- Home

- »

- Clinical Diagnostics

- »

-

Capillary Blood Collection Devices Market Size Report, 2033GVR Report cover

![Capillary Blood Collection Devices Market Size, Share & Trends Report]()

Capillary Blood Collection Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Lancets & Micro-container tubes, Micro-hematocrit tubes), By Material, By Application, End Use (Hospitals & Clinics, Blood Donation Centers) By Region, And Segment Forecasts

- Report ID: GVR-2-68038-998-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Capillary Blood Collection Devices Market Summary

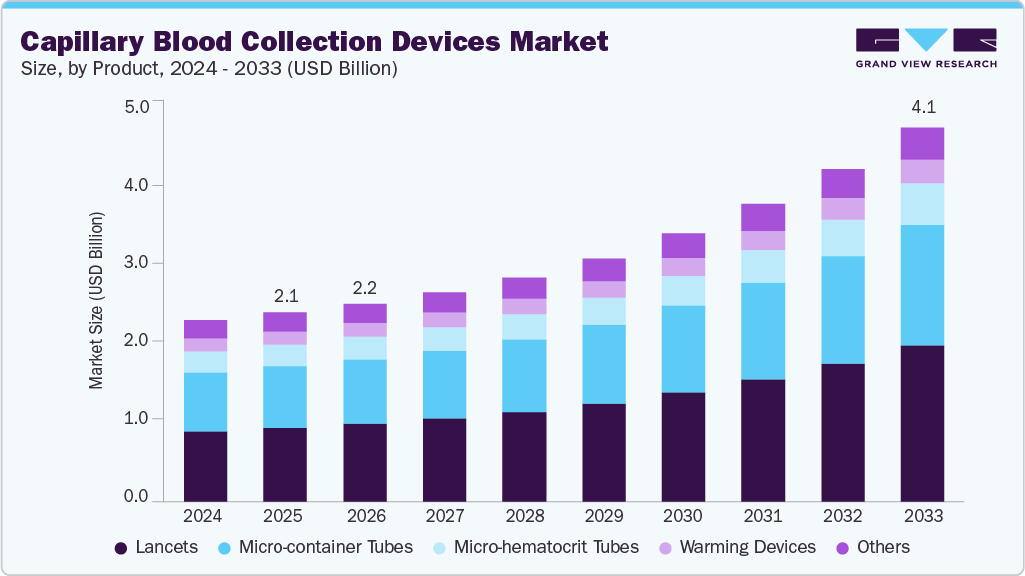

The global capillary blood collection devices market size was estimated at USD 2.09 billion in 2025 and is projected to reach USD 4.14 billion by 2033, growing at a CAGR of 9.51% from 2026 to 2033. Rising availability of PoC diagnostics, increasing prevalence of chronic diseases such as diabetes, cardiovascular diseases, & infectious diseases, and various advantages of the product, including frequent blood testing and monitoring, over its alternatives, are some of the primary factors driving the market.

