- Home

- »

- Clinical Diagnostics

- »

-

Capillary Electrophoresis Market Size, Industry Report, 2030GVR Report cover

![Capillary Electrophoresis Market Size, Share & Trends Report]()

Capillary Electrophoresis Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumable, Software), By Mode, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-354-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Capillary Electrophoresis Market Summary

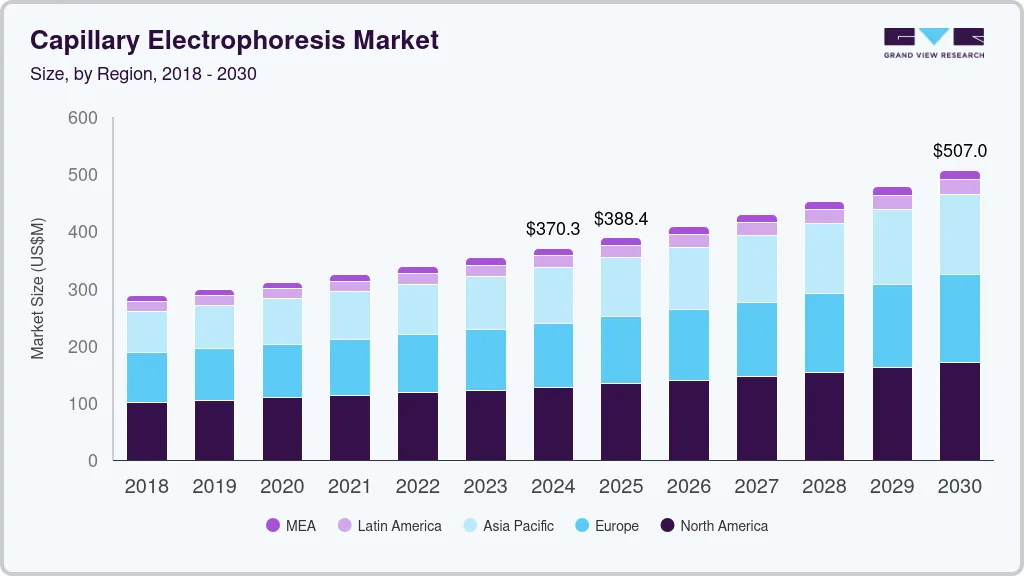

The global capillary electrophoresis market size was estimated at USD 370.3 million in 2024 and is projected to reach USD 507.04 million by 2030, growing at a CAGR of 5.48% from 2025 to 2030. This growth is attributed to the increasing prevalence of chronic diseases, increasing use in increasingly utilized in drug discovery, pharmacokinetics, and biomarker identification, coupled with rising need for personalized medicines and technological advancements are major factors driving the market.

Key Market Trends & Insights

- North America capillary electrophoresis market dominated with a revenue share of 34.47% in 2024.

- The capillary electrophoresis market in the U.S. is expected to grow substantially over the forecast period.

- By product, the consumables segment accounted for largest revenue share of 71.14% in 2024.

- By mode, the capillary gel electrophoresis segment dominated the market and accounted for the largest share of 49.07% in 2024.

- By application, the nucleic acid analysis segment dominated the market and accounted for the largest share of 28.86% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 370.3 Million

- 2030 Projected Market Size: USD 507.04 Million

- CAGR (2025-2030): 5.48%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, increasing R&D spending in drug discovery and development and rising number of clinical laboratories are likely to drive the market over the forecast period. Capillary electrophoresis (CE) is increasingly utilized in drug discovery, pharmacokinetics, and biomarker identification due to its high resolution, sensitivity, and ability to separate complex mixtures of biomolecules.As pharmaceutical companies focus on precision medicine and personalized therapies, CE plays a crucial role in understanding molecular interactions and disease mechanisms. For instance, the CAPILLARYS 3 OCTA by Sebia is an advanced automated capillary electrophoresis system. It builds on the CAPILLARYS 2 FLEX-PIERCING and shares technology with the CAPILLARYS 3 TERA. It offers a wide range of assays for conditions such as myeloma, diabetes, hemoglobinopathies, and chronic alcohol abuse. Key benefits include a flexible and scalable platform, smart reagent management, advanced piloting software, and high throughput with up to 79 results per hour. It handles multiple sample types, including whole blood, urine, and serum.

Increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and various types of cancer are driving demand for CE's. As it has high resolution and ability to separate complex mixtures of biomolecules such as proteins, nucleic acids, and carbohydrates make it invaluable in identifying disease-specific markers that traditional methods may overlook. In clinical settings, CE facilitates the detection and quantification of biomarkers indicative of chronic diseases like cardiovascular disorders, diabetes, and various types of cancer. The technique allows for rapid and accurate profiling of patient samples, aiding in early diagnosis, disease monitoring, and personalized treatment strategies.

Technological advancements in electrophoresis systems. The shift towards minimally invasive diagnostics and point-of-care testing further drives the adoption of CE technologies. In addition, Recent technological innovations by manufacturers in capillary coatings, detection systems (e.g., fluorescence detection, mass spectrometry coupling), and automation have improved CE's throughput, sensitivity, and reproducibility. For instance, in September 2021, Sciex Company launched the BioPhase8800, a cutting-edge capillary electrophoresis system, which enables biological characterization during biopharmaceutical therapy. This innovative device allows for the simultaneous analysis of eight samples and features a multi-capillary design for Capillary Electrophoresis Sodium Dodecyl Sulfate (CE-SDS) applications. These advancements reduce analysis time and enhance data accuracy, making CE more attractive for high-throughput screening and routine laboratory applications.

The capillary electrophoresis industry is characterized by presence of several key players such as Agilent Technologies, Thermo Fisher Scientific, and PerkinElmer. These companies focus on product innovation, strategic collaborations, and mergers/acquisitions to expand their product portfolios and enhance market presence. Additionally, emerging companies and startups are introducing niche CE systems targeting specific applications or technological enhancements, contributing to market dynamism.

Governments initiatives and increasing funding and substantial investments are driving the market, further research organizations worldwide are allocating significant funds towards biotechnology and life sciences research, which includes investments in CE technologies. Funding initiatives aim to accelerate research in areas such as genomics and proteomics, thereby driving market growth. Government funding programs support research initiatives focused on advancing capillary electrophoresis technologies. Funds are directed towards basic research, applied sciences, and translational research aimed at improving healthcare outcomes, environmental monitoring, and agricultural sciences. These investments play a crucial role in driving technological innovations and expanding the utility of capillary electrophoresis across diverse fields.

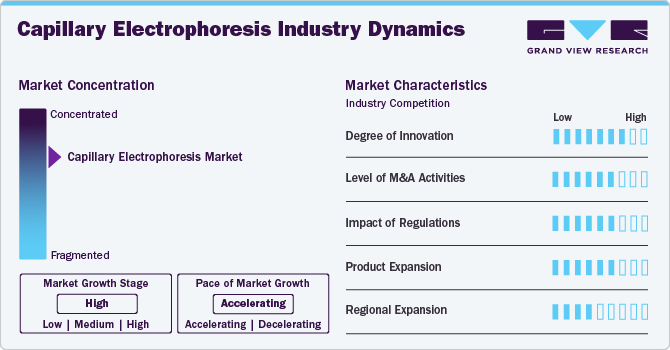

Market Concentration & Characteristics

The capillary electrophoresis market is characterized by moderate-to-high levels of innovation, with continuous advancements in techniques and diagnostic technologies. Key players are investing in novel solutions, such as automated systems and high-throughput platforms, to enhance the efficiency and accuracy of testing. Companies are also focusing on expanding their product offerings, with frequent product launches and strategic mergers and acquisitions (M&A).

