Cancer Biopsy Market Size, Share & Trends Analysis Report By Type (Liquid Biopsy, Core Needle Biopsy), By Application (Breast Cancer, Lung Cancer), By Product (Kits & Consumables, Instruments), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-254-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cancer Biopsy Market Size & Trends

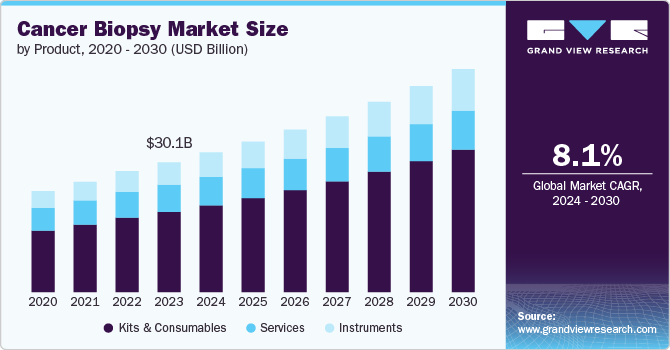

The global cancer biopsy market size was valued at USD 30.05 billion in 2023 and is projected to grow at a CAGR of 8.11% from 2024 to 2030. The growth of the market is attributed to the increasing prevalence of cancer, which is propelling the need for innovative diagnostics to provide early and effective diagnostic solutions to patients. Moreover, the rising awareness of inherited oncology disorders and the rise in genetic testing are further anticipated to drive market growth. The National Cancer Institute (NCI) 2022 update highlights that in the U.S. alone, there were approximately 20 million new cases, resulting in deaths of almost 9.7 million cancer-related deaths worldwide. These substantial figures highlight the growing cancer burden and present a significant growth opportunity for the market.

Due to the advantages of liquid biopsy technologies, massive parallel or NGS has emerged as a rapidly growing and evolving technology with increasing applications in various human diseases. An increase in alterations of molecules in various types supports the usage of NGS in clinical settings, as it provides a cost- and time-effective way of detecting cancer. Tumor heterogeneity (evaluating different genes at the same time), along with the need for gene profiling, has increased the use of liquid biopsy, which is expected to propel market growth. Moreover, for various applications, such as prostate, breast, non-small-cell lung, colorectal, and ovarian cancer, liquid biopsy is used for diagnostic & screening, making it an important tool.

The increasing incidence of disease is propelling the demand for diagnosis of cancers at early stages. When cancer is detected early, it can be treated most effectively & efficiently. When cancer is discovered early and is contained to the organ of origin before it has a chance to spread, survival rates drastically increase, and it is more likely to be effectively cured. Early detection is crucial for lowering cancer-related mortality, especially through efficient screening programs. Overall, early detection increases patient survival rates by 5 to 10 times more than late detection. The 5-year cancer-specific survival rate is only 21% when cancer is discovered after it has spread, as opposed to 89% when it is found early & still localized.

Furthermore, the increasing number of initiatives by various organizations to raise awareness is a major reason for the growing demand for diagnostic products worldwide. Collaborations and partnerships undertaken by CDC, WHO, the National Cervical Cancer Coalition, the U.S. Preventive Services Task Force, & others are expected to drive market growth by increasing cervical cancer screening rates. In addition, major market players are undertaking initiatives to increase awareness about cervical, vulvar, and vaginal cancer, which is likely to encourage people to opt for screening at regular intervals. For instance, the U.S. FDA Oncology Center of Excellence launched the National Black Family Cancer Awareness campaign in 2021 with the aim to increase awareness and knowledge about cancer-related clinical trials and specimen donation for research among minority populations in the U.S.

Moreover, awareness among people about early diagnosis & available treatment options and advancements in treatments have substantially improved patient outcomes. According to the OECD, in 2020, about 2.7 million people in the EU were expected to be diagnosed with some form of cancer. Ireland, Belgium, Denmark, and the Netherlands are expected to exhibit a higher incidence. Cancer is the second-leading cause of mortality in Europe, after CVDs. An estimated 1.3 million people died due to cancer in 2020.