Key Market Trends & Insights

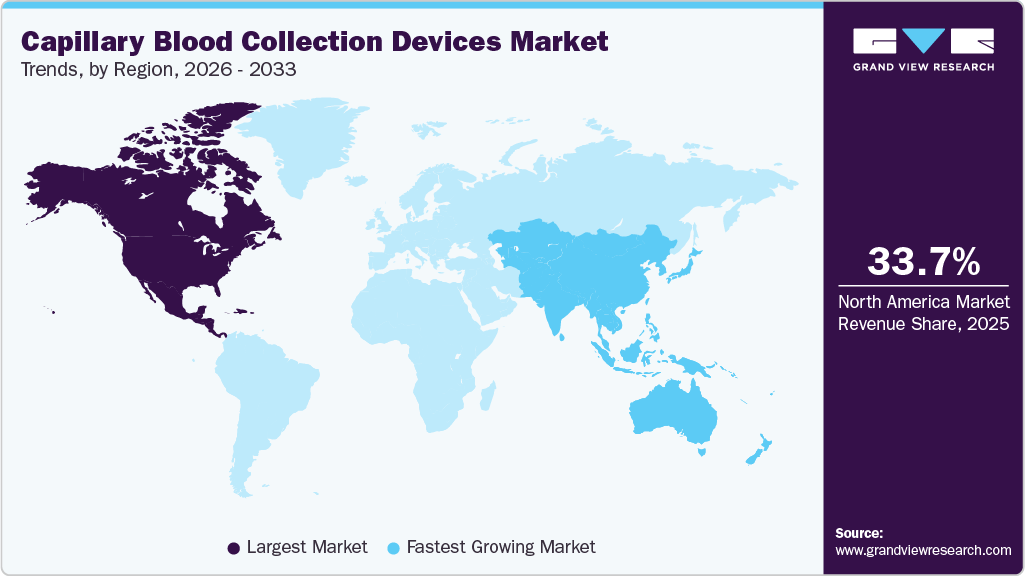

- North America dominated the global capillary blood collection devices market with the largest revenue share of 33.70% in 2025.

- The capillary blood collection devices market in the U.S. accounted for the largest market revenue share in North America in 2025.

- Based on product, the lancets segment led the market with the largest revenue share of 39.22% in 2025.

- Based on material, the plastic segment led the market with the largest revenue share of 63.10% in 2025.

- Based on application, the whole blood segment led the market with the largest revenue share of 41.54% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.09 Billion

- 2033 Projected Market Size: USD 4.14 Billion

- CAGR (2026-2033): 9.51%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, the higher prevalence of anemia in developing countries is also driving the demand for capillary blood collection devices, as they offer a convenient and accessible blood sampling method. As per World Health Organization estimates, 40% of children aged 6-59 months, 37% of pregnant women, and 30% of women aged 15-49 years globally are suffering from anemia.

Over the past few decades, the prevalence of infectious and non-communicable diseases has significantly increased. Factors such as rapid urbanization, widespread poverty in many developing regions, the rise of antimicrobial resistance, and the growing incidence of foodborne illnesses have contributed to this trend. These dynamics are expected to drive market growth during the forecast period. According to the World Health Organization, noncommunicable diseases (NCDs) are the leading cause of death and disability worldwide, including in Europe, where one in every five men and one in every ten women dies before the age of 70 from illnesses such as cardiovascular disease, cancer, chronic respiratory conditions, and diabetes. Every year, 1.8 million deaths in this region are preventable, with 60% caused by modifiable risk factors such as tobacco use, alcohol use, poor diets, obesity, and a lack of physical activity, and 40% potentially averted by early detection and proper care.

The field of Point-of-Care (PoC) diagnostics has experienced substantial growth in recent years, fueled by advancements in technologies such as biosensors, bioanalytical platforms, innovative assay designs, and other complementary research methodologies. U.S. data from the Population Reference Bureau highlights that the population aged 65 and above is likely to grow twice, from 52 million in 2018 to over 94 million by 2060, which is expected to escalate the demand for PoC diagnostic solutions.

Innovations in molecular diagnostic tools have enabled faster and more cost-effective testing with enhanced convenience. Capillary blood collection devices support rapid hematology tests in conjunction with PoC diagnostics. Compared to venous or arterial blood collection, capillary sampling is less invasive, more affordable, and does not necessitate a trained professional for the procedure.

The growing adoption of rapid PoC diagnostic methods and capillary blood collection devices is predicted to increase further during the forecast period. These devices, when integrated with PoC diagnostic technologies, are particularly suitable for remote and ambulatory healthcare settings. Capillary sampling is frequently used for glucose and hemoglobin testing in clinics and hospitals due to its ease of use and minimally invasive nature. This makes it ideal for home-based testing, further driving market expansion.

In addition, the COVID-19 pandemic significantly influenced the capillary blood collection device industry. The demand for these devices surged as they played a crucial role in testing and monitoring COVID-19 cases, particularly in the use of rapid antigen and antibody tests. Their ease of use and accessibility underscored the need for efficient diagnostic solutions, resulting in wider adoption.

