- Home

- »

- Organic Chemicals

- »

-

Caprolactam Market Size, Share And Trends Report, 2030GVR Report cover

![Caprolactam Market Size, Share & Trends Report]()

Caprolactam Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Textile Yarn, Industrial Yarn, Engineering Plastics), By End-use (Automotive, Film & Coatings, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-498-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Caprolactam Market Summary

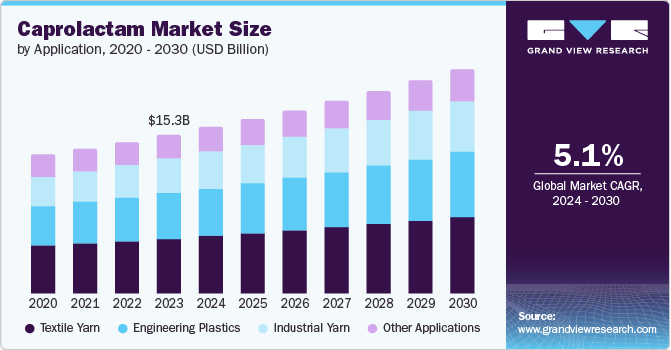

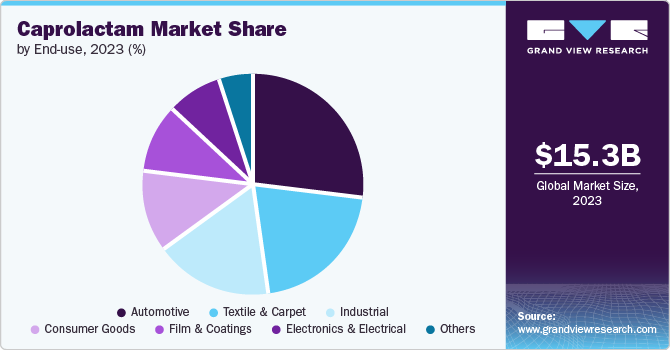

The global caprolactam market was valued at USD 15.3 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The market growth is attributed to the rising demand for caprolactam in the automotive, construction, and electrical & electronics industries.

Key Market Trends & Insights

- Asia Pacific dominated the caprolactam market with a market share of 76.0% in 2023.

- By application, the textile yarn segment dominated the market in 2023, with a share of 34.8% in 2023.

- By end use, the automotive segment dominated the market in 2023, with a share of 27.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 15.3 Billion

- 2030 Projected Market Size: USD 21.5 Billion

- CAGR (2024-2030): 5.1%

- Asia Pacific: Largest market in 2023

Caprolactam offers high elasticity, strength, chemical & oil resistance, and abrasion resistance. An increase in the demand for nylon in manufacturing ropes, conveyor belts, cables, packaging, and clothes has further aided in the market growth. Furthermore, rapid industrialization and increasing investments in the expansion of industries have also resulted in an increased demand for caprolactam.

There is an increase in the use of caprolactam in the textile industry to produce nylon fibers for textiles, carpets, and industrial yarns. Caprolactam is an essential raw material in the ring-opening polymerization process, and it is utilized to produce six nylon fibers and resins. Nylon 6 polymers create strong fibers, resins, and films. These by-products of caprolactam are used in various industries such as construction, automotive, and more.

There is an increased demand for caprolactam in the automotive, construction, and electronics industries, as they use nylon 6 in many applications, such as vehicle body parts, ropes, conveyor belts, and more. Major companies invest heavily in research and development to innovate new and improved products. Technologies such as green chemistry and biotechnology are implemented to produce caprolactam sustainably.

Government regulations regarding chemical uses and the ban on harmful chemicals aid in the market growth as caprolactam is used as a safer alternative to the chemicals that are banned by the government. Products made from caprolactam, such as nylon 6, can be recycled, so they are used as a sustainable alternative for the production of various products. Hence, these factors are responsible for the growth of the caprolactam market.

Application Insights

The textile yarn segment dominated the market in 2023, with a share of 34.8% in 2023 attributed to the increased use of caprolactam in producing nylon 6. Caprolactam is used as a monomer in the textile industry in order to produce polyamide called nylon 6. It has a high strength-to-weight ratio with excellent chemical and thermal resistance. Growth in the textile industry has further resulted in the market growth of this segment as textile yarn is used to manufacture various apparel and home furnishing products such as curtains, bedsheets, carpets, and more. Therefore, these factors contribute to the market growth of this segment.

The industrial yarn segment is expected to grow at a CAGR of 5.4% over the forecast period. This market growth is attributed to the increased use of caprolactam as a raw material to produce various by-products. Caprolactam is used to produce Nylon 6. It is used in industries such as construction and automotive to make different kinds of ropes and vehicle body parts. Therefore, growth in the automotive and construction sectors has resulted in the increased demand for caprolactam in order to produce nylon 6. Hence, these factors have resulted in the market growth of this segment.

End-use Insights

The automotive segment dominated the market in 2023, with a share of 27.0% in 2023 owing to the growth in the automotive industry and increased demand for nylon 6. There has been increased use of nylon 6 due to its strength, lightweight, and durable properties. Nylon 6 manufactures components that can handle wear and tear, such as engine components and gears. It is also used to manufacture a vehicle's door panels and dashboards. Furthermore, increased use of nylon 6 as a sustainable alternative also aids market growth.

