- Home

- »

- Biotechnology

- »

-

Tumor Profiling Market Size, Share & Growth Report, 2030GVR Report cover

![Tumor Profiling Market Size, Share & Trends Report]()

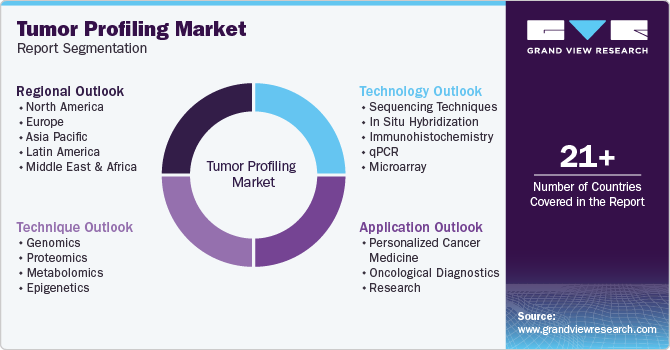

Tumor Profiling Market Size, Share & Trends Analysis Report By Technique (Genomics, Proteomics), By Technology, By Application (Personalized Cancer Medicine, Oncological Diagnostics, Research), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-625-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Tumor Profiling Market Size & Trends

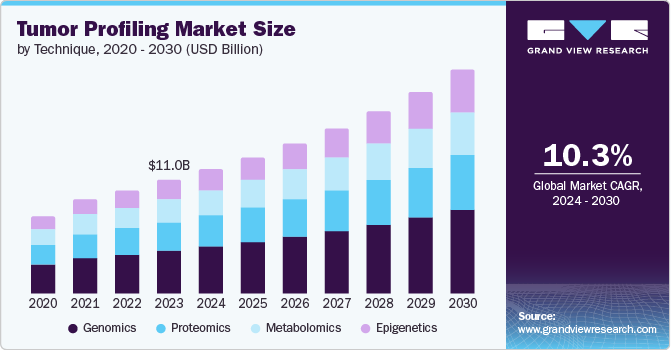

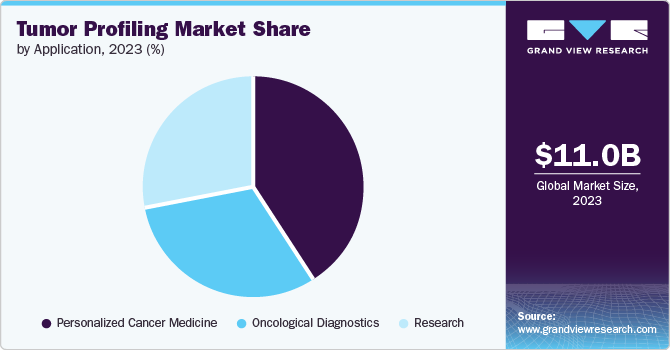

The global tumor profiling market size was valued at USD 11.00 billion in 2023 and is projected to grow at a CAGR of 10.3% from 2024 to 2030. The rising number of cancer cases and precision oncology, tailoring therapies to a tumor's unique genetic makeup, relies heavily on tumor profiling. Advancements in technologies such as next-generation sequencing make profiling faster and more accurate.

The global incidence of cancer is on the rise, due to factors such as population aging, unhealthy lifestyles, and environmental exposure to carcinogens. This increasing demand for cancer diagnosis and treatment is a major driver for the tumor profiling market. According to World Health Organization, in 2022, there were approximately 20 million new cancer cases and 9.7 million deaths. Precision oncology is a personalized approach to cancer treatment that considers the unique genetic makeup of a patient's tumor.

Technological advancements are making tumor profiling faster, more accurate, and more affordable. For instance, next-generation sequencing (NGS) is a powerful technology that can sequence the entire genome of a tumor, providing a comprehensive picture of its genetic makeup. As more and more patients become aware of the benefits of tumor profiling, such as improved treatment outcomes and reduced side effects, the demand for this technology is expected to grow.

Technique Insights

Genomics dominated the market with 38.0% of revenue share in 2023. Understanding a tumor's genetic makeup allows doctors to match patients with drugs specifically designed to target those mutations. This leads to more effective treatment with fewer side effects. Genomic profiling can predict how a tumor might respond to treatment and a patient's overall prognosis.

Epigenetics is anticipated to witness a significant CAGR of 12.7% over the forecast period. Epigenetic changes can occur early in cancer development, potentially enabling earlier and more effective intervention. The ability to profile epigenetic changes alongside genomic alterations provides a more comprehensive view of tumor biology, facilitating better patient stratification and treatment planning.