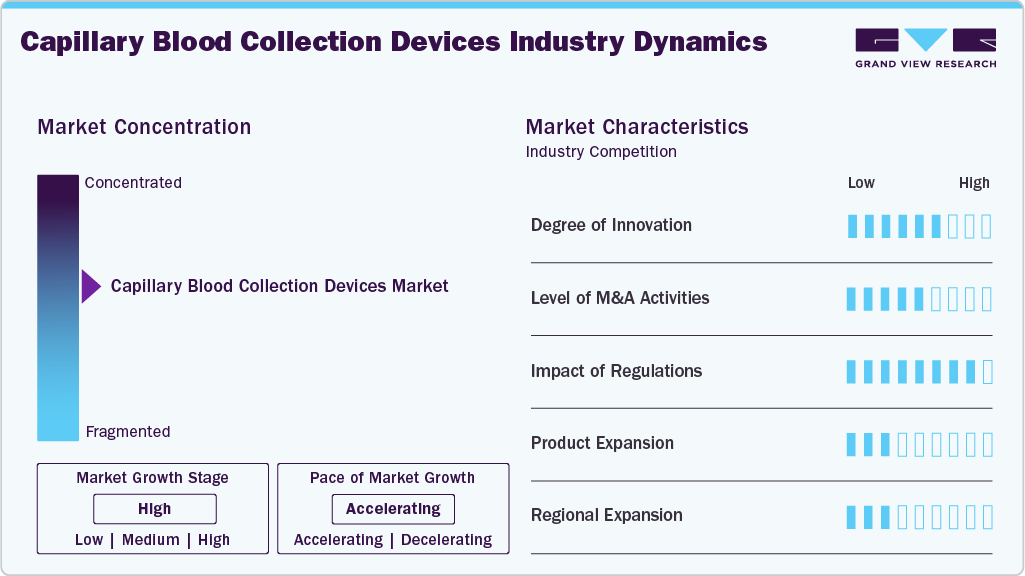

Market Concentration & Characteristics

The degree of innovation in the capillary blood collection devices industry is significant, driven by advancements in materials, design, and functionality to improve patient comfort, accuracy, and usability. Recent innovations focus on creating minimally invasive devices that require smaller blood volumes while ensuring reliability in diagnostic testing. These devices integrate ergonomic designs for ease of use, particularly in point-of-care (POC) settings and home diagnostics, where user-friendly operation is critical. For instance, in October 2023, Owen Mumford Ltd. launched the "Unistik Heelstik" range, which includes specialist sample equipment designed for babies and children, thereby expanding the market into pediatric treatment. As the capillary blood collection devices market expands, research and development efforts improve device compatibility across all age groups and healthcare settings.

There is a high level of collaboration and partnership activities among stakeholders, including manufacturers, healthcare providers, research institutions, and technology developers. These M&A activities are driven by the need to innovate and address market demands for more efficient, patient-friendly, and accurate solutions. Companies are increasingly partnering with research organizations to leverage advancements in microfluidics, biocompatible materials, and digital health integration.

Regulations significantly impact the capillary blood collection devices industry, shaping product development, manufacturing processes, and market entry strategies. Stringent regulatory requirements ensure that devices meet high standards of safety, efficacy, and quality, which is critical given their direct impact on patient health. Regulatory frameworks, such as the U.S. FDA’s 510(k) process or the EU’s in vitro diagnostic regulation (IVDR), require extensive testing and documentation, including clinical performance evaluations and risk assessments, before a product can be commercialized.

Product expansion in the capillary blood collection devices industry is a critical growth strategy driven by evolving healthcare needs, advancements in diagnostic technologies, and increasing demand for minimally invasive solutions. Manufacturers are expanding their portfolios by introducing devices specifically designed for various applications, including neonatal care, geriatric patients, and point-of-care testing, where precision and patient comfort are paramount.

Regional expansion is a key growth strategy in the capillary blood collection devices industry, driven by the need to address varying healthcare demands, regulatory landscapes, and market dynamics across different geographies. In developed regions like North America and Europe, companies focus on leveraging advanced healthcare infrastructure and higher adoption rates of innovative diagnostic technologies. These markets prioritize high-precision devices for chronic disease management, including diabetes monitoring and specialized applications such as neonatal testing.

Product Insights

The lancet segment led the market with the largest revenue share of 39.22% in 2025 and is projected to grow at the fastest CAGR during the forecast period. The growing demand for lancets can be attributed to their frequent use in blood draw procedures, particularly for monitoring blood glucose levels in individuals with diabetes and collecting small blood samples for at-home testing. This segment is expected to maintain its dominance throughout the forecast period due to the consistent need for lancets in these applications. Lancets, which are small scalpels designed to puncture the skin and extract blood samples, have become essential tools in managing diabetes and other conditions that require regular blood testing. In addition, the rising prevalence of infectious and chronic diseases has further driven the steady increase in lancet demand.

