- Home

- »

- Homecare & Decor

- »

-

Candle Holder Market Size, Share And Trends Report, 2030GVR Report cover

![Candle Holder Market Size, Share & Trends Report]()

Candle Holder Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Glass, Ceramic, Metal), By Product (Desktop, Hanging, Wall-Mounted), By End User, By Style, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-386-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Candle Holder Market Summary

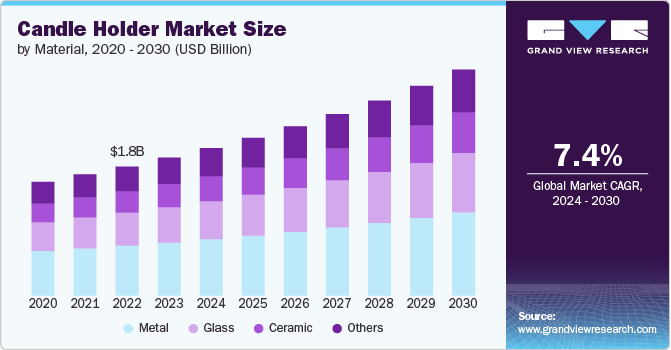

The global candle holder market size was estimated at USD 1,994.4 million in 2023 and is projected to reach USD 3,268.4 million by 2030, growing at a CAGR of 7.4% from 2024 to 2030. This is primarily attributed to the growing consumer interest in homeware and home décor, especially post COVID-19 pandemic.

Key Market Trends & Insights

- The candle holder market in Europe accounted for a revenue share of 36.1% of the global market in 2023.

- Candle holder market in the U.S. is expected to grow at a CAGR of 8.2% from 2024 to 2030.

- By material, the metal segment accounted for a revenue share of 38.4% in 2023.

- By product, the desktop segment witnessed increased sales, accounting for a share of 63.5% in 2023.

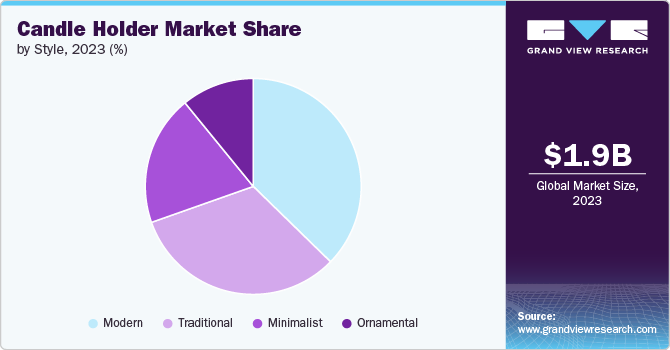

- By style, the modern segment accounted for the largest revenue share of 37.3% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,994.4 Million

- 2030 Projected Market Size: USD 3,268.4 Million

- CAGR (2024-2030): 7.4%

- Europe: Largest market in 2023

The growing consumer interest in candles, classic décor, and ambiance to add to a cozy feel in households, hotels, and spas & salons is likely to drive the demand for candle holders. Furthermore, the growing sales of decorative gifts such as candles, incense, oil burners, and candle holders are projected to drive the global candle holder market growth. As a result of the COVID-19 pandemic, consumers were confined to their homes which led to skyrocketing demand for candles and home décor products. The increasing consumer interest in candles is also likely to contribute to the demand for candle holders.The growing preference for decorative home accessories to enhance the ambiance of living spaces is driving the demand for aesthetically pleasing candle holders. Furthermore, designers and architecture professionals are developing innovative holders which offer high aesthetic value. For instance, in May 2022, an architecture start-up Studioforma created Rotonda candle holders using white waste marble obtained from collaboration with a natural stone manufacturer Valsecchi Marmi (Switzerland). The innovation in candle holder materials supporting sustainability is likely to present growth opportunities for the market.

The growth of the candle holder market is restrained by shift in consumer preferences and lifestyle trends such that consumers are shifting towards alternative lighting options or decorative items that align with modern interiors and themes. This is likely to limit the demand for traditional candle holders. Furthermore, the evolution in decorative items has led to an increasing demand for substitute products such as LED candles, flameless candle holders, and other decorative lighting solutions. It is likely that rising demand for such alternatives will challenge the demand for candle holders, limiting its market growth.

Material Insights

Metal candle holders accounted for a revenue share of 38.4% in 2023. Metal is commonly used to manufacture candle holders due to its high durability, heat resistance, versatility, and luxury appearance. Aluminum, stainless steel, and iron are some of the most common materials used to manufacture candle holders. The growing popularity of metallic candle holders owing to their durability and stability is likely to drive their sales during the forecast period. Consumers are likely to demand metal candle holders also due to its corrosion-resistance and light weight. The demand for antique items has pushed manufacturers to use a coating of brass on materials such as iron which provides an antique effect, durability, and stability to the holders.

