- Home

- »

- Clothing, Footwear & Accessories

- »

-

Canoe And Kayak Market Size, Share & Growth Report, 2030GVR Report cover

![Canoe And Kayak Market Size, Share & Trends Report]()

Canoe And Kayak Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Rigid, Folded, Inflatable), By Distribution Channel (Online, Offline), By Material, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-303-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canoe And Kayak Market Summary

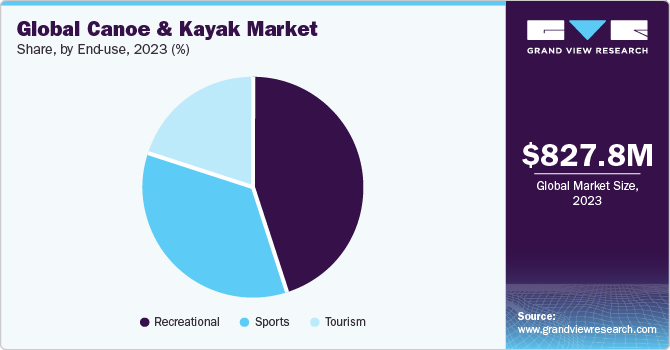

The global canoe and kayak market size was estimated at USD 827.8 million in 2023 and is projected to reach USD 1,104.5 million by 2030, growing at a CAGR of 4.4% from 2024 to 2030. Increasing interest in outdoor recreational activities and adventure tourism is driving the demand for canoes and kayaks.

Key Market Trends & Insights

- The Europe canoe and kayak market dominated the global market with a revenue share of 33.4% in 2023.

- The canoe and kayak market in the UK dominated the European regional market in 2023.

- Based on type, the inflatable segment led the market in 2023 with the largest revenue share of 40.6%.

- Based on material, the kayak material segment led the market with the largest revenue share in 2023.

- Based on distribution channel, the offline segment held the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 827.8 Million

- 2030 Projected Market Size: USD 1,104.5 Million

- CAGR (2024-2030): 4.4%

- Europe: Largest market in 2023

Whether for solo exploration, family outings, or organized tours, canoes and kayaks offer versatile and accessible options for outdoor enthusiasts of all ages and skill levels, driving demand for recreational watercraft in the market.

Moreover, the growing emphasis on health and wellness lifestyles has expanded the market for canoe and kayaks. Paddling sports are recognized for their physical and mental health benefits, providing opportunities for low-impact exercise, stress relief, and immersion in natural environments. Canoes and kayaks are seen as convenient and enjoyable means of experiencing the outdoors, attracting consumers seeking healthy and sustainable lifestyle choices.

The rise of eco-tourism and sustainable outdoor recreation practices has influenced consumer preferences and purchasing decisions. With growing awareness of environmental conservation and the importance of preserving natural habitats, consumers are increasingly seeking out eco-friendly and responsible recreational activities. Canoeing and kayaking offer eco-conscious consumers opportunities to explore pristine waterways, observe wildlife, and minimize their environmental footprint compared to motorized watercraft. As a result, there is a growing demand for canoes and kayaks made from sustainable materials, manufactured using eco-friendly processes, and endorsed by environmental certifications, reflecting a broader trend towards sustainable outdoor recreation. According to Booking.com's 2023 Sustainable Travel Report, which surveyed over 33,000 travelers globally, a significant majority want to engage in more sustainable travel practices. Approximately 76% of respondents indicated their intention to pursue sustainable travel over the coming years.

Furthermore, the expansion of organized paddling events, competitions, and festivals has fueled interest and participation in canoeing and kayaking, driving demand for specialized equipment and gear. From amateur races and guided tours to multi-day expeditions and eco-tours, there is a growing variety of paddling events catering to diverse interests and skill levels. As participation in organized paddling events continues to grow, so does the demand for canoes and kayaks optimized for specific activities and performance requirements, contributing to market expansion. According to the Watersports Participation Survey, around 13.2 million adults in the UK participated in boating activities in 2022, showing a 3% rise from the 12.8 million participants in 2021. In 2022, more than 10 million individuals participated in one or more boating activities once or twice.

