Capnography Devices Market Size, Share & Trends Analysis Report By Component (OEM Modules), By Technology (Mainstream), By Application (Pain Management), By Type, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-985-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Capnography Devices Market Size & Trends

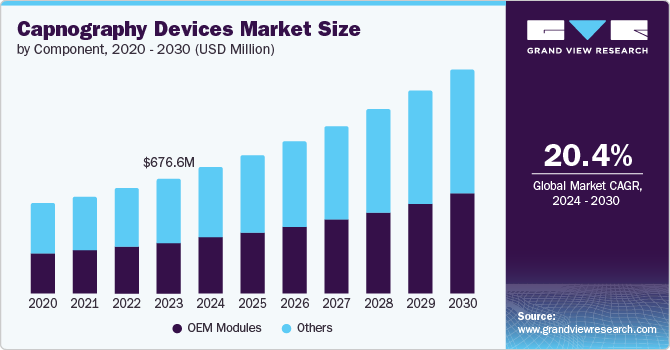

The global capnography devices market size was valued at USD 676.6 million in 2023 and is projected to grow at a CAGR of 10.0% from 2024 to 2030. Expected advancements in technology, the increasing occurrence of respiratory conditions, and backing from government programs will enhance market expansion throughout the projected period. Attributed to its superior reliability and effectiveness, the rising use of capnography for managing respiratory illnesses is forecasted to enhance the clinical performance of these devices in monitoring patients. For instance, in 2022, 4.6% of adults were reported to have received a diagnosis of COPD, emphysema, or chronic bronchitis at some point. Office-based physician visits where COPD was noted in the medical records accounted for 4.2%. There were approximately 791,000 emergency department visits where COPD was the main reason for the visit.

Technological advancements in capnography, including the development of portable and handheld devices, improved accuracy, and seamless integration with other monitoring systems, significantly drive market growth by enhancing usability and expanding application areas. For instance, in June 2022, clinicians could further personalize care with Medtronic’s integration of INVOS regional oximetry (rSO2) and Microstream capnography (CO2) technologies. These continuous monitoring solutions became available on the GE Healthcare CARESCAPE precision monitoring platform, enhancing perioperative and ICU care.

The increasing number of surgeries, especially those involving anesthesia, drives the demand for capnography devices. These devices are essential for monitoring CO2 levels during procedures, ensuring patient safety and effective anesthesia management. According to the International Society of Aesthetic Plastic Surgery, approximately 310 million major surgeries are conducted annually, with 20 million in Europe and 40 to 50 million in the U.S. In 2022, the U.S. led with over 7.4 million procedures, followed by Brazil (8.9%) and Japan (7.3%). Most surgeries occur in hospitals (47.4%) or office facilities (31.1%) worldwide.

Component Insights

The other component segment dominated the market and accounted for a share of 57.2% in 2023. Other components of capnography devices include sampling lines, sensors, airway adapters, anesthetic breathing circuits, cuvettes, cannulas, Luer connectors, etc. The sampling line is one of the major components, as the accuracy of end-tidal CO2 measurement and the quality of waveforms are highly dependent on it. For instance, in April 2021, Masimo announced FDA 510(k) clearance for Radius PCG, a portable, real-time capnograph with wireless Bluetooth. This device connects to the Connectivity Platform and Root Patient Monitoring and offers accurate, calibration-free end-tidal CO2 and respiration rate measurements within 15 seconds.

The OEM modules segment is expected to grow at the fastest CAGR of 10.3% over the forecast period. OEM modules are widely adopted in noninvasive patient monitoring and are often sold directly to end users through distributors for component replacements in capnography devices. Some companies outsource OEM module development to third-party partners under the same brand, reducing costs and meeting demand. This trend and increasing OEM partnerships are expanding the market and driving growth.

