CBD Oil & CBD Consumer Health Market Size, Share & Trends Analysis Report By Product (CBD Oil, CBD Consumer Health), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-934-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

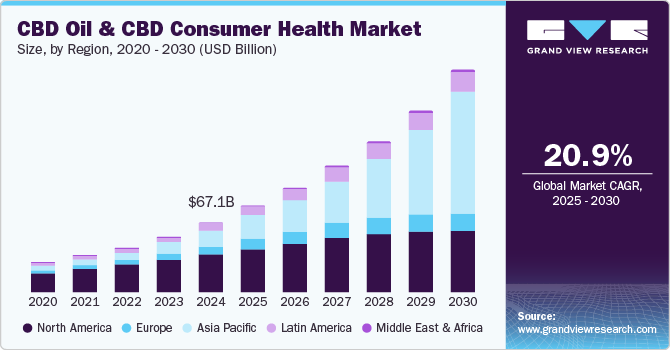

The global CBD oil & CBD consumer health market size was estimated at USD 67.1 billion in 2024 and is projected to grow at a CAGR of 20.9% from 2025 to 2030. Increasing recognition of its therapeutic potential, particularly in managing conditions such as anxiety, chronic pain, and epilepsy, has led consumers to seek natural remedies over traditional pharmaceuticals. This shift is supported by ongoing research that showcases CBD’s benefits, encouraging a broader demographic to explore CBD products as viable health solutions.

The expansion of CBD-infused edibles, beverages, and skincare products caters to a wider array of consumer preferences, enhancing the appeal of CBD within the wellness market. This diversification attracts new customers and fosters customer loyalty as individuals find products that align with their specific health needs and lifestyle choices. As a result, the range of products available is instrumental in expanding the consumer base and overall market presence.

The integration of CBD into mainstream retail channels, combined with the convenience of online shopping platforms, empowers consumers to easily incorporate CBD into their health and wellness routines. This increased accessibility is notable among younger demographics, who are increasingly turning to e-commerce for their health purchases. The combination of convenience and a wide product range facilitates greater adoption rates among consumers, reinforcing the market’s growth trajectory.

Furthermore, shifting consumer preferences towards natural and organic health solutions have fundamentally reshaped the CBD landscape. Younger generations, particularly millennials and Gen Z, show a strong inclination for ethically sourced products with transparent production processes. As awareness of these values rises, consumers are driving demand for high-quality CBD oil derived from organic hemp, thereby influencing market trends.

Product Insights

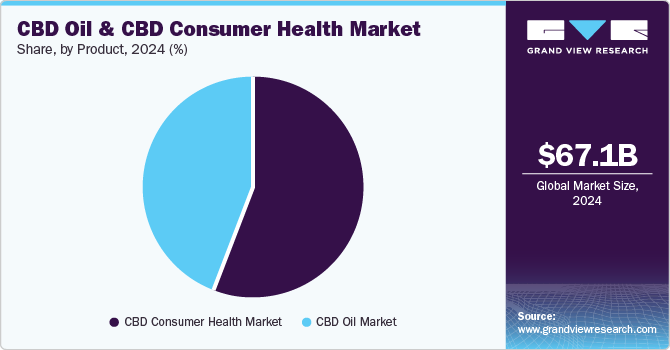

CBD consumer health products dominated the market and accounted for a share of 56.0% in 2024, owing to heightened consumer awareness of the health benefits associated with cannabidiol (CBD) products, including anxiety relief and pain management. As individuals increasingly seek natural alternatives to pharmaceuticals, CBD-infused items such as edibles, topicals, and supplements have gained traction. Favorable regulations and diverse product offerings further bolster consumer confidence and accessibility through e-commerce.

CBD oil products are expected to grow at the fastest CAGR of 20.9% over the forecast period. Consumers favor CBD oil for its ease of use and rapid absorption, making it a preferred solution for chronic pain and sleep disorders. Improvements in extraction methods have enhanced product quality, while the self-care trend drives interest in natural remedies over synthetic medications.

Regional Insights

North America CBD oil & CBD consumer health market dominated the global market with a revenue share of 55.3% in 2024. Market growth in the region is its progressive regulatory landscape and wider acceptance of cannabis-derived products. A high concentration of CBD companies fosters innovation and product diversity, while increased consumer awareness of CBD’s health benefits drives demand. The legalization of hemp cultivation under the Farm Bill further accelerates market growth.

U.S. CBD Oil & CBD Consumer Health Market Trends

The CBD oil & CBD consumer health market in the U.S. dominated North America with the largest revenue share in 2024. The presence of leading manufacturers enables swift product innovation and availability. In addition, growing consumer interest in natural health solutions and favorable regulations enhance accessibility, leading to higher adoption rates among consumers seeking effective wellness products.

Europe CBD Oil & CBD Consumer Health Market Trends

Europe CBD oil & CBD consumer health market held substantial market share in 2024. The evolving regulatory landscape provides clearer guidelines for CBD usage, fostering investment and product development. Furthermore, a heightened focus on health and wellness among European consumers is driving demand for natural remedies, supporting overall market growth.

The CBD oil & CBD consumer health market in Germany is expected to grow rapidly in the forecast period. The country has established itself as a leader in regulatory frameworks for cannabis products, ensuring safe consumer access. Moreover, rising public awareness of CBD’s therapeutic benefits contributes to increasing demand, positioning Germany as a key player in the European market.

Asia Pacific CBD Oil & CBD Consumer Health Market Trends

Asia Pacific CBD oil & CBD consumer health market is expected to register the fastest CAGR of 39.3% in the forecast period, added by increasing legalization efforts and growing consumer interest in natural health products. Countries such as Australia and Japan are experiencing heightened awareness of cannabinoid benefits, leading to higher adoption rates. Moreover, a burgeoning middle class with disposable income enhances demand for wellness products, further boosting market potential.

