- Home

- »

- Medical Devices

- »

-

Canes And Crutches Market Size And Share Report, 2030GVR Report cover

![Canes And Crutches Market Size, Share & Trends Report]()

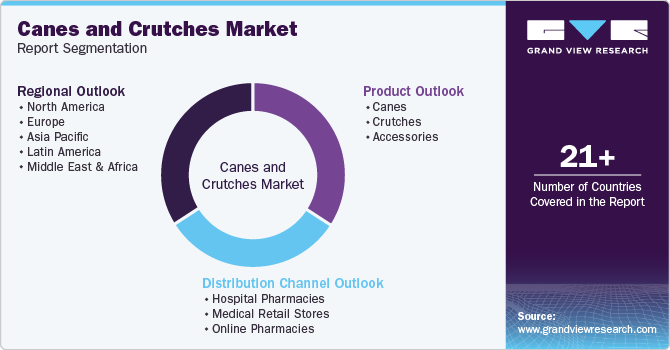

Canes And Crutches Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Canes, Crutches, Accessories), By Distribution Channel (Hospital Pharmacies, Medical Retail Stores, Online Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-344-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canes And Crutches Market Summary

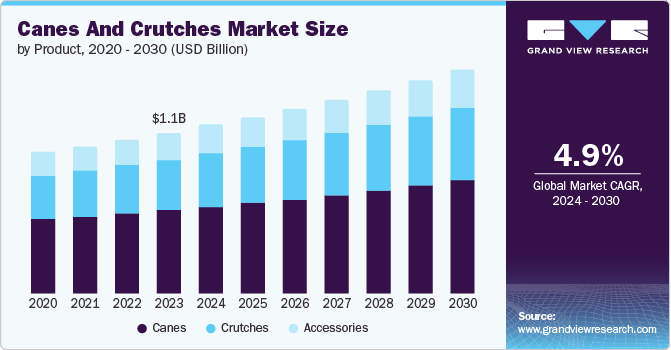

The global canes and crutches market size was estimated at USD 1.07 billion in 2023 and is expected to reach USD 1.49 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030. The rise in musculoskeletal conditions is a major factor boosting market growth.

Key Market Trends & Insights

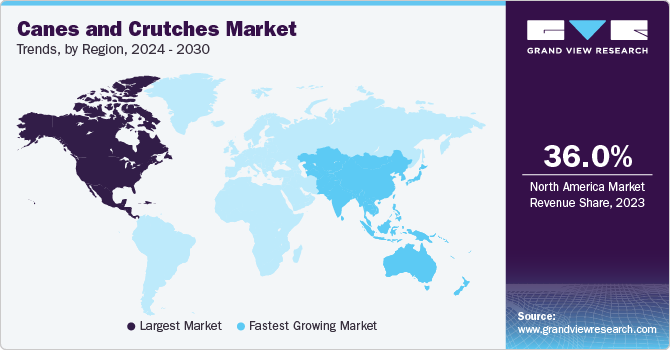

- The North America dominated the global industry with a share of around 36.0% in 2023.

- The U.S. canes and crutches market accounted for the largest share of 82.4% in 2023.

- By product, the canes segment held the largest share of over 52.07% in 2023.

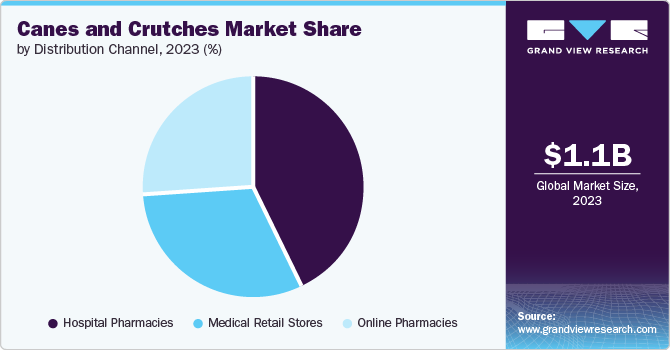

- By distribution channel, the hospital pharmacies segment held the largest share of 43.19% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.07 Billion

- 2030 Projected Market Size: USD 1.49 Billion

- CAGR (2024-2030): 4.9%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

According to the WHO article published in November 2022,about 1.71 billion people globally live with musculoskeletal conditions, such as fractures, osteoarthritis, and rheumatoid arthritis. These conditions collectively rank as the leading causes of disability worldwide. Low back pain stands out as the single most significant contributor to disability in 160 countries, with an estimated 570 million established cases globally. Other noteworthy contributors include fractures affecting 440 million people, osteoarthritis affecting 528 million people, amputations at 180 million, rheumatoid arthritis with 18 million cases, and gout affecting 54 million people.

