- Home

- »

- Advanced Interior Materials

- »

-

Canada Outdoor Air Source Heat Pump Market, Report 2030GVR Report cover

![Canada Outdoor Air Source Heat Pump Market Size, Share & Trends Report]()

Canada Outdoor Air Source Heat Pump Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Air to Air, Air to Water), By Product (Air Source Heat Pump (ASHP), Cold Climate ASHP (CC-ASHP)), By Application (Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-085-2

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The Canada outdoor air source heat pump market size was estimated at USD 1,661.9 million in 2024 and is expected to grow at a CAGR of 7.5% from 2025 to 2030.Government incentives and rebates aimed at reducing greenhouse gas emissions are encouraging the adoption of air source heat pumps, making them more financially attractive for homeowners and businesses alike. In addition, increasing awareness of energy efficiency and sustainability is prompting consumers and businesses to seek alternative heating solutions, leading to a rising demand for heat pumps that utilize renewable energy.

The advancement of technology in heat pump systems has also contributed to improved performance, reliability, and affordability, making these systems more appealing to a broader audience.

Drivers, Opportunities & Restraints

The growing trend towards electrification and the shift away from fossil fuels in the heating sector are aligning well with the capabilities of outdoor air source heat pumps, positioning them as a viable and eco-friendly alternative for Canadian consumers.

While these systems can offer long-term savings, the upfront investment can be a barrier for some consumers. In addition, awareness and understanding of how these systems operate may be limited, leading to hesitancy in adoption. Seasonal performance variability can also be a concern, as extreme cold temperatures may affect efficiency, prompting potential users to seek alternative heating solutions.

Increasing regulatory support for energy efficiency and decarbonization presents a significant avenue for growth. As governments push for cleaner energy solutions, more incentives and subsidies are likely to emerge, making heat pumps more accessible

Type Insights

“The demand for the Air to Water segment is expected to grow at a significant CAGR of 8.6% from 2025 to 2030 in terms of revenue”

Air to Water systems are driven by their compatibility with hydronic heating systems, such as underfloor heating and radiators, which are increasingly popular for providing comfortable and efficient heating in residential and commercial spaces. Their ability to deliver consistent performance, along with rising consumer demand for energy-efficient solutions, further supports their growth.

In 2024, the Air to Air segment represented 84.5% of the market's revenue. The Air to Air segment is gaining traction due to its ability to provide both heating and cooling efficiently. Its relatively lower installation costs and ease of retrofitting into existing homes make it appealing for homeowners looking for versatile climate control solutions.

Product Insights

“The growth of the Air Source Heat Pump (ASHP) segment is expected to grow at a rapid CAGR of 11.1% from 2025 to 2030 in terms of revenue”

The demand for Air Source Heat Pumps (ASHP) is driven by their versatility and ability to work efficiently in a variety of climates. Increasing awareness of their energy efficiency and lower operational costs compared to traditional heating systems is fueling their growth, along with supportive government incentives.

The Cold Climate ASHP (CC-ASHP) segment accounted for 88.3% of the revenue share in 2024. Cold Climate ASHPs (CC-ASHP) are gaining traction due to advancements in technology that enhance their efficiency in low temperatures. As more consumers and businesses seek reliable heating options in colder regions, these systems are positioned as effective solutions that can operate efficiently even in harsh winter conditions, making them attractive to homeowners in colder climates.

Size Insights

“The growth of the above 48,000 BTU segment is expected to grow at a fast-paced CAGR from 2025 to 2030 in terms of revenue”

The segment for systems above 48,000 BTU is driven by the increasing demand for heating solutions in larger residential and commercial spaces. These systems are particularly appealing for applications such as multi-family buildings and larger commercial establishments, where efficient heating is crucial. Their capacity to provide significant heating output while maintaining energy efficiency makes them attractive in regions with colder climates.

The 24,000 to 48,000 BTU segment is driven by the versatility and affordability of these systems, making them suitable for medium-sized residential properties and small commercial applications. They strike a balance between performance and cost, appealing to homeowners looking for efficient heating solutions without the high investment of larger systems. In addition, as energy efficiency becomes a priority for consumers, this size range offers a practical option for those seeking to reduce their energy bills while maintaining comfort in their living or working spaces.