The CBD oil & CBD consumer health market in China dominated the Asia Pacific CBD oil & CBD consumer health market in 2024 due to rising disposable incomes and an expanding middle class that prioritizes health and wellness. Government focus on healthcare initiatives promotes cannabinoid benefit awareness, especially among older populations seeking pain relief solutions. Moreover, increased spending on nutraceuticals establishes China as a significant player in the Asia Pacific market.

Key CBD Oil & CBD Consumer Health Company Insights

Some key companies operating in the market include CVSciences, Inc.; Medical Marijuana, Inc.; Charlotte’s Web; ENDOCA; Isodiol International Inc; among others. Companies are investing in research and development for innovative formulations, enhancing efficacy, while prioritizing collaborations, consumer education, online accessibility, and sustainability to meet growing CBD demand.

-

Medical Marijuana, Inc. is a pioneer in the CBD oil and consumer health market, recognized for its subsidiary HempMeds, which provides a diverse range of lab-tested, hemp-derived CBD products, including the flagship Real Scientific Hemp Oil.

-

ENDOCA is a prominent producer of premium CBD products, focusing on organic hemp-based oils and capsules. The company prioritizes sustainability and transparency, ensuring all offerings are free from harmful additives, while educating consumers about CBD's health benefits.

Key CBD Oil & CBD Consumer Health Companies:

The following are the leading companies in the CBD oil & CBD consumer health market. These companies collectively hold the largest market share and dictate industry trends.

- CVSciences, Inc.

- Medical Marijuana, Inc.

- Charlotte’s Web

- ENDOCA

- Isodiol International Inc

- Elixinol

- NuLeaf Naturals, LLC

- Joy Organics

- Kazmira

- Lord Jones

- AURORA CANNABIS INC.

- Canopy Growth Corporation

Recent Developments

-

In December 2024, Canopy USA completed its acquisition of Acreage, consolidating operations across key cannabis brands to enhance growth, efficiency, and market presence in the U.S. cannabis sector.

-

In October 2024, Tilray Brands launched Charlotte’s Web CBD gummies in Canada, offering two flavors with 25mg of CBD per gummy, designed to enhance consumers’ daily wellness routines.

CBD Oil & CBD Consumer Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 83.6 billion |

|

Revenue forecast in 2030 |

USD 215.9 billion |

|

Growth rate |

CAGR of 20.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Croatia, Poland, Netherlands, Czech Republic, Switzerland, China, Japan, India, South Korea, Australia, New Zealand, Colombia, Brazil, Argentina, Chile, Uruguay, South Africa, Israel |

|

Key companies profiled |

CVSciences, Inc.; Medical Marijuana, Inc.; Charlotte’s Web; ENDOCA; Isodiol International Inc; Elixinol; NuLeaf Naturals, LLC; Joy Organics; Kazmira; Lord Jones; AURORA CANNABIS INC.; Canopy Growth Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global CBD Oil & CBD Consumer Health Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CBD oil & CBD consumer health market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD Oil Market

-

CBD Oil

-

CBD Isolate

-

Synthetic CBD

-

-

CBD Consumer Health Market

-

Medical OTC Products

-

Analgesic

-

Oils

-

Pills/Capsules/Softgels

-

Topical

-

-

Mental Health

-

Oils

-

Pills/Capsules/Softgels

-

-

Dermatology

-

Sleep Aids

-

Oils

-

Pills/Capsules/Softgels

-

Oral Spray

-

-

Others

-

-

Nutraceuticals

-

VDS

-

Sports Nutrition

-

Weight Management and Well-being

-

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

CBD Infused Skincare Products

-

Creams & Moisturizers

-

Masks & Serums

-

Cleansers

-

Sunscreen

-

Bath Bombs

-

Others

-

-

CBD Infused Beauty Products

-

Lip Balm & Gloss

-

Mascara

-

Eyebrow Gels

-

Others

-

-

CBD Infused Haircare Products

-

Shampoos

-

Conditioners

-

Hair Serums

-

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Croatia

-

Poland

-

Netherlands

-

Czech Republic

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

New Zealand

-

-

Latin America

-

Colombia

-

Brazil

-

Argentina

-

Chile

-

Uruguay

-

-

Middle East & Africa

-

South Africa

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global CBD oil & CBD consumer health market size was estimated at USD 67.1 billion in 2024 and is expected to reach USD 83.6 billion in 2025.

b. The global CBD oil & CBD consumer health market is expected to grow at a compound annual growth rate of 20.9% from 2025 to 2030 to reach USD 215.9 billion by 2030.

b. North America dominated the CBD oil & CBD consumer health market with a share of 55.3% in 2024. This is attributable to increasing awareness about CBD oil, favorable regulations, growing consumer preference, and a rise in the number of manufacturers.

b. Some key players operating in the CBD oil & CBD consumer health market include CV Sciences, Inc.; Medical Marijuana, Inc.; Elixinol; NuLeaf Naturals, LLC; CHARLOTTE’S WEB; Isodiol; Joy Organics; Kazmira LLC; IRIE CBD; Lord Jones; ENDOCA; Aurora Cannabis; Canopy Growth Corporation; Bluebird Botanicals; Global Cannabinoids; CBD American Shaman; BioVectra; Noramco, Inc.; CURE Pharmaceutical; GW Pharmaceutical; CBDepot; CIBDOL; and THC Pharm GmbH.

b. Key factors that are driving the market growth include increasing adoption of cannabidiol and infused products for various medical and wellness purposes.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."