- Home

- »

- Clothing, Footwear & Accessories

- »

-

Canoe & Kayak Equipments Market Size, Share Report 2030GVR Report cover

![Canoe And Kayak Equipments Market Size, Share & Trends Report]()

Canoe And Kayak Equipments Market (2024 - 2030) Size, Share & Trends Analysis Report By Equipment & Accessories, By Distribution Channel (Online, Offline), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-407-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canoe & Kayak Equipment Market Trends

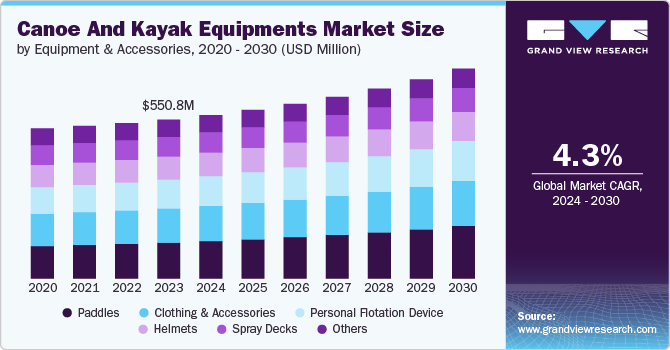

The global canoe and kayak equipments market size was estimated at USD 550.8 million in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. Manufacturers are incorporating eco-friendly materials and sustainable practices in production, catering to the environmentally conscious consumer. The continuous improvement in technology ensures that the market growth remain dynamic and competitive.

The increasing popularity of adventure tourism and water sports activities is a major contributor to the market's growth. Tourist destinations that offer canoeing and kayaking experiences attract both enthusiasts and casual participants. Adventure tourism operators and rental services are expanding their fleets and upgrading their equipment to meet the growing demand from tourists. This trend boosts sales of canoes and kayaks and drives the demand for related accessories and safety gear.

Moreover, the growth of social media and digital marketing is significantly impacting the market growth. Platforms such as Instagram, YouTube, and TikTok are filled with outdoor enthusiasts and influencers who share their adventures and experiences with a wide audience. Their content often highlights the beauty and excitement of canoeing and kayaking, inspiring others to take up these activities. In addition, digital marketing strategies by brands and retailers, including targeted advertisements and engaging content, effectively reach potential customers. The influence of social media not only raises awareness about these water sports but also drives sales as viewers aspire to replicate the experiences they see online.

The development of specialized and niche products drives the market growth. As the market matures, there is a growing demand for canoes and kayaks tailored to specific activities and user preferences. This includes products designed for fishing, white-water rafting, touring, and recreational paddling. Manufacturers are responding by producing specialized equipment that meets the unique requirements of these activities, such as fishing kayaks with built-in rod holders and storage compartments or white-water kayaks designed for maneuverability and durability.

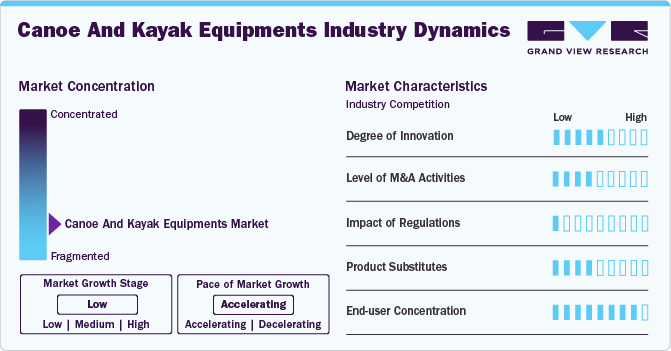

Market Concentration & Characteristics

The industry growth stage is low, and the pace is accelerating owing to growing expansion of rental services and water sports clubs. Rental services provide a convenient and cost-effective way for newcomers to engage in these activities without the initial investment. Water sports clubs and organizations also play a vital role by offering training, guided tours, and social events, fostering a community of enthusiasts.

The industry has a fragmented nature, featuring several global and regional players. The players are entering into partnerships and mergers & acquisitions as the market is characterized by innovation, disruption, and rapid change. In September 2023, Northwest River Supplies (NRS), a provider of water recreation equipment and apparel partnered with Pyranha, a kayak manufacturer, to merge their sales and marketing efforts in Europe. According to the agreement, NRS's European sales, marketing, and customer service operations will be relocated to Pyranha's headquarters in the UK. This move aims to enhance the timeliness of service for NRS's European customers. Both brands will operate from the newly expanded U.K. facility, joining forces for dealer visits, field events, and marketing initiatives to support their respective retail and center networks.