Market Concentration & Characteristics

The industry growth stage is low but with an accelerating pace owing to increasing investment in research and development of canoes and kayaks to improve their performance, durability, and user experience, incorporating lightweight materials, ergonomic features, and cutting-edge technologies. Innovations such as rotomolded polyethylene kayaks, inflatable kayaks, pedal-driven kayaks, and hybrid canoe-kayak designs have expanded the possibilities for paddlers, making water-based recreation more accessible and convenient.

The industry has a fragmented nature, featuring several global and regional players. The players are entering into partnerships and mergers & acquisitions. The market is characterized by innovation, disruption, and rapid change. In April 2024, Sanborn Canoe expanded its portfolio by acquiring Grey Duck Outdoor, based in the Twin Cities. This acquisition adds Grey Duck SUPs and canoes to Sanborn's family of brands, which already includes Sanborn Canoe Co., Merrimack Canoes, and Current Designs. With this addition, Sanborn is better equipped to facilitate functional and inspiring water experiences.

Government initiatives and investments are influencing the growth of the market. Governments across the globe have implemented strategies to encourage research and innovation in canoe and kayak development, often involving funding, collaborations, and regulatory frameworks that foster partnerships between government bodies, companies, and industry associations. In June 2023, The Tehri Hydro Development Corporation Limited (THDC), the Indian Kayaking Canoeing Association (IKCA), and the Uttarakhand government announced a collaboration to construct India's inaugural Kayaking Canoeing High-Performance Centre in Koteshwar, Tehri. This collaboration aims to offer top-tier athletes from across the country access to state-of-the-art amenities, including accommodation, gear, and a fitness facility, all at no cost. Following signing the memorandum of understanding (MoU) among IKCA, THDC, and the state, the sports department will assume a central role in ensuring the center's successful operation.

Type Insights

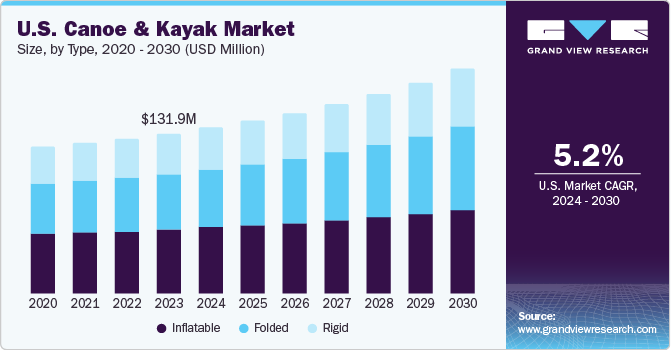

Based on type, the inflatable segment led the market in 2023 with the largest revenue share of 40.6% and is expected to continue to dominate the industry over the forecast period. Inflatable canoes and kayaks allow paddlers to easily transport and store their watercraft, whether for spontaneous outings, extended trips, or travel to remote locations. The portability and convenience of inflatable canoes and kayaks have broadened their demand among recreational paddlers, outdoor enthusiasts, and travelers, driving demand for inflatable watercraft. A study conducted by the Outdoor Industry Association in 2022 revealed that 32% of paddlers valued the convenience of transporting inflatable kayaks over traditional hardshell ones. This ease of transportation simplifies the trip to the water and broadens the options for kayaking destinations.

The folded segment is anticipated to witness the fastest CAGR during the forecast period. The rise of adventure travel and experiential tourism has fueled demand for foldable canoes and kayaks among travelers seeking immersive and authentic outdoor experiences. Foldable watercraft offers travelers the flexibility to explore remote and off-the-beaten-path destinations that may be inaccessible by traditional transportation. Whether for exploring hidden coves, navigating narrow waterways, or embarking on multi-day expeditions, foldable canoes and kayaks allow travelers to customize their paddling adventures to suit their preferences and interests. The portability and versatility of foldable watercraft make them popular choices for adventure travelers seeking unique and memorable experiences in natural environments, driving demand for foldable watercraft in the travel and tourism sector.

Material Insights

Based on material, the kayak material segment led the market with the largest revenue share in 2023. The advent of customization and personalization trends in the paddle sports industry has led to increased demand for kayak materials and construction methods. Paddlers increasingly seek customized solutions that reflect their preferences, body dimensions, paddling styles, and performance goals. Customized kayak materials may include specialized layup configurations, material combinations, or proprietary construction methods designed to optimize performance and comfort for the individual paddler. The trend towards customization and personalization is driving demand for specialized kayak material segments tailored to meet paddlers' diverse needs and preferences.

