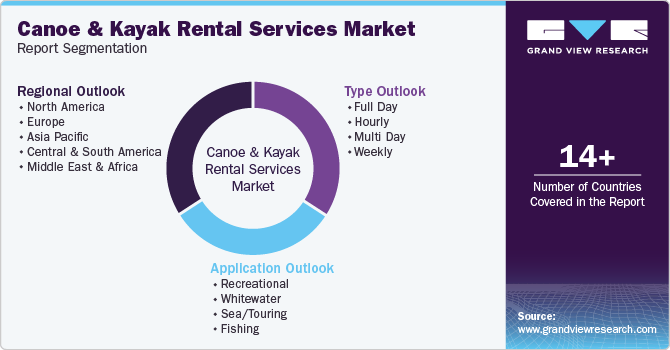

Canoe And Kayak Rental Services Market Size, Share & Trends Analysis Report By Type (Full Day, Hourly), By Application (Recreational, Whitewater), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-424-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

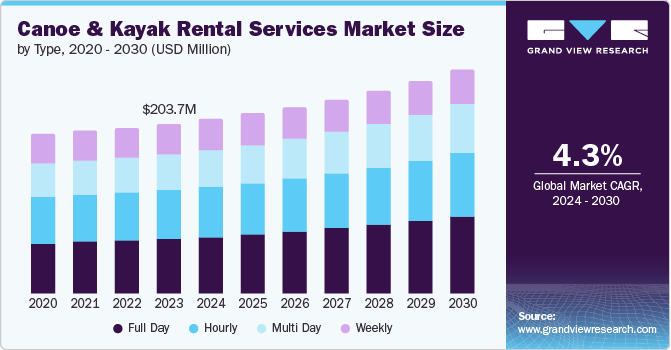

The global canoe and kayak rental services market size was estimated at USD 203.7 million in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The increasing emphasis on wellness and mental health has contributed to the popularity of canoe and kayak rental services. Rental services offer a convenient way for people to incorporate these wellness activities into their routines, catering to those looking for holistic health experiences.

Additionally, government and community support for outdoor recreation initiatives have positively impacted the popularity of canoe and kayak rental services. Many municipalities and local governments recognize the value of promoting outdoor activities for public health and tourism. They also offer grants, incentives, or partnerships to support local rental businesses. This support enhances the infrastructure needed for safe and enjoyable paddling and promotes the growth of rental services that cater to residents and visitors.

Moreover, urbanization and the development of green spaces within cities are driving the canoe and kayak rental services market. These urban green spaces provide accessible locations for residents to engage in recreational activities such as canoeing and kayaking. This accessibility encourages more people to try paddling, contributing to the growth of rental services.

Partnerships with the hospitality and tourism sectors further boost the popularity of canoe and kayak rental services. Hotels, resorts, and vacation rentals often collaborate with rental companies to offer guests convenient access to water sports. These partnerships enhance the guest experience by providing on-site rentals, guided tours, and packages that include paddling adventures.

Furthermore, the rise of eco-tourism has significantly impacted the demand for canoe and kayak rentals. Eco-tourism focuses on responsible travel to natural areas, conserving the environment, and improving the well-being of local communities. Rental services that partner with eco-tourism operators or offer guided eco-tours can tap into this growing market segment.

Market Concentration & Characteristics

The industry growth stage is low, and the pace is accelerating owing to the growing expansion of rental services and water sports clubs. Rental services provide a convenient and cost-effective way for newcomers to engage in these activities without the initial investment. Water sports clubs and organizations also play a vital role by offering training, guided tours, and social events, fostering a community of enthusiasts.

The industry has a fragmented nature, featuring several global and regional players. The players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. In June 2024, Rent. Fun partnered with Kalamazoo’s Parks and Recreation department to launch a self-service kayak rental station in Kalamazoo’s Verburg Park. Rent. Fun will supply four kayaks, paddles, and life jackets for rent. Rent. Fun app provides a code to renters to unlock a kayak from the kiosk, including a paddle and life jacket. Renters can paddle wherever they want, and the rental concludes when the equipment is returned to the kiosk.

Stand-up paddle boarding (SUP) is an alternative to canoeing and kayaking. Paddleboards are relatively easy to learn, even for beginners, and they can be used in various water conditions, from calm lakes to coastal areas. Motorboats, sailboats, and fishing boat rental services are other substitutes that offer a different type of water-based experience compared to canoeing and kayaking rental services. The availability of boat rentals and charters with amenities such as onboard dining and entertainment drives the demand for boat rentals.

Type Insights

Based on type, the full day segment led the market with largest revenue share of 32.4% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The rise of solo adventures is another important driver. Full-day canoe and kayak rentals allow solo adventurers to explore waterways independently, providing a sense of accomplishment and self-discovery. Rental services that cater to solo paddlers by offering lightweight, easy-to-handle equipment, safety briefings, and support can tap into this growing market segment.

The multi-day segment is expected to grow at a significant CAGR during the forecast period. The slow travel trend also contributes to the growth of multi-day canoe and kayak rentals. Slow travel emphasizes taking the time to fully experience a destination fully, often prioritizing quality over quantity. The rental service market effectively engages the expanding demographic of travelers who prioritize slow travel.