Leading players in the capillary electrophoresis industry, including Thermo Fisher Scientific, Agilent Technologies, and Bio-Rad Laboratories, are actively pursuing M&A, partnerships, and collaborations to increase their market share, enhance their technological capabilities, and expand their global reach. These strategic moves help companies tap into new markets and strengthen their competitive position in the growing market for capillary electrophoresis.

The market exhibits a moderate-to-high degree of innovation, driven by advancements in automation, high-throughput systems, and precision diagnostics. For instance, Agilent Technologies has introduced capillary electrophoresis instruments with enhanced sensitivity and automation features, streamlining workflows in clinical and research applications. Innovations such as integration with mass spectrometry and point-of-care diagnostic capabilities are further expanding the market's applications, catering to the growing demand for accurate and efficient analytical solutions.

The capillary electrophoresis market experiences a moderate level of mergers and acquisitions (M&A) activity, as companies seek to expand their technological capabilities and geographic presence. For example, Thermo Fisher Scientific's acquisition of Advanced Analytical Technologies enhanced its portfolio of capillary electrophoresis instruments for genomic analysis. Such strategic M&A activities allow market players to strengthen their competitive position, access new markets, and accelerate innovation in diagnostic and research applications.

Regulations play a significant role in shaping the capillary electrophoresis industry, ensuring product safety, efficacy, and compliance with international standards. For example, instruments and reagents must meet stringent guidelines set by regulatory bodies like the FDA in the U.S. or the CE marking requirements in Europe. Compliance with these regulations can increase development timelines and costs but also boosts market credibility. Companies like Agilent Technologies prioritize regulatory adherence to maintain competitive advantage globally.

The market faces competition from product substitutes such as high-performance liquid chromatography (HPLC) and mass spectrometry, which are widely used for similar analytical applications. For example, HPLC is preferred in pharmaceutical research for its efficiency in separating and quantifying compounds. While these alternatives offer advantages like broader application ranges, capillary electrophoresis remains favored for its cost-effectiveness, high resolution, and suitability for analyzing small molecules and charged biomolecules.

Geographical expansion is a key strategy in the market for capillary electrophoresis, as companies aim to tap into emerging markets with growing research and healthcare needs. For instance, Bio-Rad Laboratories has expanded its distribution network in Asia-Pacific regions like China and India to meet rising demand for advanced diagnostic tools. Such expansions help companies access untapped markets, strengthen their global presence, and cater to the increasing adoption of precision diagnostic technologies worldwide.

Product Insights

The consumables segment accounted for largest revenue share of 71.14% in 2024 is also anticipated to grow at the fastest CAGR of 5.76% over the forecast period. This high growth is attributable to the fact that they are essential for the regular operation and maintenance of CE systems. These include capillaries, reagents, buffers, and sample vials, which need frequent replacement to ensure optimal performance and accurate results. The continuous need for consumables creates a steady revenue stream for manufacturers, making them a significant market driver. Additionally, advancements in consumable technologies, such as enhanced sensitivity and specificity of reagents, further propel the growth and adoption of CE systems across various applications in diagnostics, pharmaceuticals, and research.

Novel capillary coatings are being explored to enhance separation efficiency, resolution, and reproducibility in CE. These include dynamic coatings that are added to the running buffer as well as covalently bonded static coatings on the inner capillary surface. Manufacturers are introducing dynamically coated capillaries for easier method development. Such as, PVA-coated capillaries from Agilent Technologies.

The instrument segment is anticipated to witness significant growth over the forecast period. The capillary electrophoresis instruments market is driven by advancements in biotechnology, pharmaceutical research, clinical diagnostics, and food safety. Key instruments include Beckman Coulter PA 800 Plus, Agilent 7100, SCIEX CESI 8000 Plus, Bio-Rad BioFocus 2000. These systems address the need for precise and efficient analytical techniques.

