Carbon Capture And Storage Market Size, Share & Trends Analysis Report By Technology, By Application (Power Generation, Oil & Gas), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-216-7

- Number of Report Pages: 192

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Carbon Capture And Storage Market Trends

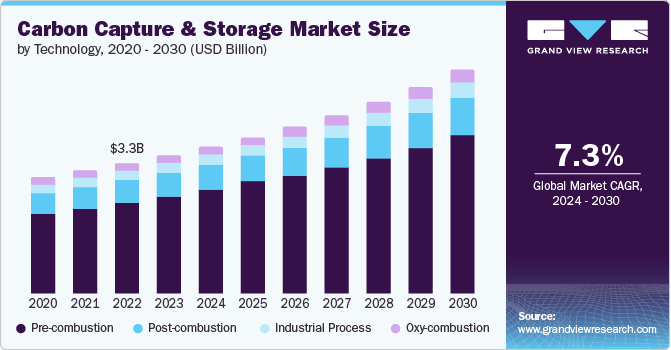

The global carbon capture and storage market size was estimated at USD 3.47 billion in 2023 and is projected to grow at CAGR of 7.3% from 2024 to 2030. Increasing carbon emissions across the world and surging concerns regarding the detrimental effect of carbon emissions on the environment have prompted the global adoption of carbon capture and storage technology, thereby leading to the growth of the market.

The U.S. has the largest number of carbon capture and storage projects, with 34 planned projects as of 2022. Moreover, according to the U.S. Department of Energy, in the recent past, the U.S. government started providing loans up to 80% of the cost for nascent stage CCS projects.

Drivers, Opportunities & Restraints

Increasing concerns regarding the detrimental effect of carbon emissions on the environment have prompted the adoption of carbon capture and storage technology. Various governments are encouraging the implementation of CCS technology through pilot projects across various industries. This is attributed to the ability of the carbon capture and storage technology to serve as a large-scale solution for achieving high CO2 emission reduction targets and climate control goals.

The increasing demand for CO2 in enhanced oil recovery (EOR) techniques is a major driver, with around 500,000 barrels of oil produced daily using CO2-EOR, according to the IEA. Governments worldwide are launching initiatives to encourage CCS adoption and implementing regulations to curb CO2 emissions from industries and power plants. North America, led by the USA, is the largest and most lucrative CCS market due to the presence of leading end-use industries, growing demand for clean technologies, rising EOR usage, and increasing market players.

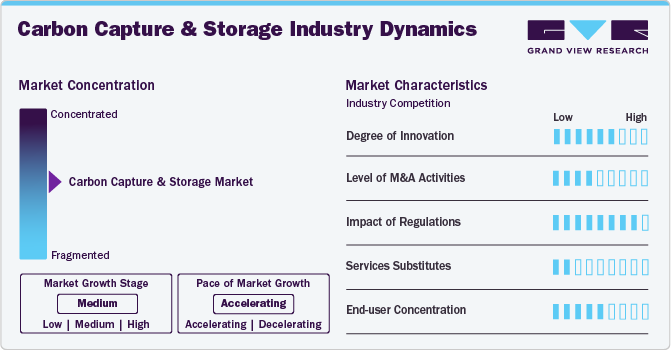

The high capital investment costs of CCS projects are a major factor holding back the industry's growth. CCS projects require significant upfront investments, as the technology is relatively complex and commands high initial costs for setting up capture, transportation, and storage infrastructure. The high costs and technical complexities involved in CCS projects are the primary factors limiting the widespread adoption and growth of the CCS market.

Industry Dynamics

The CCS market is driven by the growing focus on reducing CO2 emissions globally, with governments implementing regulations and initiatives to encourage CCS adoption. The oil and gas industry is a major application area, as CCS technologies are increasingly used for enhanced oil recovery (EOR) projects. Around 500,000 barrels of oil are produced daily using CO2-EOR.

Awareness about the importance of CCS in tackling climate change is also growing, especially in developing regions, which is expected to further drive market expansion. Overall, the CCS market is poised for strong growth, with North America, led by the US, being the largest and most lucrative regional market.

Technology Insights

Based on technology, the market is further categorized into post-combustion, pre-combustion, oxy-combustion, and industrial process segments. Among these, the pre-combustion technology accounted for the largest revenue share of over 70.28% in 2023. Pre-combustion CO2 capturing with the usage of water-gas shift reaction (WGSR) and its removal with acid gas removal (AGR) process is commercially carried out across the world at present. However, the major obstacle in the extraction of carbon dioxide from the atmosphere is the high proportion of nitrogen in combustion air. The solution adopted to overcome this challenge is known as the integrated gasification combined cycle (IGCC).

