- Home

- »

- Plastics, Polymers & Resins

- »

-

Canada Plastic Packaging Market Size, Share, Report, 2030GVR Report cover

![Canada Plastic Packaging Market Size, Share & Trends Report]()

Canada Plastic Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (PE, PET, PS, PP, Bioplastic), By Product, By Type , By Technology, By Application, By Application Channel, And Segment Forecasts

- Report ID: GVR-4-68039-981-2

- Number of Report Pages: 144

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Plastic Packaging Market Trends

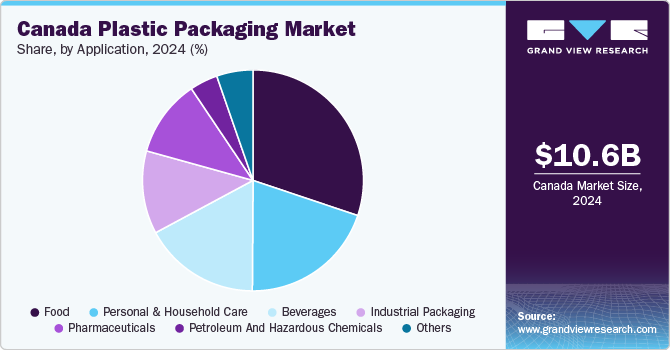

The Canada plastic packaging market size was estimated at USD 10.63 billion in 2024 and is expected to grow at a CAGR of 5.3% from 2025 to 2030. The market growth is driven by various factors, including consumer behavior, environmental awareness, technological advancements, and industry-specific requirements. A primary driver is the increased demand for convenience among consumers, particularly in food, beverage, and personal care products.

Canadian consumers increasingly value on-the-go packaging solutions, which has driven the adoption of lightweight, flexible, and resealable plastic packaging. This trend is particularly evident in urban areas, where busy lifestyles prioritize packaging that supports ease of transport and usage. Moreover, the growth in e-commerce has spurred demand for plastic packaging solutions that provide product protection during shipping, fueling further growth in the sector.

Sustainability is another crucial driver in the Canadian plastic packaging market. As environmental consciousness grows among both consumers and regulatory bodies, there is a push for eco-friendly plastic packaging options. Initiatives from both government and private sectors, such as the Canadian Plastic Pact, target a circular economy approach that encourages the recycling and reuse of plastics. This trend not only influences material choices but also incentivizes packaging manufacturers to innovate with eco-friendly alternatives, such as bioplastics, which have a lower environmental footprint than traditional plastics.

Advancements in technology are also propelling the plastic packaging market in Canada. Technological innovations in materials science have led to the development of high-performance plastics that offer improved barrier properties, extended shelf life, and enhanced product safety. Furthermore, digital printing and other customization technologies enable brands to create distinctive, high-quality packaging designs tailored to various consumer segments, boosting brand appeal and enhancing customer engagement.

The growing food and beverage industry in Canada further drives the demand for plastic packaging. As the Canadian food industry continues to expand with an emphasis on processed and ready-to-eat food products, there is a consistent demand for durable and hygienic packaging solutions. Plastic packaging is essential in food preservation, shelf life extension, and reducing food waste, which resonates well with consumers and retailers. Additionally, there is a notable shift toward single-serve packaging formats, particularly for beverages and snack products, which aligns with the lifestyle preferences of Canadian consumers, further boosting the market.

Material Insights

Based on material, the polyethylene (PE) segment accounted for over 32.0 % of the revenue share in the year 2024 owing to the packaging industry in Canada is highly dependent on polyethylene due to the increasing demand for packaged goods, surging trade activities, and growing dependency of customers on online delivery of the goods.

Polyethylene terephthalate (PET) is a major component in Canada’s plastic packaging market due to its versatility, durability, and recyclability. PET is widely used for packaging in the food, beverage, personal care, and pharmaceutical sectors because of its strong barrier properties, which protect contents from contamination while extending shelf life. The clear, lightweight nature of PET also makes it an attractive option for brands aiming to showcase product quality, especially in beverage packaging for items like water, juices, and carbonated drinks.

Product Insights

Based on product, rigid product dominated the market with a over 56.0 % market share in 2024 owing to its applicability and functionality of offering excellent protection to the packaged goods and products. Plastics are long polymer chains making them durable and extremely difficult to break. The rise in the demand for rigid plastic packaging from the healthcare industry to prevent contamination of medicines and from the food & beverage industry is projected to accelerate the growth of the segment over the forecast period.

