- Home

- »

- Plastics, Polymers & Resins

- »

-

Cannabis Packaging Market Size And Share Report, 2030GVR Report cover

![Cannabis Packaging Market Size, Share & Trends Report]()

Cannabis Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Rigid, Flexible), By Material, By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-258-1

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabis Packaging Market Size & Trends

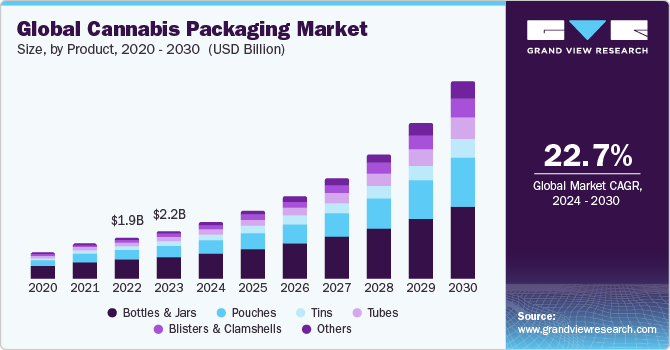

The global cannabis packaging market size was estimated at USD 2,239.57 million in 2023 and is expected to grow at a CAGR of 22.7% from 2024 to 2030. The increasing legalization of cannabis for both medical and recreational use in various countries has been a significant driver contributing to market growth. According to the World Health Organization, the consumption of cannabinoids has demonstrated therapeutic effects against vomiting and nausea caused during AIDS and cancer treatments. This has resulted in its legalization in most U.S. states for medical applications. Cannabis for recreational use is also legal in the U.S. Medical marijuana is legal in approximately 37 states of the U.S.

The legislation legalizing its recreational consumption has been enacted in 18 states, two territories, and the District of Columbia of the country as of 2021. The National Cannabis Packaging and Labeling Standards Committee in the U.S. regulates cannabis packaging in the country The U.S. Food & Drug Administration (FDA) directs that all cannabis products intended for sale are required to be packed in child-resistant exit bags or child-resistant containers before they leave the licensed premises. Cannabis products in non-child-resistant packages may be designed for a physically disabled or geriatric population having difficulty opening child-resistant packaging.

Focus on Cannabidiol (CBD) regulation is becoming increasingly important. The rising demand and ongoing research on CBD underscore its potential as a key component in the cannabis industry. The FDA's approach to regulating CBD products is expected to be a pivotal factor in shaping the future of the cannabis market. Packaging solutions that align with evolving regulatory requirements for CBD products are expected to see heightened demand, presenting a strategic opportunity for innovation and growth in the U.S. cannabis packaging market.

Market Concnetration & Characteristics

Prominent players operating in the global cannabis packaging market include Greenlane Holdings, Inc., J.L. CLARK, Kaya Packaging, KacePack, Cannaline Cannabis Packaging Solutions, Dymapak, Diamond Packaging, and N2 Packaging Systems LLC among others.

Global cannabis packaging is highly consolidated. Since cannabis is not legalized in most countries and its sales are highly regulated by government agencies, the overall presence of market players is limited. The changing regulatory landscape related to packaging products designed for cannabis is expected to influence cannabis packaging manufacturers to develop upgraded packaging products. For instance, in March 2024, the Cannabis Regulation Division of Missouri issued new rules regarding cannabis packaging. This new regulation mandates that terms such as hybrid, indica, and sativa should only be displayed on cannabis packaging if they are a part of a product name or logo. The new rule is intended to make cannabis products less appealing to children, which can propel cannabis packaging producers to develop products based on this regulation.

Mergers and acquisitions initiatives are undertaken by market players to strengthen their market presence. For instance, in March 2023, eBottles, a U.S.-based cannabis packaging manufacturer acquired Greenlane Holdings’ (GNLN) business of cannabis concentrate packaging products.

Type Insights

Based on types, the global market is further segmented into rigid and flexible types. The rigid type segment dominated the overall market and accounted for a share of over 66.0% in 2023. Rigid containers are less susceptible to crushing, puncturing, or tearing compared to flexible pouches, ensuring the product's integrity. Furthermore, many regulations for cannabis packaging mandate child-resistant and tamper-evident features. It is easier to design and implement child-resistant features in rigid type which contributed to its high market share.

The flexible type segment is expected to progress with a CAGR of 24.3% over the forecast period. Flexible packaging generally offers a lower cost per unit compared to rigid containers, making it an attractive option for cannabis product manufacturers and budget-conscious consumers. Since cannabis products are high-priced, the adoption of cost-effective packaging options presents a positive market forecast for the segment.

Material Insights

Based on material, the global market is further categorized into plastic, metal, glass, and paper. The plastics segment dominated the market and accounted for the largest share of over 52.0% in 2023. The cost benefits associated with the use of plastic compared to its counterparts, coupled with its ease of molding and super performance characteristics, are a few key factors contributing to the high market share of this segment.

