- Home

- »

- Medical Devices

- »

-

Cannabis Tourism Market Size, Share & Growth Report, 2030GVR Report cover

![Cannabis Tourism Market Size, Share & Trends Report]()

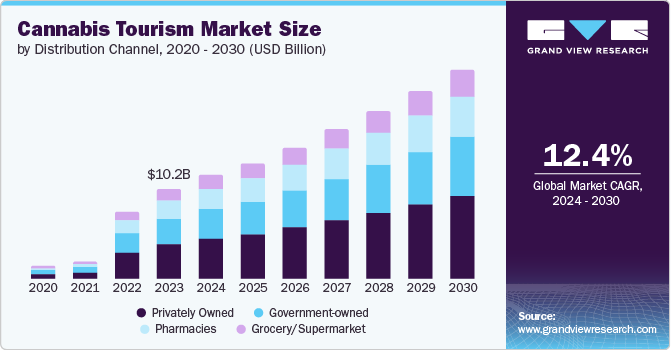

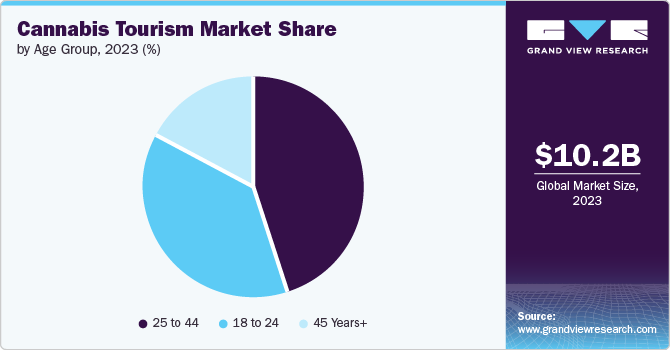

Cannabis Tourism Market Size, Share & Trends Analysis Report By Age Group (18 to 24, 25 to 44, 45 years+), By Distribution Channel (Privately Owned, Government-owned, Grocery/Supermarket, Pharmacies), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-367-0

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cannabis Tourism Market Size & Trends

The cannabis tourism market size was estimated at USD 10.23 billion in 2023 and is expected to grow at a CAGR of 12.38% during the forecast period. The market is expected to experience substantial growth in the coming years, driven by rising demand for unique experiences, growing legalization and regulation. As more countries and states legalize cannabis for recreational use, the market is poised for expansion. The Dutch government's study revealed that 58% of international tourists visit Amsterdam to consume recreational cannabis, and business in Dutch coffee shops has increased since the start of the pandemic. With the increasing acceptance and legalization of cannabis around the globe, the market is expected to continue to grow over the forecast period.

However, Amsterdam's new regulation of cannabis usage is expected to have a significant impact on the cannabis tourism sector. The city has historically been a prominent destination for marijuana enthusiasts, but recent changes in regulations are shifting the landscape. This shift creates opportunities for emerging destinations in Asia, Africa, and the Americas to benefit from evolving market dynamics. Countries such as South Africa, Uruguay, Germany, Jamaica, Malta, Canada, and the U.S. are already capitalizing on the opportunity by relaxing their cannabis laws, attracting a growing number of tourists seeking cannabis-friendly experiences.

In the U.S., more than 19 states, along with Washington D.C., now permit the recreational use of cannabis, attracting visitors from nearby states and other countries. According to the MJBizDaily published article, Michigan's cannabis industry saw a remarkable 30% increase in total sales in 2023, influenced by a 15.7% rise in sales for adult-use cannabis.

The legalization of recreational cannabis in Illinois in January 2020 has been a significant driver of this trend. With nearly 30% of cannabis purchases coming from out-of-state visitors, various destinations are evolving to meet the increased demand for cannabis, CBD, and hemp products. This shift is not only creating distinctive experiences but is also contributing to higher hotel occupancy rates, job creation, increased tax revenues, and business growth while potentially improving land values and contributing to public health and safety.

Furthermore, Canada legalized cannabis for nonmedical purposes in October 2018, integrating it into the broader framework of the Cannabis Act; it became the first major industrialized country to fully legalize and regulate cannabis access for adults. This historic move, building on the country’s medical cannabis legalization since 1999, opened the doors to a robust cannabis tourism market. With the government's strict controls on manufacturing, distribution, and sales, Canada is expected to experience significant growth in cannabis-driven tourism, attracting visitors both domestically and globally who are interested in exploring the legal cannabis landscape.