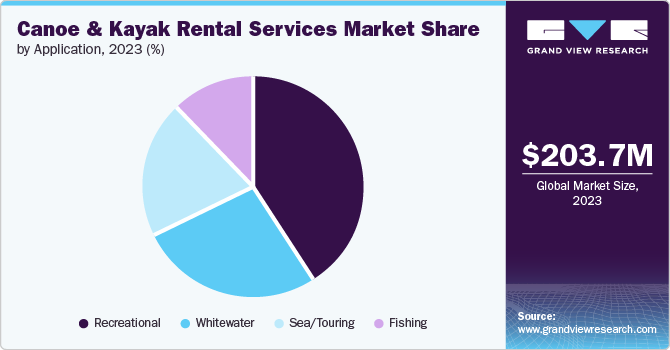

Application Insights

The recreational segment held the largest revenue share in 2023 based on application. The popularity of water-based activities in urban settings is also driving the demand for recreational canoe and kayak rentals. Many cities and metropolitan areas are revitalizing waterfronts, creating public parks, and promoting recreational activities on nearby rivers, lakes, and reservoirs. Rental services that operate within or near urban centers cater to this demographic by offering convenient access to watercraft rentals, guided tours, and educational programs that showcase local history, architecture, and natural ecosystems.

The whitewater segment is expected to witness the fastest CAGR during the forecast period. The development of specialized training programs and certifications is driving the growth of whitewater rental services. Many paddlers adopt formal training and certification in whitewater skills, safety, and rescue techniques to enhance their competence in the water. Rental services offer whitewater instruction, workshops, and certification programs for customers to improve their paddling skills and prepare for challenging river environments. By providing access to qualified instructors and comprehensive training resources, these services support the growth of a skilled and knowledgeable whitewater paddling community.

Regional Insights

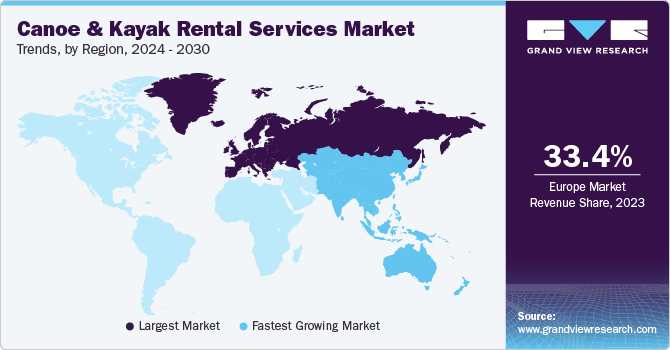

North America market is anticipated to grow at the significant CAGR during the forecast period. The development and popularity of paddling festivals and events across North America further stimulate interest in canoeing and kayaking. Events such as Paddlefest, Canoe the Caney, and various local paddling races and festivals create a sense of community among paddling enthusiasts. These events often include rental opportunities, demonstrations, workshops, and guided tours, enabling newcomers to get involved. Rental services that participate in or sponsor these events gain exposure.

Europe Canoe And Kayak Rental Services Market Insights

Europe dominated the market with a revenue share of 33.4% in 2023 and is projected to grow over the forecast period. The growing popularity of outdoor recreation and eco-tourism is fueling the demand for canoe and kayak rentals in Europe. Paddlers navigate pristine rivers, observe wildlife habitats, and access remote areas inaccessible by other means of transportation. Rental services promoting eco-friendly practices, such as using biodegradable gear and partnerships with conservation organizations, allow eco-conscious travelers to aim for responsible outdoor adventures.

The UK canoe and kayak rental services market accounted for a market share of 7.2% in the global market in 2023. Local tourism initiatives and government support also play a pivotal role in driving the growth of canoe and kayak rentals in the UK. Whitewater boards, local councils, and outdoor recreation organizations actively promote water-based activities as part of regional tourism strategies. Rental services participating in tourism partnerships, promotional campaigns, and community events benefit from increased visibility and visitor traffic, especially during peak travel seasons.

The Spain canoe and kayak rental services market is anticipated to grow at the fastest CAGR during the forecast period. Online booking systems, mobile apps, and social media platforms enable rental services to reach potential customers, showcase their offerings, and facilitate easy reservations. Digital marketing strategies, such as targeted advertising and customer reviews, help rental services build trust and credibility among prospective paddlers. Adopting technology allows canoe and kayak rental services in Spain to adapt to changing consumer preferences, streamline operations, and provide personalized customer experiences that enhance overall satisfaction.

Asia Pacific Canoe And Kayak Rental Services Market Insights

Asia Pacific market is expected to grow at the fastest CAGR over the forecast period. Infrastructure development and accessibility are driving the market growth of canoe and kayak rentals in the Asia Pacific. Investments in waterfront developments, recreational facilities, and transportation networks improve access to water bodies and enhance the overall visitor experience. Governments and private sector stakeholders often collaborate to develop infrastructure that supports water-based recreational activities, including canoeing and kayaking. Rental services that capitalize on these developments by establishing convenient locations, providing quality equipment, and offering customer-friendly services can cater to a broader audience of residents and tourists.

