growth of trading platforms. Additionally, the complexity and cost associated with verifying carbon credits further pose a challenge to the product demand. The process of measuring, reporting, and verifying carbon emissions and reductions can be technically complex and expensive, particularly for smaller businesses or projects in developing regions. This complexity can create barriers to entry for new participants in the carbon credit market.

Product Type Insights

The voluntary segment dominated the market with a revenue share of 67.5% in 2023 and is further expected to grow at the fastest CAGR from 2024 to 2030. These platforms enable participants to purchase carbon credits voluntarily, often as part of corporate social responsibility (CSR) initiatives or to achieve carbon neutrality goals. Voluntary carbon credits are ideal for companies looking to enhance their environmental reputation, engage with eco-conscious consumers, and demonstrate a commitment to sustainability. The voluntary market also allows organizations to prepare for potential future regulations by developing emissions reduction strategies early on.

The growth of voluntary carbon credit trading platforms also offers flexibility in the types of projects supported, allowing participants to align their carbon offset purchases with their corporate missions. Additionally, advancements in technology and data transparency are enhancing the credibility and tracking of voluntary carbon credits, thereby boosting product demand. Hence, the segment is expected to reach USD 354.8 million by 2030.

Regulated carbon credit trading platforms accounted for USD 42.0 million in 2023. These systems operate by the frameworks established by governmental or international bodies to enforce mandatory emissions reduction targets. Furthermore, this system incentivizes companies to lower their carbon footprint most cost-effectively and sell excess allowances for profit. The primary goal of regulated carbon trading platforms is to ensure compliance with emissions targets, thereby contributing to national or international climate goals.

The growth of regulated carbon credit trading platforms depends heavily on the regulatory framework's design and enforcement. Key factors include the stringency of the emissions cap, the allocation mechanism of allowances, and the robustness of monitoring and verification systems. A well-designed cap-and-trade system can drive significant emissions reductions and stimulate investment in low-carbon technologies. However, these platforms also face challenges, such as regulatory uncertainty and potential market manipulation. Despite these challenges, regulated carbon markets are expanding globally, thereby raising product demand.

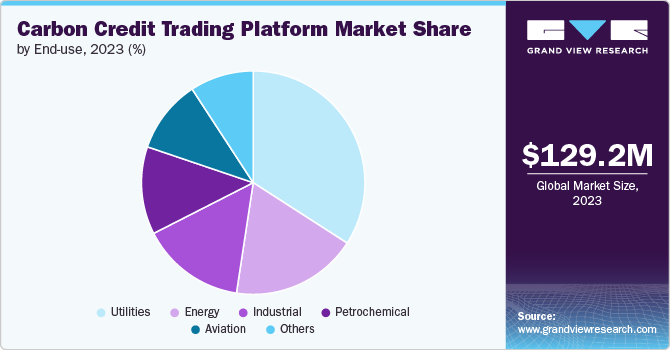

End-use Insights

The utilities accounted for the largest revenue share of 34.1% in 2023 and are further expected to grow at a substantial rate from 2024 to 2030. The utilities sector includes electricity and gas companies which rely on carbon credit trading platforms to manage and mitigate emissions from power generation. With a substantial share of emissions stemming from fossil fuel-based energy production, utilities use carbon credits to offset these emissions and adhere to regulatory caps. Participation in carbon markets allows utilities to finance renewable energy projects and invest in carbon capture and storage technologies, promoting a transition to greener energy sources and reducing overall carbon intensity.

In the industrial sector, the product is utilized to offset emissions from manufacturing processes, which are often significant contributors to greenhouse gas emissions. Companies in this sector participate in trading carbon credits to comply with environmental regulations and enhance sustainability credentials. Using carbon credit trading platforms, industrial firms can easily invest in cleaner technologies and carbon reduction projects, ultimately aiming to balance their emissions. Therefore, the segmental revenue is projected to reach USD 77.1 million by 2030.

The product plays a crucial role in energy sectors including oil and gas exploration as it manages emissions associated with fossil fuel extraction and processing. Energy companies utilize the product to offset emissions from operations and product use, thus fulfilling corporate sustainability goals and regulatory requirements. The sector's involvement in carbon trading also supports investments in renewable energy projects and innovations aimed at reducing the carbon footprint of energy products.

The petrochemical end use segment is expected to grow at a CAGR of 17.7% from 2024 to 2030, owing to the rising pressure to reduce emissions from its energy-intensive processes. The product offers petrochemical companies a mechanism to offset emissions by investing in environmental projects that reduce greenhouse gases. This participation helps companies meet regulatory compliance and support initiatives in sustainable chemical production, energy efficiency, and the development of low-carbon technologies.

Regional Insights

The North America carbon credit trading platform market is anticipated to account for a revenue share of 20.5% in 2023 and is further expected to grow at a significant rate from 2024 to 2030. The increasing adoption of cap-and-trade programs, particularly in regions like the U.S. and Canada supports product growth. Additionally, growing emphasis on corporate sustainability and environmental responsibility drives demand for carbon credits, as businesses seek to offset their emissions and meet regulatory requirements bolstering market growth in the region.