However, the high cost of diagnostic tests is anticipated to hamper the overall market growth. Diagnostic cancer tests are expensive, increasing the financial burden on families of patients. The government insurance framework is less well-defined in developing countries than in developed countries. Thus, the middle-class patient population who are uninsured cannot afford these tests. In addition, many private insurance players do not cover costs associated with diagnosis in developing countries. As a result, the high cost of diagnosis is limiting the adoption of screening tools, especially in developing countries. However, the scenario is expected to change in the coming years due to booming medical tourism in countries such as India and Malaysia, wherein healthcare treatments & diagnostic solutions are becoming affordable.

Market Characteristics & Concentration

The degree of innovation is high in the market, particularly in innovations such as liquid biopsy, Next-Generation Sequencing (NGS), and molecular imaging technologies. Liquid biopsy technology has emerged as a major development in the market, allowing the detection of cancer-related biomarkers from blood samples. This minimally invasive approach facilitates early detection, monitoring of treatment responses, and detection of recurrence. Companies like Guardant Health and Foundation Medicine are some of the leading players in this innovation, utilizing tests for circulating tumor DNA (ctDNA), circulating tumor cells (CTCs), and exosomes.

The merger and acquisition activities are moderate in the market, driven by strategic expansion, technological advancement, consolidation, and financial investment. Companies are actively adopting M&A to diversify their product portfolios, integrate innovative technologies, enhance market leadership, and accelerate research and development. This trend reflects the ongoing evolution of diagnostics and the growing importance of advanced biopsy solutions in improving detection and treatment.

The use of biopsy is largely impacted by regulations. Although they play a crucial role in ensuring patient safety and maintaining high-quality standards. However, they also present challenges, including increased costs, market access barriers, and variability across global markets.

In diagnosis, several alternatives to traditional biopsy procedures offer valuable options for reducing invasiveness and enhancing accuracy. Liquid biopsy is a leading alternative, analyzing biomarkers like circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) from blood samples, which facilitates early cancer detection and monitoring without the need for invasive tissue sampling. Advanced imaging techniques, such as PET and MRI, provide detailed insights into tumor characteristics and can sometimes reduce the immediate need for biopsy by guiding diagnosis through non-invasive methods.

The concentration of end-users in the market reflects the diversity of healthcare settings and specialties that utilize biopsy solutions for diagnosis. End-users in this market typically include hospitals, diagnostic laboratories, research institutions, and specialized centers. The concentration of these end-users is influenced by various factors, including the type of biopsy technology, the healthcare infrastructure in a region, and the specific needs of patients.

Product Insights

Kits and consumables dominated the market with a share of 61.82% in 2023 driven by the rising adoption and usage of kits for effective screening and diagnosis solutions in the market. Technological advancements in biopsy technologies are also contributing to market growth. Innovations such as advanced biopsy needles, specialized collection containers, and improved tissue preservation solutions are enhancing the efficiency and accuracy of biopsy procedures. Additionally, the trend toward personalized medicine, which often requires detailed molecular and genetic analysis, is increasing the need for advanced biopsy kits and consumables.

The instruments segment is expected to register the fastest CAGR of 9.33% during the forecast period. The growth of the segment is expected to be driven by the advancements in technology and increasing demand for precise diagnostic tools. This growth is largely driven by the rising incidence, which accelerates the need for advanced biopsy instruments used in detecting and analyzing tumors. Innovations in biopsy technologies, such as automated tissue processors, advanced imaging systems, and precision-guided biopsy needles, are enhancing the accuracy and efficiency of cancer diagnostics. Moreover, technological advancements, including the integration of digital pathology and robotics, are further accelerating market growth.