These figures highlight the widespread impact and burden of musculoskeletal disorders on global health and emphasize the need for effective management and prevention strategies.

Increasing vehicle collision cases drive the market's growth. According to the WHO article published in December 2023, about 1.19 million people die yearly from road traffic accidents. In addition to these tragic fatalities, an estimated 20 to 50 million people sustain non-fatal injuries annually due to vehicle collisions. Many of these injuries cause long-term disabilities, significantly impacting individuals' mobility and quality of life, resulting in a substantial number of people requiring rehabilitation and long-term support. Thus, the rising cases of disabilities from road accidents drive the demand for walking aids, such as canes and crutches.

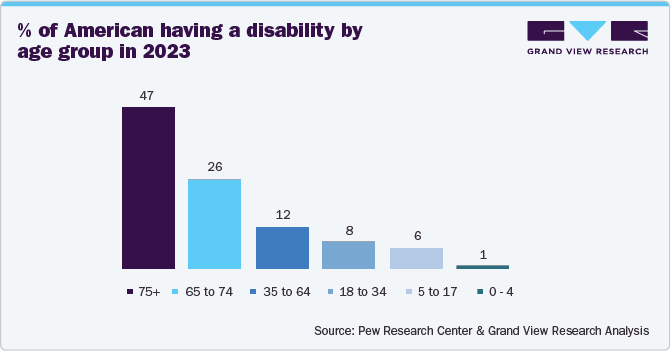

The rising number of people with disabilities fuels the market growth. For instance, as per a Center for American Progress article published in February 2024, between 2019 and 2023, there was a significant 10% rise in the civilian noninstitutional population aged 16 to 64 years identified as having a disability, adding 1.45 million individuals to this demographic. In contrast, the nondisabled population grew by only 2%. This substantially boosts demand for mobility aids, such as canes and crutches, as more people seek to improve their mobility and quality of life.

Advancements in materials and design are boosting the growth of the market. According to the NCBI article published in February 2024, the recent advancements in canes for individuals with visual impairments involve the integration of sonars and sensors to detect obstacles in their path. These devices are designed to be easily rechargeable, universally mountable, and long-lasting on any ordinary white cane. One significant development is the Mobility Assistant for Visually Impaired (MAVI) project, which aims to upgrade these canes to detect and describe obstacles. The MAVI project is working on enabling the cane to detect pedestrians, sign boards, animals, and text through optical character recognition (OCR).

The design of crutches has significantly advanced from the conventional heavy, bulky wooden models to lighter, more ergonomic versions made from aluminum, titanium, and carbon fiber. Modern crutches feature contoured arm pads, improved tips, and better ergonomics to enhance user comfort and mobility. Companies like Ergoactive offer crutches with an enhanced range of motion and rubber tips for shock absorption. These advancements help reduce secondary injuries associated with traditional underarm crutches and increase weight-bearing capacity.

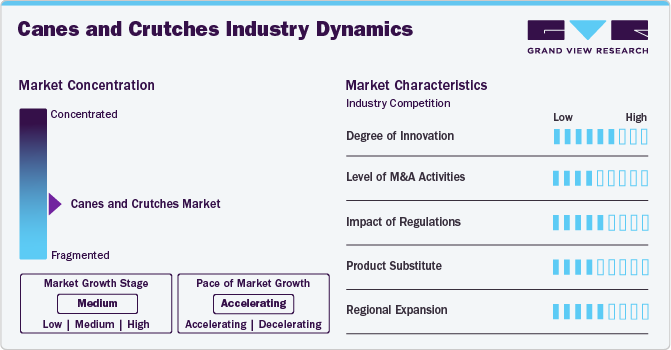

Industry Dynamics

The market is witnessing a high degree of innovation, with companies introducing high-tech canes and crutches that incorporate smart technology, such as sensors and alarms, to alert users of incorrect posture or potential falls and to track usage data for health monitoring