Government initiatives and support for outdoor recreational activities also play a crucial role in driving the market growth. Many governments are investing in infrastructure and programs that promote outdoor activities, including the construction of parks, lakes, and waterfronts that are ideal for canoeing and kayaking. In addition, public campaigns that emphasize the benefits of outdoor sports and the importance of leading an active lifestyle encourage more people to participate in these activities. Government support can also come in the form of grants and subsidies for community organizations and clubs that offer canoeing and kayaking programs, thereby increasing accessibility and participation rates. In June 2023, The Sports Ministry of Canada and the Economic Development Agency of Canada announced that Canoe Kayak Canada will receive USD 404,700 in funding through the Community Sports for All Initiative. This investment is intended to support accessible canoe and kayak programs for diverse groups through a range of projects.

Equipment & Accessories Insights

Based on equipment & accessories, the paddles segment led the market with largest revenue share of 22.6% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The growing popularity of specialized paddling activities, such as white-water rafting, kayak fishing, and touring, is driving the market growth. Each of these activities requires specific types of paddles designed to meet unique performance needs. The rise in popularity of these specialized activities increases the demand for a variety of paddle types, encouraging manufacturers to innovate and diversify their product offerings to cater to these niche markets.

The personal flotation device (PFD) segment is expected to grow at a significant CAGR during the forecast period. The growing popularity of adventure and water sports drives the PFD segment. This trend is particularly evident in the rise of adventure tourism and eco-tourism, where safe and responsible participation in water activities is paramount. Tour operators and rental services often require participants to use PFDs, further driving the demand. The increasing participation in water sports across various age groups and skill levels ensures a broad market for PFDs, from basic models for beginners to advanced options for experienced paddlers.

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 62.1% in 2023. The influence of local outdoor culture and tourism also drives the offline segment. In regions where canoeing and kayaking are popular recreational activities, local retailers benefit from a steady influx of tourists and outdoor enthusiasts. These customers often prefer to purchase or rent equipment locally rather than transporting their gear. Moreover, partnerships between retailers and local tour operators or adventure companies can drive additional traffic to physical stores, further boosting sales.

The online segment is expected to witness the fastest CAGR during the forecast period. The rise of mobile commerce (m-commerce) drives the online segment. With the increasing use of smartphones and tablets, consumers easily browse and shop for canoe and kayak equipment through mobile apps and responsive websites. Mobile-friendly interfaces, secure payment gateways, and personalized shopping experiences make it convenient for consumers to make purchases on the go. The growth of m-commerce is further supported by advancements in mobile technology and increased internet penetration, enabling more consumers to access online stores and purchase equipment anytime, anywhere.

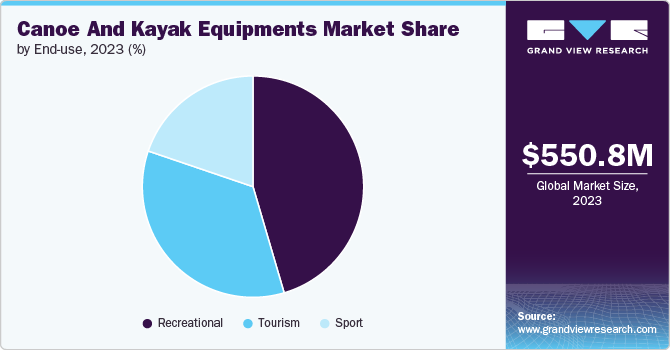

End-use Insights

Based on end use, the recreational segment led the market with the largest revenue share of 45.5% in 2023. The expansion of rental services and paddle sports clubs also significantly contributes to the growth of the recreational segment. These services make it easy for newcomers to try out canoeing and kayaking without the initial investment. Paddle sports clubs provide a community-oriented environment where individuals can learn, practice, and socialize. The availability of lessons, guided tours, and organized events through these clubs fosters a supportive network for enthusiasts, encouraging more people to participate and, eventually, invest in their equipment.

The tourism segment is expected to witness the fastest CAGR during the forecast period. The growing trend towards sustainable tourism drives for the tourism segment growth. Travelers are increasingly conscious of their environmental impact and seek eco-friendly and low-impact activities that support conservation efforts and respect local ecosystems. Tour operators and rental services that promote sustainable practices, such as Leave No Trace principles and wildlife conservation initiatives, appeal to environmentally conscious travelers, driving demand for canoe and kayak tourism experiences.

Regional Insights

The canoe and kayak equipment market in North America is anticipated to grow at the significant CAGR during the forecast period. The increasing availability of guided paddling tours and experiences is contributing to the market growth in North America. Many tour operators and outdoor outfitters offer guided paddling excursions, ranging from leisurely day trips to multi-day expeditions in remote wilderness areas. These guided tours provide access to unique paddling destinations, expert instruction, and opportunities to learn about local history, ecology, and wildlife.