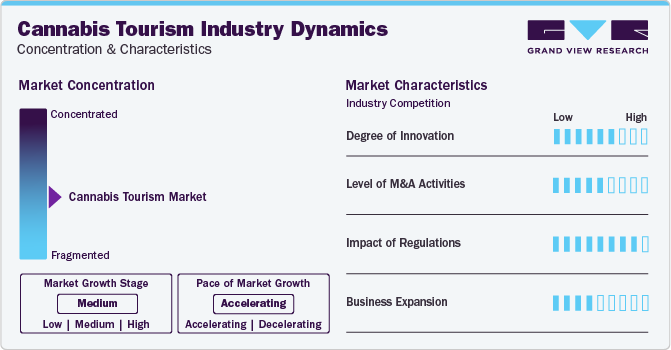

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, degree of innovation, level of mergers & acquisitions activities, impact of regulations, and business expansion.

The degree of innovation in the market is moderate. Innovation is fueling growth in the cannabis tourism market by creating new products, improving quality, and enhancing the visitor experience. For instance, the MoTown Cannapass in Modesto, California, is a gamified passport experience that connects cannabis with art and nature, guiding visitors to legal cannabis shops. Integrating new technologies with traditional plant handling techniques improves product quality, while innovations in dispensary technology enhance efficiency and customer experience.

The impact of mergers & acquisitions on the market is moderate. Large operators are acquiring smaller cannabis companies to expand their reach and product offerings, making it easier for travelers to access cannabis products. For instance, in June 2023, TerrAscend Corp entered into a definitive agreement to acquire Derby, a medical dispensary in Maryland. This move will enhance TerrAscend's ability to serve cannabis tourists ahead of the positioning of adult-use sales on July 1, 2023. Overall, M&A activity is expected to continue driving expansion and consolidation in the cannabis industry, further benefiting the cannabis tourism market.

The impact of regulations on the market is high. The legalization and regulation of cannabis have significantly fueled the expansion of cannabis tourism. In countries where cannabis is legal, such as the U.S. and Canada, the regulated cannabis market has opened up new prospects for tourism. This has led to the advent of regulated cannabis businesses, including dispensaries, cannabis-friendly lodging, and cannabis-themed tours and events, all designed to meet the increasing interest of travelers keen on exploring cannabis culture. This regulated framework has played a crucial role in legitimizing and integrating cannabis tourism into the mainstream, enabling it to emerge as a dynamic and growing segment of the tourism industry.

Business expansion in the market is moderate. Key players are entering new destinations to expand their business. For instance, in December 2023, Sunderstorm, Inc. announced its plan to expand the KANHA brand by launching operations into Thailand's cannabis market. To achieve this, the company partnered with THCG Group, a Thai-based medical cannabis license-holder company. Thus, the entry of new players into legal countries is expected to drive market growth.

Age Group Insights

Based on the age group, the 25 to 44 segment dominated the market with a revenue share of over 44% in 2023 and is expected to witness the fastest CAGR during the forecast period. The 25 to 45 age group is expected to drive the market growth, as they make up a significant portion of current cannabis consumers. As cannabis becomes legal in more U.S. states and countries, this age group is expected to continue to seek out cannabis-friendly destinations for travel, fueling the rise of cannabis tourism worldwide.

The 18 to 24 segment is anticipated to experience significant growth in the coming years owing to the support for recreational marijuana among this age group. According to the University of North Florida, 86% of 18-24-year-olds support cannabis legalization. As more jurisdictions legalize recreational cannabis, this age group is more likely to seek out cannabis-friendly travel experiences, such as cannabis-themed tours, events, and accommodations. As cannabis becomes more mainstream, this younger demographic is expected to continue to shape the emerging cannabis tourism sector.

Distribution Channel Insights

The privately-owned distribution channel segment accounted for largest revenue share of over 38% in 2023 and expected to witness the fastest CAGR during the forecast period. Privately owned dispensaries and tour operators are expected to offer a more personalized and customized experience for cannabis tourists, catering to their preferences and needs. This allows for the development of unique cannabis-themed attractions, events, and activities that appeal to a growing segment of travelers seeking cannabis-related experiences. As the industry matures, privately owned distribution channels are expected to play a crucial role in shaping the cannabis tourism landscape and meeting the evolving demands of this emerging market.

The government-owned segment is expected to experience significant growth during the forecast period. Countries, such as Canada, have government-owned retailers, such as the LCBO, which control cannabis sales. This provides a safe, regulated environment for tourists to access cannabis products. Destinations are expected to leverage these channels to promote cannabis tourism experiences, such as guided tours and events. With clear regulations and oversight, government-owned distribution supports responsible cannabis tourism that benefits visitors and the local community.