The oxy-combustion technology segment is expected to grow at the fastest CAGR of 7.4% over the forecast period 2024-2030. Oxy-fuel combustion involves the combustion of fossil fuels with the help of oxygen instead of air. Combustion carried out under these conditions reduces the production of nitrogen oxides and other by-products that are produced in pre-combustion and post-combustion techniques.

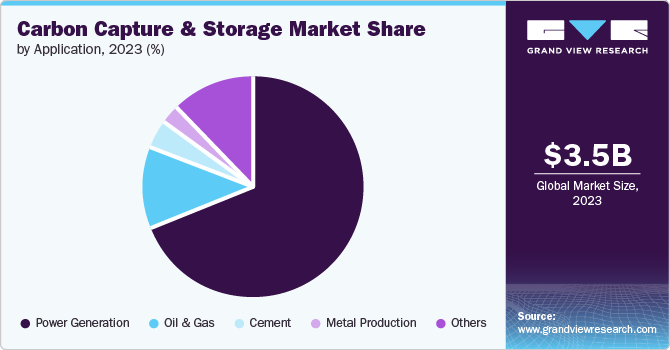

Application Insights

Based on application, the market is further categorized into power generation, oil & gas, metal production, cement, and others segments. Among these, the power generation segment accounted for the largest revenue market share of about 68.60% in 2023. The global power sector was responsible for an increase of nearly two-thirds in carbon dioxide emissions in 2022 compared with that of the previous year. Due to high greenhouse gas emission rates, the potential of using carbon capture and storage technology is extremely high in coal-fired power plants. This is anticipated to lead to the growth of the power generation segment of the market in the coming years.

The others segment recorded a CAGR of 7.4% over the forecast period. Carbon capture and storage systems are widely used in industries such as pulp and paper, chemicals, and fertilizers. Nitrogen-based fertilizers are widely used worldwide to replenish the soil nutrients used by crops. The fertilizer production process emits a CO2 stream, which is pure and well-suited for capture. Hence, CCS technologies are best suited for the fertilizer industry and are anticipated to witness significant growth in demand over the forecast period.

Regional Insights

North America carbon capture and storage market is the largest in the world. North American region accounted for more than 36.76% global share in 2023. The U.S. dominates the region and is the front runner in technology implementation for CCS globally. The first CCS project in the world was started in 1978 by Searles Valley Minerals in a coal-based power plant located in the state of California in the U.S.

U.S. Carbon Capture And Storage Market Trends

The U.S. carbon capture and storage market dominated the North American region and accounted for a revenue share of over 78.77% in 2023. Moreover, according to the U.S. Department of Energy, in recent years, the U.S. government started providing loans up to 80% of the cost for nascent-stage CCS projects.

The carbon capture and storage market in Canada is expected to grow at a significant CAGR of 10.2%. Canada is one of the major users of CCS technologies worldwide and is highly committed to continuous advancements of these technologies. Moreover, the development of CCS infrastructure in the country is also part of a broad spectrum of measures pursued by the country's government to meet the GHG reduction targets.

Europe Carbon Capture And Storage Market Trends

The Europe carbon capture and storage market has seen significant growth. Europe has been very active in R&D efforts related to CCU. European countries working in the field of CCU, in the form of pilot projects or testing phases, outnumber other regional countries involved in CCU activities.

The carbon capture and storage market in the UK accounted for the largest share of over 37.45% in 2023 in the European region. UK has been very active in R&D efforts related to CCU. UK is working in the field of CCU, in the form of pilot projects or testing phases, outnumber other regional countries involved in CCU activities.

Italy carbon capture and storage market is expected to progress with a CAGR of 6.8% over the forecast period. Italy has a few pilot CCS projects, and the government is providing funding and incentives to encourage further CCS deployment, particularly in the industrial and power generation sectors, to help meet its climate goals.

Asia Pacific Carbon Capture And Storage Market Trends

The Asia Pacific carbon capture and storage market is emerging as a major hub for carbon capture and storage (CCS), with significant growth potential. However, challenges such as a lack of nearby storage sites, limited regulations and incentives, and access to funding remain. Collaboration between the private and public sectors is crucial to unlocking the region's vast CCS potential.

The carbon capture and storage market in China is projected to grow significantly. China, one of the largest carbon dioxide emitters in the world, is planning to double its capacity to capture and store carbon dioxide in the coming years to reduce its contribution to global warming.

The India carbon capture and storage market is expected to grow significantly, with a CAGR of 10.04% over the forecast period. This growth is due to favorable government initiatives, which are expected to drive the market's growth over the forecast period.

Central & South America Carbon Capture And Storage Market Trends

The carbon capture and storage market in Central and South America is projected to grow significantly over the forecast period. Driven by increasing demand and favorable policies, the market is expected to emerge as a significant player in the global carbon credit market.

