- Home

- »

- Alcohol & Tobacco

- »

-

Canned RTD Cocktails Market Size & Share Report, 2030GVR Report cover

![Canned RTD Cocktails Market Size, Share & Trends Report]()

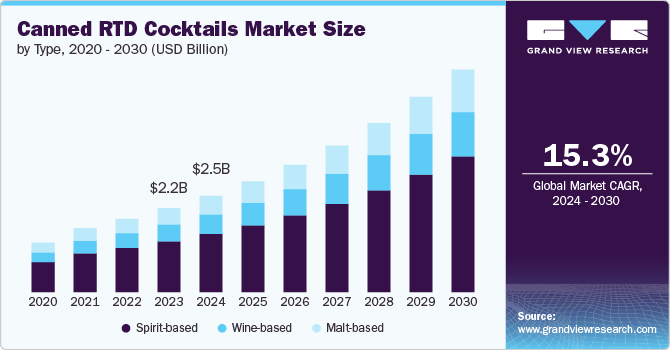

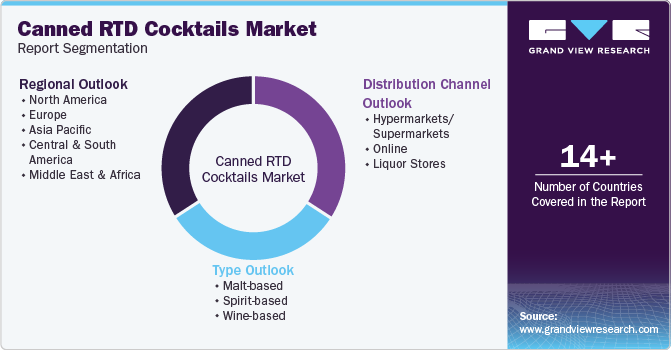

Canned RTD Cocktails Market Size, Share & Trends Analysis Report By Type (Malt-based, Spirit-based), By Distribution Channel (Hypermarkets/Supermarkets, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-461-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Canned RTD Cocktails Market Size & Trends

The global canned RTD cocktails market size was estimated at USD 2,190.6 million in 2023 and is projected to grow at a CAGR of 15.3% from 2024 to 2030. One of the key drivers of the market growth is the increasing consumer demand for convenience. Canned RTD cocktails offer the luxury of portability, allowing consumers to enjoy pre-mixed, ready-to-consume cocktails without the need for additional preparation or bartending skills. With the rise of busy, fast-paced lifestyles, especially among urban dwellers, consumers increasingly prefer products that save time and effort. This convenience factor is further amplified by the ease of transportation, as canned cocktails can be taken to picnics, parties, and outdoor events or simply consumed at home without any additional setup.

As consumers become more health-conscious, they are seeking lower-calorie, lower-sugar alternatives to traditional alcoholic beverages. Many canned RTD cocktails now cater to this demand by offering low-calorie, low-sugar, and even low-alcohol content options. The trend toward moderation, known as “mindful drinking,” is further fueling the demand for such products. Leading manufacturers have responded by launching "better-for-you" cocktails with natural ingredients, no added sugars, and even organic certifications. For instance, in June 2023, VK & Soda launched RTD cocktails specifically targeting Gen Z consumers. This product contains no sugar, is low in calories (69 calories per can), and is available in two flavors: berries and lime. These innovations align with the growing trend of clean-label products, where transparency about ingredients and health benefits is paramount.

Consumer’s desire for premium experiences has also driven the growth of the market. Premiumization refers to consumers' willingness to pay more for products that offer higher quality, unique flavors, or a premium brand image. The success of the craft beer industry has had a ripple effect, with many consumers now seeking high-quality, handcrafted cocktails in a convenient format. Manufacturers are capitalizing on this trend by developing premium and craft-inspired canned cocktails that feature unique ingredients, artisanal production methods, and creative packaging. Brands often highlight the use of premium spirits, such as top-shelf tequila or bourbon, and fresh mixers to attract discerning consumers who prioritize quality over quantity.