Country Insights

U.S. Cannabis Tourism Market Trends

The U.S. cannabis tourism market dominated the market and accounted for the largest revenue share of over 50%. The U.S. is driving the growth, with 19 states and Washington, D.C., allowing recreational use. Favorable cultivation norms in major cannabis-producing states, such as Florida, Oregon, Nevada, California, Washington, and Colorado, along with the legalization of recreational marijuana, contribute to the dominance of the U.S. market. Millennials are increasingly choosing destinations where cannabis is legal, with 50% considering it essential for vacation planning. The legalization of cannabis provides opportunities for destinations to integrate cannabis tourism into the broader visitor economy and enhance community engagement.

Canada Cannabis Tourism Market Trends

The cannabis tourism market in Canada is anticipated to grow significantly over the forecast period. With nationwide legalization in 2018, the country has seen a surge in cannabis-friendly accommodations, tours, and events. Destinations such as Smith Falls, Ontario, and West Edmonton Mall in Alberta are already attracting visitors with immersive cannabis experiences. As more Canadians and international travelers seek out unique cannabis-infused activities, the country's regulated market and tourism infrastructure make it an attractive destination for cannabis tourism.

Germany Cannabis Tourism Market Trends

The Germany cannabis tourism market is expected to experience substantial growth during the forecast period owing to the German authorities' announcement on the legalization of cannabis in October 2022, making Germany one of the leading countries in Europe to legalize marijuana.

Key Cannabis Tourism Company Insights

The market is highly fragmented, with the presence of many country-level players. Key market participants are divided into various strategic initiatives to expand their business footprint and gain a competitive edge in the global market. Some of the emerging players in the market include GanjaVacations, USA Weed.org, Aurora Cannabis, and Tilray Brands.

Key Cannabis Tourism Companies:

- VISIT MODESTO

- Discover Southern Humboldt

- Bud and Breakfast

- Emerald Farm Tours, LLC.

- Niagara Weed & Wine.

- Okanagan Cannabis Tours

- Victoria Cannabis Tours Ltd.

- Del Mundo Cannabis

- Canopy Growth Corp.

- TPCO Holding Corp.

Recent Developments

-

In February 2023 TPCO Holding Corp, a California cannabis company, merged with Gold Flora in an all-stock deal to create a vertically integrated operator with 20 retail stores, a dominant brand portfolio, and statewide coverage in the world's largest cannabis market

-

In January 2023, Cloud Nine Thailand has officially opened, offering a new concept for cannabis consumers. The dispensary provides high-quality cannabis along with paraphernalia and rolling papers

-

In addition, in 2022, Canopy Growth and Acreage Holdings, Inc. entered a new strategic arrangement for speeding the entry of Canopy into the U.S. market

Cannabis Tourism Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.78 billion

Revenue forecast in 2030

USD 23.73 billion

Growth rate

CAGR of 12.38% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, distribution channel, countries

Country scope

U.S.; Canada; Germany; Jamaica; Malta; Uruguay; Luxembourg; South Africa; The Netherlands; Thailand

Key companies profiled

Discover Southern Humboldt; Bud and Breakfast; Emerald Farm Tours, LLC; Niagara Weed & Wine; Okanagan Cannabis Tours; Victoria Cannabis Tours Ltd.; GanjaVacations; USAWeed.org; Del Mundo Cannabis; Canopy Growth Corp.; VISIT MODESTO; TPCO Holding Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Cannabis Tourism Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cannabis tourism market report based on age group, distribution channel, and countries:

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18 to 24

-

25 to 44

-

45 Years+

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Privately Owned

-

Government-owned

-

Grocery/Supermarket

-

Pharmacies

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Germany

-

Jamaica

-

Malta

-

Uruguay

-

Luxembourg

-

South Africa

-

The Netherlands

-

Thailand

-

Frequently Asked Questions About This Report

b. Key factors that are driving the cannabis tourism market growth include increasing legalization of cannabis across the globe, emergence of cannabis-friendly accommodations and experience, rising number of cannabis farms or cultivators due to legalization

b. The global cannabis tourism market size was estimated at USD 10.23 billion in 2023 and is expected to reach USD 11.78 billion in 2024.

b. The global cannabis tourism market is expected to grow at a compound annual growth rate of 12.38% from 2024 to 2030 to reach USD 23.73 billion by 2030.

b. U.S. dominated the cannabis tourism market, with a share of over 50% in 2023. This is attributable to the favorable cultivation norms in major cannabis-producing states such as Florida, Oregon, Nevada, California, Washington, and Colorado, along with the legalization of recreational marijuana, contribute to the dominance of the U.S. cannabis tourism market.

b. Some key players operating in the cannabis tourism market include Discover Southern Humboldt, Bud and Breakfast., Emerald Farm Tours, LLC., Niagara Weed & Wine., Okanagan Cannabis Tours, Victoria Cannabis Tours Ltd., GanjaVacations, USA Weed.org, Del Mundo Cannabis, Canopy Growth Corp, VISIT MODESTO, TPCO Holding Corp.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."