- Home

- »

- Consumer F&B

- »

-

Cannabis Beverages Market Size And Share Report, 2030GVR Report cover

![Cannabis Beverages Market Size, Share & Trends Report]()

Cannabis Beverages Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Alcoholic, Non-Alcoholic), By Component (Cannabidiol (CBD), Tetrahydrocannabinol (THC)), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-166-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cannabis Beverages Market Summary

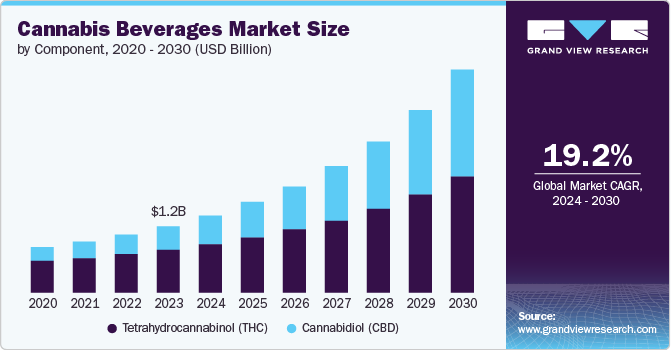

The global cannabis beverages market size was valued at USD 1.16 billion in 2023 and is projected to reach USD 3.86 billion in 2030, growing at a CAGR of 19.2% from 2024 to 2030. The projected market growth is attributed to the increasing demand for cannabis-based wellness drinks and beverages.

Key Market Trends & Insights

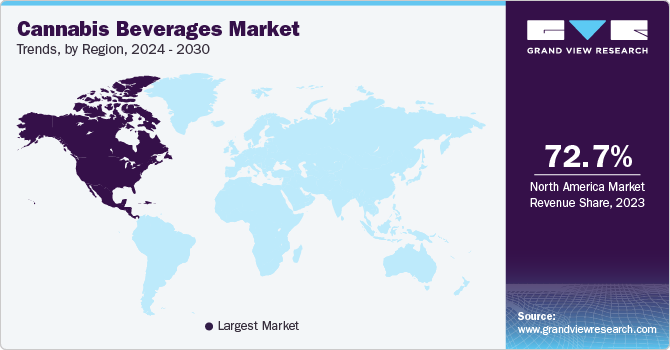

- The North America cannabis beverages market dominated the global industry with revenue share of 72.7% in 2023.

- The U.S. cannabis beverages market dominated the regional industry in 2023.

- By component, the tetrahydrocannabinol (THC) segment dominated the global market and accounted for a revenue share of 64.9% in 2023.

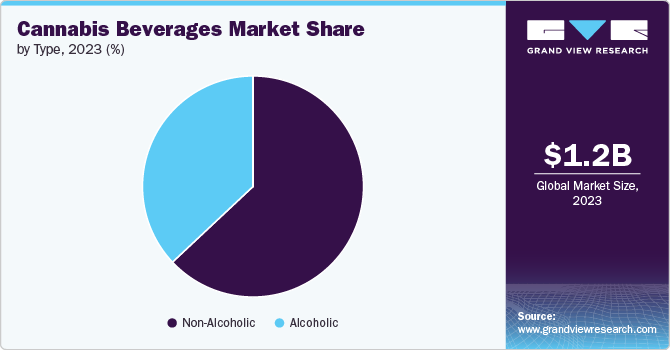

- By type, the non-alcoholic cannabis beverages segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.16 Billion

- 2030 Projected Market Size: USD 3.86 Billion

- CAGR (2024-2030): 19.2%

- North America: Largest market in 2023

Product features such as low sugar content and the required amount of cannabis content, favorable regulations in multiple countries for medical as well as recreational use of marijuana, growing product portfolio based on cannabis as a key ingredient, and ease of accessibility are some of the key growth drivers for this industry. The increasing utilization of cannabis in treating health conditions such as cancer, neurological disorders, and chronic pain is expected to increase the acceptance and consumption of cannabis beverages in the approaching years. The wide-ranging use of marijuana in the development of multiple products such as oils, lotions, pastes, tinctures, and others has attracted a large base of consumers to this market. Increased consumer curiosity in cannabis-infused foods & beverages is most likely to generate greater demand for this industry in the forecast period. In recent years, owing to changes in regulations and availability, multiple users have shifted their mode of consumption from smoking to other alternatives, such as the consumption of chocolates, beverages, and other edibles.