Sustainability has become a crucial consideration for both consumers and manufacturers across industries, including the alcohol sector. Canned RTD cocktails offer an eco-friendly alternative to traditional glass bottles, which are heavier and require more energy to transport. Cans are lightweight, highly recyclable, and have a lower environmental footprint compared to other packaging formats. Many manufacturers have embraced this trend by adopting sustainable practices in their production and packaging processes. Moreover, the market growth is also being driven by the constant innovation in flavors and product offerings. In an increasingly competitive market, manufacturers are experimenting with new and exotic flavors to capture consumer interest. This product diversification has helped to keep the category fresh and appealing to a wide range of consumers. Many brands have introduced limited-edition flavors, seasonal offerings, and collaborations with mixologists to differentiate their products from competitors. For instance, in May 2024, Australian ready-to-drink (RTD) cocktail manufacturer Curatif introduced a canned Piña Colada for summer. Limited edition Piña Coladas were first offered by the company to subscribers, but due to high demand, the cocktail is now available to a broader public.

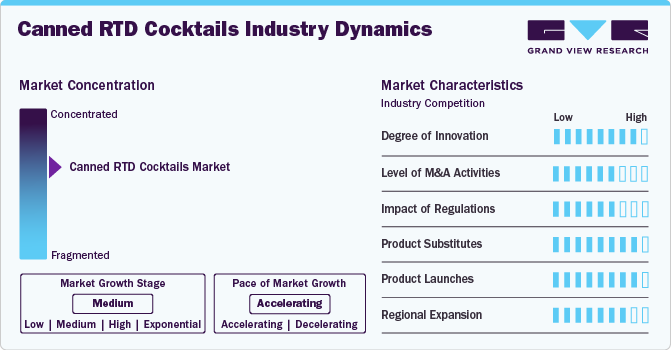

Market Concentration & Characteristics

The market is highly innovative, driven by evolving consumer preferences for premium ingredients, unique flavor profiles, and healthier options. Brands are incorporating functional ingredients, such as botanicals and low-sugar alternatives, and experimenting with new formats, like nitro-infused cocktails. Packaging innovations, such as sustainable materials and visually appealing designs, are also key in attracting eco-conscious consumers.

Mergers and acquisitions are increasing as large beverage companies acquire smaller craft RTD cocktail brands to enhance their product portfolios. Major players like Diageo and AB InBev have been active in acquiring or investing in innovative RTD brands to capitalize on the growing demand. These M&A activities aim to expand market reach, strengthen brand portfolios, and enhance production capabilities.

Regulations on canned RTD cocktails vary by region, particularly concerning alcohol content, labeling, and distribution. In some regions, like the U.S., malt-based cocktails face fewer restrictions than spirit-based ones, leading to different product availability. Regulatory changes, such as easing online alcohol sales and modifying excise taxes, have also impacted the market's growth and accessibility, especially during and after the COVID-19 pandemic.

Substitutes for canned RTD cocktails include traditional spirits, wines, craft beers, and homemade cocktails. Non-alcoholic alternatives, such as alcohol-free RTD cocktails and functional beverages, are also gaining popularity among health-conscious consumers. While these substitutes provide competition, the convenience, flavor consistency, and portability of canned RTD cocktails remain key advantages.

The market is witnessing numerous product launches, with brands introducing new flavor combinations, premium ingredients, and healthier options like low-calorie or organic variants. Various companies have expanded their product lines to include limited-edition cocktails and regionally inspired flavors, catering to diverse consumer preferences. These launches highlight the industry’s continuous evolution and responsiveness to trends.

The market is expanding globally, with significant growth in regions like Asia-Pacific, driven by rising disposable incomes and Western drinking trends. Companies are increasingly focusing on emerging markets in Latin America and the Middle East, where consumer preferences are shifting towards convenient, on-the-go alcohol solutions.

Type Insights

Spirit-based RTD cocktails held a revenue share of 60.4% in 2023. Superior flavor profile and perceived quality of spirit-based cocktails, which appeal to a broad demographic of consumers, particularly those looking for premium, authentic cocktail experiences in a convenient format, a key factor driving the spirit-based market. Spirits like vodka, tequila, rum, and whiskey have a strong reputation for being the foundation of classic cocktails such as margaritas, mojitos, and cosmopolitans. These cocktails are difficult to replicate with malt or wine bases because consumers associate specific flavors with these spirits, leading to an authentic taste preference.