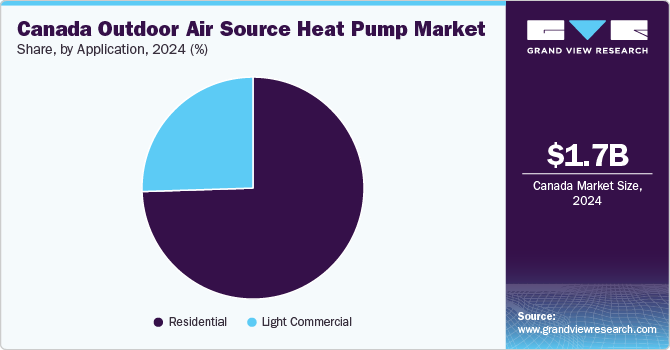

Application Insights

“The growth of the residential segment is expected to grow at a fast-paced CAGR of 7.5% from 2025 to 2030 in terms of revenue”

In the residential segment, a significant driver of demand for outdoor air source heat pumps is the growing consumer interest in energy efficiency and sustainability. Homeowners are becoming more aware of the environmental impact of their energy consumption, leading to a shift towards eco-friendly solutions. This heightened awareness is accompanied by a desire to reduce carbon footprints and contribute to climate change mitigation, making air source heat pumps an attractive option.

In 2024, the light commercial segment accounted for 25.5% of the market share in 2023. In the light commercial sector, the demand is driven by the need for energy-efficient heating and cooling solutions that can reduce operational costs. Businesses are increasingly focused on sustainability and reducing their carbon footprint, which positions air source heat pumps as an appealing option for maintaining comfortable indoor environments while lowering energy consumption.

Regional Insights

British Columbia Outdoor Air Source Heat Pump Market Trends

The outdoor air source heat pump market in British Columbia is expected to grow at a significant CAGR over the forecast period. In British Columbia, the market for outdoor air source heat pumps is driven by a strong focus on sustainability and energy efficiency, aligned with the province's ambitious climate goals. The government offers various incentives and rebates aimed at promoting renewable energy technologies, making heat pumps more financially accessible to homeowners and businesses. The region's mild coastal climate enhances the appeal of air source heat pumps, as they can operate efficiently year-round without the extreme performance concerns seen in colder areas.

Ontario Outdoor Air Source Heat Pump Market Trends

The market in Ontario accounted for a substantial market share in 2024. In Ontario, the market is supported by urbanization and a growing emphasis on energy-efficient technologies in both residential and commercial buildings. Government incentives and programs promoting the adoption of renewable energy solutions further enhance the attractiveness of air source heat pumps, making them a viable choice for those looking to invest in sustainable heating solutions. In addition, the province's commitment to reducing greenhouse gas emissions aligns well with the growing demand for efficient heating options.

Key Canada Outdoor Air Source Heat Pump Company Insights

Some of the key players operating in the Canada Outdoor Air Source Heat Pump market include Carrier and DAIKIN INDUSTRIES Ltd.

-

Carrier’s business segments include refrigeration, HVAC, and fire & security. It offers heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and food service sectors.

-

DAIKIN INDUSTRIES Ltd. primarily manufactures and sells air conditioning systems and chemical products. The company owns 313 consolidated subsidiaries worldwide and offers air-conditioning systems, room heating & heat pumps, hot water supply systems, room air conditioning systems, packaged air-conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key Canada Outdoor Air Source Heat Pump Companies:

- Carrier

- Daikin Industries Ltd.

- Ingersoll-Rand Plc (Trane)

- Robert Bosch GmbH

- Danfoss

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- Fujitsu

- LG Electronics, Inc.

- Rheem Manufacturing Company

- Gree Comfort

- Samsung

- Lennox International

- Hitachi, Ltd.

- Johnson Controls, Inc.

