- Home

- »

- Biotechnology

- »

-

Cancer Stem Cells Market Size And Share Report, 2030GVR Report cover

![Cancer Stem Cells Market Size, Share & Trends Report]()

Cancer Stem Cells Market (2024 - 2030) Size, Share & Trends Analysis Report By Mode Of Action (Targeted Cancerous Stem Cells (CSCs), Stem Cell Usage Against Cancer), By Cancer Forms (Breast, Blood, Lung), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-112-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cancer Stem Cells Market Summary

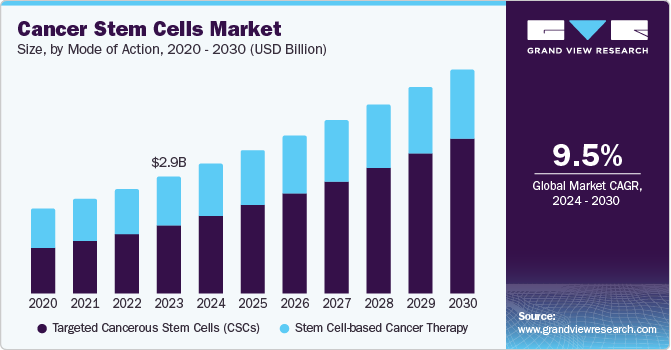

The global cancer stem cells market size was estimated at USD 2.89 billion in 2023 and is projected to reach USD 5.55 billion by 2030, growing at a CAGR of 9.6% from 2024 to 2030. The growing prevalence of cancer, increased R&D activities, and adoption of stem cells are some of the major factors driving the market.

Key Market Trends & Insights

- The North America cancer stem cells market dominated the global market with 36.6% share in 2023.

- The cancer stem cells market in the U.S. dominated the market with 71.7% market share in 2023 due to the country’s well-established infrastructure and increasing number of R&D activities in the cancer stem cells market.

- Based on mode of action, the targeting cancer stem cells (CSCs) segment dominated the market with 58.7% share in 2023 and is expected to show lucrative growth over the forecast period.

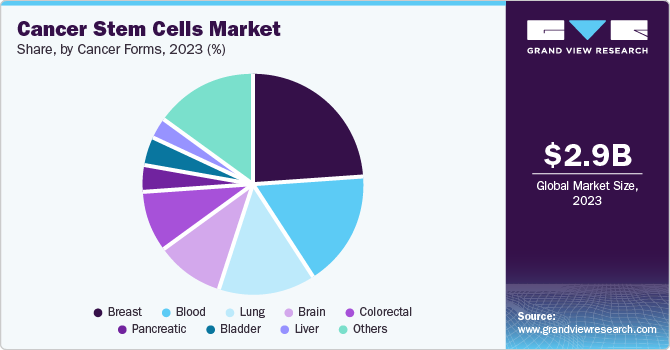

- In terms of cancer forms, breast cancer dominated the market with 24.6% share in 2023 owing to its rising incidence and a relatively large number of stem cell therapeutics for this tumor type.

- On the basis of cancer forms, lung cancer is projected to grow at the fastest CAGR of 11.7% over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2.89 billion

- 2030 Projected Market Size: USD 5.55 billion

- CAGR (2024-2030): 9.6%

- North America: Largest market in 2023

Currently, oncology therapeutics has entered a new era with conventional therapies such as radiotherapy, chemotherapy, & surgeries on one side and stem cell therapies on another side.

Over the past few years, stem cells have been successfully utilized in immuno-reconstitution and for blood replenishment after tumor development or treatment. Furthermore, these cells have gained significant attention among healthcare entities for their employment as tools for delivering anti-cancer agents and tissue regeneration. A considerable number of entities have reported positive outcomes of using this mode of tumor treatment. While this therapy is receiving huge success in clinical oncology, a substantial number of published studies have mentioned cancer as a “Cancer Stem Cell (CSC) disorder”. Due to the introduction of this novel concept, an enormous potential for anti-CSC therapeutics has been created.

This approach enables comprehensive investigation of essential and poorly understood clinical events in tumor initiation, propagation, relapse, and metastasis. This is considered one of the major factors responsible for increasing interest in the cancer stem cell model. There is accumulating evidence that sheds light on the existence of cancer stem cells and their role in conferring drug resistance. This further allows generating of novel targets to overcome therapeutic resistance by controlling the regulation of these cells. Hence, CSCs, as potential therapeutic targets, enable therapeutic development that effectively combat tumor progression.

There has been a constant rise in the number of cancer cases and cancer-related deaths globally over the years. For instance, according to World Health Organization (WHO), in February 2022, cancer was responsible for approximately 10 million deaths worldwide in 2020, and it is the leading cause of death worldwide. Thus, it has become very important to find an efficient treatment to regulate cancer and improve the standard of living of cancer patients. This has increased the R&D activities in the market. For instance, in January 2022, Takeda announced its plan to acquire Adaptate Biotherapeutics for the development of novel gamma delta T cell engager therapies. This can provide Takeda a leading edge to utilize delta T cell’s full potential against cancer.