Mode Insights

The capillary gel electrophoresis segment dominated the market and accounted for the largest share of 49.07% in 2024. The increasing advancements in CGE are enabling more efficient protein characterization, purity analysis, and aggregate detection crucial for the development and quality control of biopharmaceuticals. Integrated CGE platforms with streamlined workflows and higher sample throughput are increasing the productivity and efficiency of electrophoresis-based analyses. Furthermore, making capillary electrophoresis more feasible for academic, clinical, and commercial laboratories. Thus, driving the adoption of capillary electrophoresis systems in the pharmaceutical and biotechnology industries. Further, innovations such as microchip-based CGE and automated platforms are further expanding its applications and market adoption, ensuring continuous growth and technological evolution in this segment.

The capillary electrochromatography segment is anticipated to grow at the fastest CAGR of 5.94% over the forecast period. Owing to its unique ability to combine high efficiency with enhanced selectivity, making it particularly valuable for complex sample analysis. The technique's growth is further propelled by increasing demand in pharmaceutical research, proteomics, and environmental monitoring. Technological advancements, such as improved column materials, miniaturization, and integration with mass spectrometry, are expanding CEC's capabilities and applications. The push for more sensitive and specific analytical methods in drug development, personalized medicine, and forensic science is also contributing to CEC's adoption. Additionally, the technique's low sample and solvent requirements align well with the growing emphasis on sustainable and cost-effective laboratory practices.

Application Insights

The nucleic acid analysis segment dominated the market and accounted for the largest share of 28.86% in 2024. The global incidence of genetic disorders, cancer, and infectious diseases has been escalating in recent years. Genetic alterations in an individual's DNA can cause devastating conditions like thalassemia, sickle cell anemia, and cystic fibrosis. By analyzing nucleic acids, researchers provide valuable insights into these diseases. The rapid development of cost-effective, point-of-care testing kits and streamlined laboratory procedures for COVID-19 diagnosis has accelerated innovation in diagnostics, leading to a new wave of diagnostic advancements. In January 2023, QIAGEN announced the launch of the EZ2 Connect MDx platform for the purification of DNA and RNA from 24 samples in parallel in under 30 minutes via its automated sample processing method to be used in diagnostic labs. Furthermore, in September 2021, Thermo Fisher Scientific announced expansion of nucleic acid testing kit manufacturing in India, capitalizing on the versatility of these tools beyond COVID-19 testing. The company's innovative kits can process up to 96 samples within just 30 minutes, showcasing their speed and efficiency.

The protein analysis segment is anticipated to grow at the fastest CAGR of 6.56% over the forecast period. The ability of CE to provide high-resolution separation and quantification of proteins, including post-translational modifications and complex mixtures, makes it invaluable. Recent advancements in CE technology, such as improved detection methods and automation, have enhanced its accuracy and efficiency. These innovations meet the growing demand for detailed protein characterization, driving significant market expansion in this segment.

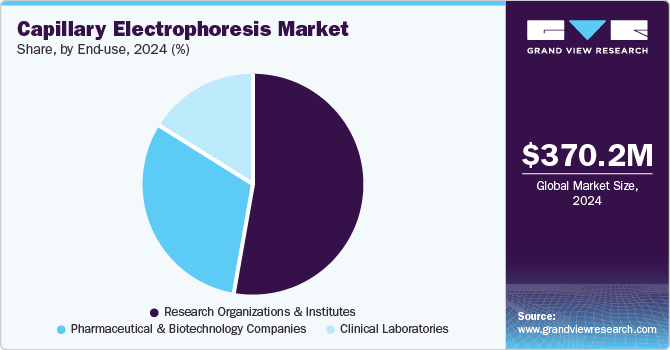

End Use Insights

The research organizations and institutes segment dominated the end use segments with the largest market share of 52.30% in 2024. Research organizations and institutes play a crucial role in advancing the capillary electrophoresis (CE) market. They drive innovation by developing new methodologies and applications for CE, enhancing its capabilities in fields like genomics, proteomics, and clinical diagnostics. These entities often collaborate with industry leaders to translate scientific discoveries into commercial products, fostering technological advancements. Additionally, they provide critical validation and standardization of CE techniques.