U.S. Canoe and Kayak Equipments Market Trends

The canoe and kayak equipment market in U.S. is anticipated to grow at the fastest CAGR during the forecast period. The availability of canoeing and kayaking infrastructure, such as public access points, water trails, and rental services, enables people to participate in these activities. Many state and local governments in the U.S. have invested in developing and maintaining waterways suitable for canoeing and kayaking as part of broader efforts to promote outdoor recreation and tourism. The availability of well-maintained waterways and supporting infrastructure has lowered the barrier to entry, encouraging more people to invest in their equipment and participate in canoeing and kayaking regularly.

Europe Canoe and Kayak Equipments Market Trends

Europe dominated the canoe and kayak equipment market with a revenue share of 33.4% in 2023 and is projected to grow at the fastest CAGR over the forecast period. The accessibility of outdoor recreation areas and the development of paddling infrastructure contribute to the market growth in Europe. Many European countries have invested in the creation of paddling trails, launch sites, and water sports centers for canoe and kayak enthusiasts to access waterways and enjoy paddling activities. The availability of well-maintained facilities and designated paddling routes encourages paddlers to invest in quality equipment, driving the market growth.

The canoe and kayak equipment market in UK accounted for the largest market share of 7.2% in Europe in 2023. The increasing trend towards staycations and domestic tourism is driving the market growth. As more people opt to explore their own country for vacations and weekend getaways, there is a greater demand for outdoor activities and experiences. Canoeing and kayaking offer an accessible way to discover the UK cultural heritage, from meandering through historic canals to paddling along the rugged coastline of Cornwall or the serene lochs of Scotland. The versatility of paddling allows travelers to immerse themselves in diverse landscapes and environments, driving the demand for canoe and kayak equipment rentals and purchases.

The Spain canoe and kayak equipment market is anticipated to grow at the fastest CAGR during the forecast period. The emergence of paddling events and competitions as spectator sports contributes to the market growth in Spain. Major events such as the International Canoe Federation (ICF) Canoe Sprint World Championships and the Euro Cup showcase the skill of competitive paddling. The visibility of these events in the media and online platforms raises awareness of canoe and kayak sports and stimulates interest in the equipment used by athletes, driving sales in the Spanish market.

Asia Pacific Canoe and Kayak Equipments Market Trends

The canoe and kayak equipment market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The development of paddling infrastructure, facilities, and amenities facilitated the market growth in Asia Pacific, making paddling more accessible for enthusiasts of all ages and abilities. Countries in the region have invested in the construction of paddling centers, water sports complexes, and eco-tourism resorts along rivers, lakes, and coastlines, providing paddlers with safe and convenient access to waterways. Paddling clubs, schools, and associations offer instructional programs, safety courses, and guided tours to introduce newcomers to the sport and help them develop their paddling skills. The availability of rental services, equipment shops, and online resources further supports the paddling community and promotes participation in paddling activities across Asia Pacific.

The China canoe and kayak equipment market accounted for the largest market share in Asia Pacific in 2023. The rise of experiential tourism and travel experiences is contributing to the market growth in China. With a burgeoning middle class and rising disposable incomes, more Chinese travelers are adopting authentic and memorable experiences when they venture abroad or explore domestic destinations. Canoeing and kayaking excursions are increasingly featured as part of adventure tourism packages, offering travelers the opportunity to explore natural landscapes and cultural heritage sites from a unique perspective. The demand for guided paddling tours and equipment rentals stimulates the development of the paddling industry in China, driving market growth.

The canoe and kayak equipment market in Australia market is expected to grow at the fastest CAGR over the forecast period. Increasing participation in water-based sports and activities among Australians is driving the market growth. With the country's abundant coastline and numerous inland waterways, there is a strong culture of water sports, including canoeing and kayaking. Australians of all ages and backgrounds are drawn to the water for recreation, fitness, and socializing. This widespread participation in water sports drives demand for a range of equipment, from entry-level kayaks for beginners to specialized gear for experienced paddlers.