Metal-based cannabis packaging solutions are expected to progress with a CAGR of 22.4% over the forecast period. This growth rate can be attributed to features of metal-based packaging products, such as shatterproof and impenetrable barriers to light and moisture, thereby preserving the freshness, aroma, and primary constituents of packed cannabis products.

Product Insights

Based on product, the global market is further segmented intobottles & jars, tubes, tins, pouches, blisters & clamshells, and others. The bottles & jars segment dominated the market and accounted for a share of over 52.0% in 2023. The suitability exhibited by bottles and jars to pack various forms of cannabis products, such as powder, gummies, and concentrates, is a major factor contributing to the segment's growth.

The blisters and clamshells product type segment is anticipated to progress at the fastest CAGR of 31.3%, in terms of revenue, from 2024 to 2030. The high growth rate can be attributed to the growing requirement for child-proof and tamper-evident packaging for cannabis products.

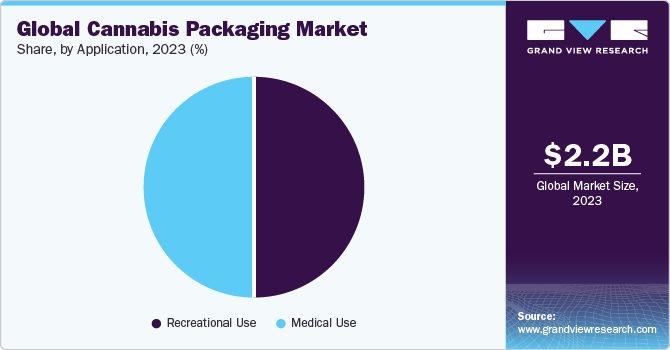

Application Insights

Based on applications, the global market is further bifurcated into recreational use and medical use applications. The recreational use application segment dominated the market and accounted for the largest share of over 50.0% in 2023. Its high share can be attributed to the increasing legalization of cannabis and cannabis-based products for recreational purposes in countries, such as Canada, Uruguay, Malta, and Thailand.

The medical use application segment is expected to register a CAGR of 21.5% over the forecast period. Cannabis helps in decreasing anxiety, insomnia, and muscle stiffness. According to the World Health Organization, the consumption of cannabinoids has demonstrated therapeutic effects against vomiting and nausea caused during AIDS and cancer treatments, which is contributing to the growing adoption of cannabis in medical applications and presents a positive outlook for cannabis packaging.

Regional Insights

The cannabis packaging market in North America ccounted for the largest revenue share of over 69.0% in 2023. The high market share can be attributed to the increased legalization of consumption and selling of cannabis for medical and recreational purposes in North America.

U.S. Cannabis Packaging Market Trends

The U.S. cannabis packaging market is expected to register substantial growth, driven primarily by the increasing legalization of recreational cannabis usage and cannabis-based products across different states, such as Colorado, Washington, California, and Oregon. The evolving legal landscape is a crucial factor influencing the U.S. market. For instance, in May 2023, the Governor of Minnesota signed a bill legalizing adult-use cannabis in the state. The legalized bill allowed for adult possession beginning on August 1, 2023.

The cannabis packaging market in Canada is expected to progress with a CAGR of 13.8% over the forecast period. The high growth rate can be attributed to increasing consumption of cannabis in Canada since its legalization in October 2018. For instance, according to data provided by Statistics Canada, the purchase of cannabis from legalized sales centers is seen to be increasing, which registered a 70% share in overall cannabis purchase in the first half of 2023. Thus, the growing legalized purchasing of cannabis presents a positive forecast for cannabis packaging in Canada.

Europe Cannabis Packaging Market Trends

The Europe cannabis packaging market will witness steady growth in the future as several European countries have moved toward the legalization of medical cannabis, with varying degrees of acceptance for recreational use. For instance, in December 2021, Malta became the first European country to legalize the use of cannabis for recreational and medical purposes; however, the regulation was finalized in year 2022. In April 2023, Luxembourg announced the product legalization for recreational use with proposed state control of cultivation and sale, presenting a growth opportunity for the market.

The UK cannabis packaging market is expected to register significant growth over the coming years. According to the UK Government, most cannabis medicines are imported from foreign countries. Legislative changes in November 2018 eased restrictions on prescribing and supplying medicinal cannabis products, opening avenues for growth in the cannabis packaging sector. Prescription guidelines issued by healthcare professional bodies and subsequent guidelines from the National Institute for Health and Care Excellence (NICE) have provided clarity on prescribing cannabis-based medicinal products for specific medical conditions, which can positively influence market growth.