The micro-container tubes segment is anticipated to grow at a significant CAGR during the forecast period. These tubes are in demand due to their essential role in capillary blood collection, particularly in scenarios where only small volumes of blood are required. These tubes are widely used in diagnostic tests for infants, elderly patients, and individuals with conditions that make traditional venous blood collection challenging. Their compact design ensures precise sample handling and reduces the risk of contamination or wastage. The growing adoption of point-of-care (PoC) diagnostics and at-home testing has further driven the demand for micro-container tubes, as they align perfectly with the need for minimally invasive, efficient, and convenient sample collection methods.

Material Insights

The plastic segment led the market with the largest revenue share of 63.10% in 2024, and is expected to register at the fastest CAGR during the forecast period. The widespread adoption of plastic-based devices can be attributed to their ease of use, disposability, and cost-effectiveness. Plastic materials are commonly employed in the production of various collection products due to their lightweight nature and biocompatibility with the human body. Over the last few decades, the use of plastic in medical device manufacturing has grown significantly. Key attributes such as safety, chemical stability, transparency, flexibility, and durability have driven its increasing utilization in healthcare applications. This segment is projected to retain its leading position throughout the forecast period.

The glass segment is anticipated to grow at a significant CAGR during the forecast period. Compared to plastic, glass offers the advantage of being easily recyclable, enhancing its environmental sustainability. This has led to a growing number of manufacturers focusing on producing glass-based medical products and devices. Glass is also highly resistant to heat, making it a preferred material for certain medical applications. Key attributes such as stability, precision, and resistance to microbial growth have contributed to its widespread adoption in the healthcare industry.

Ceramic materials are frequently used in the production of components like capillaries, connectors, and adapters. Their lightweight properties, exceptional heat resistance, and superior electrical insulation make them valuable in medical applications. Their mechanical strength is a critical factor driving their usage in healthcare. However, the high production costs and expensive nature of ceramics are expected to constrain the growth of this segment during the forecast period.

Application Insights

The whole blood tests segment led the market with the largest revenue share of 41.54% in 2025 and is projected to grow at the fastest CAGR during the forecast period. Complete blood count (CBC) tests are the most commonly performed blood tests, used to measure various components, including white blood cells (WBCs), red blood cells (RBCs), hemoglobin, hematocrit, and platelets. These tests provide essential insights for clinicians, enabling them to detect abnormalities and make accurate diagnoses. They are also vital for monitoring chronic conditions such as diabetes and anemia. According to the CDC, diabetes is the eighth leading cause of death in the U.S.

The increasing prevalence of infectious and chronic diseases, including cancer, anemia, autoimmune disorders, and diabetes, has driven higher demand for hematology tests, particularly whole blood tests. For instance, a recent investigation conducted by the Indian Council of Medical Research (ICMR) revealed that 11.1% of 450,000 patients tested in 2025 tested positive for infectious disease pathogens, with Influenza A, Dengue virus, Hepatitis A, Norovirus, and Herpes simplex virus being the most frequently detected. Similarly, the global resurgence of Chikungunya virus disease (CHIKV) in 2025, which has resulted in hundreds of thousands of probable or confirmed cases, highlights the growing need for diagnostic tests and blood-related assessments.

Moreover, plasma or protein tests are used to evaluate blood protein levels, providing clinicians with a comprehensive view of a patient’s overall health. These tests, which analyze albumin and globulin levels, are commonly used to diagnose liver and kidney disorders, pancreatic disease, intestinal malabsorption, inflammation, nephrotic syndrome, and chronic liver conditions such as cirrhosis.

The plasma/ serum protein tests segment is anticipated to grow at a significant CAGR during the forecast period, due to its critical role in diagnosing and monitoring a wide range of health conditions. These tests provide essential information about the levels of proteins, such as albumin and globulin, which are key indicators of overall health. They are extensively used to detect and manage liver and kidney disorders, inflammation, autoimmune diseases, and nutritional deficiencies. In addition, plasma/serum protein tests help identify conditions like nephrotic syndrome, chronic liver diseases such as cirrhosis, and pancreatic and intestinal malabsorption issues. Their ability to offer a comprehensive health profile makes them indispensable in clinical diagnostics, driving their growing utilization in healthcare settings.