Moreover, several international and global organizations are working independently and collaboratively to discover new cancer stem cell therapy advancements. For instance, in Jan 2022, Lisa Dean Moseley Foundation gave a grant of USD 9.1 million to the American Cancer Society (ACS) to form a cancer stem cell consortium. This consortium is expected to advance discoveries in cancer stem cells for increased impact on patients. However, regulatory challenges regarding the approval and usage of stem cell therapies are anticipated to inhibit the growth of the market. In addition, certain manufacturing and pharmacological issues associated with this cell therapy development are estimated to slow down the progress of the market during the forecast period.

Mode Of Action Insights

The cancer stem cells market can be segmented into two models of tumor treatment based on the mode of action. The first model incorporates targeted CSCs using monoclonal antibodies, recombinant proteins, nanomaterials, and other natural compounds. The majority of commercially available drugs facilitate tumor shrinkage but do not target the root cause of tumor progression, which may further result in a relapse of tumor growth.

The targeting cancer stem cells (CSCs) segment dominated the market with 58.7% share in 2023 and is expected to show lucrative growth over the forecast period. Increasing research on CSCs biology and their key signaling pathways, microenvironment, and surface markers are enabling the development of agents that target these aspects of CSCs to control their regulation. Of these aspects, agents targeting key pathways accounted for a major share.

Several review articles have documented the roles of these pathways in the functioning of CSCs. The second model deploys stem cells for tissue regeneration, immuno-reconstitution, and delivery of anti-cancer therapeutics. The stem cell usage against cancer segment is projected to grow at CAGR of 9.5% over the forecast period. Stem cells have the unique ability to differentiate into different cell types, which can be harnessed to regenerate healthy tissues damaged by cancer or its treatments. The use of stem cells in combination with other anti-cancer agents offers a novel approach to combatting tumors and enhancing patient outcomes. As research continues to explore the therapeutic potential of stem cells in oncology, the demand for innovative stem cell-based cancer therapies is driving the expansion of the global market.

This segment is further bifurcated into autologous and allogenic cell treatment. Autologous treatments captured a significant market share in 2023 in terms of revenue. Factors such as the advantages of autologous transplants, affordability, improved survival rate of patients, and increase in transplantation procedures are poised to contribute to the growth of the segment. However, it has been observed that many cell therapy companies are increasingly focusing on the development of allogeneic cellular therapy products. This is expected to result in noteworthy growth for this segment over the forecast period.

Cancer Forms Insights

Breast cancer dominated the market with 24.6% share in 2023 owing to its rising incidence and a relatively large number of stem cell therapeutics for this tumor type. According to WHO, breast cancer was diagnosed in around 2.3 million women in 2020 and accounted for almost 6,85,000 deaths worldwide in the same year. In addition, according to an article published by the American Cancer Society (ACS), it is estimated that in the U.S., a total of 43,250 women will pass away from breast cancer with 2,87,850 new instances of invasive breast cancer in 2022. Women over the age of 50 account for 83% of new cases of invasive breast cancer and 91% of all breast cancer-related deaths. Moreover, the fact that autologous transplant has taken chemotherapy to the next level is likely to supplement the growth of the segment. Furthermore, stem cell therapies are successful in combating cardiotoxicity observed in survivors. Factors such as obesity, lack of physical activity, unhealthy diet, and alcohol consumption have been linked to an increased risk of developing breast cancer. These lifestyle choices can lead to hormonal imbalances and inflammation in the body, creating a favorable environment for cancer stem cells to thrive and proliferate.

Lung cancer is projected to grow at the fastest CAGR of 11.7% over the forecast period. The growth of the segment can be attributed to the high prevalence of lung cancer. According to the American Cancer Society, in the U.S., there can be approximately 2,38,340 new lung cancer cases in 2023, causing around 1,27,070 deaths. Moreover, ongoing developments to curb the rising incidence of lung malignancy worldwide are also expected to boost the segment growth. In November 2022, Regeneron Pharmaceuticals, Inc. announced FDA approval of its Libtayo, a human monoclonal antibody, combined with chemotherapy for treating non-small cell lung cancer (NSCLC).

Regional Insights

North America cancer stem cells market dominated the global market with 36.6% share in 2023 due to the presence of a substantial number of organizations engaged in conducting R&D activities related to stem cell therapy, developed healthcare infrastructure, and the prevalence of cancers such as breast cancer, blood cancer, and lung cancer. For instance, according to United States Cancer Statistics (USCS), in 2020, almost 16,03,844 people were diagnosed with cancer, and around 6,02,347 cancer-related deaths were recorded in the U.S. Moreover, several internationally recognized hospitals and medical institutes, such as Cancer Treatment Centers of America at Midwestern Regional Medical Center, offer stem cell transplant therapies.

U.S. Cancer Stem Cells Market Trends

The cancer stem cells market in the U.S. dominated the market with 71.7% market share in 2023 due to the country’s well established infrastructure and increasing number of R&D activities in cancer stem cells market. In

Europe Cancer Stem Cells Market Trends

The Europe cancer stem cells market was identified as a lucrative region in 2023. Presence of well-developed healthcare infrastructure with a strong focus on research and development.