The canoe material segment is expected to witness the fastest CAGR during the forecast period. Paddlers often seek canoes that perform well across various water conditions, from calm lakes and slow-moving rivers to fast-flowing streams and whitewater rapids. Canoe materials such as composite fabrics and hybrid constructions are engineered to provide the strength and flexibility to withstand the rigors of different water conditions. Pursuing versatility drives innovation and differentiation within the canoe material segment as manufacturers strive to meet paddlers' diverse needs and preferences.

Distribution Channel Insights

Based on distribution channel, the offline segment held the largest revenue share in 2023. Increasing demand for brick-and-mortar retail experiences is driving the segment's growth. Despite the rise of e-commerce, many paddlers prefer the tactile experience of visiting physical stores, where they can see, touch, and test different canoes and kayaks before deciding to purchase. Brick-and-mortar retailers offer customers the opportunity to receive personalized advice from knowledgeable staff, try out different models in-store or in demo pools, and benefit from in-person customer service and support. The offline segment of the market thrives on the immersive and experiential nature of traditional retail environments, providing paddlers with a comprehensive shopping experience that extends beyond mere product transactions.

The online segment is expected to witness the fastest CAGR during the forecast period, owing to the rising number of direct-to-consumer (DTC) brands. DTC brands leverage e-commerce platforms to reach customers directly, offering competitive pricing, personalized customer service, and streamlined purchasing experiences. DTC brands offer lower prices, faster shipping, and greater transparency in product sourcing and manufacturing by eliminating intermediaries such as distributors and brick-and-mortar retailers. The growth of DTC brands disrupts traditional retail models and expands the options for paddlers to shop online, driving demand for the online segment of the market.

End-use Insights

Based on end-use, the recreational segment dominated the market in 2023. The demand for outdoor escapism and connection with nature has driven the demand for recreational paddling experiences that allow individuals to disconnect from the stresses of modern life and reconnect with the natural world. Recreational paddling provides opportunities for solitude, reflection, and rejuvenation in natural environments such as lakes, rivers, and coastal waters. The recreational segment caters to paddlers seeking moments of relaxation and mindfulness experiences in nature, driving demand for canoes and kayaks.

The tourism segment is expected to witness the fastest CAGR during the forecast period. The growth of niche and specialty tourism markets has created opportunities for paddling experiences tailored to specific interests and demographics. Canoe and kayak tours cater to niche markets such as birdwatching, photography, wellness retreats, or culinary tourism, offering travelers unique and themed paddling experiences that cater to their preferences. Specialty tours include guided expeditions to remote islands, cultural immersion experiences with indigenous communities, or culinary adventures featuring local cuisine and gastronomic delights. The tourism segment provides travelers with diverse paddling experiences tailored to their interests.

Regional Insights

North America canoe and kayak market is expected to grow significantly over the forecast period. The growth of online retail and e-commerce platforms has transformed how consumers shop for paddling equipment and accessories in North America. Online marketplaces offer a convenient and accessible way for paddlers to browse and purchase a wide range of products, compare prices, read reviews, and access expert advice and recommendations. The rise of online sales channels has contributed to the overall growth and diversification of the North American regional market, empowering paddlers to explore new waters and discover new adventures with confidence.

U.S. Canoe And Kayak Market Trends

The canoe and kayak market in the U.S. accounted for a global market share of 15.9% in 2023. The proliferation of outdoor recreation infrastructure and support services expanded access to paddling opportunities. It enhanced the overall paddling experience in the U.S. Local governments, conservation organizations, and private entities invested in developing paddling trails, boat launches, and waterfront amenities, making it easier for individuals to access water bodies and embark on paddling adventures. Similarly, outfitters, rental shops, and guided tour operators offer services to cater to novice and experienced paddlers, providing equipment, instruction, and logistical support. This infrastructure development and service expansion contribute to the democratization of paddling, attracting new participants and driving market growth.