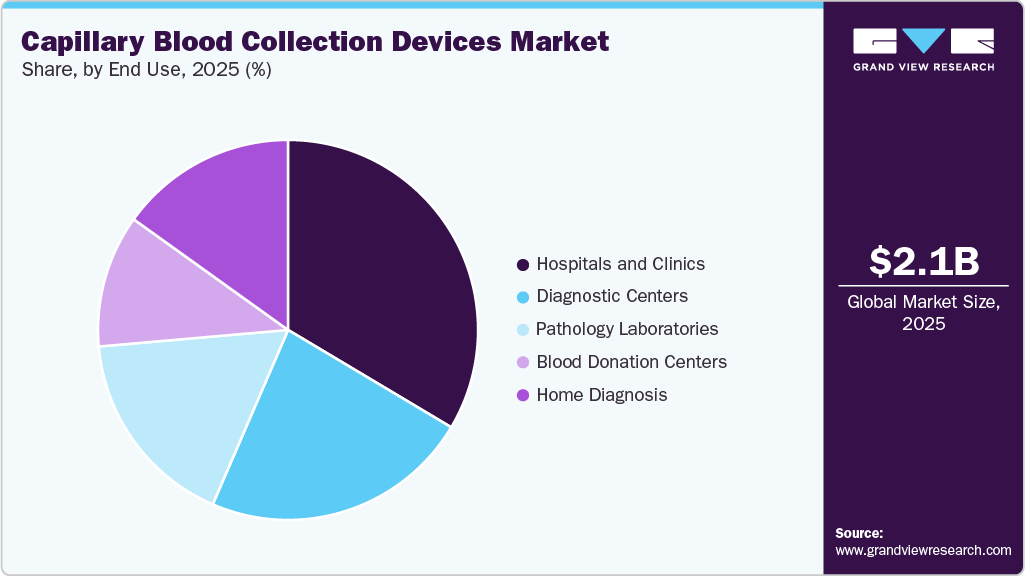

End Use Insights

The hospitals and clinics segment led the market with the largest revenue share of 33.56% in 2025 and is also anticipated to grow at the fastest CAGR over the forecast period. The increase is being driven by the ongoing demand for diagnostic tests, a high frequency of patient appointments, and the increased prevalence of chronic and acute disorders that require constant monitoring. Furthermore, hospitals and clinics are frequently used as primary venues for both conventional and specialty testing, resulting in a consistent demand for capillary blood collection tools. The adoption of minimally invasive, user-friendly, and safety-enhanced equipment in these settings enhances operational efficiency, improves patient comfort, and reduces turnaround times, thereby contributing to the segment's market dominance.

The diagnostic centers segment is anticipated to grow at a significant CAGR during the forecast period, due to the increasing demand for routine testing, preventive health check-ups, and rapid, minimally invasive blood sampling solutions. Data from the Centers for Disease Control and Prevention (CDC) indicates that approximately 125.7 million outpatient department visits occur annually in the U.S. Diagnostic centers play a critical role in these settings by performing routine blood tests, screenings, and specialized analyses. The rising prevalence of chronic diseases, preventive health check-ups, and demand for rapid diagnostics has significantly increased the use of capillary blood collection devices in these centers. These devices enable minimally invasive, accurate sampling, often requiring smaller blood volumes, which is ideal for high-throughput diagnostic workflows. Increased R&D investments by industry players to develop user-friendly, automated, and safety-enhanced devices are expected to further accelerate growth in the diagnostic centers segment.

Regional Insights

North America dominated the global capillary blood collection devices market with the largest revenue share of 33.70% in 2025. The regional market is driven by a robust healthcare infrastructure and the presence of prominent clinical diagnostics companies. The growing adoption of advanced technologies and an increased emphasis on clinical research are expected to support market expansion. According to CDC data, 6 out of 10 adults in the U.S. suffer from at least one chronic condition, while four out of ten have two or more. Factors such as the rising number of surgical interventions, increasing incidence of accidents and trauma, and the growing prevalence of both infectious and non-communicable diseases are anticipated to further fuel market growth in the region.