Technology Insights

The side stream segment accounted for the largest market revenue share of 53.2% in 2023. The significant growth is attributed to the extensive use of side-stream technology in anesthesia monitoring. Devices equipped with side-stream technology provide several advantages, such as easy connectivity and reduced sterilization challenges. For instance, EtCO2 monitoring is an effective way to detect serious health conditions such as hyper or hypothermia, requiring highly accurate and durable sensors. Philips Respironics' LoFlo sidestream sensor, which uses advanced infrared absorption spectroscopy, ensures precise respiration rate and EtCO2 measurements, producing clear programs even at respiratory rates as high as 150 breaths per minute.

The microstream segment is expected to grow at the fastest CAGR of 10.7% over the forecast period. Microstream capnography devices are highly valued in healthcare due to their versatility. They are used in diverse settings, such as operating rooms, ICUs, emergency departments, and during patient transport. Their wide range of applications enhances patient monitoring across various clinical environments. For instance, in September 2022, Medtronic received FDA 510(k) clearance for the RespArray patient monitor, specifically designed for procedural sedation and medical-surgical units. The monitor incorporates advanced technologies, including noninvasive blood pressure (NiBP), microstream capnography, Nellcor pulse oximetry, ECG, and temperature monitoring.

Application Insights

The emergency medicine segment accounted for the largest market revenue share of 24.0% in 2023. Emergency medicine, encompassing acute care for obstetric, medical, and surgical emergencies, is driving significant growth in the emergency medical services segment. Capnographs are increasingly used to optimize prehospital ventilation, manage pediatric emergencies, and assess pulmonary blood flow. The rising incidence of trauma cases requiring rapid medical intervention further boosts the demand for these services. According to the American Association for the Surgery of Trauma, trauma is a leading cause of death for individuals under 45. It ranks as the fourth most common cause of mortality across all age groups.

The procedural sedation segment is expected to grow at the fastest CAGR of 11.2% over the forecast period. Sedation is mainly used in minor procedures, such as suturing a laceration. For instance, in 2020, the National Center for Biotechnology Information (NCBI) estimated that nearly 48 million outpatient surgeries were performed in the U.S. This indicates the rising number of surgeries, which results in high demand for procedural sedation and the adoption of capnography devices, driving the segment growth.

Type Insights

The hand-held segment accounted for the largest market revenue share of 60.6% in 2023. Hand-held capnography devices, crucial for monitoring CO2 levels and ensuring patient safety, are increasingly adopted due to their portability and versatility, making them ideal for diverse medical settings such as hospitals, clinics, and ambulances. Their ease of use enhances their appeal across various healthcare environments, supporting critical care in anesthesia, sedation, and emergency scenarios.

The multi-parameter segment is expected to grow at the fastest CAGR of 11.3% over the forecast period. Technological advancements in sensor technology, data integration, and non-invasive monitoring have enhanced the accuracy and usability of multi-parameter capnography devices, driving their increased adoption in critical care and anesthetic settings. For instance, in August 2022, Medtronic partnered with BioIntelliSense, granting them exclusive U.S. distribution rights for the BioButton multi-parameter wearable in hospitals and post-acute care settings. This collaboration allows Medtronic's Patient Monitoring division to offer continuous, connected monitoring of vital signs both during hospitalization and after discharge.