Europe Canoe And Kayak Market Trends

The Europe canoe and kayak market dominated the global market with a revenue share of 33.4% in 2023 and is projected to grow over the forecast period. The diverse natural landscape of Europe, which offers abundant opportunities for paddling enthusiasts to explore scenic waterways, pristine coastlines, and picturesque lakes and rivers, is driving the market growth in Europe. From Scandinavia's rugged fjords to the Mediterranean's tranquil water bodies, Europe boasts a wealth of paddling destinations that attract outdoor adventurers worldwide. The continent's varied geography, including mountainous regions, coastal areas, and inland water systems, provides paddlers with a wide range of paddling experiences, from whitewater rafting in the Alps to sea kayaking along the Adriatic coast. The natural beauty and accessibility of Europe's waterways drive demand for canoes and kayaks among outdoor enthusiasts.

The canoe and kayak market in the UK dominated the European regional market in 2023. The country's extensive network of waterways, including iconic rivers such as the Thames, the Severn, and the Spey, provides paddlers with various paddling experiences, from leisurely river cruises to challenging whitewater runs. In addition, the UK's scenic coastline, which stretches over 12,000 kilometers and encompasses rugged cliffs, sandy beaches, and secluded coves, offers prime opportunities for sea kayaking, coastal exploration, and wildlife watching. The accessibility of the UK's waterways drives demand for canoes and kayaks among outdoor enthusiasts, families, and adventure seekers looking to experience the country's natural landscapes from a unique and immersive perspective.

The Spain canoe and kayak market is anticipated to grow at the fastest CAGR during the forecast period. The influence of competitive paddling sports and events has helped popularize canoeing and kayaking as recreational and spectator sports in Spain. Major international events such as the ICF Canoe Sprint World Championships and the International Whitewater Grand Prix bring together top paddlers worldwide to compete in Spain's rivers and waterways, showcasing the country's prowess as a paddling destination. The exposure and visibility of competitive paddling events contribute to promoting and growing canoeing and kayaking as recreational activities, driving interest and investment in paddling equipment and infrastructure throughout Spain.

Asia Pacific Canoe and Kayak Market Trends

The canoe and kayak market in Asia Pacific is expected to grow at a significant CAGR over the forecast period. The development of paddling infrastructure, facilities, and amenities facilitated the canoe and kayak market growth in Asia Pacific, making paddling more accessible for enthusiasts of all ages and abilities. Countries in the region have invested in constructing paddling centers, water sports complexes, and eco-tourism resorts along rivers, lakes, and coastlines, providing paddlers with safe and convenient access to waterways. Paddling clubs, schools, and associations offer instructional programs, safety courses, and guided tours to introduce newcomers to the sport and help them develop their paddling skills. The availability of rental services, equipment shops, and online resources further supports the paddling community and promotes participation in paddling activities across Asia Pacific.

The China canoe and kayak market dominated the regional Asia Pacific market in 2023. Expanding outdoor recreational infrastructure and amenities in China makes paddling more accessible to a broader audience. Local governments and private investors are developing water sports centers, eco-parks, and waterfront resorts equipped with paddling facilities and rental services to cater to the growing demand for outdoor recreation. Paddling clubs, schools, and associations are also increasing across China, offering instructional programs, safety courses, and guided tours to introduce newcomers to the sport and foster a sense of community among paddling enthusiasts. As infrastructure and support services for paddling continue to expand, participation in the sport is expected to increase, driving further growth in China market.

Key Canoe And Kayak Company Insights

Some of the key players operating in the market include Riot Kayaks, Pelican, Northshore Kayaks, and Tahe Outdoors.

-

Riot Kayaks manufactures kayaks and related accessories, catering to outdoor enthusiasts and watersport aficionados worldwide. Riot Kayaks offers diverse kayaks designed for various skill levels and purposes, including recreational kayaking, touring, fishing, whitewater rafting, and sea kayaking. In addition to kayaks, Riot Kayaks provides a comprehensive selection of accessories, such as paddles, life jackets, dry bags, kayak seats, and safety gear, designed to enhance comfort, safety, and convenience during outdoor adventures.