Type Insights

Tissue biopsies dominated the market with a share of 61.77% in 2023, driven by increasing cancer incidence and advancements in biopsy technology. The shift towards personalized medicine, which requires detailed molecular and genetic profiling of tumors, is increasing the need for sophisticated tissue biopsy methods. The development of minimally invasive biopsy techniques is also contributing to market growth by offering patients less discomfort and faster recovery times. The expansion of healthcare infrastructure and increased awareness about the importance of early detection are further boosting the demand for tissue biopsies.

The liquid biopsy segment is expected to register the fastest CAGR of 9.07% during the forecast period. Liquid biopsy is an innovative testing technology for the diagnosis of tumor-related genetic alteration. It has also been used to stratify tumors to provide appropriate treatment for precision oncology. For instance, in January 2023, Guardant Health received FDA approval for Guardant360 CDx, its liquid biopsy assay as companion diagnostics for diagnosis of ESR1 mutant breast cancer. These recent advancements, expansions, and innovations in the industry promoting the use of liquid biopsy are driving the market. Due to the advantages of liquid biopsy technologies, NGS or massive parallel is the fastest growing and evolving technology with increasing applications in various human diseases. An increase in alterations of molecules in various types supports the usage of NGS in clinical settings, as it provides a cost- and time-effective way of detecting.

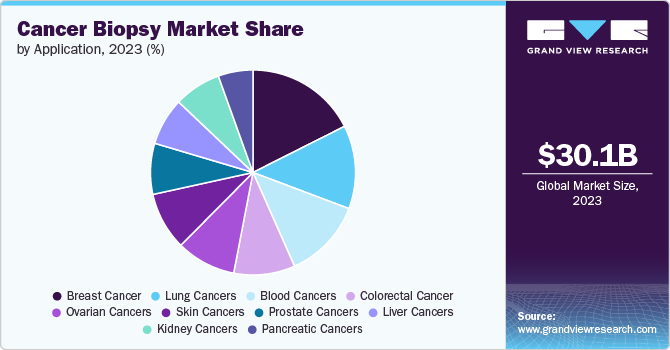

Application Insights

The breast cancer segment dominated the market with a share of 15.79% in 2023. Increasing R&D in advanced screening tools is anticipated to significantly boost the segment. A research study published in Scientific Reports in September 2019 studied a novel breast cancer screening test that combined the expression of MMP-1 or matrix metalloproteinase-1 and miR-21 expression in the urinary exosomes, which can help detect 95% of breast cancers without the development of metastasis. The study concluded that both markers provide specificity and sensitivity and, therefore, can be used for the screening. Rapid launch of new products is anticipated to boost market growth over the forecast period. In February 2023, NGeneBio launched an NGS-based breast cancer diagnostics test in Thailand.

The kidney cancers segment is expected to register the fastest CAGR of 10.34% during the forecast period. An increase in research activities conducted by various academic and research organizations is anticipated to boost segment growth in the near future. A research study conducted by the University of Michigan Rogel Cancer Center in April 2020 was aimed at identifying biomarkers for the diagnosis of kidney cancer. The researchers utilized next-generation RNA sequencing techniques to reveal Chromophobe Renal Cell Carcinoma’s (ChRCC) gene signature and tested for the expression of three biomarkers that are newly discovered for the diagnosis. Researchers from Ghent University collaborated with the University of Turku to develop a method for biomarker discovery of urological cancers.

Regional Insights

North America cancer biopsy market dominated the global market with the largest revenue share of 40.38% in 2023. The dominance of the region is attributed to the presence of advanced healthcare infrastructure and substantial healthcare expenditure in North America that are driving the widespread adoption of diagnostic technologies. In addition, a number of product launches and funding are further anticipated to drive market growth in the region. For instance, in February 2024, Freenome, a biotechnology company focused on developing blood tests for early detection, secured USD 254 million in funding from new and existing investors. This funding is expected to help Freenome advance its single-cancer and tailored Multicancer Early Detection (MCED)

U.S. Cancer Biopsy Market Trends

The cancer biopsy market in the U.S. is expected to grow over the forecast period due to the high cancer prevalence in the country and consequent rapid adoption of biopsies. Furthermore, rapid technological advancements, recent FDA approvals, and intense competition between companies are expected to boost market growth over the forecast period.