U.S. Capillary Blood Collection Devices Market Trends

The capillary blood collection devices market in the U.S. accounted for the largest revenue share in North America in 2025. The increasing prevalence of chronic and infectious diseases, such as diabetes, anemia, and cardiovascular conditions, has driven the demand for minimally invasive and efficient diagnostic tools. Capillary blood collection devices are ideal for point-of-care (PoC) testing and home-based diagnostics, aligning with the growing preference for convenient and rapid healthcare solutions. Moreover, innovations in device design, safety-focused lancets, and micro-collection tubes improve accuracy and patient comfort, while the expansion of outpatient services and telemedicine programs encourages greater acceptance in hospitals, clinics, and diagnostic institutions.

Europe Capillary Blood Collection Devices Market Trends

The capillary blood collection devices market in Europe is likely to emerge as a lucrative region, driven by increasing focus on point-of-care (PoC) testing and early disease detection. Moreover, the aging population in Europe, which often requires regular monitoring for chronic conditions, has contributed to the demand for these devices. The rising frequency of diabetes, heart disease, and anaemia has increased the demand for less invasive blood collection methods. According to the Diabetes Atlas, the number of people aged 20 to 79 diagnosed with diabetes in Europe has increased considerably during the last two decades. Diabetes afflicted around 22.4 million people in 2000, and this figure rose to 52.8 million in 2011. This amount was expected to rise to 65.6 million by 2024, and 72.4 million by 2050. These forecasts cover 60 countries and territories in the IDF Europe (EUR) region, highlighting the rising diabetes burden and the growing need for improved diagnostic and monitoring tools. In addition, technological advancements such as safety-engineered lancets, micro-collection tubes, and automated analyzer equipment are increasing patient comfort, sample precision, and workflow efficiency, encouraging the use of capillary blood collection devices in hospitals, clinics, and diagnostic centers.

The UK capillary blood collection devices market is projected to grow at a significant CAGR during the forecast period. In the UK, the focus on preventive healthcare and early diagnosis has accelerated the adoption of these devices, as they facilitate frequent monitoring of conditions like diabetes. The National Health Service (NHS) has also supported the adoption of patient-friendly diagnostic tools to reduce hospital visits and promote self-management of chronic diseases. Moreover, the rising prevalence of heart disease, anemia, and other chronic conditions has increased need for less invasive blood collection methods. Technology innovations, such as safety-engineered lancets, micro-capillary tubes, and devices that work with automated analyzers, have improved patient comfort, sample precision, and operational efficiency, leading to increased use in hospitals, diagnostic centers, and home healthcare settings.

The capillary blood collection devices market in Germany is projected to expand at a substantial CAGR during the forecast period. The aging population in Germany, which requires continuous health monitoring, further drives the demand for these devices. In addition, technological advancements in diagnostic tools, combined with the country's strong regulatory support for medical innovations, are enhancing the adoption of capillary blood collection devices. In addition, technological innovations such as safety-engineered lancets, micro-capillary tubes, and automated analyzer-compatible equipment are boosting patient comfort, sample accuracy, and workflow efficiency. Strong regulatory support for medical advances, combined with increased usage of point-of-care testing and home diagnostics, is driving up the deployment of capillary blood collection devices in hospitals, clinics, and diagnostic centers.

The France capillary blood collection devices market is expected to show steady growth over the forecast period, driven by France’s well-developed healthcare infrastructure and public health initiatives focusing on early diagnosis and disease management. The increased government support for diabetes and cardiovascular disease screening initiatives, combined with a growing awareness of preventive healthcare, is encouraging the use of minimally invasive blood collection technologies in clinics and diagnostic facilities across France. For instance, in November 2024, Nice held a free diabetes screening week, offering blood sugar and blood pressure checks at several community places to raise awareness and target at-risk people.

Asia Pacific Capillary Blood Collection Devices Market Trends

The capillary blood collection devices market in Asia Pacific is expected to experience at the fastest CAGR of 10.73% during the forecast period, owing to the increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular diseases. In the regions of the Western Pacific and South-East Asia, hundreds of millions are affected by diabetes or high blood pressure, many of whom remain undiagnosed, increasing the demand for simple and minimally invasive diagnostic tools. Furthermore, the growth of rural healthcare systems and government-led point-of-care (PoC) programs is enhancing access to diagnostics. Innovations such as micro-volume capillary tubes, easy-to-use lancets, and portable PoC analyzers are also improving usability in home and remote environments, contributing to further market expansion.