The pharmaceutical and biotechnology companies segment is anticipated to grow at a substantial CAGR over the forecast period. The pharmaceutical and biotechnology companies have a profound impact on the capillary electrophoresis (CE) market, driving innovation, demand, and application development. These industries are major end users of CE technology, particularly in drug discovery, quality control, and biopharmaceutical analysis. Their substantial R&D investments and need for high-resolution, high-throughput analytical techniques push the boundaries of CE capabilities. The growing focus on biologics, personalized medicine, and stringent regulatory requirements has further increased CE adoption in areas like protein characterization, impurity profiling, and chiral separations. Pharmaceutical companies method development efforts often set industry standards, while their global presence influences CE market trends globally.

Regional Insights

North America capillary electrophoresis market dominated with a revenue share of 34.47% in 2024. This high share is attributable to increasing prevalence of chronic diseases in the region, coupled with the rising demand for personalized medicine in North America, as the need for precise and individualized treatment options. Capillary electrophoresis (CE) systems play a crucial role in this field due to their ability to analyze complex biological samples quickly and accurately. Key players in the region are involved in strategic initiatives such as product launches, mergers and acquisitions to cater to wide range of clientele.

U.S. Capillary Electrophoresis Market Trends

The capillary electrophoresis market in the U.S. is expected to grow substantially over the forecast period. Increasing demand in pharmaceutical research, clinical diagnostics, and forensic applications. The market is expected to continue expanding due to technological advancements and growing adoption in various fields. Capillary electrophoresis (CE) has significantly improved disease diagnosis accuracy in the U.S. by providing a rapid, high-throughput, and sensitive analytical technique. Government support through funding for biotechnology research further propels the market.

Europe Capillary Electrophoresis Market Trends

Europe capillary electrophoresis market was identified as a lucrative region in this industry. Owing to advancements in biotechnology and increasing demand for precise diagnostic tools. This growth is fueled by applications in clinical diagnostics, pharmaceuticals, and research laboratories. The market benefits from innovations in microfluidic technology, which enhance the efficiency and accuracy of molecular analysis. Key players in this market include Agilent Technologies, Bio-Rad Laboratories, and PerkinElmer, who are driving advancements and meeting the demand for high-performance analytical instruments. Europe’s strong focus on research and development further propels this market forward.

The UK capillary electrophoresis market is experiencing steady growth, driven by advancements in molecular diagnostics and increasing demand for precise analytical techniques in clinical and research settings. The rising prevalence of chronic diseases, such as cancer and genetic disorders, is fueling the adoption of capillary electrophoresis for protein and nucleic acid analysis. Additionally, the growing focus on personalized medicine and biomarker discovery is boosting its use in pharmaceutical research. Key players in the UK are introducing innovative instruments and reagents, enhancing workflow automation and sensitivity. Academic institutions and diagnostic laboratories are also increasingly adopting this technology due to its versatility and accuracy, further contributing to market growth.

The capillary electrophoresis market in Germany is experiencing growth, driven by advancements in biotechnology and increasing demand for precise analytical tools in clinical diagnostics and research. The country's strong pharmaceutical and biotechnology sectors are key contributors to the adoption of capillary electrophoresis for applications such as protein analysis, DNA sequencing, and quality control. Rising investments in research and development, coupled with a focus on personalized medicine and biomarker discovery, are further boosting market growth. Additionally, the adoption of automated and high-throughput capillary electrophoresis systems in academic and diagnostic laboratories is enhancing efficiency and accuracy, making it a preferred choice for various analytical applications in Germany.

The France capillary electrophoresis market is growing due to increased demand for advanced diagnostic and analytical tools in clinical and research applications. The focus on personalized medicine, coupled with advancements in biotechnology, is driving the adoption of capillary electrophoresis for protein and DNA analysis. Additionally, the rise in research funding and the integration of automation in laboratories are further enhancing the market's growth prospects in France.