Europe Cancer Biopsy Market Trends

The cancer biopsy market in Europe accounted for a significant share in 2023. This can be attributed to the increase in the number of approvals by regulatory bodies, intense competition between companies to increase market share, rise in government initiatives, and improving reimbursement scenarios.

UK cancer biopsy market is growing primarily due to the presence of commercial partnerships between the government and key players for the routine use of cancer biopsies in the country.

The cancer biopsy market in France is expected to grow over the forecast period due to the strong presence of well-established and emerging product manufacturers, who are expected to adopt continuous organic and inorganic growth strategies to support the market.

Germany cancer biopsy market is expected to witness substantial growth owing to the increasing number of companies striving to enter the market and government-sponsored aid for developing these tests.

Asia Pacific Cancer Biopsy Market Trends

The cancer biopsy market in Asia Pacific is expected to witness the fastest CAGR over the projected period, driven by healthcare reforms. Some of the other factors contributing to market growth are increasing population, improving healthcare infrastructure, and entry of new players. Asia Pacific has a large population and a high prevalence of cancer. According to Global Cancer Statistics, the estimated number of new cases in Asia in 2022 was 10.5 million. Government initiatives, such as free screening for breast cancer, cervical cancer, & lung cancer, and improved collaborations between the government, research institutes, & companies for distribution & supply of these tests for screening cancers, have increased in the past few years.

China cancer biopsy market is expected to grow over the forecast period due to lifestyle changes, dietary habits, and an aging population.

The cancer biopsy market in Japan is expected to grow over the forecast period, driven by substantial government investments aimed at reducing incidence. Japan has a significantly aging population, with over 10% of its citizens aged 80 or older, making it consistently the world's oldest population.

Latin America Cancer Biopsy Market Trends

The cancer biopsy market in Latin America is growing owing to the increased prevalence of various types in the region. Several surveys by various government and nonprofit organizations revealed that overall cancer mortality in Latin America is almost twice that of high-income countries.

Brazil cancer biopsy market is expected to grow over the forecast period. The market has observed high growth in the adoption of cancer biopsy techniques owing to increasing collaborations of key market players and various initiatives being undertaken by various organizations for cancer care.

Middle East & Africa Cancer Biopsy Market Trends

The cancer biopsy market in the Middle East & Africa is witnessing significant growth opportunities, as the majority of the market is untapped due to the absence of structured screening programs in underdeveloped African economies has impeded early detection efforts.

Saudi Arabia cancer biopsy market is expected to grow over the forecast period, attributed to the increasing involvement of the government and the rising awareness about benefits of noninvasive diagnostic procedures.

Key Cancer Biopsy Company Insights

Some of the leading players operating in the market include QIAGEN, Illumina Inc., and Thermo Fisher Scientific, Inc. These players are involved in developing liquid biopsy technologies. These methods analyze circulating tumor DNA (ctDNA) or other biomarkers in blood samples, providing a less invasive alternative to traditional biopsies. This approach aims to facilitate early detection and ongoing monitoring with minimal discomfort for patients. Moreover, by using these advanced technologies, companies are able to obtain more detailed insights into the genetic mutations and characteristics of tumors.

CureMetrix, Tempus, and Inivata are some of the emerging market participants in the market. These players are collaborating with other major & local players to gain a competitive edge. These players focus on regional expansion by exploring possibilities to develop innovative diagnostics solutions. This expansion aims to make advanced biopsy technologies more accessible to a broader patient population.

Key Cancer Biopsy Companies:

The following are the leading companies in the cancer biopsy market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- Illumina, Inc.

