- Home

- »

- Petrochemicals

- »

-

Carbon Black Feedstock Market Size & Share Report, 2030GVR Report cover

![Carbon Black Feedstock Market Size, Share & Trends Report]()

Carbon Black Feedstock Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Clarified Slurry Oil, Coal Tar Oil), By Product (High BMCI Type, General Type), By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-461-1

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Black Feedstock Market Summary

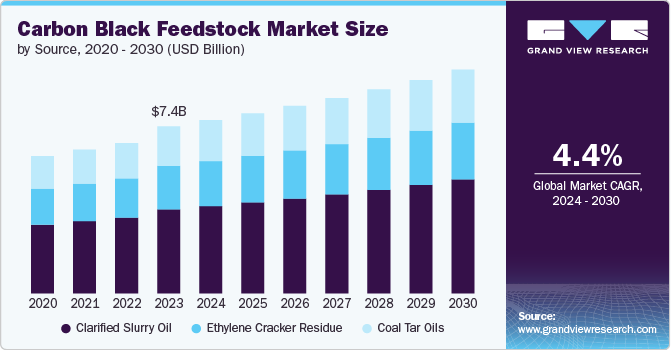

The global carbon black feedstock market size was estimated at USD 7.4 billion in 2023 and is projected to reach USD 9.97 billion by 2030, growing at a CAGR of 4.4% from 2024 to 2030. The market is primarily driven by the growing demand for carbon black, a key component in various industries.

Key Market Trends & Insights

- The Asia Pacific carbon black feedstock market dominated with a revenue share of 43% in 2023.

- Based on source, the coal tar oil is another potential feedstock for carbon black production.

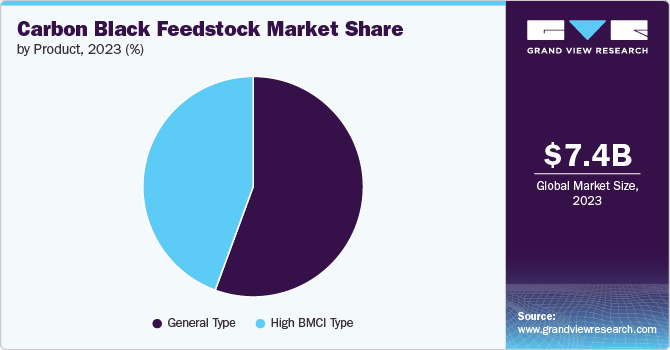

- Based on product, the general type carbon black is a broad category that encompasses various types of carbon black with a wide range of properties.

Market Size & Forecast

- 2023 Market Size: USD 7.4 Billion

- 2030 Projected Market USD 9.97 Billion

- CAGR (2024-2030): 4.4%

- Asia Pacific: Largest market in 2023

The increasing production of tires, plastics, rubber, and other products that require carbon black is a significant factor driving the market.

In addition, the shift towards electric vehicles is expected to positively impact the carbon black feedstock market. While electric vehicles require fewer tires, they often incorporate carbon black in their batteries and other components, which could offset the decline in tire demand. Furthermore, the increasing focus on sustainability and the development of carbon black from renewable sources are also contributing to the growth of the market.

The increasing production of tires, plastics, rubber, and other products that require carbon black is a major driver. While electric vehicles require fewer tires, they often incorporate carbon black in their batteries and other components. Government regulations related to emissions and environmental standards can impact the use of carbon black.

Source Insights

The market is segmented into clarified slurry oil, ethylene cracker residue, and coal tar oils. Clarified slurry oil (CSO) is a byproduct of the sugar industry that can produce carbon black as a feedstock. CSO is a dark, viscous liquid that is rich in hydrocarbons. After a clarification process to remove impurities, it can be processed into carbon black, a valuable material used in various industries.

Coal tar oil is another potential feedstock for carbon black production. It is a byproduct of the coal tar distillation process and is rich in aromatic hydrocarbons. Its high carbon content makes it suitable for carbon black production. The use of coal tar oil as a carbon black feedstock is well-established, with proven production processes in place.

Ethylene cracker residue (ECR) is a byproduct of ethylene production. It is a complex mixture of hydrocarbons that can be used as a feedstock for carbon black production. ECR's high carbon content makes it suitable for this purpose. Finding a valuable use for this byproduct can help reduce the petrochemical industry's environmental impact.

Product Insights

The market is segmented into High BMCI Type and General Type. High BMCI-type carbon black is a type of carbon black characterized by its high black modulus (BMCI). This property indicates its ability to reinforce rubber compounds, making it a valuable material for applications requiring high strength, durability, and abrasion resistance.

General type carbon black is a broad category that encompasses various types of carbon black with a wide range of properties. It is used in various applications, including tires, plastics, rubber, and inks. It is used as a filler and reinforcement material in plastics, such as polyethylene and polypropylene. It is also used to improve rubber products' strength, durability, and abrasion resistance.

Regional Insights

The key driver influencing the carbon black feedstock market in North America is the growing demand for carbon black itself. This demand is primarily fueled by the region's robust automotive industry, which is a major consumer of carbon black for tire production. Additionally, the plastics and rubber industries in North America also contribute significantly to the demand for carbon black.

U.S. Carbon Black Feedstock Market Trends

The demand for carbon black feedstock in the U.S. has been steadily increasing due to the expanding automotive industry, particularly the production of electric vehicles (EVs). EVs require more carbon black than traditional gasoline powered vehicles due to their larger battery capacity and need for reinforced tires.