Brazil's carbon capture and storage market had the largest share, 65.86%, in 2023. Brazil has the Petrobras Lula Oil Field CCUS Project, the world's only offshore CO2-EOR project. Mexico is laying the foundation for CCS projects through policy initiatives. However, widespread adoption remains limited due to high costs and a lack of infrastructure.

Middle East & Africa Carbon Capture And Storage Market Trends

The carbon capture and storage market in the Middle East and Africa is expected to grow significantly. The region is emerging as a key hub for carbon capture and storage (CCS) technology, driven by high CO2 emissions, government climate goals, and potential for enhanced oil recovery.

Key Carbon Capture And Storage Company Insights

Key companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations and agreements to produce an advanced product with superior performance characteristics to increase revenue. For instance, in March 2023, Carbfix hf. announced an expansion in its global footprint by launching a new carbon capture plant in Iceland. This plant is expected to capture 3,000 tons of carbon annually.

Key Carbon Capture And Storage Companies:

The following are the leading companies in the carbon capture and storage market. These companies collectively hold the largest market share and dictate industry trends.

- Shell PLC

- Aker Solutions

- Equinor ASA

- Dakota Gasification Company

- Linde plc

- Siemens Energy

- Fluor Corporation

- Sulzer Ltd.

- Mitsubishi Heavy Industries Ltd. (MHI)

- Japan CCS Co. Ltd

Recent Developments

-

In February 2024, Carbfix hf. announced an expansion of its global footprint by launching a new carbon capture plant in Iceland. This plant is expected to capture 3,000 tons of carbon annually.

-

In June 2023, Technip Energies N.V. announced the launch of CaptureNow, which is a platform that brings all the carbon capture, storage, and utilization technologies under one platform.

-

In June 2023, CHN ENERGY Investment Group Co., LTD. announced the launch of Asia's largest carbon capture project in China. This project is expected to produce 500,000 tons of carbon dioxide annually.

Carbon Capture And Storage Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.68 billion |

|

Revenue forecast in 2030 |

USD 5.61 billion |

|

Growth rate |

CAGR of 7.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million tons, revenue in USD billion/million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, China, Japan, India, South Korea, Australia, Brazil, Argentina, UAE, Saudi Arabia, and South Africa. |

|

Key companies profiled |

Shell PLC, Aker Solutions, Equinor ASA, Dakota Gasification Company, Linde plc, Siemens Energy, Fluor Corporation, Sulzer Ltd., Mitsubishi Heavy Industries Ltd. (MHI), Japan CCS Co. Ltd, Carbon Engineering Ltd, and LanzaTech. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Carbon Capture And Storage Market Report Segmentation

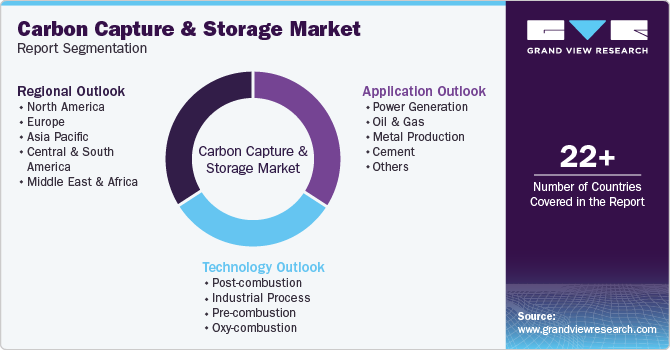

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon capture and storage market report on the basis of technology, application, and region:

-

Technology Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Post-combustion

-

Industrial Process

-

Pre-combustion

-

Oxy-combustion

-

-

Application Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

Power Generation

-

Oil & Gas

-

Metal Production

-

Cement

-

Others

-

-

Regional Outlook (Volume, Million Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the carbon capture and storage market include Shell CANSLV, AkerSolutions, Statoil, Linde Engineering, Mitsubishi Heavy Industries, and Sulzer.

b. Key factors driving the growth of the carbon capture and storage market include increasing the application of enhanced oil recovery (EOR) technologies and increasing emissions of carbon dioxide globally.

b. The global carbon capture and storage market size was estimated at USD 3.47 billion in 2023 and is expected to reach USD 3.68 billion in 2024.

b. The global carbon capture and storage market is expected to witness a compound annual growth rate of 7.3% from 2024 to 2030 to reach USD 5.61 billion by 2030.

b. Pre-combustion capture technologies for carbon dioxide constituted the largest share, accounting for over 70.3% in 2023. Increased energy generation, newly developed advanced amine systems, and heat integration systems are expected to be the main factors driving its demand over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."