Key Canoe And Kayak Equipments Company Insights

Some of the key players operating in the global market include Werner Paddles, Riot Kayaks, and Pelican

-

Werner Paddles is a manufacturer of high-quality paddles for kayaking, canoeing, stand-up paddle boarding (SUP), and other paddle sports. The company's extensive product lineup includes fishing paddles, kids' paddles, adjustable paddles, carbon paddles, bent shaft paddles, straight shaft paddles, touring paddles, whitewater paddles, allowing paddlers to choose the paddle that best suits their individual needs and preferences. Additionally, Werner Paddles offers customization options, allowing paddlers to tailor their paddles to their specific requirements

-

Riot Kayaks is a manufacturer of kayaks and related accessories, catering to outdoor enthusiasts and watersport aficionados worldwide. Riot Kayaks offers a diverse range of kayaks designed for various skill levels and purposes, including recreational kayaking, touring, fishing, whitewater rafting, and sea kayaking. In addition to kayaks, Riot Kayaks provides a comprehensive selection of accessories, such as paddles, life jackets, dry bags, kayak seats, and safety gear, designed to enhance comfort, safety, and convenience during outdoor adventures

-

Pelican International is a company in the watersports industry primarily engaged in manufacturing kayaks, canoes, pedal boats, paddleboards, and other water-related recreational products. Pelican offers a wide range of kayaks, including recreational kayaks, fishing kayaks, sit-on-top kayaks, sit-in kayaks, tandem kayaks, and inflatable kayaks. Pelican manufactures durable and lightweight canoes suitable for recreational paddling, fishing, and wilderness exploration. Their canoes feature advanced hull designs for optimal performance and versatility in various water conditions

Key Canoe And Kayak Equipments Companies:

The following are the leading companies in the canoe and kayak equipment’s market. These companies collectively hold the largest market share and dictate industry trends.

- Pelican

- Old Town Canoe (Johnson Outdoors Inc.)

- Northwest River Supplies

- Bending Branches

- Werner Paddles

- AIRE

- Argyll Kayaks

- Celtic Paddles NA

- Wetsuit Outlet

- LOMO

- Riot Kayaks

- Wave Sport

- Oru Kayak

- Airhead

Recent Developments

-

In May 2024, Jackson Kayak acquired Werner Paddles. Both companies will persist in prioritizing specialty shops as the central focus of their sales endeavors, emphasizing exclusive products and exceptional service. While maintaining separate sales and marketing teams, both companies remain dedicated to providing the highest quality services to their customers. Production of paddles will transition to Jackson Kayak's facility in Sparta, Tennessee

-

In March 2024, Northwest River Supplies (NRS) launched a range of products aimed at enhancing the water recreation experience for enthusiasts worldwide. This innovative lineup includes Life Jackets/Personal Flotation Devices (PFDs), Fishing Rafts, Packrafts, Stand-Up Paddleboards (SUPs), Snooze Pads, and Dry Duffels. These offerings emphasize NRS's steadfast commitment to excellence and its mission to equip customers with top-notch gear for water adventures

-

In February 2024, Oru Kayak, an origami-inspired foldable kayak, launched a significant upgrade to its fleet: electric motors. Developed in partnership with Bixpy Motors, Oru's new e-propulsion system provides paddlers with an innovative electric-assist option in a lightweight and portable package. This collaboration enhances the maneuverability, adaptability, and control of Oru's foldable kayaks, aligning with their mission to make paddling more accessible

Canoe And Kayak Equipments Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 566.5 million

Revenue forecast in 2030

USD 727.8 million

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment & accessories, distribution channel, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Switzerland; China; India; Japan; Australia; Indonesia; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Pelican; Old Town Canoe (Johnson Outdoors Inc.); Northwest River Supplies; Bending Branches; Werner Paddles; AIRE; Argyll Kayaks; Celtic Paddles NA; Wetsuit Outlet; LOMO; Riot Kayaks; Wave Sport Oru Kayak; Airhead

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Canoe & Kayak Equipments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global canoe and kayak equipment market report based on the equipment & accessories, distribution channel, end-use, and region:

-

Equipment & Accessories Outlook (Revenue, USD Million, 2018 - 2030)

-

Paddles

-

Clothing & Accessories

-

Personal Flotation Device (PFD)

-

Helmets

-

Spray Decks

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Recreational

-

Tourism

-

Sports

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Switzerland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Indonesia

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global canoe and kayak equipment market size was estimated at USD 550.8 million in 2023 and is expected to reach USD 566.5 million in 2024

b. The global canoe and kayak equipment market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 727.8 million by 2030

b. Europe dominated the canoe and kayak equipment market with a share of 33.4% in 2023. The diverse natural landscape of Europe, which offers abundant opportunities for paddling enthusiasts to explore scenic waterways, pristine coastlines, and picturesque lakes and rivers, is driving the market growth in Europe

b. Some key players operating in the canoe and kayak equipment market include Pelican, Old Town Canoe (Johnson Outdoors Inc.), Northwest River Supplies, Bending Branches, Werner Paddles, AIRE, Argyll Kayaks, Celtic Paddles NA, Wetsuit Outlet, LOMO, Riot Kayaks, Wave Sport, Oru Kayak, Airhead

b. Factors such as growing demand for water tourism and an increase in canoe and kayak competition/events across the globe are driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.