Several market players, such as Drive DeVilbiss Healthcare, Ossenberg GmbH, and Ergoactives, are involved in mergers and acquisitions. Through these M&As, companies in the canes and crutches market utilize key strategies like product innovation, strategic partnerships, and geographical expansion. These approaches help them strengthen their market presence and meet the increasing demand for advanced mobility aids

Regulations in the market have a significant impact. Regulation of canes and crutches ensures safety, quality, and accessibility for users. Regulations often include provisions to make canes and crutches more accessible to those who need them. For instance, Medicare in the U.S. covers the cost of these mobility aids for eligible beneficiaries, making them more affordable and widely available

Product substitutes are available for canes and crutches. These substitutes include mobility aids like walkers, rollators, and knee scooters, which offer varying degrees of support and mobility assistance depending on the user's needs

Market players in the canes and crutches industry are pursuing regional expansion through various strategic initiatives. This includes entering new geographical markets to tap into emerging opportunities and expanding their customer base. Additionally, these companies are establishing partnerships with local distributors to enhance market penetration and improve product accessibility

Product Insights

The canes segment held the largest share of over 52.07% in 2023 due to ongoing product advancements, growing initiatives by key companies, and increasing product adoption. Recent advancements in canes, including folding, quad, and offset designs, focus on enhancing comfort, functionality, and adaptability through new materials and ergonomic features. Folding canes benefit from lightweight materials like aluminum and carbon fiber, improving durability and ease of use, especially for seniors. Quad canes prioritize stability with advancements in materials like aluminum and carbon fiber. Offset canes offer support from the opposite side of the body, aiding users with specific medical needs. These innovations are driving increased adoption and growth in the canes segment.

The crutches segment is expected to grow at the fastest CAGR of 5.4% during the forecast period due to ongoing product advancements, initiatives by key companies, a rapid increase in the elderly population, and a rise in disability cases. According to the Amputee Coalition article published in February 2024, in the U.S., over 5.6 million individuals live with either limb loss or limb difference. Approximately 2.3 million people experience limb loss, while 3.4 million live with limb differences. These individuals require crutches for mobility assistance, which fuels the segment's growth. For instance, modern forearm crutches use lightweight materials like aluminum or carbon fiber for strength and reduced weight. They're adjustable for different heights, ensuring a custom fit and comfort. Ergonomic designs minimize discomfort with padded handles and adjustable cuffs. Shock absorption in the bases reduces joint impact, enhancing stability on uneven surfaces. They come in various colors and styles for personalization and include accessories like terrain tips and safety features for added convenience and functionality.

Distribution Channel Insights

The hospital pharmacies segment held the largest share of 43.19% in 2023. Hospitals are crucial centers for providing a central point for healthcare facilities to procure these mobility aids. Hospitals can access various canes and crutches tailored to patient needs, including advanced designs and ergonomic features that enhance comfort and functionality. Hospital pharmacies ensure the accessibility and availability of these aids to healthcare professionals, facilitating better patient care and rehabilitation outcomes. For instance, in November 2023, a new walking aid return and reuse program at The Royal London and Newham Hospitals. This initiative aims to foster a greener future for Trust and the wider NHS while providing essential mobility support to those in need. In August 2022, the University College of London Hospitals (UCLH) started a 'return and reuse' program for walking aids. Through this initiative, patients who visit the emergency departments at either the Grafton Way Building or the University College Hospital are encouraged to return their crutches to UCLH if they no longer require them.

The online pharmacies segment is expected to grow at the fastest CAGR of 5.6% during the forecast period. Online pharmacies allow consumers to conveniently purchase various mobility aids, including canes and crutches, from the comfort of their homes. Online pharmacies often offer diverse products, competitive pricing, and detailed product information, enhancing the customer experience. In addition, the ease of home delivery and the ability to compare different options online contribute to this market segment's growing popularity and expansion. According to the American perception and use of online pharmacies in 2023, Fifty-two percent of Americans aged 18 and older have used an online pharmacy, reflecting a 10%-point rise from 2021 and a 17%-point increase from 2020. This demonstrates a substantial shift towards online pharmacies in recent years. Among current users, 71% began using online pharmacies within the past 1-3 years, indicating a recent surge in popularity, with most users being new to the platform. These aspects are boosting the growth of the online pharmacies segment.

