- Home

- »

- Electronic & Electrical

- »

-

Car Wash Ancillary Products Market Size Report, 2020-2027GVR Report cover

![Car Wash Ancillary Products Market Size, Share & Trends Report]()

Car Wash Ancillary Products Market Size, Share & Trends Analysis Report By Product (Car Wash Vacuum System, Bay Doors), By Distribution Channel, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-791-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The global car wash ancillary products market size was valued at USD 655.8 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 2.1% from 2020 to 2027. Demand for car wash services has been rising over the past decade due to their increased convenience and a greater array of budget and luxury options. Increasing environmental regulations prohibiting residential car washing practices are anticipated to expand the customer base for professional car washes, thereby driving the demand for ancillary products. The market growth is primarily attributed to the increasing focus of consumers on vehicle maintenance and rising spending power. Busy schedules and time constraints have also led to consumers giving their vehicles to professional car washes rather than cleaning them at home.

Growing demand for a quick car wash has resulted in the demand for ancillary products that enable car wash owners and distributors to achieve this goal. Express car wash services are installed with equipment that can wash cars faster and this has been attracting those who are frequently on the road or who do not have the time for a full-service wash. In line with this trend, there has been a rising demand for In-Bay Automatic or Conveyor/Tunnel washes.

There has also been an increasing inclination of people to opt for professional car washes instead of DIY or at-home washes, which is supporting the growth of ancillary products among car wash operators. According to the International Car Wash Association (ICA), over 2 million cars are washed every year in North America. This scenario predicts the increasing movement of manufacturers producing ancillary products for car wash service operators.

While touch-free car wash services have been gaining the trust of consumers, there has been an increasing focus on the usage of only water pressure and chemicals instead of cleaning brushes and cloths. This is driving the adoption of RO systems and water softeners so as to provide spotless results with no scaling due to hard water. Moreover, with growing consciousness regarding the environment, there has been a rising preference for eco-friendly car washes and service centers that use minimum water. This is driving the demand for ancillary equipment that can ensure minimum impact on the environment. In general, an automated car wash uses 10-60 gallons of water per car, whereas a home car wash uses more than 60 gallons of water.

Car washing is classified under NAICS code 8111 (Automotive Repair & Maintenance) in the U.S., making it an essential business. Hence, resuming operations at car wash centers is estimated to create demand for ancillary products. Moreover, car wash operators are offering free vehicle disinfection against COVID-19. For instance, Seven Southern California carwashes owned by Vahid David Delrahim have reopened with new, unprecedented sanitation protocols, including providing customers free vehicle disinfection against COVID-19. Starting 15th May, the staff is disinfecting every vehicle by administering a germicidal cleaner and deodorant, which is registered with the Environmental Protection Agency. The cleaner is a fog sanitizer, not available to consumers, and functions as a bactericidal, fungicidal, and most importantly a viricidal, meaning it kills all viruses. Manufacturers can start offering such cleaners along with ancillary products to boost their sales and gain significant market share despite the impact of the pandemic.

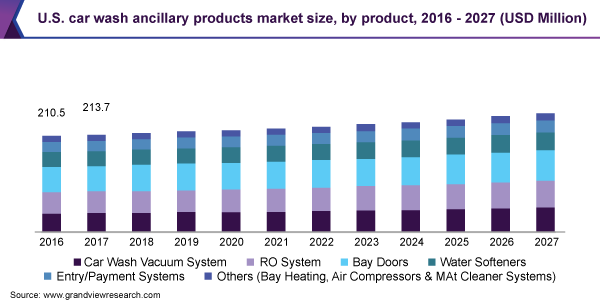

Product Insights

In terms of revenue, bay doors dominated the car wash ancillary products market with a share of 26.3% in 2019. This is attributed to its importance in the car wash industry, where they are important to keep out freezing winds and maintain hot/cold temperatures. Many cars wash across the globe experience periods of extremely cold weather, prompting owners and operators to consider the need for doors on their carwash bays. In addition, bay doors provide security for customers as well as equipment. Most car washes are located in highly populated areas and many countries or cities have noise ordinances that must be adhered to. In this scenario, bay doors are proven to reduce the noise generated by car wash equipment.

Car wash vacuum systems are expected to expand at the fastest CAGR of 2.8% from 2020 to 2027. Vacuum systems have become an integral component of most professional car wash service stations and often play a key role in a consumer’s decision-making process. Customers choose car washes that meet their expectations of cleanliness, both inside and outside, and free as well as paid vacuuming services can be a deciding factor for many. These factors are fueling the segment growth. Car wash vacuum systems consume a sizeable amount of energy and even the latest and up-to-date vacuum system requires frequent upkeep and fine-tuning in order to ensure affordable and efficient operations. Central vacuum systems, which have become increasingly popular with car wash operators, have proven to be more energy-efficient than their canister counterparts. This is because the central vacuum system operates through a single motor while the individual/canister variant requires a multiple motor setup, thus increasing energy demand.