The flexible product is is expected to grow at a revenue CAGR of 3.1% over the forecast period. Flexible packaging offers convenience to consumers and occupies less retail space, which drives its popularity as a packaging solution. In addition, flexible packaging helps reduce food wastage. Rising demand for bio-based PLA films in bakery, confectionery, food, and snack packaging applications, on account of their recyclability and biodegradability, is anticipated to be a major factor agumenting the growth of the segment over the forecast period.

Type Insights

Based on type, packaging is segmented into primary, secondary, and tertiary. The primary packaging segment accounted for a revenue share of over 49.0% in 2024 and is projected to maintain its dominance throughout the forecast period. The factors attributing to the market growth are increasing demand for processed food products and medicines and increasing adoption of personal care products.

Secondary packaging serves as an additional layer around primary packaging, providing added protection and often playing a role in product grouping and branding. In Canada, secondary plastic packaging typically includes items such as shrink-wrapped cases, plastic overwraps, and trays used to bundle multiple primary packaged units, especially in sectors such as food and beverage and consumer goods.

Tertiary packaging is mainly focused on logistics and transportation, used to protect products during shipping and storage. In Canada, common tertiary plastic packaging includes pallets, stretch wraps, and plastic crates that support bulk transport across supply chains. Tertiary packaging is essential for maintaining the integrity of products from warehouses to retail points and ultimately to consumers.

Technology Insights

Based on technology, extrusion dominated the product segment with a over 39.0% revenue share in 2024. Extrusion is a common plastic processing method where plastic materials are melted and shaped into continuous profiles, such as films, sheets, or tubes. Extrusion offers high-speed production and is cost-effective, especially for creating lightweight packaging with minimal material waste.

Injection molding technology is essential for manufacturing rigid plastic containers, lids, caps, and intricate packaging components. The injection molding segment is driven by demand for complex and durable packaging structures.

Blow molding is a technology is highly efficient for creating large volumes of lightweight containers, especially for liquids and beverages, and is versatile in producing various container sizes and shapes for different industries. Rising demand for bottled beverages and personal care products is a key driver for blow molding.

Thermoforming technology is widely used for producing rigid trays, containers, lids, and clamshell packaging, ideal for food and retail applications where product visibility is important. The growth of ready-to-eat meals, takeout, and convenience foods drives the demand for thermoformed packaging.

Application Insights

Based on the application, the food packaging application commanded the largest share of over 30.0% in the year 2024. The demand for plastic packaging in the food industry is driven by consumer preference for convenience and pre-packaged foods. Increased reliance on e-commerce for grocery delivery has also spiked demand, as plastic provides lightweight and durable options that withstand transport.

In beverage industry, plastic is a popular choice for packaging, including bottled water, juices, carbonated drinks, and sports drinks. PET is the most commonly used plastic in this segment due to its strength, transparency, and recyclability. Plastic bottles and containers are convenient for on-the-go consumption and maintain product integrity, especially for carbonated beverages.

In personal and household care industry, plastic packaging products are available in the form of shampoo bottles, detergent containers, and cleaning product sprays. The versatility and cost-effectiveness of plastic make it an ideal choice for these products, which require packaging that is both resilient and user-friendly. Additionally, plastics offer creative design options, which are valuable for brands in this highly competitive market.

In pharmaceutical industry, plastic packaging products are available in the form of blister packs, bottles, and sachets. The materials used in pharmaceutical plastic packaging are designed to meet stringent regulatory standards to protect medications from contamination, moisture, and UV exposure.

Application Channel Insights

Retail emerged as a dominating application channel for Canada plastic packaging. This segment caters directly to consumer-facing products, including food and beverage packaging, personal care products, and household items. This segment is designed with high appeal, durability, and convenience in mind, given the emphasis on shelf visibility and consumer interaction. The retail segment is driven by evolving consumer preferences toward convenience, sustainability, and visually appealing packaging.

The industrial segment of Canada’s plastic packaging market primarily serves sectors such as manufacturing, logistics, and pharmaceuticals. The industrial segment’s growth is fueled by an increase in e-commerce, manufacturing, and logistics activities across Canada. The need for reliable, durable packaging for safe product handling and transportation, particularly in the pharmaceutical and food processing industries, is a significant driver for this segment in the market.