The China capillary blood collection devices market is projected to expand throughout the forecast period. Expanding healthcare infrastructure, coupled with a shift toward preventive care and early diagnosis, has further supported the adoption of these devices. As the healthcare system emphasizes managing chronic conditions outside of hospitals, there has been a strong push for point-of-care (PoC) testing and home-based diagnostics, both of which are facilitated by capillary blood collection devices. Domestic firms, such as Guangzhou Improve Medical Instruments, are actively providing capillary-sampling consumables in China, strengthening local supply chains and increasing accessibility. Similarly, Zhejiang Pushkang Biotechnology Co., Ltd. has developed point-of-care blood-testing devices that work in tandem with capillary sampling, thereby increasing diagnostic capabilities in clinics and smaller healthcare facilities. These company-level advancements help to expand the capillary blood collection devices market in China, as overall demand grows.

The Japan capillary blood collection devices market is anticipated to grow at a significant CAGR during the forecast period. There is a growing awareness in Japan about the benefits of self-monitoring for chronic diseases, further driving the demand for capillary blood collection devices. The increase is being driven by rising rates of chronic illnesses such as diabetes and cardiovascular disease among Japan's elderly population, which necessitate frequent blood tests and monitoring. Capillary blood collection devices are in high demand due to the growing trend of home-based and remote diagnostics, aided by telehealth infrastructure and point-of-care (PoC) testing. These devices allow for minimally invasive sampling outside of traditional hospital settings.

Latin America Capillary Blood Collection Devices Market Trends

The capillary blood collection devices market in Latin America is expected to experience significant growth throughout the forecast period. Healthcare infrastructure improvements in several countries, along with increasing access to medical services, have contributed to the adoption of these devices. In rural and underserved areas, where access to healthcare facilities may be limited, capillary blood collection devices provide a practical and affordable solution for disease monitoring.

The Brazil capillary blood collection devices market is projected to grow during the forecast period. Brazil's expanding healthcare infrastructure, along with growing government efforts to improve healthcare access in underserved areas, has further supported the use of these devices. In 2025, the federal government launched a program to build 899 new healthcare facilities and assign more than 300 specialized doctors to municipalities with insufficient medical services, significantly improving diagnostic and screening capabilities in remote areas. Moreover, regulatory changes implemented in 2024 have simplified medical device approval processes, promoting the widespread use of point-of-care (PoC) diagnostics and capillary sampling tools in Brazil's public and private sectors.

Middle East and Africa Capillary Blood Collection Devices Market Trends

The capillary blood collection devices market in Middle East and Africa is expanding slowly due to limited healthcare infrastructure in various areas, a lack of awareness about preventive healthcare, and limited budgets for advanced medical technologies. Many rural and underserved areas lack access to diagnostic services, reducing the demand for capillary blood collection devices. Furthermore, regulatory complexities and fragmented healthcare systems impede the rapid implementation of new medical technologies. Despite these challenges, the rising prevalence of chronic diseases such as diabetes, anemia, and cardiovascular disorders, combined with government efforts to improve access to primary healthcare, are expected to gradually accelerate market growth in the region.

The Saudi Arabia capillary blood collection devices market is anticipated to experience lucrative growth during the forecast period. Saudi Arabia's aging population, along with the government's initiatives to improve public health and reduce the burden of chronic diseases, further supports the adoption of these devices. There is also a growing awareness of the importance of preventive healthcare and self-management, particularly for chronic conditions such as diabetes, which drives the need for convenient and user-friendly testing options.

Key Capillary Blood Collection Devices Company Insights

The capillary blood collection devices industry is highly competitive, with numerous manufacturers holding significant market share. Key strategies, including product launches, regulatory approvals, strategic acquisitions, and innovations, are employed by market players to enhance their presence and expand globally.

Key Capillary Blood Collection Devices Companies:

The following are the leading companies in the capillary blood collection devices market. These companies collectively hold the largest market share and dictate industry trends.

- Becton, Dickinson and Company (BD)

- Greiner Bio-One International GmbH

- SARSTEDT AG & Co. KG

- Terumo Medical Corp.