Recent Developments

-

In March 2024, LG Electronics Canada (LG Electronics, Inc.) launched the LG R32 Air-to-Water Heat Pump Monobloc at the Canadian Mechanical and Plumbing Expo (CMPX) in Toronto. This innovative HVAC system simplifies installation by combining hydronic components and operates quietly at 49dB. It efficiently provides hot water for heating, maintaining full capacity even at -15°C, making it ideal for colder climates. Designed for energy efficiency, it aims to meet the growing demand for electric heating solutions. Attendees can explore the product at booth #845 during CMPX.

-

In April 2024, York, a brand of Johnson Controls, Inc. introduced a new 575-volt high-efficiency air-to-water heat pump designed for commercial applications. This innovative system enhances energy efficiency and reduces operational costs, making it suitable for various building types. It features advanced controls for optimal performance and can operate effectively in diverse climates.

Canada Outdoor Air Source Heat Pump Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,661.9 million

Revenue forecast in 2030

USD 2,526.1 million

Growth rate

CAGR of 7.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, product, size, application, region

Key companies profiled

Carrier; Daikin Industries Ltd.; Ingersoll-Rand Plc (Trane); Robert Bosch GmbH; Danfoss¸Mitsubishi Electric Corporation; Panasonic Holdings Corporation; Fujitsu, LG Electronics, Inc.; Rheem Manufacturing Company; Gree Comfort. Samsung; Lennox International; Hitachi, Ltd.; Johnson Controls, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Outdoor Air Source Heat Pump Market Report Segmentation

This report forecasts volume & revenue growth at regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Canada outdoor air source heat pump market report based on type, product, size, application, and region:

-

Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Air to Air

-

Unitary system

-

Ductless system

-

-

Air to Water

-

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Air Source Heat Pump (ASHP)

-

Hybrid

-

Electric

-

-

Cold Climate ASHP (CC-ASHP)

-

Hybrid

-

Electric

-

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Light Commercial

-

-

Size Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

6,000 BTU

-

9,000 BTU

-

12,000 BTU

-

15,000 BTU

-

15,001 to 24,000 BTU

-

24,000 to 48,000 BTU

-

Above 48,000 BTU

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Ontario

-

Quebec

-

Maritimes (NB, PEI, NFL, NS)

-

British Columbia

-

Alberta

-

Manitoba

-

Saskatchewan

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Light Commercial

-

-

Size Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

6,000 BTU

-

9,000 BTU

-

12,000 BTU

-

15,000 BTU

-

15,001 to 24,000 BTU

-

24,000 to 48,000 BTU

-

Above 48,000 BTU

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Ontario

-

Quebec

-

Maritimes (NB, PEI, NFL, NS)

-

British Columbia

-

Alberta

-

Manitoba

-

Saskatchewan

-

Frequently Asked Questions About This Report

b. The Canada Outdoor Air Source Heat Pump market size was estimated at USD 1,661.9 million in 2024 and is expected to be USD 1,763.5 million in 2025.

b. The Canada outdoor air source heat pump market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030 to reach USD 2,526.1 million by 2030.

b. The air to air segment dominated the Canada outdoor air source heat pump market with a revenue share of 84.5% in 2024. The increasing emphasis on energy efficiency and sustainability is leading consumers and businesses to seek alternatives to traditional heating systems. Government initiatives and incentives aimed at reducing greenhouse gas emissions are making air source heat pumps more financially accessible, encouraging adoption across various demographics.

b. Some of the key players operating in the Canada outdoor air source heat pump market include Carrier, Daikin Industries Ltd., Ingersoll-Rand Plc (Trane), Robert Bosch GmbH, Danfoss¸Mitsubishi Electric Corporation, Panasonic Holdings Corporation, Fujitsu, LG Electronics, Inc., Rheem Manufacturing Company, Gree Comfort. Samsung, Lennox International, Hitachi, Ltd., and Johnson Controls, Inc.

b. The growth of the Canada outdoor air source heat pump market is driven by increasing awareness of energy efficiency and sustainability, along with government incentives that make these systems more financially attractive. Fluctuating energy prices encourage investment in efficient heating solutions, while advancements in technology improve performance and affordability. Additionally, the trend towards electrification and reduced reliance on fossil fuels enhances the appeal of air source heat pumps as eco-friendly alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.