End Use Insights

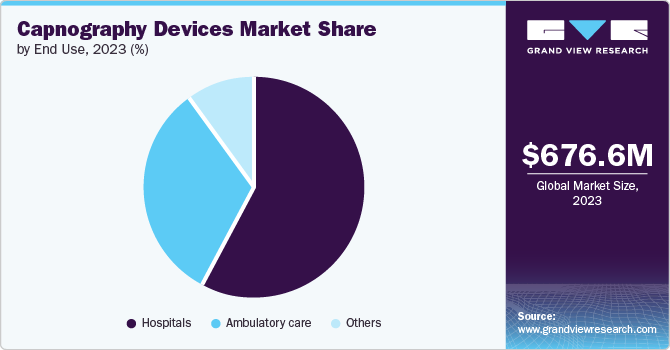

The hospitals segment accounted for the largest market revenue share of 57.7% in 2023. They are owing to their higher capability of patient monitoring, availability of a higher number of ventilation measurement systems, and higher adoption. The market is likely to grow due to the rising number of surgeries and growing prevalence of lifestyle disorders, such as diabetes, respiratory diseases such as asthma, and others. Furthermore, the presence of state-of-the-art infrastructure in hospitals in developed countries is expected to drive growth in the segment. According to the American Hospital Association findings, in 2023, nearly 6,129 hospitals were registered in the U.S. with nearly 919,649 staffed beds.

The ambulatory care segment is expected to grow at the fastest CAGR of 11.0% over the forecast period. The segment is growing due to the demand for quick recovery, reduced hospital stays, and lower healthcare costs. Technological advancements in minimally invasive procedures, often requiring capnography for respiratory monitoring during anesthesia, further drive this market.

Regional Insights

North America capnography devices market dominated the market in 2023. The rising prevalence of respiratory diseases as a consequence of unhealthy lifestyles and high stress levels is the high impact rendering driver for the regional market. In addition, the incorporation of new reimbursement models for respiratory and monitoring solution procedures in this region and the stringent regulatory guidelines aimed at patient safety, medical efficacy, and clinical efficiency are expected to drive product demand in the future. The American Psychological Association's 2020 survey found that increased stress negatively impacted 49% of U.S. adults' behavior, leading to heightened bodily tension in 21%.

U.S. Capnography Devices Market Trends

The U.S. capnography devices market dominated the North America market with a share of 88.7% in 2023 due to the increasing prevalence of respiratory conditions such as COPD, asthma, and sleep apnea is driving the demand for continuous respiratory monitoring in the U.S. For instance, in 2023, the Research Institute was launched by the American Lung Association, which pledged to increase its annual investment in lung disease research to USD 25 million.

Europe Capnography Devices Market Trends

Europe capnography devices market was identified as a lucrative region in 2023. Capnography devices are crucial for confirming endotracheal tube placement and distinguishing between successful and failed intubations, leading to a projected rise in demand. In addition, the increasing prevalence of chronic diseases such as diabetes and cancer is driving the need for efficient medication delivery, further fueling market growth. According to the World Health Organization (WHO), Chronic Obstructive Pulmonary Disease (COPD) ranks as the fifth most prevalent cause of death in Europe, and smoking stands out as the primary and & most significant risk factor associated with COPD.

UK capnography devices market is expected to grow rapidly in the coming years due to the growing installation of capnograph devices in emergency departments, critical care, and ambulatory settings is driving market growth. Due to their high specificity and sensitivity, their use has become mandatory in the UK for endotracheal tube placement and cardiac arrest management.

Germany capnography devices market held a substantial market share in 2023 owing to the presence of a large patient pool suffering from sleep apnea, asthma, and COPD is expected to increase the usage of capnography devices in the country.

Asia Pacific Capnography Devices Market Trends

Asia Pacific capnography devices market is anticipated to witness significant growth in the market. The increasing need for efficient respiratory monitoring systems and introducing new products to treat respiratory diseases in countries such as India and China are expected to propel the market. For instance, in May 2022, Max Ventilator introduced multipurpose noninvasive ventilators with built-in humidifiers in India.

Japan capnography devices market is expected to grow rapidly in the coming years due to the rapid adoption of capnography devices across healthcare settings. Moreover, introducing innovative devices will likely help companies obtain a larger market share. The increasing number of surgical procedures across Japan drives the demand for capnography devices. These devices play a crucial role in monitoring patients during anesthesia and surgery.

China capnography devices market held a substantial market share in 2023 owing to the increasing incidence of cancer. For instance, a China Pulmonary Health study survey in 2022 stated that the incidence of spirometry-defined COPD among adults was 8.6%, nearly 100 million people.