Recent developments in rules and regulations associated with serving cannabis-based beverages through cafes and restaurants have resulted in multiple opportunities for the hospitality industry to cater to the untapped areas of the market. With a growing number of businesses serving cannabis beverages, the product is expected to experience lucrative demand in the next few years. Some common ingredients used in cannabis beverages include water, natural aromatic bitters, fruit flavors, lime juice, acacia gum, sodium benzoate, potassium sorbate, and others.

Increasing market penetration of other cannabis-based products such as gummies, tea, oils, butter, beer, wine, and juices is projected to assist the cannabis beverages market in terms of growth. Ease of accessibility & availability, controlled use of cannabis, and enhanced marketing strategies adopted by the key industry participants have contributed to the growing demand of this market. Unprecedented response for movements such as Dry January and the sober curious is also anticipated to fuel demand for cannabis-based beverages as several young consumers have shifted their preference from alcoholic to non-alcoholic drinks.

Component Insights

The tetrahydrocannabinol (THC) segment dominated the global market and accounted for a revenue share of 64.9% in 2023. The rising demand for THC drinks is primarily driven by the growing interest of adult consumers seeking recreational products other than traditional alcohol-based beverages. The market growth during the forecast period is projected to increase awareness of tetrahydrocannabinol's therapeutic benefits. According to Health Canada, in December 2023, the average everyday amount sanctioned by official healthcare practitioners for individuals registered to utilize cannabis for specific medical purposes from sellers (federally licensed) was 2.4 grams per day to be purchased from licensed sellers to use. This amount has nearly been constant since the emergence of the Cannabis Act in 2018.

The cannabidiol (CBD) segment is expected to experience the fastest CAGR of 24.5% during the forecast period. CBD's non-psychoactive properties, which can be utilized for medical purposes, are likely to result in the development of novel products in the segment. Numerous consumers prefer CBD beverages for health and anti-inflammatory properties, such as kombucha - a probiotic beverage offered with the inclusion of a few milligrams of hemp CBD (cannabidiol). The ability to provide relief from chronic pain, increasing acceptance, availability through online portals, growing market penetration, and large existing consumer base are expected to boost growth for this segment during the forecast period.

Type Insights

The non-alcoholic cannabis beverages segment accounted for the largest revenue share in 2023. Some of the popular non-alcoholic cannabis beverages include coffee, juice, tea, and others. Young consumers' rising inclination toward buying beverages with subtle and controlled doses of CBD and THC in beverages is anticipated to deliver growth for this segment in the coming years. Consumers seeking healthy beverages have preferred non-alcoholic cannabis-infused options such as teas, elixirs, carbonated drinks, energy drinks, and fruit beverages. For instance, in June 2024, PAMOS, one of the prominent brands in the cannabis cocktails & spirits market, launched the Delta-9 THC hemp-derived beverage brand through collaborations with multiple key retailers based in South Carolina, Georgia, and Florida. The strong consumer sentiment associated with access to regulated products in the cannabis category and the growing demand for non-alcoholic beverages is expected to drive the segment growth.

The alcoholic cannabis beverages segment is projected to experience significant growth during the forecast period. The segment is further divided into sub-segments, including wine, beer, and other products. As the alcoholic beverages industry experiences unceasing demand for innovative and novel products from young consumers, multiple prominent organizations have been engaging in research and development efforts related to cannabis-infused alcoholic beverages.

Regional Insights

North America cannabis beverages market dominated the global industry with revenue share of 72.7% in 2023. The presence of countries such U.S., Mexico and Canada, multiple organizations offering cannabis based products, favorable regulations by regulatory authorities, growing awareness about access to regulated cannabis-based offerings and availability of products offered by numerous domestic brands and global players are some of the key growth driving factors for this regional industry.

U.S. Cannabis Beverages Market Trends

The U.S. cannabis beverages market dominated the regional industry in 2023. According to the National Conference of State Legislatures in the U.S., 24 states, three territories, and the District of Columbia have implemented laws to control the use of cannabis for non-medical purposes by adults. Rising disposable income levels, the growing popularity and availability of cannabis beverages, the diverse range of products offered by major industry participants, and the large number of consumers shifting their focus from alcoholic beverages to cannabis beverages are expected to generate greater demand for this market.

Europe Cannabis Beverages Market Trends

Europe cannabis beverages market is anticipated to experience rapid growth during the forecast period. Adding CBD to various drinks like coffee, tea, and other products has gained an increasing response from consumers. Growing availability, large existing consumer base of cannabis, increasing availability of global brands, rising market penetration through effective distribution, and ease of accessibility are expected to develop an upsurge in demand for cannabis beverages in this region.