Distribution Channel Insights

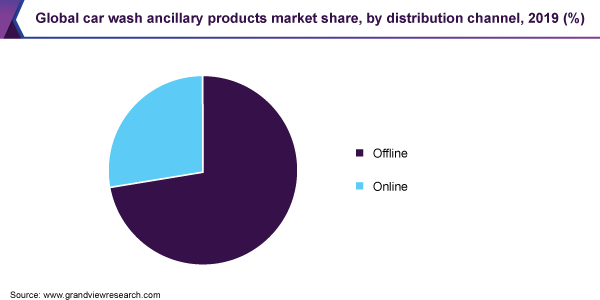

In terms of revenue, offline distribution channels dominated the market with a share of 85.7% in 2019 and are expected to maintain their lead throughout the forecast period. This is attributed to higher demand for ancillary products through manufacturers, distributors, and dealers. Most car wash service providers prefer to buy ancillary products through offline channels due to the easy availability of a range of products, the ability to request customization, and the excellent customer service offered by them. In addition, product guidance and assistance, in-house and on-site training, installation, 24/7 technical support, and repair services offered by this sales channel drive customers’ preferences. Numerous car wash operators and owners procure equipment from manufacturers and distributors as there is a variation in pricing when procured in bulk. Moreover, the growing demand for customized car wash ancillary equipment is supporting sales via offline mode.

The online distribution channel is expected to expand at the highest CAGR of 2.9% from 2020 to 2027. The online segment includes the sale of car wash ancillary products through company websites, e-commerce sites, and other third-party websites. The growth of this segment can be attributed to technological advancements and a rising preference for online distribution channels to purchase car wash ancillary products, especially by small car wash operators who have fewer requirements. Customers who are comfortable purchasing predefined and standard products are the major target audience for online platforms.

Regional Insights

North America dominated the market for car wash ancillary products with a share of 38.7% in 2019. The increasing number of car wash/service centers and declining home car washes are acting as major factors for market growth. Moreover, the trend of on-demand car washing is driving consumer preference toward professional car washing rather than home washing. The shift from ‘do-it-yourself’ to ‘do-it-for-me’ is a major trend observed among consumers with hectic lifestyles and busy schedules.

Asia Pacific is expected to register the fastest CAGR of 2.7% over the forecast period. Increasing car sales in the region, particularly in India, Thailand, New Zealand, and Singapore, is drawing the need for car wash service operators, thereby spurring the adoption of ancillary products. Moreover, increasing luxury car sales in India and China will exhibit higher penetration of automated and touchless car wash equipment owing to an increased focus on car maintenance.

Key Companies & Market Share Insights

The market is characterized by the presence of several well-established players. These players account for a considerable market share and have a strong presence across the globe. Moreover, the market comprises small to midsized players, which offer a selected range of car wash ancillary products. The impact of established players on the market is quite high as the majority of them have vast distribution networks across the globe to reach out to their large customer base. Key players operating in the market are focusing on strategic initiatives, such as collaborations, participation in events, and expansions, in order to drive revenue growth and reinforce their position in the global market. Some of the prominent players in the car wash ancillary products market include:

-

Ezytek Clean Pvt. Ltd.

-

Mr. Nozzle Inc.

-

AutoVac Industrial Vacuum & Air Systems

-

GinSan Industries

-

Coleman Hanna Carwash Systems LLC

-

WashTec AG

-

Vacutech LLC

-

Eurovac

-

Fragramatics

-

JE Adams Industries, Ltd.

-

PurClean (New Wave Industries)

-

Huron Valley Sales, Inc.

-

Velocity Water Works, LLC

-

Airlift Doors, Inc.

-

Goff's Enterprises Inc.

-

Hamilton Manufacturing Corp.

-

AVW Equipment Company, Inc.

-

Extractomat

-

Carolina Pride Carwash Systems & Solutions

-

CustomKraft Industries Inc.

Car Wash Ancillary Products Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 661.8 million

Revenue forecast in 2027

USD 772.1 million

Growth Rate

CAGR of 2.1% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Germany; U.K.; China; Australia; Brazil; UAE

Key companies profiled

Ezytek Clean Pvt. Ltd.; Mr. Nozzle Inc.; AutoVac Industrial Vacuum & Air Systems; GinSan Industries; Coleman Hanna Carwash Systems LLC; WashTec AG; Vacutech LLC; Eurovac; Fragramatics; JE Adams Industries, Ltd.; PurClean (New Wave Industries); Huron Valley Sales, Inc.; Velocity Water Works, LLC; Airlift Doors, Inc.; Goff's Enterprises Inc.; Hamilton Manufacturing Corp.; AVW Equipment Company, Inc.; Extractomat; Carolina Pride Carwash Systems & Solutions; CustomKraft Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global car wash ancillary products market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Car Wash Vacuum System

-

RO Systems

-

Bay Doors

-

Water Softeners

-

Entry/Payment Systems

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The car wash ancillary products market size was estimated at USD 655.8 million in 2019 and is expected to reach USD 661.8 million in 2020.

b. The car wash ancillary products market is expected to grow at a compound annual growth rate of 2.1% from 2020 to 2027 to reach USD 772.1 million by 2027.

b. North America region dominated the car wash ancillary products market with a share of 38.7% in 2019. This is attributable to the increasing number of car wash/service centers and declining home car washes.

b. Some key players operating in the car wash ancillary products market include Ezytek Clean Pvt. Ltd., Mr. Nozzle Inc., AutoVac Industrial Vacuum & Air Systems, GinSan Industries, Coleman Hanna Carwash Systems LLC, WashTec AG, Vacutech LLC, Eurovac, Fragramatics, JE Adams Industries, Ltd. and others.

b. Key factors that are driving the market growth include high adoption of professional car wash services and increasing consumer spending on comfort and relaxation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."