Key Capnography Devices Company Insights

Some of the key companies in the capnography devices market include Smiths Medical (acquired by ICU Medical Inc.), Dragerwerk AG & Co. KGaA, Baxter, Masimo, Koninklijke Philips N.V., Medtronic, Nonin, NIHON KOHDEN CORPORATION, BD, Diamedica (UK) Limited, and EDAN Instruments, Inc. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Smiths Medical, a division of the UK-based Smiths Group plc, is a global manufacturer of specialty medical devices serving various healthcare sectors such as critical care, anesthesia, and oncology. The company operates in over 50 countries and markets its products to more than 100 countries, catering to hospitals, clinics, and home care settings.

-

Dragerwerk AG & Co. KGaA is an international company specializing in medical and safety technology, offering neonatal, intensive, prenatal, and emergency care solutions. Their product range includes monitoring, ventilation, anesthetics, warming therapy, and information management systems.

Key Capnography Devices Companies:

The following are the leading companies in the capnography devices market. These companies collectively hold the largest market share and dictate industry trends.

- Smiths Medical (acquired by ICU Medical Inc.)

- Dragerwerk AG & Co. KGaA

- Baxter

- Masimo

- Koninklijke Philips N.V.

- Medtronic

- Nonin

- NIHON KOHDEN CORPORATION

- BD

- Diamedica (UK) Limited

- EDAN Instruments, Inc.

Recent Developments

-

In January 2023, Koninklijke Philips N.V. and Masimo extended their collaboration to enhance global telehealth. Through innovative technologies and solutions, they aim to improve healthcare experiences for patients and clinicians. This partnership seeks to advance remote patient monitoring and telehealth services on a global scale.

-

In January 2022, ICU Medical Inc. acquired Smiths Medical from Smiths Group plc, incorporating a diverse product range, including syringes, vascular access, ambulatory infusion devices, and vital care solutions.

Capnography Devices Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 741.5 million |

|

Revenue forecast in 2030 |

USD 1.31 billion |

|

Growth Rate |

CAGR of 10.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, technology, application, type, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Japan, China, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Smiths Medical (acquired by ICU Medical Inc.); Dragerwerk AG & Co. KGaA; Baxter; Masimo; Koninklijke Philips N.V.; Medtronic; Nonin; NIHON KOHDEN CORPORATION; BD; Diamedica (UK) Limited; EDAN Instruments, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Capnography Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global capnography devices market report based on component, technology, application, type, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM Modules

-

Infrared Sources

-

Others

-

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Mainstream

-

Sidestream

-

Microstream

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Medicine

-

Pain Medicine

-

Procedural Sedation

-

Critical Care

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hand-Held

-

Stand-Alone

-

Multi-Parameter

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

India

-

New Zealand

-

Singapore

-

Japan

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global capnography devices market size was estimated at USD 676.6 million in 2023 and is expected to reach USD 741.5 million in 2023.

b. The global capnography devices market is expected to grow at a compound annual growth rate of 9.9% from 2023 to 2030 to reach USD 1.31 billion by 2030.

b. North America dominated the capnography devices market with a share of 42.8% in 2023. This is attributable to the rising prevalence of respiratory diseases as a consequence of unhealthy lifestyles and high-stress levels.

b. Some key players operating in the capnography devices market include Masimo, Smiths Medical (acquired by ICU Medical Inc.), Dragerwerk AG & Co. KGaA, Welch Allyn (Hill-Rom Holdings, Inc.), Koninklijke Philips N.V., Medtronic, Nonin Medical, Inc., Nihon Kohden Corporation, BD, Diamedica (UK) Limited, Edan Instruments, Inc.

b. Key factors that are driving the capnography devices market growth include increasing adoption of capnography in anesthesia administration in target applications, such as monitoring patients undergoing procedural sedation, intubated patients during patient transfer in hospitals, and patient-controlled analgesia.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."