The UK cannabis beverages market held a substantial market share of the regional industry in 2023. The demand for non-alcoholic CBD drinks significantly influences the market. The availability of a variety of brands with their unique taste and incorporation of natural ingredients is driving the market growth. The presence of multiple international brands, the unceasing inflow of tourists, rising disposable income levels, and growing acceptance of changes in the mode of consumption are likely to result in growth for this market.

APAC Cannabis Beverages Market Trends

APAC cannabis beverages market was identified as a lucrative region in 2023. The increasing awareness regarding the medicinal use of cannabis and its benefits in some instances, such as chronic pain, is expected to drive growth for this market in Asia Pacific. Countries such as Australia, South Korea, China, and Japan are expected to engage in exploring the use of cannabis for medicinal purposes in the coming years. Major companies are participating to incorporate low to medium quantities of CBD and THC to produce new beverages and expand their brand in the region.

The China cannabis beverages market is expected to grow rapidly in the coming years. The authority is being granted to consumers for legalized cultivation of cannabis, which is driving the market in the country. The hemp- a variety of cannabis is widely used in the region for industrial purposes, and the rising global need for the seeds, leaves, and flowers of legal hemp is driving the cultivation of cannabis in the region. The potential for relaxation of CBD-infused product development and distribution regulations is expected to drive growth for this market during the forecast period.

Key Cannabis Beverages Company Insights

Some of the key companies in the cannabis beverages market include CANN SOCIAL TONICS, ARTET, LLC, VCC BRANDS., Keef Brands, BellRock Brands (Dixie Brands) and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

ARTET, one of the emerging brands in the cannabis beverages market, offers non-alcoholic cannabis-infused beverages. The brands offer products such as Chamomile Lemon Spritz, Mango Ginger Spritz, and limited edition, extra-strength Flagship Aperitif in different packaging and sizes.

-

VCC Brands, a cannabis health and wellness company, offers cannabis-based beverages through its brand CQ. It delivers a variety of flavors, such as watermelon cucumber, blackberry lemon line, strawberry lemonade, and others. The portfolio of CQ includes low-dose spritzers, variety packs, high-dose bottles, shots, and sodas as well.

Key Cannabis Beverages Companies:

The following are the leading companies in the cannabis beverages market. These companies collectively hold the largest market share and dictate industry trends.

- CANN SOCIAL TONICS

- ARTET, LLC

- VCC BRANDS (CQ Drinks)

- Keef Brands

- BellRock Brands (Dixie Brands)

- Aphria Inc. (Tilray)

- Canopy Growth (Tweed)

- FABLE

- Mary Jones

- Teapot (Boston Beer Company, Inc.)

Recent Developments

-

In January 2024, Texas Original, one of the prominent medical cannabis providers in Texas, launched Elevate, the company's first beverage product. This product's key features include an equal mixture of CBG and THC and the inclusion of other ingredients such as turmeric and ginger juice.

-

In May 2024, Tilray Brands, Inc. announced the launch of new cannabis-infused beverages through its brand XMG under two sub-brands: XMG Plus ("XMG+") and XMG Zero. As a strategic initiative, the company is focusing on diverse offerings and reshaping the cannabis beverage market with quality and variety.

Cannabis Beverages Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.34 billion

Revenue forecast in 2030

USD 3.86 billion

Growth Rate

CAGR of 19.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, Australia, South Korea, Brazil, Argentina

Key companies profiled

CANN SOCIAL TONICS; ARTET, LLC; VCC BRANDS.; Keef Brands; BellRock Brands (Dixie Brands); Aphria Inc. (Tilray ); Canopy Growth (Tweed); FABLE; Mary Jones; Teapot (Boston Beer Company, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cannabis Beverages Market Report Segmentation

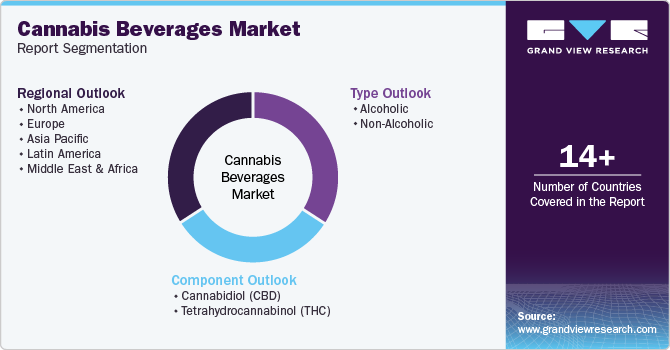

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cannabis beverages market report based on type, component, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcoholic

-

Wine

-

Beer

-

Others

-

-

Non-Alcoholic

-

Coffee

-

Tea

-

Juice

-

Others

-

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Cannabidiol (CBD)

-

Tetrahydrocannabinol (THC)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.