Ceramic candle holders are projected to witness a CAGR of 8.5%. from 2024 to 2030. Ceramic candle holders are expected to experience significant growth in demand in the candle holder market due to their cost-effectiveness, aesthetic appeal, artisanal charm, customization options, eco-friendliness, and heat resistance. Their suitability as gifts further contributes to their popularity in the market.

Product Insights

Desktop candle holders witnessed increased sales, accounting for a share of 63.5% in 2023. This is primarily attributed to the convenience offered by desktop holders to enhance the ambiance in a room. These candle holders are suitable for use in living rooms, bedrooms, and dining areas. Key market participants showcase a wide selection of desktop candle holders. Product diversity and safety in the usage of desktop holders in any space are projected to contribute to its sales.

Wall-mounted candle holders are expected to witness a CAGR of 7.0% from 2024 to 2030. This is primarily attributed to the rising interest in wall décor. A survey on home furnishings purchase plans in the second half of 2022 involving nearly 2,000 consumers in the U.S.; highlighted that 49% of Generation Z consumers and 43% of younger millennials are shopping for wall décor. This survey was conducted by Décor News Now in collaboration with its sister publications Home News Now and Casual News Now. Wall-mounted candle holders are also suitable for smaller living areas which further drives their demand as a space-saving solution while providing an appealing ambiance.

End User Insights

Candle holders are primarily used for residential use. The revenue from candle holders used in residential buildings accounted for a share of 61.2% in 2023. The residential demand for candle holders is driven by personal preferences and home decor choices. According to a 2021 Home Décor Consumer Behavior Survey published in the Gifts & Decorative Accessories newsletter, about 37% of respondents indicated that their main motivation for purchasing home decor is to "add comfort to their home" rather than expressing their personal ty. Consumers are now prioritizing creating safe and comfortable spaces in their homes. These trends are driving the demand for candle holders at residential buildings, contributing to the market growth.

Revenue from candle holders for commercial use is expected to grow at a CAGR of 7.8% during the forecast period. Commercial spaces such as restaurants, hotels, spas, and event venues are increasingly using regular and scented candles to enhance the ambiance and create a pleasant experience for their customers. The rising trend of scented candles in spas & salons to create a relaxing ambiance, promoting a sense of calmness is likely to contribute to the demand for candle holders. Further, they also contribute to the spa's visual appeal and enhance aromatherapy experiences for the customers. Such features are expected to drive the demand for candle holders in commercial spaces, thereby driving market growth.

Style Insights

Modern candle holders accounted for the largest revenue share of 37.3% in 2023. The demand for modern candle holders is rising, surpassing that of traditional candle holders. Modern candle holders are gaining traction due to their versatility and space efficiency aligning with evolving consumer preferences and interior design trends.

Furthermore, celebrities and influencers often set trends in home décor and design. For instance, in February 2022, drummer Travis Barker partnered with London design brand Buster + Punch to create the Skull Collection, a series of homeware items that includes a table lamp, candle holder, and bowl. The product was launched with the aim of bringing the iconic skull motif into interior designs. The collection features solid metal skulls made of stainless steel or brass, incorporated into each piece, such as a skull-shaped candle holder. The association of well-known celebrities with a specific collection is likely to attract attention and interest from their fan base and followers. The rising interest in modern styles and functionality is further due to the influence of social media and celebrities.is projected to drive the demand for modern candle holders during the forecast period.

Minimalist candle holder sales is expected to witness a CAGR of 8.3% from 2024 to 2030 due to increasing favoritism for the "minimal aesthetic" products for home decor, architecture, and fashion. While many households are retaining traditional pieces of home décor, modern urban spaces worldwide are increasingly influenced by the minimalist aesthetic culture. The shifting consumer focus from ornamentation to minimalistic and functional designs is projected to drive the growth of minimalist styles.

Distribution Channel Insights

Candle holder sales via offline channels accounted for a share of 66.9% in 2023. This is mainly due to supermarkets expanding their product offerings beyond groceries, and stocking a variety of home decor items, including candle holders, to cater to evolving consumer preferences. Among offline channels, specialty stores-driven candle holder sales are projected to account for more than 55% revenue share in 2023.

E-commerce channel sales are projected to grow at a CAGR of 8.7% from 2024 to 2030. The e-commerce industry has witnessed steady growth since 2010, driven by the availability of a wide selection of products. The growing digital penetration and affordable prices of home décor products over online channels have fueled the growth of candle holder sales through e-commerce. The rise of online users has led to the popularity of shopping for home interior products online, making home décor a thriving segment in the e-commerce industry. These trends are likely to impact the sales of candle holders through e-commerce channels and company-owned websites positively.

Regional Insights

The candle holder market in North America accounted for a revenue share of 23.9% of the global market in 2023. This is attributed to strong consumer preference for home décor and ambiance-enhancing products, a high disposable income, and a growing trend towards home improvement and personalization. In addition, the influence of holiday seasons and cultural events further drives demand for decorative candle holders in the region.