China canoe and kayak rental services market dominated the global market in 2023. China’s diverse natural landscapes drive the development of canoe and kayak rental services. The country boasts numerous scenic waterways, including rivers such as the Yangtze, the Li, and West Lake in Hangzhou. These locations demand domestic and international tourists to experience China’s natural landscapes. Rental services offer guided tours and educational experiences about the local culture and environment, enhancing the demand for canoeing and kayaking.

Japan canoe and kayak rental services market is expected to grow at the fastest CAGR over the forecast period. The growing popularity of multi-activity adventure tourism packages drives the market growth. Tourists are adopting comprehensive adventure experiences that combine multiple outdoor activities. These packages offer a well-rounded adventure experience for tourists who want to maximize their time outdoors and engage in diverse activities. Rental services collaborating with other adventure tourism providers to offer bundled packages are tapping into this trend, providing added value and convenience for their customers.

Key Canoe And Kayak Rental Services Company Insights

Some of the key players operating in the market include Werner Full Day, Riot Kayaks, and Pelican

-

Tahoe Adventure Company provides outdoor recreational services. The company offers a variety of rental options, including single and tandem kayaks, stand-up paddleboards, and canoes. Tahoe Adventure Company enhances rental services with guided tours and instructional sessions. The company utilizes advanced online reservation systems for customers to book rentals and tours in advance, ensuring a hassle-free experience from start to finish.

-

Milwaukee Kayak Company is a well-established provider of canoe and kayak rental services. The company offers a diverse range of rental options, including single and tandem kayaks and canoes. Milwaukee Kayak Company's popular routes include paddles along the Milwaukee River, Menomonee River, and Kinnickinnic River, where paddlers can enjoy views of downtown Milwaukee, historic bridges, and vibrant waterfront areas. In addition to rentals, the company organizes guided tours and special events, such as moonlight paddles and themed tours, catering to groups, families, and corporate outings.

Key Canoe And Kayak Rental Services Companies:

The following are the leading companies in the canoe and kayak rental services market. These companies collectively hold the largest market share and dictate industry trends.

- Tahoe Adventure Company

- Saco Canoe Rental Company

- Waco Paddle Company

- Rowing Dock

- Susquehanna Canoe and Kayak Rentals

- Long Island Canoe Kayak Rentals

- Alder Creek

- SEBAGO TRAILS PADDLING CO.

- Zaloo's Canoes

- Deep Cove Canoe & Kayak Centre Ltd.

- Paddle Boston

- Dan River Company

- Milwaukee Kayak Company

Recent Developments

- In May 2023, The Havelock City government partnered with Rent.Fun, a self-service equipment rental company, to launch a self-service rental kiosk at Slocum Creek Park. Rent.Fun has installed a self-service kiosk that contains four kayaks, paddles, and life vests. Users can rent the kayaks on a self-service basis through the Rent. Fun app. The cage is powered by solar energy, which unlocks and locks the kayaks as they are rented and returned.

Canoe And Kayak Rental Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 209.5 million |

|

Revenue forecast in 2030 |

USD 269.2 million |

|

Growth rate |

CAGR of 4.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central and South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Tahoe Adventure Company; Saco Canoe Rental Company; Waco Paddle Company; Rowing Dock; Susquehanna Canoe and Kayak Rentals; Long Island Canoe Kayak Rentals; Alder Creek; SEBAGO TRAILS PADDLING CO.; Zaloo's Canoes; Deep Cove Canoe & Kayak Centre Ltd.; Paddle Boston; Dan River Company; Milwaukee Kayak Company |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Canoe And Kayak Rental Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global canoe and kayak rental services market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Full Day

-

Hourly

-

Multi Day

-

Weekly

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Recreational

-

Single

-

Tandem

-

-

Whitewater

-

Single

-

Tandem

-

-

Sea/Touring

-

Single

-

Tandem

-

-

Fishing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global canoe and kayak rental services market size was estimated at USD 203.7 million in 2023 and is expected to reach USD5 209.5 million in 2024

b. The global canoe and kayak rental services market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 269.2 million by 2030

b. Europe dominated the market with a revenue share of 33.4% in 2023 and is projected to grow over the forecast period. The growing popularity of outdoor recreation and eco-tourism is also fueling the demand for canoe and kayak rentals in Europe.

b. Some key players operating in the canoe and kayak rental services market include Tahoe Adventure Company, Saco Canoe Rental Company, Waco Paddle Company, Rowing Dock, Rent.Fun, Long Island Canoe Kayak Rentals, Alder Creek, SEBAGO TRAILS PADDLING CO., Zaloo's Canoes, Deep Cove Canoe & Kayak Centre Ltd., Paddle Boston, Dan River Company, Milwaukee Kayak Company

b. The increasing emphasis on wellness and mental health and urbanization and the development of green spaces within cities has contributed to the popularity of canoe and kayak rental services

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."