Technology Insights

Sequencing techniques dominated the market with 31.2% revenue share in 2023. Sequencing techniques, particularly next-generation sequencing (NGS), are revolutionizing the tumor profiling market. NGS allows researchers to rapidly analyze the entire genome of a tumor, identifying mutations, gene fusions, and other genetic abnormalities. The increasing prevalence of cancer globally, coupled with the demand for precision medicine, has further propelled the adoption of these advanced sequencing techniques in clinical settings.

Immunohistochemistry is anticipated to witness the fastest CAGR of 16.0% over the forecast period. Immunohistochemistry allows researchers to visualize the presence and location of specific proteins within a tumor sample. Furthermore, advancements in antibody development and staining technologies have improved the sensitivity and specificity of immunohistochemistry assays, making them indispensable in modern oncology.

Application Insights & Trends

Personalized cancer medicine dominated the market with 40.8% share in 2023. Personalized cancer medicine tailors’ treatment strategies based on the individual genetic makeup of both the patient and the tumor, allowing for more effective and targeted therapies. Personalized therapies target the specific mutations in a patient's tumor, minimizing damage to healthy cells. This translates to fewer side effects and a better quality of life for cancer patients.

Research is projected to grow at a CAGR of 12.0% over the forecast period. As funding for cancer research increases from both public and private sectors, there is a growing emphasis on developing innovative profiling techniques that can lead to breakthroughs in treatment protocols.

Regional Insights & Trends

North America tumor profiling market dominated the market with 30.1% share in 2023. North America has well-established healthcare systems with high investment in research and development. This fosters the adoption of advanced tumor profiling technologies and facilitates access to these services.

U.S. Tumor Profiling Market Trends

The U.S. tumor profiling market dominated the North America market in 2023 due to the rising incidence of cancer andinnovations in bioinformatics and data analytics that have improved the accuracy and efficiency of tumor profiling tests. According to the American Cancer Society, there is rising incidence of cancer in North America, with estimates suggesting over 1.9 million new cancer cases expected in the U.S. alone in 2024.

Europe Tumor Profiling Market Trends

The Europe tumor profiling market was identified as a lucrative region in this industry due to rising burden of cancer, increasing emphasis on personalized medicine approach and robust research infrastructure.

The UK tumor profiling market is expected to grow rapidly in the coming years due to the National Health Service (NHS) initiatives aimed at integrating genomic medicine into routine clinical practice. The NHS Genomic Medicine Centre estimates that over 200,000 patients in the UK will benefit from whole genome sequencing by 2023/24, a key component of comprehensive tumor profiling.

Asia Pacific Tumor Profiling Market Trends

The Asia Pacific market is anticipated to witness significant growth in the coming years. This growth is attributed to the increasing prevalence of cancer and increased healthcare spending across the region.

Key Tumor Profiling Company Insights

Some of the key companies in the tumor profiling market include Illumina, Inc., Bruker Spatial Biology, Inc., Ribomed Biotechnologies Inc., Guardant Health, FOUNDATION MEDICINE, INC.and others.

-

QIAGEN offers sample & assay technologies for academic research, pharmaceutical research, molecular diagnostics and applied testing.

Key Tumor Profiling Companies:

The following are the leading companies in the tumor profiling market. These companies collectively hold the largest market share and dictate industry trends.

- Illumina, Inc.

- QIAGEN

- Genomic Health

- Neogenomics Inc.

- Life Sciences

- Oxford Gene Technology

- Bruker Spatial Biology, Inc.

- Ribomed Biotechnologies Inc.

- GenomeDX

- Guardant Health

- FOUNDATION MEDICINE, INC.

Recent Developments

-

In November 2023, Illumina, Inc launched a generation of its liquid biopsy assay for genomic profiling. TruSight Oncology 500 ctDNA v2 enables ctDNA’s comprehensive genomic profiling (CGP) from blood when tissue testing isn’t available.

Tumor Profiling Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.05 billion

Revenue forecast in 2030

USD 21.73 billion

Growth rate

CAGR of 10.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technique, technology, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Illumina, Inc., QIAGEN, Genomic Health, Neogenomics Inc, Life Sciences, Oxford Gene Technology, Bruker Spatial Biology, Inc., Ribomed Biotechnologies Inc., GenomeDX, Guardant Health, FOUNDATION MEDICINE, INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Tumor Profiling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the tumor profiling market report based on technique, technology, application, and region:

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomics

-

Proteomics

-

Metabolomics

-

Epigenetics

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sequencing Techniques

-

NGS

-

Sanger Sequencing

-

Pyro Sequencing

-

-

In Situ Hybridization

-

Immunohistochemistry

-

qPCR

-

Microarray

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personalized Cancer Medicine

-

Oncological Diagnostics

-

Research

-

Cancer Research

-

Biomarker Discovery

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."