-

Pelican International is a company in the watersports industry primarily engaged in manufacturing kayaks, canoes, pedal boats, paddleboards, and other water-related recreational products. Pelican offers various kayaks, including recreational kayaks, fishing kayaks, sit-on-top kayaks, sit-in kayaks, tandem kayaks, and inflatable kayaks. Pelican manufactures durable, lightweight canoes for recreational paddling, fishing, and wilderness exploration. Their canoes feature advanced hull designs for optimal performance and versatility in various water conditions.

-

Tahe Outdoors is a prominent company in the outdoor recreation industry, specializing in a wide range of water sports equipment and accessories. Tahe Outdoors offers a diverse range of kayaks, including touring kayaks, sea kayaks, recreational kayaks, fishing kayaks, and whitewater kayaks. Their kayaks are known for their superior craftsmanship, innovative designs, and exceptional performance on the water.

Key Canoe And Kayak Companies:

The following are the leading companies in the canoe and kayak market. These companies collectively hold the largest market share and dictate industry trends.

- Feelfree US

- Riot Kayaks

- Wave Sport

- Pelican

- Tahe Outdoors

- Gumotex

- Nova Craft Canoe

- Navarro Canoe Co.

- Merrimack Canoe Co.

- Oru Kayak

- Jackson Kayak

- Northwest River Supplies

- Vibe Kayaks

- Old Town Canoe

- NAUTIRAID

Recent Developments

-

In March 2023, Feelfree US launched the Moken 10 PDL, a pedal kayak. The freshly designed 2023 Moken 10 PDL promises an enhanced, efficient, and enjoyable experience ideal for extended fishing trips or leisurely exploration. Pedalers can maximize their water adventures with the seamlessly integrated Rapid Drive Pedal system, complemented by the comfort of the EZ Rider hanging-style seat.

-

In May 2022, Pelican, a prominent player in paddle sports, acquired GSI Outdoors, an outdoor equipment manufacturer. This strategic move represents a significant milestone in Pelican's expansion efforts, enabling the company to broaden its product range in North American and international outdoor markets.

-

In June 2021, Pelican, via its wholly-owned subsidiary, Confluence Outdoors LLC, acquired Advanced Elements Inc., a company in the inflatable market. This strategic move enhances Pelican's product portfolio in the paddlesports sector, providing a comprehensive array of quality offerings infused with cutting-edge technology.

Canoe And Kayak Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 852.7 million

Revenue forecast in 2030

USD 1,104.5 million

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Switzerland; China; India; Japan; Australia; Indonesia; Brazil; Argentina; UAE; Saudi Arabia; Turkey; South Africa

Key companies profiled

Feelfree US; Riot Kayaks; Wave Sport; Pelican; Tahe Outdoors; Gumotex; Nova Craft Canoe; Navarro Canoe Co.; Merrimack Canoe Co.; Oru Kayak; Jackson Kayak; Northwest River Supplies; Vibe Kayaks; Old Town Canoe; NAUTIRAID

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canoe And Kayak Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global canoe and kayak market report based on the type, material, distribution channel, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Folded

-

Inflatable

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Canoe Material

-

Plastic

-

Fiberglass Composites

-

Kevlar Composites

-

Wood

-

Aluminum

-

Others

-

-

Kayak Material

-

Rotomolded Polyethylene

-

Thermoform

-

Fiberglass Composites

-

Kevlar Composites

-

Wood

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Recreational

-

Tourism

-

Sports

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Turkey

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global canoe and kayak market size was estimated at USD 827.8 million in 2023 and is expected to reach USD 852.7 million in 2024

b. The global canoe and kayak market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 1,104.5 million by 2030

b. Europe dominated the canoe and kayak market with a share of 33.4% in 2023. The diverse natural landscape of Europe, which offers abundant opportunities for paddling enthusiasts to explore scenic waterways, pristine coastlines, and picturesque lakes and rivers, is driving the market growth in Europe.

b. Some key players operating in the canoe and kayak market include Feelfree US, Riot Kayaks, Wave Sport, Pelican, Tahe Outdoors, Gumotex, Nova Craft Canoe, Navarro Canoe Co., Merrimack Canoe Co., Oru Kayak, Jackson Kayak, Northwest River Supplies, Vibe Kayaks, Old Town Canoe, and NAUTIRAID

b. Factors such rising awareness of health benefits associated with outdoor activities and growing trend towards eco-tourism are driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.