Key Canada Plastic Packaging Company Insights

The plastic packaging market in Canada is highly competitive. Increasing regulatory pressures to reduce single-use plastics and adopt recyclable materials have further intensified competition, as companies invest in innovative solutions such as biodegradable plastics and advanced recycling technologies to capture market share and comply with Canada’s evolving environmental standards. The market's competitive dynamics are shaped by continuous investments in technology, product differentiation, and eco-friendly materials, as well as partnerships within the value chain to enhance sustainability practices.

-

In August 2024, CMG Plastics announced a significant expansion of its Canadian operations in Brantford, Ontario, aimed at meeting increasing customer demand in the plastic packaging industry. The new facility can accommodate up to 11 additional manufacturing lines, allowing for greater flexibility and scalability in operations

-

In March 2024, Coca-Cola North America introduced new lightweight PET bottle designs for its sparkling beverage portfolio in the U.S. and Canada, marking the first redesign in a decade. The updated bottles, which include 12-, 16.9-, and 20-ounce sizes of popular brands such as Coca-Cola, Sprite, and Fanta, now weigh 18.5 grams, down from 21 grams, due to advancements in modeling technology that maintain quality while reducing material usage. This initiative is part of Coca-Cola's broader sustainability goals, aiming to cut new plastic use by around 800 million bottles by 2025.

-

In December 2021, Jones Healthcare Group introduced sustainable medication packaging products including FlexRx, FlexRx One, and Qube Pro Reseal blister packs. These blister packs are manufactured using Bio-PET, a medically approved bioplastic produced by Good Natured Products, Inc. These packaging solutions aim to assist pharmacies in minimizing their environmental impact and adopting more sustainable practices.

Key Canada Plastic Packaging Companies:

- Amcor plc

- Berry Global, Inc.

- CCL Industries

- Coveris

- Sealed Air

- Sonoco Products Company

- WINPAK Ltd.

- Alpha Packaging

- Constantia Flexibles

- Mondi

- Gerresheimer AG

- Silver Spur Corporation

- Greif

- Transcontinental Inc.

- ALPLA

Canada Plastic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.06 billion

Revenue forecast in 2030

USD 13.76 billion

Growth rate

CAGR of 5.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, type, technology, application, applications channel

Country Scope

Canada

Key companies profiled

Amcor plc; Berry Global, Inc.; CCL Industries; Coveris; Sealed Air; Sonoco Products Company; WINPAK LTD.; Alpha Packaging; Constantia Flexibles; Mondi; Gerresheimer AG; Silver Spur Corporation; Grief; Transcontinental Inc.; ALPLA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Canada Plastic Packaging Market Report Segmentation

This report forecasts volume & revenue growth at the country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada plastic packaging market report on the basis of material, product, type, technology, application, and application channel:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

PE

-

HDPE

-

LDPE

-

LLDPE

-

-

PET

-

PS

-

PP

-

Bioplastic

-

PLA

-

Starch Blend

-

PHA

-

Biodegradable Polyester

-

Others

-

-

Others

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Bottles Jars

-

Cans

-

Trays & Containers

-

Caps & Closures

-

Drums

-

IBC

-

Pails

-

Others

-

-

Flexible

-

Wraps and Films

-

Bags

-

Pouches

-

FIBC

-

Others

-

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

Tertiary

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Extrusion

-

Blow Moldings

-

Thermoforming

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food

-

Beverages

-

Industrial Packaging

-

Pharmaceuticals

-

Personal & Household Care

-

Petroleum and Hazardous Chemicals

-

Others

-

-

Application Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Retail

-

In-store

-

E-commerce

-

-

Industrial

-

Frequently Asked Questions About This Report

b. The Canadian plastic packaging market was estimated at USD 10.63 billion in 2024 and is expected to reach USD 11.06 billion in 2025.

b. The Canada plastic packaging market is expected to grow at a compound annual growth rate of 5.3% from 2025 to 2030 to reach USD 13.76 billion by 2030.

b. The food segment dominates the Canada plastic packaging market with a revenue share of 30.27% in 2024 owing to the presence of a large number of food manufacturers, rising dependency on processed food, and increasing trend of snacking

b. Some key players operating in the Canada plastic packaging market include Amcor plc; Berry Global, Inc.; CCL Industries; Coveris; Sealed Air; Sonoco Products Company; WINPAK LTD.; Alpha Packaging; Constantia Flexibles Group GmbH; Gerresheimer AG; Mondi plc; Silver Spur Corporation; Greif; Transcontinental Inc; ALPLA.

b. Expanding key end-use industries, increasing spending on personal care products and rising demand for conventional and efficient packaging solution.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.