U.S. Candle Holder Market Trends

Candle holder market in the U.S. is expected to grow at a CAGR of 8.2% from 2024 to 2030. This is attributed to increasing consumer interest in home aesthetics and décor in the U.S., a growing trend towards sustainable and artisanal products, and rising disposable incomes. In addition, the influence of social media and online platforms promoting interior design further fuels market growth.

Europe Candle Holder Market Trends

The candle holder market in Europe accounted for a revenue share of 36.1% of the global market in 2023. The region’s dominance in the global market is mainly credited to its rich history and cultural traditions that have influenced various design styles, ranging from classic and ornate to modern and minimalist. Europe has a significant and diverse demand for candle holders.

Asia Pacific Candle Holder Market Trends

The Asia Pacific candle holder market is expected to witness a CAGR of 8.3% from 2024 to 2030. The Asia Pacific comprises countries with distinct cultural backgrounds, leading to a wide range of aesthetic preferences driving the demand for candle holders ranging from traditional to modern. Festivals and religious ceremonies in countries such as India, Japan, Thailand, and Indonesia often involve the use of candles and candle holders. The growing urbanization and rise of modern lifestyles contribute to the demand for home decor products, including candle holders in the region.

Key Candle Holder Company Insights

The global market is characterized by the presence of various small and medium size companies. The presence of various local players in each region and large & prominent key players in the market has led to the moderately fragmented nature of the candle holder market.

Key companies are focused on new product launches and innovative designs to increase their clientele. Seasonal launches in the candle holder market are becoming a common practice among companies. They align their product releases with specific seasons, festivals, and events to capitalize on consumer preferences and demand during those times.

For instance, companies may introduce holiday-themed candle holders for Christmas, Halloween, or Valentine's Day, or launch special collections for spring, summer, fall, and winter. In late December 2022, Bath & Body Works launched a variety of candle holders such as Sun 3 wick Candle Holder, Turtle 3 wick Candle Holder, Marble Orb Single Wick Holder, and Lotus Flower Single Wick (8oz) Candle Holder for Spring 2023. The company is also gearing up for Halloween by launching its highly anticipated Halloween 2023 collection, featuring over 55 spooky items, including candles, accessories, and spooky candle stands. The collection was released in stores and online on July 24, 2023.

Key Candle Holder Companies:

The following are the leading companies in the candle holder market. These companies collectively hold the largest market share and dictate industry trends.

- The A.I. Root Company

- Bath & Body Works

- Aloha Bay

- AzureGreen

- The Yankee Candle Company, Inc.

- Black Tai Salt Co.

- Pavilion Gift Company

- Woodbury Pewterers,Inc

- Hosley

- L&L Candle Company, LLC

Recent Developments

-

In April 2024, Celebration Stadium, known for its candle holders, revolutionized with new and innovative candle holders and accessories. Their flagship product, the Grandstand, offers a customizable design for any number of candles, while the elegant Candelabra combines flexibility and sophistication.

-

InMay 2022, an architecture start-up Studioforma created Rotonda candle holders using white waste marble obtained from collaboration with a natural stone manufacturer Valsecchi Marmi (Switzerland).

Candle Holder Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,132.7 million

Revenue forecast in 2030

USD 3,268.4 million

Growth rate (Revenue)

CAGR of 7.4% from 2024 to 2030

Base year

2023

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, end user, style, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany, UK; France; Italy; Spain; China; India; Japan; Australia; Brazil; South Africa; UAE

Key companies profiled

The A.I. Root Company; Bath & Body Works; Aloha Bay; AzureGreen; The Yankee Candle Company, Inc.; Black Tai Salt Co.; Pavilion Gift Company; MyGift; Woodbury Pewterers, Inc.; Hosley; L&L Candle Company, LLC

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Candle Holder Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global candle holder market on the basis of material, product, end user, style, distribution channel, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Ceramic

-

Metal

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Desktop

-

Hanging

-

Wall-mounted

-

-

End user Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Style Outlook (Revenue, USD Million, 2018 - 2030)

-

Modern

-

Traditional

-

Ornamental

-

Minimalist

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Supermarkets & Hypermarkets

-

Specialty Stores

-

Online

-

E-Commerce Websites

-

Company Owned Websites

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global candle holder market was estimated at USD 1,994.4 million in 2023 and is expected to reach USD 2,132.7 million in 2024.

b. The global candle holder market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030 to reach USD 3,268.4 million by 2030.

b. Europe dominated the candle holder market with a share of around 36% in 2023. The growth of the regional market is driven on account of growth in home decor and furnishings.

b. Some of the key players operating in the candle holder market include Bath & Body Works, The Hosley Store, Woodbury Pewterers,Inc, Pavilion Gift Company, and The Yankee Candle Company, Inc.

b. Key factors that are driving the candle holder market growth include growing demand for home decor and ambiance-enhancing products and growing popularity of candle holders as gifts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.