Canned Legumes Market Size, Share & Trends Analysis Report By Product (Beans, Peas, Chickpeas, Others), By Distribution Channel (Online Offline), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-233-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Canned Legumes Market Size & Trends

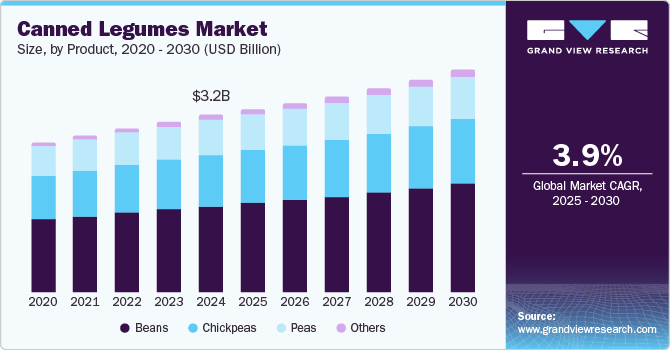

The global canned legumes market size was valued at USD 3.18 billion in 2024 and is projected to grow at a CAGR of 3.9% from 2025 to 2030. The increasing number of working individuals, particularly in dual-income households, is fueling the demand for convenient foods, including canned legumes for quick preparation. Additionally, the growing demand for plant-based protein sources, the rising popularity of ethnic foods, and the use of various legumes in traditional cooking drive the adoption of canned legumes across different regions and countries.

Canned legumes are considered highly nutritious, as they are packed with protein, carbohydrates, B vitamins, copper, iron, manganese, magnesium, phosphorus, and zinc. Legumes are low in fat, free from saturated fat, and cholesterol-free. The high fiber content in legumes helps support good digestive health and maintain stable blood sugar levels. Due to these benefits, legumes have long been a preferred source of protein for vegan and vegetarian diets. With the limited availability of fresh legumes during the off-season, consumers often prefer to buy canned legumes. Canned legumes offer convenience and a longer shelf life and are cost-effective, allowing consumers to stock up on a variety of legumes. As a result, the demand for canned legumes increases during the off-season and in emergency situations, such as mandatory lockdowns.

Over the past few years, canned legume companies have been procuring beans for canning from farms that have incorporated sustainable farming practices. Companies prefer products from organic farms and upcycled food for their canned fruits, vegetables, and legumes. For instance, companies such as SER!OUS Bean Co., and Heyday Canning among others are already sourcing the beans from organic farms and canning them in neutral and different flavors. Numerous European producers promote products by incorporating local heritage or local beans in their portfolio. This approach is expected to help them enter the local food trend, hence widening their opportunity within the canned legume industry. In addition, shifting consumer preference for BPA-free packaging is boosting the demand for canned legumes.

Governments worldwide are promoting canned fruits, vegetables, and legumes as part of efforts to enhance food security, particularly in regions with limited access to fresh produce. Canned legumes offer a long shelf life, making them a reliable option during emergencies or natural disasters. For instance, programs like the U.S. government’s Supplemental Nutrition Assistance Program (SNAP) and the UK's National Health Service (NHS) encourage the consumption of nutritious canned foods as affordable, accessible sources of protein, vitamins, and minerals. Strict government regulations regarding product quality and hygiene maintenance during the canning process also instill confidence among consumers to choose canned products, thereby boosting the growth of the canned legume industry.

Product Insights

Based on products, the beans segment dominated the global canned legumes market, with a revenue share of 48.8% in 2024. Beans are often preferred over other legumes due to their high nutritional content, affordability, and versatility in cooking. They provide a rich source of protein, fiber, and essential vitamins and minerals, which support a balanced diet. Additionally, beans are easier to digest than some other legumes, making them suitable for a wider range of diets. Their mild flavor complements traditional cooking, including Mexican, Indian, Mediterranean, and Asian delicacies. Moreover, canned beans offer longer shelf life, adding to their convenience and appeal.