Asia Pacific Capillary Electrophoresis Market Trends

Asia Pacific capillary electrophoresis industry is anticipated to witness the fastest growth of 6.23% CAGR over the forecast period. This is due to market due to rising incidence of cancer and infectious diseases in Asia Pacific is likely driving adoption of advanced diagnostic technologies like capillary electrophoresis and increasing industry academia collaborations in countries like India and China and Japan. Factors driving growth include increasing investments in pharmaceutical and biotechnology research, rising demand for personalized therapeutics, and growing number of clinical and research laboratories in the region.

The China capillary electrophoresis market is expanding rapidly, driven by the country's growing biotechnology and pharmaceutical industries. Increased research funding, along with a rising focus on genetic research, disease diagnostics, and personalized medicine, is fueling demand for capillary electrophoresis. The technology is widely used for protein and nucleic acid analysis in both academic and clinical settings. Additionally, the integration of automated systems and advancements in diagnostic technologies are improving the efficiency and accuracy of capillary electrophoresis, further supporting market growth in China.

The capillary electrophoresis market in Japan is experiencing growth, driven by the country's strong healthcare infrastructure and advancements in biotechnology. The increasing focus on precision medicine, genetic research, and early disease detection is boosting the demand for capillary electrophoresis, particularly for protein and DNA analysis. Additionally, the adoption of automated systems and high-throughput capabilities in research and diagnostic laboratories is enhancing the efficiency of testing. Japan’s aging population and the rise in chronic diseases are further contributing to the growing need for advanced diagnostic tools, supporting the expansion of the market.

Latin America Capillary Electrophoresis Market Trends

The Latin America capillary electrophoresis industry is experiencing gradual growth, driven by increasing demand for advanced diagnostic tools in clinical and research applications. Rising investments in healthcare infrastructure, particularly in countries like Brazil and Mexico, are boosting the adoption of capillary electrophoresis for protein analysis, genetic testing, and disease diagnostics. Additionally, the growing focus on personalized medicine and biomarker research is fueling market demand. As research institutions and diagnostic laboratories in the region adopt more automated and efficient systems, the market is expected to expand further, improving the accessibility and accuracy of capillary electrophoresis techniques.

The Brazil capillary electrophoresis market is expanding as demand for advanced diagnostic and research tools increases. The growing focus on personalized medicine, genetic research, and disease diagnostics is driving the adoption of capillary electrophoresis, particularly for protein and DNA analysis. Brazil's increasing investments in healthcare infrastructure and research are further supporting market growth. Additionally, the rise in chronic diseases and the need for accurate, efficient diagnostic methods are contributing to the demand for capillary electrophoresis in clinical settings. The integration of automation and high-throughput systems in laboratories is enhancing the efficiency and precision of testing, further fueling the market's expansion.

Middle East & Africa Capillary Electrophoresis Market Trends

The Middle East and Africa (MEA) capillary electrophoresis industry is witnessing steady growth, driven by advancements in clinical diagnostics and rising demand for precision medicine. Key trends include increased adoption of automated systems for high-throughput analysis and integration with next-generation sequencing technologies. For instance, Beckman Coulter's PA 800 Plus and Agilent's 7100 CE system are widely used for protein characterization and DNA sequencing. The growing prevalence of genetic disorders and cancer in the region is spurring demand for robust analytical tools. Additionally, partnerships between diagnostic labs and healthcare providers are enhancing accessibility to cutting-edge electrophoresis technologies.

The Saudi Arabia capillary electrophoresis market is growing steadily, driven by advancements in the healthcare and biotechnology sectors. The increasing focus on genetic research, personalized medicine, and disease diagnostics is boosting the demand for capillary electrophoresis, particularly in protein and DNA analysis. Saudi Arabia's significant investments in healthcare infrastructure and research are further fueling market growth. Additionally, the rising prevalence of chronic diseases, such as cancer and genetic disorders, is contributing to the adoption of more advanced diagnostic technologies. The integration of automation in laboratories is also enhancing the efficiency and accuracy of capillary electrophoresis, supporting its broader use in the country.