Regional Insights

The canes and crutches market in North America dominated the global industry with a share of around 36.0% in 2023 owing to favorable reimbursement policies, rising number of vehicle collision cases, advanced healthcare infrastructure, growing geriatric population, an increasing number of arthritis cases, and regulatory approvals & product launches in North America. According to The Trustees of the University of Pennsylvania article published in January 2023, arthritis affects over 50 million adults in the U.S., making it the leading reason for disability in the nation. Moreover, as per a CDC article published in May 2023, almost 61 million adults in the U.S. are living with a disability.

U.S. Canes And Crutches Market Trends

The U.S. canes and crutches market accounted for the largest share of 82.4% of the North American regional market. Increasing musculoskeletal conditions, advancements in materials and design, and the rising number of disability cases drive market growth in the country. According to the NCBI article published in January 2024, musculoskeletal diseases are becoming a significant health and financial burden in the U.S. due to the aging population. These conditions impact over one in three Americans, totaling about 127.4 million people.

Europe Canes And Crutches Market Trends

The canes and crutches market in Europe held the second-largest revenue market share in 2023. This can be attributed to the increasing number of disability cases, the rising number of geriatric patients, and the increasing number of osteoarthritis cases. In 2022, 27% of the EU population aged 16 and older had some type of disability. Eurostat estimates indicate that this amounts to 101 million people, or one in four adults, in the EU.

The Germany canes and crutches market dominated the Europe market with a revenue share of 25.1% in 2023. The factors contributing to this large share are the presence of key market players, high awareness and adoption of musculoskeletal conditions, increased number of cases of disability, and advanced healthcare infrastructure. For instance, at the end of 2021, Germany had around 7.8 million people living with severe disabilities.

The canes and crutches market in the UK held the second-largest market share in Europe. This is due to the rise in vehicle collisions, the growing number of people with Osteoarthritis (OA), and advancements in materials and design. For instance, in 2022, about 10 million people will be affected by Osteoarthritis (OA), with an estimated 5.4 million individuals experiencing knee OA specifically.

The France canes and crutches market is anticipated to witness a significant CAGR of 4.5% during the forecast period. Rising number of disability cases, growing geriatric population, and increased number of musculoskeletal conditions. In 2021, there are 12 million individuals living with disabilities.

Asia Pacific Canes And Crutches Market Trends

The canes and crutches market in Asia Pacific is expected to grow fastest CAGR of 6.2% from 2024 to 2030 owing to improved awareness about musculoskeletal conditions, rising number of vehicle collisions cases,and increasing osteoarthritis cases in the region. According to the University of Washington article published in August 2023, regarding regional prevalence, osteoarthritis affected more than 5.5% of the global population in 2020, with Southeast Asia reporting 5677.4 cases per 100,000 people and high-income Asia Pacific reporting 8632.7 cases per 100,000. The knee emerged as the most prevalent site for osteoarthritis. In addition, a high body mass index (BMI) contributed to 20.4% of osteoarthritis cases.

The China canes and crutches market is experiencing significant growth driven by factors, such as the growing geriatric population, rising number of disability cases, and government initiatives. According to the Global Times article published in December 2023, the number of elderly individuals aged 60 years and above has grown substantially and reached to 280 million. Moreover, as per a Stanford University article published in March 2024, China faces a similar challenge, with 85 million individuals living with disabilities, which accounts for approximately 6.5 percent of its population.

The canes and crutches market in Japan held the largest market share in Asia Pacific due to the increasing geriatric population, new product launches by key manufacturers, and a rising number of disability cases. According to Disability IN an article published in January 2024, around 9.63 million individuals in Japan have various disabilities, encompassing intellectual and mental disabilities. This accounts for approximately 7.6% of the total population, translating to about one in every 13 people.

The India canes and crutches market is experiencing significant growth due to factors including high awareness of musculoskeletal conditions, expanding healthcare infrastructure, and government initiatives. According to the NCBI article published in February 2024, India has several government institutes, schemes, and organizations dedicated to providing rehabilitation solutions for individuals with disabilities. The National Institute for Empowerment of Persons with Intellectual Disabilities (NIEPID) offers high-quality services for individuals with intellectual disabilities, offering various rehabilitation programs. In addition, it has specially structured training courses for rehabilitation professionals, ranging from certificate to postgraduate levels.

Latin America Canes And Crutches Market Trends

The canes and crutches market in Latin American is growing due to several factors, including longer life expectancies, greater awareness of home healthcare services, rising incidences of disabilities, and increased demand for long-term care medical devices. Economic activities in this region are notably influenced by Brazil. In addition, the average lifespan in this area is reported to surpass 75 years.