Malt-based RTD cocktails are expected to grow at a CAGR of 14.8% from 2024 to 2030. One of the main reasons for their rising popularity is the cost-effectiveness of malt beverages compared to spirit-based cocktails. Malt beverages are generally cheaper to produce due to the lower costs of ingredients and the simpler brewing process compared to distilling spirits like vodka or whiskey. This makes malt-based canned cocktails a more affordable option for both producers and consumers, contributing to their growing market share, especially among price-sensitive consumers. The appeal of malt-based cocktails is also partly fueled by regulatory considerations. In many regions, particularly in the United States, malt-based beverages can be sold in a wider variety of retail outlets than spirit-based drinks.

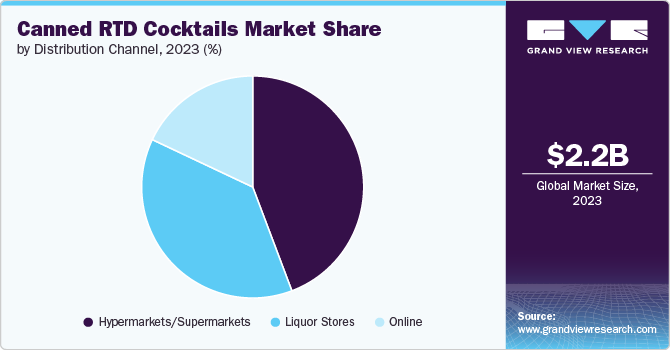

Distribution Channel Insights

The sales of canned RTD cocktails through hypermarkets/supermarkets accounted for a revenue share of 44.3% in 2023. This dominance can be attributed to the accessibility, convenience, and extensive product variety these retail formats offer. Hypermarkets and supermarkets provide a one-stop shopping experience for consumers, where they can purchase groceries, household items, and alcohol in a single visit. This convenience is particularly appealing to consumers who prefer to buy their beverages in bulk or alongside their weekly grocery shopping. Another key factor driving the dominance of hypermarkets and supermarkets is their wide geographical reach. Supermarket chains like Walmart, Tesco, and Carrefour have extensive networks of stores across urban, suburban, and even rural areas, making canned RTD cocktails easily accessible to a broad range of consumers.

The sales of canned RTD cocktails through online channels are expected to grow at a CAGR of 18.2% from 2024 to 2030. The shift toward online retail for alcohol, including canned RTD cocktails, has been driven by several trends, most notably the COVID-19 pandemic, which accelerated e-commerce adoption across all consumer categories, including alcoholic beverages. During the pandemic, consumers turned to online shopping for convenience and safety, and this behavior has persisted even as restrictions eased. Moreover, consumers become accustomed to the ease and convenience of having their beverages delivered directly to their homes, owing to which usage of online channels is increasing. Besides, online platforms also provide greater access to a wider range of products, including niche or hard-to-find canned RTD cocktails that may not be available in physical stores.

Regional Insights

The North America canned RTD cocktails market accounted for a global revenue share of 33.4% in 2023, driven by several factors. This large share can be attributed to the well-established cocktail culture in the U.S. and Canada, where consumers have a long-standing preference for mixed drinks and cocktails. The popularity of spirit-based cocktails such as margaritas, mojitos, and whiskey sours has naturally transitioned into the RTD category, with consumers seeking the same flavors and quality in a more convenient format. Another significant factor is the growing trend of premiumization in the North American market, where consumers are willing to pay a premium for high-quality, craft-style cocktails. As a result, many U.S.-based brands have focused on developing premium canned cocktails using artisanal spirits and natural ingredients, further bolstering the market growth.

Asia Pacific Canned RTD Cocktails Market Trends

Asia Pacific canned RTD cocktails market is anticipated to grow at a CAGR of 16.6% from 2024 to 2030,driven by changing consumer preferences, increasing disposable incomes, and the growing influence of Western drinking trends. As more consumers in countries such as China, Japan, and South Korea adopt Western-style cocktails, there is increasing demand for convenient, ready-to-drink options that can be consumed at home or on the go. In particular, Japan has a long history of canned alcoholic beverages, with products like chuhai (a canned cocktail made from shochu, a Japanese spirit, and flavored soda) being popular for decades. The canned RTD cocktail trend has expanded into other parts of Asia as well, where consumers are seeking new and innovative drinks that align with their modern lifestyles.