The film and coating segment is projected to grow at a CAGR of 5.9% during the forecast period. This market growth is attributed to the increase in the demand for caprolactam as an additive in the production of films. Caprolactam aids in increasing the barrier properties of the films, enhancing the film's protection against various gases and chemicals. Furthermore, the increased use of caprolactam as an additive in the production of adhesives and coatings has helped in the market growth.

Regional Insights

The growth of the North America caprolactam market can be attributed to the presence of key manufacturing companies and increased use of caprolactam in producing nylon 6. Due to growing automotive sectors, caprolactam is always in demand as it is used to make various vehicle components such as engine parts and interior parts of the vehicle. Furthermore, the growing use of caprolactam in the textile industry due to its high strength and durability properties helps in the market growth in this region.

U.S. Caprolactam Market Trends

The U.S. dominated the market of North American caprolactam market in 2023. The factors responsible for the country's market growth are the presence of key manufacturing companies and government rules regarding the use of sustainable materials. High-quality textiles made from caprolactam are used to manufacture vehicle interiors and seat covers. Increased use of nylon 6 as a sustainable product has further resulted in the growth of the caprolactam market in the country.

Asia Pacific Caprolactam Market Trends

Asia Pacific dominated the caprolactam market with a market share of 76.0% in 2023. This market growth resulted from rapid industrialization and increased demand for caprolactam in various industries such as automotive and construction. The rapid growth of industry, especially in India and China, with the establishment of many automotive and appliance manufacturing plants, is expected to impact industry growth positively in the coming years. Furthermore, due to the increase in disposable incomes, the growing need for passenger vehicles in India and China is predicted to enhance the demand for products made from caprolactam by-products.

China had a substantial market share of 68.5% in the Asia Pacific caprolactam market due to major manufacturing companies in the automotive and construction sectors. There is an increased demand for caprolactam to produce nylon 6, which is used in the production of various vehicle components. The increased use of nylon 6 in the manufacturing of products such as ropes, carpets, and conveyor belts has also increased the demand for caprolactam. Hence, these factors are responsible for the growth of the caprolactam market in China.

Europe Caprolactam Market Trends

Europe caprolactam market was identified as a lucrative region in this industry as it had a market share of 13.6% in 2023. This growth resulted due to the presence of significant textile and fabric industries in the region. Increased use of caprolactam in manufacturing nylon 6, which is used in producing textiles such as curtains, bedsheets, seat covers, and more, has resulted in market growth. Furthermore, the government's emphasis on sustainability has increased the demand for nylon 6 due to its recyclable properties. Hence, these factors aid in the market growth in this region.

The UK caprolactam market is expected to grow rapidly due to the growth in the country's textile and automotive sectors. There is an increased demand for caprolactam as it is used to produce nylon 6 and various other films and coatings used in industries such as automotive and construction. The increased use of nylon 6 in the manufacturing of products such as ropes, bed sheets, curtains, car interiors, and more has resulted in the increased demand for caprolactam. Therefore, these factors contribute to the market growth of caprolactam.

Key Caprolactam Company Insights

Some of the major companies in the caprolactam market are UBE Corporation, Advansix, BASF SE, DOMO Chemicals, Valco Group, and others. Companies are focusing on increasing caprolactam production and then using it to produce different products such as nylon 6 and resins. Companies are integrating caprolactam in the production of various films and coatings to improve the strength and durability of the films.

-

UBE Corporation is a chemical company that specializes in manufacturing chemicals, plastics, pharmaceuticals, cement, battery materials, construction material, and machinery. It has six core business units namely chemicals and plastics, specialty chemicals and products, pharmaceuticals, cement, machinery and metal products, energy and environment.

-

Advansix is a chemical company that specializes in production of nylon 6, caprolactam and ammonium sulfate fertilizers. The company also sells acetone, phenol, alpha-methylstyrene, and more.

Key Caprolactam Companies:

The following are the leading companies in the caprolactam market. These companies collectively hold the largest market share and dictate industry trends.

- UBE Corporation

- Advansix

- BASF SE

- DOMO Chemicals

- Valco Group

- SPOLANA

- Zhengzhou Meiya Chemical Products Co.Ltd

- LUXI GROUP

- Caprolactam Chemicals Ltd.

- Gujarat State Fertilizers & Chemicals Limited

Caprolactam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.0 billion

Revenue forecast in 2030

USD 21.5 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, Volume in Kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

UBE Corporation; Advansix; BASF SE; DOMO Chemicals; Valco Group; SPOLANA; Zhengzhou Meiya Chemical Products Co.;Ltd; LUXI GROUP; Caprolactam Chemicals Ltd.; Gujarat State Fertilizers & Chemicals Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Caprolactam Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caprolactam market report based on application, end-use and region:

-

Application Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Textile Yarn

-

Industrial Yarn

-

Engineering Plastics

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

Automotive

-

Film & Coatings

-

Industrial

-

Electronics & Electrical

-

Consumer Goods

-

Textile & Carpet

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.