The UK cancer stem cells market is expected to grow rapidly in the coming years due to the increasing focus on personalized medicine approaches in oncology. With a strong National Health Service (NHS) and a growing number of research institutions, the UK is well-positioned to develop and implement targeted therapies based on individual patient characteristics, including the identification of specific cancer stem cells.

Asia Pacific Global Cancer Stem Cells Market Trends

Asia Pacific cancer stem cells market is expected to grow rapidly in coming yearsowing to the rise in cancer cases in the region. According to the GLOBCON 2020, around 4.5 million people were diagnosed with cancer in China. The presence of several organizations in the region that focus on the R&D of stem cells and funding agencies providing grants to research communities to accelerate their scientific research on cancer stem cells in Asian countries are also expected to propel the regional growth of the cancer stem cell market. For instance, according to an article published by South China Morning Post Publishers Ltd. in September 2022, scientists at the Chines Academy of Sciences’ Key Laboratory of RNA Biology have successfully developed nanoparticles to target and eliminate cancer stem cells. The experiment was said to be successful on laboratory rats.

The significant market share of cancer stem cells in China in 2023 can be attributed the country’s large population and the high incidence of cancer cases. The cancer stem cells market in India held a substantial market share due to several factors such as India’s expanding healthcare infrastructure, growing aging population and changing lifestyle factors.

Key Cancer Stem Cells Company Insights

Some of the key companies in the global cancer stem cells market include Thermo Fisher Scientific, Inc.; AbbVie, Inc.; Merck KGaA; Bionomics and Lonza. In order to keep pace with the growing popularity of stem cell therapy in clinical oncology, these firms are undertaking various endeavors to stay competitive. Strategic alliances, facility expansion, and broadening product pipelines are key initiatives these participants undertake. For instance, in April 2023, Gamida Cell received the U.S. Food and Drugs Administration (FDA) approval for their allogeneic cell therapy Omisirge. This is expected to increase stem cell transplant access and improve patient outcomes.

In January 2023, First Light Acquisition Group and Calidi Biotherapeutics, Inc. announced their merger to create a clinical-stage biotechnology company to develop oncolytic virotherapy using a stem cell-based cancer treatment delivery platform. In May 2022, Gilead and Dragonfly announced their research collaboration to advance natural killer cell engagers in oncology. Under this agreement, Gilead received a worldwide license from Dragonfly for their 5T4 targeting immunotherapy program DF7001. Some of the prominent players in the global cancer stem cells market include:

-

STEMCELL Technologies Inc. is a biotechnology company that specializes in developing cell culture media, instruments, cell separation products, and other reagents for use in stem cell, immunology, cancer, regenerative medicine, and cellular therapy research.

Key Cancer Stem Cells Companies:

The following are the leading companies in the cancer stem cells market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- AbbVie, Inc.

- Merck KGaA

- Bionomics

- Lonza

- The Menarini Group

- Miltenyi Biotec

- PromoCell GmbH

- MacroGenics, Inc.

- OncoMed Pharmaceuticals, Inc.

- FUJIFILM Irvine Scientific

- STEMCELL Technologies.

- Sino Biological, Inc.

- Lineage Cell Therapeutics, Inc.

Cancer Stem Cells Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.21 billion

Revenue forecast in 2030

USD 5.55 billion

Growth Rate

CAGR of 9.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of action, cancer forms and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, Thailand, South Korea, Brazil, Mexico, Colombia, Argentina, South Africa, Saudi Arabia, UAE and Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; AbbVie, Inc.; Merck KGaA; Bionomics; Lonza; Stemline Therapeutics, Inc.; Miltenyi Biotec; PromoCell GmbH; MacroGenics, Inc.; OncoMed Pharmaceuticals, Inc.; FUJIFILM Irvine Scientific; STEMCELL Technologies.; Sino Biological, Inc.; Lineage Cell Therapeutics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cancer Stem Cells Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cancer stem cells market report based on mode of action, cancer forms and region.

-

Mode of Action Outlook (Revenue, USD Million, 2018 - 2030)

-

Targeted Cancerous Stem Cells (CSCs)

-

By Anti-CSC Therapeutics

-

Pathway Inhibitors

-

WNT Signaling Pathway

-

Hedgehog Signaling Pathway

-

Notch Signaling Pathway

-

Others

-

-

Surface Marker-based

-

Immuno-evasion & Targeting Tumor Microenvironment

-

Nanoparticle-based Therapies

-

Others

-

-

By Products

-

Cell-Culturing

-

Cell-Separation

-

Cell Analysis

-

Molecular Analysis

-

Others

-

-

-

Stem Cell-based Cancer Therapy

-

Autologous SC Transplant

-

Allogeneic SC Transplant

-

-

-

Cancer Forms Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast

-

Blood

-

Lung

-

Brain

-

Colorectal

-

Pancreatic

-

Bladder

-

Liver

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.