Key Canned RTD Cocktails Company Insights

Key players operating in the market are Diageo, AB InBev, Constellation Brands, Pernod Ricard, Suntory Holdings Limited, BACARDÍ, The Coca-Cola Company, Molson Coors Beverage Company, Heineken, and Campari Group. The market participants are constantly working towards new product launches, partnerships, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

Key Canned RTD Cocktails Companies:

The following are the leading companies in the canned RTD cocktails market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- AB InBev

- Constellation Brands

- Pernod Ricard

- Suntory Holdings Limited

- BACARDÍ

- The Coca-Cola Company

- Molson Coors Beverage Company

- Heineken

- Campari Group

Recent Developments

-

In August 2024, Nowadays introduced a new product line: Nowadays THC Canned Cocktails, offering a low-dose option with 5 mg of THC per can. Crafted with the brand’s cannabis-infused spirit, carbonated water, and natural fruit flavors, the cocktails come in four flavors: Spicy Lime, Original, Berry, and Citrus. Available in a variety of packs, they deliver a light, uplifting experience within 15 minutes, providing a non-alcoholic alternative without negative side effects.

-

In February 2024, Diageo's Captain Morgan brand is expanding into the malt-based beverage market with the launch of Captain Morgan Sliced, a new line of canned cocktails containing 5.8% ABV. Available in four flavors—Pineapple Daiquiri, Strawberry Margarita, Passionfruit Hurricane, and Mango Mai Tai.

-

In March 2023, The Jack Daniel’s & Coca-Cola RTD, a pre-mixed canned cocktail, launched in the U.S. stores. This popular ready-to-drink cocktail combines Jack Daniel’s Tennessee Whiskey with Coca-Cola for a balanced, refreshing taste. Available in 12-ounce cans with 7% ABV, the U.S. launch includes a Zero Sugar version, set to release in May.

Canned RTD Cocktails Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,513.5 million

Revenue forecast in 2030

USD 5,892.4 million

Market size volume in 2024

USD 298,849 Thousand Liters

Volume forecast in 2030

USD 682,504 Thousand Liters

Growth rate (Revenue)

CAGR of 15.3% from 2024 to 2030

Growth rate (Volume)

CAGR of 14.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in Thousand Liters, and CAGR from 2024 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, and South Africa

Key companies profiled

Diageo, AB InBev, Constellation Brands, Pernod Ricard, SUNTORY HOLDINGS LIMITED, BACARDÍ, The Coca-Cola Company, Molson Coors Beverage Company, Heineken, and Campari Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Canned RTD Cocktails Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global canned RTD cocktails market report based on type, distribution channel, and region:

-

Type Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Malt-based

-

Spirit-based

-

Wine-based

-

-

Distribution Channel Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Online

-

Liquor Stores

-

-

Regional Outlook (Volume, Thousand Liters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global canned RTD cocktails market size was estimated at USD 2,190.6 million in 2023 and is expected to reach USD 2,513.5 million in 2024.

b. The global canned RTD cocktails market is expected to grow at a compounded growth rate of 15.3% from 2024 to 2030 to reach USD 5,892.4 million by 2030.

b. Spirit-based canned RTD cocktails dominated the canned RTD cocktails market with a share of 61.6% in 2023. The superior flavor profile and perceived quality of spirit-based cocktails appeal to a broad demographic of consumers, particularly those looking for premium, authentic cocktail experiences in a convenient format.

b. Some key players operating in the canned RTD cocktails market include Diageo, AB InBev, Constellation Brands, Pernod Ricard, SUNTORY HOLDINGS LIMITED, BACARDÍ, The Coca-Cola Company, Molson Coors Beverage Company, Heineken, Campari Group.

b. One of the key drivers of the canned RTD cocktail market is the growing consumer demand for convenience. Canned RTD cocktails offer the luxury of portability, allowing consumers to enjoy pre-mixed, ready-to-consume cocktails without the need for additional preparation or bartending skills.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."