Asia Pacific Cannabis Packaging Market Trends

The cannabis packaging in Asia Pacific held a significant revenue share in 2023 owing to the changing regulatory landscape related to cannabis legalization. In January 2022, several countries in Asia Pacific witnessed changes in their regulations related to cannabis, with some of them legalizing its medical use while others strictly prohibiting it. For instance, countries, such as Thailand and South Korea, have legalized medical cannabis, thereby creating opportunities for packaging companies to cater to the requirements of the emerging cannabis market in these countries.

The China cannabis packaging market held a significant share of over 25.0% in 2023. Although the consumption of cannabis products is prohibited in China, ithas a well-established manufacturing infrastructure and a large pool of skilled workers. This makes China a potential hub for producing cannabis packaging for export to countries in Asia Pacific countries, such as Thailand, Australia, and parts of Southeast Asia, where it is legalized for medical usage.

The cannabis packaging market in Thailand is expected to progress with a CAGR of 34.9% over the forecast period. Thailand legalized medical cannabis in 2018, and in 2020, it further decriminalized cultivation and possession of cannabis for personal use. This has opened a new market for cannabis products, including a demand for compliant and effective packaging solutions.

Key Cannabis Packaging Company Insights

The global cannabis packaging market is highly consolidated with the presence of several companies as the market is highly regulated. Companies undertake various strategies, such as mergers & acquisitions, joint ventures, new product launches, and geographical expansions, to strengthen their industry presence. For instance:

-

In November 2023, Amcor Plc and CRATIV Packaging launched Crativ PCR50, a cannabis container made of 50% post-consumer recycled (PCR) polypropylene material. Crativ PCR50 was manufactured as a child-resistant container to protect edible, vape, pre-roll, and flower products servicing the CBD, hemp, and cannabis markets

-

In January 2024 Israel-based compostable packaging manufacturer partnered with Wyld to develop compostable packaging for cannabis-based edible products. 608 home compostable laminate developed by Tipa will be used to develop pouches and wraps for edible gummies.

Key Cannabis Packaging Companies:

The following are the leading companies in the cannabis packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Greenlane Holdings, Inc.

- J.L. CLARK

- Kaya Packaging

- KacePack

- Cannaline Cannabis Packaging Solutions

- Dymapak

- Diamond Packaging

- N2 Packaging Systems LLC

- Green Rush Packaging

- Elevate Packaging

- Berry Global Inc.

- RXD Co

- MMC Depot

- Norkol Packaging LLC (Grow Cargo)

- CurTec Nederland B.V.

- IMPAK CORPORATION

- Origin Pharma Packaging

- SANNER

- Guangdong Bowe Packaging Co., Ltd.

- Seidel GmbH & Co. KG

- Amcor Plc

- GPA Global

Cannabis Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,651.04 million

Revenue forecast in 2030

USD 9,061.40 million

Growth rate

CAGR of 22.7% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country Scope

U.S.; Canada; China; Japan; Thailand; Australia; New Zealand; Germany; UK

Key companies profiled

Greenlane Holdings, Inc.; L. CLARK; Kaya Packaging; KacePack; Cannaline Cannabis Packaging Solutions; Dymapak; Diamond Packaging; N2 Packaging Systems LLC; Green Rush Packaging; Elevate Packaging; Berry Global Inc.; RXD Co.; MMC Depot; Norkol Packaging LLC (Grow Cargo); CurTec Nederland B.V.; Impak Corp.; Origin Pharma Packaging; SANNER; Guangdong Bowe Packaging Co., Ltd.; Seidel GmbH & Co. KG; Amcor Plc; GPA Global

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabis Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global cannabis packaging market report on the basis of type, material, product, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Flexible

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Metal

-

Glass

-

Paper

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles & Jars

-

Tubes

-

Tins

-

Pouches

-

Blisters & Clamshells

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Recreational Use

-

Medical Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

Thailand

-

Australia

-

New Zealand

-

-

Rest of World

-

Frequently Asked Questions About This Report

b. The global cannabis packaging market was estimated at around USD 2,239.57 million in the year 2023 and is expected to reach around USD 2,651.04 million in 2024.

b. The global cannabis packaging market is expected to grow at a compound annual growth rate of 22.7% from 2024 to 2030 to reach around USD 9,061.40 million by 2030.

b. North America emerged as the dominant region in the global cannabis packaging market and accounted for the largest share of over 69.0% in 2023. Growing legalization of cannabis for recreational and medical use in North American countries are expected to contribute to this high market share.

b. Some of the key players in global cannabis packaging market include Greenlane Holdings, Inc., J.L. CLARK, Kaya Packaging, KacePack, Cannaline Cannabis Packaging Solutions, Dymapak, Diamond Packaging, N2 Packaging Systems LLC, Berry Global Inc, Green Rush Packaging, and Amcor plc among others.

b. Growing legalization of cannabis use for both recreational and medical use globally and growing developments in the production of cannabis-based medicines are expected to drive the cannabis packaging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.