Asia Pacific Carbon Black Feedstock Market Trends

Asia Pacific carbon black feedstock market dominated with a revenue share of 43% in 2023 and is expected to grow at a significant rate from 2024 to 2030. The Asia-Pacific region is home to some of the world's largest automotive markets, and the demand for cars and other vehicles is driving the demand for carbon black used in tires and other components. The region is experiencing rapid industrialization, leading to increased demand for products that require carbon black, such as tires, plastics, rubber, and inks.

Europe Carbon Black Feedstock Market Trends

Europe is a major automotive market, and the demand for cars and other vehicles drives the demand for carbon black used in tires and other components. The plastics and rubber industries in Europe are also major consumers of carbon black, used as a reinforcement material and pigment. European Union regulations regarding emissions and product safety have influenced the use of carbon black in various applications, driving demand for specific types of carbon black.

Central & South America Carbon Black Feedstock Market Trends

The key driver influencing the carbon black feedstock market in Central and South America is the rapid industrialization and economic growth in the region. As these countries develop and modernize, there is a surge in demand for various products that require carbon black, such as tires, plastics, rubber, and inks.

Key Carbon Black Feedstock Company Insights

Some key players operating in the market are Dow and BASF SE

-

Dow is a global materials science company that produces a wide range of products used in various industries. Founded in 1897, Dow is one of the world's largest chemical companies. Dow offers solutions for a wide range of industries, including automotive, construction, electronics, and energy.

-

BASF SE is a German multinational chemical company. It is one of the world's largest chemical producers, offering a wide range of products and solutions across various industries.The company is committed to sustainability and has implemented various initiatives to reduce its environmental impact.

Haldia Petrochemicals Ltd (HPL) and Arham Petrochem Private Limited are some emerging participants in the market.

-

Haldia Petrochemicals Ltd. (HPL) is a joint venture between the Indian Government and a consortium of global petrochemical companies. It is a major petrochemical complex located in Haldia, West Bengal, India. HPL is one of the largest petrochemical complexes in India and a significant contributor to the country's petrochemical industry. It plays a crucial role in meeting the domestic demand for petrochemical products and also exports to international markets.

-

Arham Petrochem Private Limited is an Indian petrochemical company that specializes in the production and distribution of various petrochemical products. While I couldn't find specific details about their operations and products, based on their name, it's likely that they are involved in the petrochemical industry.

Key Carbon Black Feedstock Companies:

The following are the leading companies in the carbon black feedstock market. These companies collectively hold the largest market share and dictate industry trends.

- Indian Oil Corporation Ltd

- Dow

- Arham Petrochem Private Limited

- Haldia Petrochemicals Ltd (HPL)

- Jalan Carbons & Chemicals (P) Ltd.

- Shell

- BASF

- Aramco

- Sherwin-Williams Company

- Epsilon Carbon Private Limited

Recent Developments

-

In May 2022, Sabic introduced five carbon black grades in ASTM 2 and 3 series (N220, N326, N330, N339 and N375) in GCC. Sabic’s high reinforcing grades are used by the rubber industry for various end-product applications like tires, molded rubber goods, conveyor belts, rubber sheeting and other industrial rubber products to enhance their durability.

Carbon Black Feedstock Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.72 billion

Revenue forecast in 2030

USD 9.97 billion

Growth rate

CAGR of 4.4% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK, Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Indian Oil Corporation Ltd; Dow; Arham Petrochem Private Limited; Haldia Petrochemicals Ltd (HPL); Jalan Carbons & Chemicals (P) Ltd.; Shell; BASF SE; Aramco; Sherwin-Williams Company; Epsilon Carbon Private Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

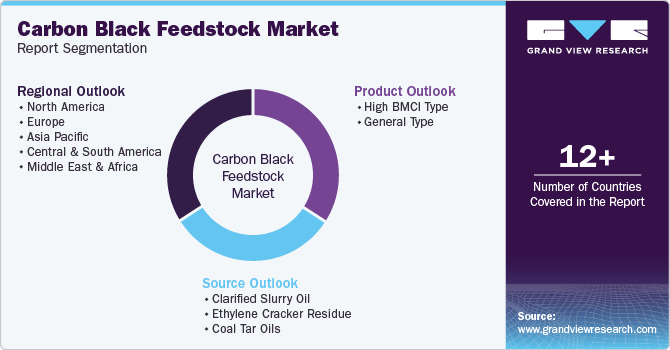

Global Carbon Black Feedstock Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global carbon black feedstock market based on the source, product, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Clarified Slurry Oil

-

Ethylene Cracker Residue

-

Coal Tar Oils

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High BMCI Type

-

General Type

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global carbon black feedstock market size was estimated at USD 7.4 billion in 2023 and is expected to reach USD 7.72 billion in 2024.

b. The global carbon black feedstock market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 9.97 billion by 2030.

b. North America dominated the carbon black feedstock market with a share of 24.5% in 2023. This is attributable to the region's robust automotive industry, which is a major consumer of carbon black for tire production.

b. Some key players operating in the carbon black feedstock market include Indian Oil Corporation Ltd, Dow, Arham Petrochem Private Limited, Haldia Petrochemicals Ltd (HPL), Jalan Carbons & Chemicals (P) Ltd., Shell, BASF SE, Aramco, Sherwin-Williams Company, Epsilon Carbon Private Limited

b. Key factors that are driving the market growth include increasing production of tires, plastics, rubber, and other products in various industries

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.