Key Capillary Electrophoresis Company Insights

Some of the key players operating in the market include Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; and Shimadzu Corporation. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Capillary Electrophoresis Companies:

The following are the leading companies in the capillary electrophoresis market. These companies collectively hold the largest market share and dictate industry trends.

- C.B.S Scientific

- Danaher

- Helena Laboratories

- QIAGEN

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Bio-Techne

- PerkinElmer Inc.

- Merck KGaA

- Shimadzu Corporation

Recent Developments

-

In January 2024, Agilent Technologies announced a new automated parallel capillary electrophoresis ‘ProteoAnalyzer’ system designed to enhance proteomics research and analysis capabilities. The system integrated advanced liquid chromatography with mass spectrometry (LC-MS) technologies, offering improved sensitivity and throughput for protein characterization and identification. This innovation aimed to address the growing demand for high-resolution proteomics solutions in pharmaceutical research, biomarker discovery, and clinical diagnostics.

-

In May 2022, QIAGEN expanded its automation capabilities with the introduction of the QIAxcel Connect, a high-performance capillary electrophoresis instrument that offers rapid, precise, and ultra-sensitive analysis for nucleic acid detection. This latest addition to QIAGEN's automation solutions enables high-speed, high-resolution, and high-sensitivity results for a range of applications

-

In June 2021, Thermo Fisher Scientific and Advanced Electrophoresis Solutions Ltd (AES) have partnered to integrate essential protein separation techniques with mass spectrometry (MS), aimed at advancing therapeutic protein development through more efficient characterization. This collaboration will utilize Thermo Fisher's expertise in mass spectrometry technology for biopharma and proteomics applications, complemented by AES' advanced whole column imaging detection capillary electrophoresis systems. Together, these technologies the company will enhance protein separation, quantification, and characterization, offering laboratories in biopharmaceuticals, clinical research, food analysis, and academia advanced capabilities. This partnership is expected to provide scientists with deeper insights into protein analysis, particularly through the enhanced results achieved with Imaged Capillary Isoelectric Focusing (iCIEF) techniques.

Capillary Electrophoresis Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 388.33 million

Revenue forecast in 2030

USD 507.04 million

Growth rate

CAGR of 5.48% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

C.B.S Scientific; Danaher; Helena Laboratories; QIAGEN; Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; Bio-Rad Laboratories Inc.; Bio-Techne; PerkinElmer Inc.; Merck KGaA; Shimadzu Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Capillary Electrophoresis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global capillary electrophoresis market report on the basis of product, mode, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instrument

-

Automatic Capillary Electrophoresis Systems

-

Semi-Automatic Capillary Electrophoresis Systems

-

-

Consumables

-

Software

-

-

Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Capillary zone electrophoresis

-

Capillary gel electrophoresis

-

Capillary electrochromatography

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleic acid analysis

-

Protein analysis

-

Genomic DNA

-

Plasmid DNA

-

Fragment Analysis

-

RNA/mRNA Analysis

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Organizations and Institutes

-

Pharmaceutical & Biotechnology Companies

-

Clinical laboratories

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global capillary electrophoresis market size was estimated at USD 370.24 million in 2024 and is expected to reach USD 388.33 million in 2025.

b. The global capillary electrophoresis market is expected to grow at a compound annual growth rate of 5.48% from 2025 to 2030 to reach USD 507.04 million by 2030.

b. North America dominated the capillary electrophoresis market with a share of 34.47% in 2024. This is attributable to well-established healthcare infrastructure, high acceptance and penetration of products across the region

b. Some key players operating in the capillary electrophoresis market include C.B.S Scientific, Danaher, Helena Laboratories, QIAGEN, Thermo Fisher Scientific Inc., Agilent Technologies Inc., Bio-Rad Laboratories Inc., Bio-Techne, PerkinElmer Inc., Merck KGaA, Shimadzu Corporation

b. Key factors that are driving the market growth include increasing prevalence of chronic diseases, increasing use in drug discovery, pharmacokinetics, and biomarker identification

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.