U.S. Carbon Credit Trading Platform Market Trends

The carbon credit trading platform market in the U.S. is anticipated to grow at a CAGR of 18.2% owing to increasing state-level initiatives such as California's cap-and-trade program and the Regional Greenhouse Gas Initiative (RGGI) in the Northeast. Despite the absence of a federal carbon pricing policy, these regional programs create a robust market, encouraging businesses to participate in emissions trading.

Europe Carbon Credit Trading Platform Market Trends

Europe carbon credit trading platform market accounted for the largest revenue share of 48.5% in 2023 as it is one of the most mature and advanced globally, anchored by the European Union Emissions Trading System (EU ETS). The EU ETS is a key component of the EU's climate policy, driving significant product demand as industries strive to meet stringent emissions reduction targets. Moreover, the market is supported by a well-established regulatory framework, strong political commitment to sustainability, and growing corporate participation in carbon offsetting initiatives.

Asia Pacific Carbon Credit Trading Platform Market Trends

The carbon credit trading platform market in the Asia Pacific accounted for the fastest growing CAGR of 19.2% over the forecast period. The emerging cap-and-trade systems in countries like China, South Korea, and New Zealand. China's national carbon trading scheme significantly influences the regional market. In addition, the region’s growing industrial base, coupled with increasing awareness of climate change and environmental responsibility, is spurring product demand.

Key Carbon Credit Trading Platform Company Insights

Some key players operating in the market include AirCarbon Pte Ltd and Carbonex Ltd

-

AirCarbon Pte Ltd is a company primarily focused on addressing climate change by developing solutions that promote sustainability. It specializes in creating innovative platforms that facilitate the buying and selling of carbon credits.

-

Carbonex Ltd is involved in the carbon management and sustainability sector. This company specializes in providing comprehensive solutions for carbon footprint measurement, reduction, and offsetting. This company helps organizations to achieve their sustainability goals. This company combines advanced technology, expert consulting, and innovative strategies to address the challenges of climate change.

BetaCarbon Pty Ltd is the emerging market participants in the market.

- BetaCarbon Pty Ltd is an innovative company dedicated to transforming the market through advanced technology and strategic solutions. It focuses on providing a user-friendly platform for trading carbon credits, enabling individuals and organizations to offset their emissions effectively.

Key Carbon Credit Trading Platform Companies:

The following are the leading companies in the carbon credit trading platform market. These companies collectively hold the largest market share and dictate industry trends.

- AirCarbon Pte Ltd.

- Carbonplace

- Carbonex Ltd.

- Likvidi Technologies Ltd

- CME Group Inc.

- European Energy Exchange AG

- Carbon Trade Exchange

- Nasdaq Inc.

- Xpansiv Data Systems Inc.

- Climate Impact X

- BetaCarbon Pty Ltd.

Recent Developments

-

In 2022, Zerocap joined forces with ANZ Bank and Beta Carbon to successfully trade on its platform tokenized Australian carbon credits (BCAU) using the ANZ Bank issued A$DC stablecoin. This is expected to help the company gain a competitive edge and expand its market share.

Carbon Credit Trading Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 157.1 million |

|

Revenue forecast in 2030 |

USD 507.8 million |

|

Growth rate |

CAGR of 18.2% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy, Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia |

|

Key companies profiled |

AirCarbon Pte Ltd.; Carbonplace; Carbonex Ltd.; Likvidi Technologies Ltd; CME Group Inc.; European Energy Exchange AG; Carbon Trade Exchange; Nasdaq Inc.; Xpansiv Data Systems Inc.; Climate Impact X; BetaCarbon Pty Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Carbon Credit Trading Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon credit trading platform market report based on product type, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 -2030)

-

Voluntary

-

Regulated

-

-

End-use Outlook (Revenue, USD Million, 2018 -2030)

-

Industrial

-

Utilities

-

Energy

-

Petrochemical

-

Aviation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global Carbon Credit Trading Platform size was estimated at USD 129.2 million in 2023 and is expected to reach USD 157.1 million in 2024.

b. The Carbon Credit Trading Platform is expected to grow at a compound annual growth rate of 18.2% from 2024 to 2030 to reach USD 507.8 million by 2030.

b. Among product type, voluntary segmented accounted for the largest market in 2023 with a revenue share of 67.5% as voluntary carbon credits are ideal for companies looking to enhance their environmental reputation, engage with eco-conscious consumers, and demonstrate a commitment to sustainability.

b. Some of the key players operating in the Carbon Credit Trading Platform include AirCarbon Pte Ltd., Carbonplace, Carbonex Ltd., Likvidi Technologies Ltd, CME Group Inc., European Energy Exchange AG, Carbon Trade Exchange, Nasdaq Inc., Xpansiv Data Systems Inc., Climate Impact X, BetaCarbon Pty Ltd.

b. The key factor that is driving the Carbon Credit Trading Platform is rising number of markets permitting the partial use of carbon credits.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."