- B. Braun Melsungen AG

- Improve Medical

- Abbott Laboratories

- Cardinal Health

- Retractable Technologies Inc

- Haemonetics Corporation

Recent Initiatives

-

In December 2025, Hims & Hers Health, Inc. acquired of YourBio Health, Inc., a Boston-based leader in innovative, painless capillary blood sampling technology. YourBio's TAP device, based on HALO micro-needle technology, allows for quick and high-quality blood collection with minimal discomfort, expanding sampling beyond traditional clinical settings. This acquisition strengthens Hims & Hers' position in the capillary blood collection device market by incorporating YourBio's patented, minimally invasive technology into its wellness platform, reflecting the industry's growing preference for convenient, home-based diagnostics and transforming the future of blood sampling.

-

In July 2024, O’Ryan.Health announced 2 pivotal studies namely The JDM Study and The Healthy Kids Study, which involves at home pediatric blood collection with capillary collection devices from YourBio Health. According to research, there is an increasing acceptance of minimally invasive and simple capillary blood collection technologies for home diagnostics, particularly in children. The use of YourBio's devices enables secure, dependable, and painless sampling outside of traditional clinical settings, emphasizing the shift to patient-centered care and remote monitoring. This trend is expected to accelerate the growth of the capillary blood collection devices market.

-

In December 2024, BD and Babson expanded the use of this minimally invasive collection and testing technology to include a variety of healthcare settings, including clinics and retail pharmacies, increasing the accessibility and convenience of routine diagnostics. This demonstrates how regulatory approvals and innovation drive competition and promote market growth.

-

In December 2023, BD received U.S. FDA approval for its MiniDraw Capillary Blood Collection System. The device enables blood collection from fingertips for accurate laboratory results. This approval underscores the trend toward minimally invasive, user-friendly capillary blood collection solutions that support both point-of-care and home-based diagnostics. Devices like MiniDraw enhance patient comfort, reduce the need for traditional venipuncture, and improve workflow efficiency in clinical and laboratory settings, reflecting the ongoing innovation and regulatory support that are driving growth in the capillary blood collection devices market.

Capillary Blood Collection Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.19 billion

Revenue forecast in 2033

USD 4.14 billion

Growth rate

CAGR of 9.51% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark, Sweden, Norway, China; Japan; India; Australia; Thailand, South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Becton; Dickinson and Company (BD); Greiner Bio-One International GmbH; SARSTEDT AG & Co. KG; Terumo Medical Corp.; B. Braun Melsungen AG; Improve Medical; Abbott Laboratories; Cardinal Health; Retractable Technologies Inc.; Haemonetics Corporation

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Capillary Blood Collection Devices Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the global capillary blood collection devices market on the basis of product, material, application, End Use, region:

-

Product Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Lancets

-

Micro-container tubes

-

Micro-hematocrit tubes

-

Warming devices

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Plastic

-

Glass

-

Stainless steel

-

Ceramic

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Whole Blood

-

Plasma/ serum protein Tests

-

Comprehensive metabolic panel tests

-

Liver panel/ liver profile/ liver function tests

-

Dried blood spot tests

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals and Clinics

-

Blood Donation Centers

-

Diagnostic Centers

-

Home Diagnosis

-

Pathology Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global capillary blood collection devices market size was estimated at USD 2.09 billion in 2025 and is expected to reach USD 2.19 billion in 2026.

b. The global capillary blood collection devices market is expected to grow at a compound annual growth rate of 9.51% from 2026 to 2033 to reach USD 4.14 billion by 2033.

b. North America dominated the capillary blood collection devices market with a share of 33.70% in 2025. This is attributable to the rising incidence of infectious and chronic diseases coupled with the easy availability of products.

b. Some key players operating in the capillary blood collection devices market include SARSTEDT AG & Co. KG, Becton, Dickinson and Company (BD), Thermo Fisher Scientific, Inc., Terumo Medical Corp., Cardinal Health, Nipro Europe NV, KABE LABORTECHNIK GmbH, Braun Melsungen AG, and Owen Mumford Ltd. among others.

b. Key factors that are driving the market growth include increasing incidence of chronic and infectious diseases, rise in surgeries, and technological innovation in blood collection techniques across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.