The chickpeas segment is expected to experience a significant CAGR from 2025 to 2030. The demand for healthy plant-based protein sources continues to grow, and chickpeas are gaining popularity for direct consumption or as an ingredient in healthy high-protein foods. Chickpeas have a mild flavor, a creamy texture, and proven nutrition. Owing to this, chickpeas are considered as a versatile ingredient in delicacies across the globe. Recently, social media platforms, including TikTok and Facebook, have been flooded with content highlighting the significance of chickpeas. Influencers and dietitians promote the benefits of eating beans and share various recipes for preparing canned beans. Making healthy snacks from canned chickpeas is convenient, and hence, the demand for canned chickpeas is growing, complementing the growth of the overall market.

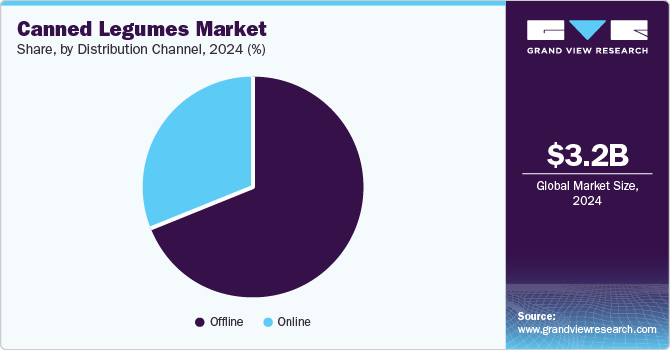

Distribution Channel Insights

Offline distribution held the largest canned legume market revenue share in 2024. The widespread presence of supermarkets, hypermarkets, and grocery stores has boosted the sales of canned legumes through offline sales channels. Additionally, the growing number of grocery chains in regions across South America, Asia-Pacific, and Africa is further driving this offline channel globally. Many consumers prefer physical shopping in stores, where they can verify the products and take them home immediately.

The online distribution segment is expected to experience the highest market growth during the forecast period. With the growing trend of online shopping, major grocery chains like Walmart and Target have expanded their online services. The entry of Amazon, a leading e-commerce player, into the grocery and food market has further driven online sales of canned legumes. Additionally, concepts such as dark stores and quick delivery services are expected to boost online purchases of canned legumes in the coming years.

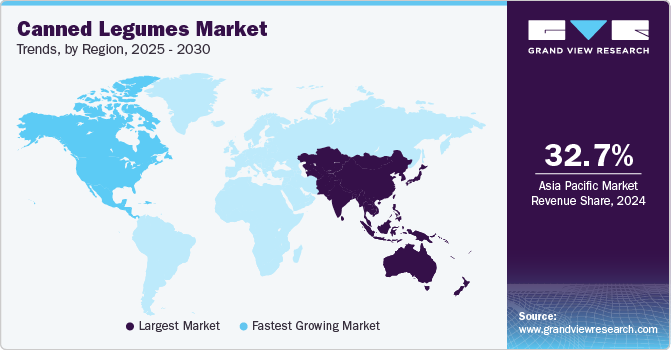

Regional Insights

Asia Pacific canned legumes market dominated the global market with a revenue share of 32.7% in 2024. Legumes are vital in Asian cuisine, offering a rich source of protein, fiber, and essential nutrients, especially in vegetarian and plant-based diets. Canned legumes are an important ingredient in a wide range of dishes, from curries and stews to soups and salads, adding both flavor and texture to many traditional Asian meals. Thus, consumption of canned legumes supersedes the demand across other regions. Additionally, the growing prevalence of online grocery ordering and quick delivery services in developing nations of Asia Pacific is helping the region to dominate the global canned legumes market.

China canned legumes market is projected to experience the fastest growth in the regional market over the forecast period. China is one of the leading bean-producing countries in the region, with a long history of bean cultivation, processing, and consumption. It is also one of the largest consumers of legumes and pulses, with per capita consumption reaching up to 1.7 kg, making it the fastest-growing market in East Asia. These factors play a significant role in driving the growth of the canned legumes industry within the country.

North America Canned Legumes Market Trends

North America canned legumes market is projected to experience the fastest CAGR from 2025 to 2030. Over the past few years, consumers in the U.S. have been increasingly consuming processed beans and pulses owing to their convenience. Consumers in the U.S. and Canada are including these products in their meals due to their nutritional value, convenience to serve, and affordability. Pinto, great northern, navy, black beans, and red kidney are the majorly consumed beans in the region.