- ANGLE plc

- BD (Becton, Dickinson and Company)

- Myriad Genetics, Inc.

- Hologic, Inc.

- Biocept, Inc.

- Thermo Fisher Scientific, Inc.

- Danaher

- F. Hoffmann-La Roche Ltd.

- Lucence Health Inc.

- GRAIL, Inc.

- Guardant Health Inc.

- Exact Sciences Corporation

- Freenome Holdings, Inc.

- Biodesix (Integrated Diagnostics)

- Oncimmune

- Epigenomics AG

- HelioHealth (Laboratory for Advanced Medicine)

- Genesystems, Inc. (Genesys Biolabs)

- Chronix Biomedical, Inc.

- Personal Genome Diagnostics Inc.

- Natera, Inc.

- Personalis Inc.

Recent Developments

-

In August 2024, Illumina, Inc. received approval for in vitro diagnostic (IVD) TruSight Oncology (TSO), cancer biomarker tests with its two companion diagnostic indications to rapidly match patients to targeted therapies.

-

In June 2024, Guardant Health, Inc. announced the launch of updated version of Guardant360 TissueNext test with an expanded identification of genes in tissue sample to 498. This helps enable oncologists to identify treatment strategies and targeted therapies for patients with advanced cancer.

-

In May 2024, VESICA HEALTH, INC. announced the launch of AssureMDX test as LDT for diagnosis of bladder cancer.

Cancer Biopsy Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 32.32 billion |

|

Revenue forecast in 2030 |

USD 51.61 billion |

|

Growth Rate |

CAGR of 8.11% from 2024 to 2030 |

|

Actual Data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait |

|

Key companies profiled |

QIAGEN, Illumina, Inc., ANGLE plc, BD (Becton, Dickinson and Company), Myriad Genetics, Inc., Hologic, Inc., Biocept, Inc., Thermo Fisher Scientific, Inc., Danaher, F. Hoffmann-La Roche Ltd., Lucence Health Inc., GRAIL, Inc., Guardant Health Inc., Exact Sciences Corporation, Freenome Holdings, Inc., Biodesix (Integrated Diagnostics), Oncimmune, Epigenomics AG, HelioHealth (Laboratory for Advanced Medicine), Genesystems, Inc. (Genesys Biolabs), Chronix Biomedical, Inc., Personal Genome Diagnostics Inc., Natera, Inc., Personalis Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Cancer Biopsy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cancer biopsy market report based on product, type, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

Kits and Consumables

-

Services

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tissue Biopsies

-

Needle Biopsies

-

Surgical Biopsies

-

-

Liquid Biopsies

-

Fine Needle Aspiration (FNA)

-

Core Needle Biopsy (CNB)

-

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancers

-

Lung Cancers

-

Prostate Cancers

-

Skin Cancers

-

Blood Cancers

-

Kidney Cancers

-

Liver Cancers

-

Pancreatic Cancers

-

Ovarian Cancers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cancer biopsy market size was estimated at USD 30.05 billion in 2023 and is expected to reach USD 32.32 billion in 2024.

b. The global cancer biopsy market is expected to grow at a compound annual growth rate of 8.11% from 2024 to 2030 to reach USD 51.61 billion by 2030.

b. The tissue biopsy segment dominated the cancer biopsy market with a share of 61.77% in 2023. Tissue biopsy is the only test that confirms the onset of lung cancer in patients and is a preferred biopsy technique across the diagnosis of different cancer types.

b. Some key players operating in the cancer biopsy market include Illumina, Inc., ANGLE Plc, BD (Becton, Dickinson, And Company), Myriad Genetics, Hologic, Inc., Biocept, Inc., Thermo Fisher Scientific, Inc. (Qiagen N.V.), Danaher, and F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the cancer biopsy market growth include the emerging significance of cancer biopsy and tissue sectioning in providing important information with respect to oncology-based molecular profiling coupled with the advent of non-invasive liquid biopsies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."