The Brazil canes and crutches market is expanding due to rising healthcare expenditures, government initiatives for disability cases, and advancements in materials & design. For instance, more than 18 million people in Brazil are living with disabilities. In addition, the market growth in Brazil can be attributed to the increasing instances of accidental injuries.

MEA Canes And Crutches Market Trends

The canes and crutches market in MEA is expected to grow lucratively. The region represents a key emerging market for medical devices. Factors driving growth include a growing population, government initiatives to improve healthcare access, and rising number of vehicle collisions increasing interest from international medical device firms looking to enter the market. The sector is expected to expand in the coming years, buoyed by higher healthcare expenditure, an aging demographic, and a rise in the incidence of disabilities.

The South Africa canes and crutches market is growing due to rising healthcare spending and an increasing number of disability cases. According to the Rhodes University article published in January 2024, about 2.9 million people in South Africa, constituting approximately 7.5% of the total population, live with some form of disability.

Key Canes And Crutches Company Insights

Some of the key players operating in the industry include Drive DeVilbiss Healthcare, Ossenberg GmbH, and Ergoactives. Key strategies undertaken by these companies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, & challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences.

Sunrise Medical Limited and Besco Medical Co., Ltd. are some of the emerging players in the market.

Key Canes And Crutches Companies:

The following are the leading companies in the canes and crutches market. These companies collectively hold the largest market share and dictate industry trends.

- Drive DeVilbiss Healthcare

- Ossenberg GmbH

- Ergoactives

- NOVA Medical Products

- GF Health Products Inc

- Sunrise Medical Limited

- Besco Medical Co., Ltd

- Invacare Corporation

- Medline Industries, Inc

- Cardinal Health, Inc.

Recent Developments

-

In May 2024, The British Red Cross in Taunton inaugurated a new service focused on providing mobility aids. The service offers a range of mobility aids, ensuring that people with mobility challenges can borrow the necessary equipment to improve their daily lives

-

In January 2024, the Royal Shrewsbury Hospital (RSH) launched a new walking aid return and reuse scheme to benefit patients and the environment. This initiative allows patients to return walking aids once they are no longer needed, promoting sustainability by recycling and reusing equipment

-

In August 2023, Alumni from the Indian Institute of Technology (IIT), Delhi, developed the world's first automotive crutches that can stand independently. These innovative crutches help address mobility challenges for older adults and people with locomotive disabilities. Unlike traditional models, they are designed for use across various terrains, including support during activities like trekking, as highlighted by the creators from IIT Delhi

-

In August 2023, Cool Crutches and Walking Sticks introduced the inaugural walking aid recycling scheme in the UK. This initiative marks a significant step towards sustainability in mobility support, allowing users to recycle and reuse walking aids rather than discarding them

Canes And Crutches Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.12 billion

Revenue forecast in 2030

USD 1.49 billion

Growth Rate

CAGR of 4.9% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Drive DeVilbiss Healthcare; Ossenberg GmbH; Ergoactives; NOVA Medical Products; GF Health Products Inc.; Sunrise Medical Ltd.; Besco Medical Co., Ltd.; Invacare Corp.; Medline Industries, Inc.; Cardinal Health, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Canes And Crutches Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global canes and crutches market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Canes

-

Folding Canes

-

Quad Canes

-

Offset Canes

-

-

Crutches

-

Axillary Crutches

-

Forearm Crutches

-

-

Accessories

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Medical Retail Stores

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

UAE

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global canes and crutches market size was estimated at USD 1.07 billion in 2023 and is expected to reach USD 1.12 billion in 2024.

b. The global canes and crutches market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 1.49 billion by 2030.

b. North America dominated the canes and crutches market with a share of 36.0% in 2023. This is attributable to the growing geriatric population, increasing adoption of advanced canes and crutches, and rising disabled population.

b. Some of the players operating in this market are Drive DeVilbiss Healthcare, Ossenberg GmbH, Ergoactives, NOVA Medical Products, GF Health Products Inc, Sunrise Medical Limited, Besco Medical Co., Ltd, Invacare Corporation, Medline Industries, Inc, Cardinal Health, Inc.

b. Key factors that are driving the canes and crutches market growth include the increasing geriatric population, the rising number of disorders requiring canes and crutches, and the increasing handicapped population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.