The U.S. canned legumes market held the largest revenue share of the regional industry in 2024 owing to growing number of health-conscious consumers that are preferring nutritious, plant-based foods. The popularity of vegetarian, vegan, and flexitarian diets is further driving demand, as consumers seek affordable and self-stable alternatives to animal-based proteins. Additionally, the expansion of online grocery shopping and quick delivery services has made canned legumes more accessible than ever thus, promoting market growth.

Europe Canned Legumes Market Trends

Europe canned legumes market is anticipated to experience significant growth during the forecast period. The demand for canned legumes in Europe is majorly influenced by factors such as the growing demand for meat-alternative protein sources and the growing popularity of vegan and vegetarian diets. Additionally, growing consumer awareness towards BPA-free packaging and healthier food options are also driving the canned legumes industry in Europe.

The UK canned legumes market dominated the regional market in 2024. Consumers across the UK are increasingly preferring convenient, nutritious, and affordable food options. Owing to this, canned legumes are becoming a go-to alternative for a quick, ready-to-eat source of protein and fiber. With inflation affecting food prices, canned beans are also valued for their cost-effectiveness and long shelf life. Additionally, government initiatives, such as the NHS’s focus on promoting balanced diets, highlight canned beans as a nutritious choice, further driving demand in the country.

Key Canned Legumes Company Insights

Some of the key companies operating in the global canned legumes market are The Kraft Heinz Company, Goya Foods, Inc., Bush Brothers & Company, Del Monte Food, Inc., and others. The major players have adopted strategies such as providing sustainable products sourced from ethical farms, strategic acquisition, paying keen attention to quality standards, and more.

-

The Kraft Heinz Company is a leading global food manufacturer known for its wide range of products, including canned legumes. Some of the key products offered by the company include canned beans, canned pinto beans, canned kidney beans, canned black beans, canned chickpeas, canned butter beans, and canned lentils.

-

Del Monte Foods, Inc. is a leading provider of high-quality canned fruits, vegetables, and legumes, known for its commitment to sustainability and innovation. Their canned legumes range from green beans, kidney beans, garbanzo beans (chickpeas), pinto beans, black beans, navy beans, butter beans, and mixed beans.

Key Canned Legumes Companies:

The following are the leading companies in the canned legumes market. These companies collectively hold the largest market share and dictate industry trends.

- The Kraft Heinz Company

- Goya Foods, Inc.

- Bush Brothers & Company

- Faribault Foods, Inc.

- Conagra Brands

- KYKNOS

- Fujian Chenggong Fruits & Vegetables Food Co. Ltd.

- SATKO

- Del Monte Food, Inc.

- Co-op Food

- Teasdale Latin Foods

View a comprehensive list of companies in the Canned Legumes Market

Recent Developments

-

In 2023, Bush Brothers & Company, one of the prominent companies in the conned legumes market, announced the acquisition of Westbrae Natural brand of The Hain Celestial Group, Inc. Westbrae’s products include non-dairy beverages, canned beans, and soups. The acquisition will help Bush Brothers & Company dedicate more resources to expanding their distribution channels and focus on the innovation of priority brands such as canned beans.

-

In November 2021, Del Monte Foods, Inc., a major player in the canned fruits, vegetables, and legumes market, announced its adoption of the upcycled food movement and received the industry's first certification from the Upcycled Food Association for its canned beans.

Canned Legumes Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.29 billion |

|

Revenue forecast in 2030 |

USD 3.99 billion |

|

Growth Rate |

CAGR of 3.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, Brazil, Argentina, South Africa, UAE |

|

Key companies profiled |

The Kraft Heinz Company, Goya Foods, Inc., Bush Brothers & Company, Faribault Foods, Inc., Conagra Brands, KYKNOS, Fujian Chenggong Fruits & Vegetables Food Co. Ltd., SATKO, Del Monte Food, Inc., Co-op Food, Teasdale Latin Foods |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Canned Legumes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the canned legumes market report based on product, distribution channel, and region.

-

Product (Revenue, USD Billion, 2018 - 2030)

-

Beans

-

Peas

-

Chickpeas

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."