Canada Nutraceuticals Market Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Foods, Functional Beverages), By Ingredient, By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-213-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Canada Nutraceuticals Market Size & Trends

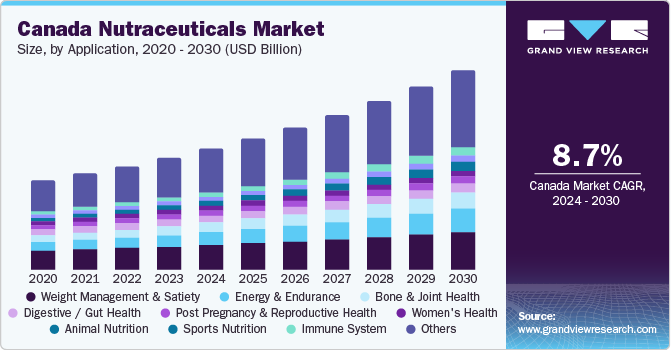

The Canada nutraceuticals market size was estimated at USD 7.87 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2030. Rising awareness of nutritional supplements among working professionals in Canada for maintaining the balanced nutrition in human body is expected to promote the consumption of dietary supplements. In addition, high adoption rates for herbal medicines among individuals in the Canada, on account of rising concerns over hazardous effects associated with conventional pharma drugs, are expected to contribute to the market growth over the forecast period.

The nutraceutical market is anticipated to witness considerable growth over the next years owing to their increasing consumption for the prevention of diseases and growing health consciousness among the population. The increased usage of internet has resulted in the consumer being more knowledgeable about chronic diseases and the preventive methods that include the consumption of nutraceuticals. Recently, consumers have turned their attention towards nutraceuticals manufactured from natural ingredients or by the usage of natural methods.

The technological progress in the field of nutraceuticals involves heavy spending on research & development. Research & development costs may involve clinical trials or research on products that adhere to the food regulations of the respective country. Nutraceutical manufacturers need to comply with food regulations to obtain feasible returns on the money spent on developing a product.

Canada nutraceuticals market accounted for the share of 8.7% of the global nutraceuticals market in 2023. Rising obesity levels and lifestyle-related diseases on account of their dietary habits, high disposable income, and the availability of several processed & ready-to-eat foods, which are not necessarily always good for consumer health. The demand for functional food has been continuously growing, which can provide numerous health benefits beyond basic nutrition. The functional food includes whole, fortified, enriched, or enhanced foods with a potentially beneficial effect on health when consumed as part of a varied diet on a regular basis at effective levels.

The increasing trend among consumers to alter dietary habits is expected to boost the demand for nutraceuticals. The consumer belief that an improper diet results in increasing pharmaceutical spending is anticipated to boost the demand for nutraceuticals, which, in turn, is projected to help the governments in terms of low expenditure on healthcare as well as social security costs.

Market Concentration & Characteristics

The Canada nutraceuticals industry is characterized high degree of innovation owing rapid technological advancements and evolving consumer preferences for healthy supplements. Rise in technological advancements and growing number of innovations influenced the adoption of AI, which will enable more personalized solutions based on dietary and health data of a consumer. Therefore, AI is expected to play an important role in the growth of nutraceuticals.

The industry is Under Canadian law, a nutraceutical can either be marketed as a food or as a drug; the terms "nutraceutical" and "functional food" have no legal distinction, referring to "a product isolated or purified from foods that are generally sold in medicinal forms not usually associated with food and is demonstrated to have a physiological benefit or provide protection against chronic disease."

End-user concentration is a significant factor in the Canada nutraceuticals industry. Growing health concerns among consumers and increasing awareness about nutraceuticals are expected to drive industry growth. Increasing aging population, rising spending on healthcare products, and changing lifestyles have further enhanced the growth of the market.

Ingredient Insights

The probiotic ingredients accounted for the revenue share of 24.7% in 2023.Rising demand for food components providing digestive and immune health benefits. These nutraceutical ingredients are incorporated in food items to yield strain-specific benefits related to their interactions with the gastrointestinal tract (GI). Consumers are widely consuming prebiotics & probiotics to enhance the gut and systemic immune system functions.

Product Insights

The functional foods held the share of 37.6% in 2023. Several benefits associated with functional foods such asregulating the immune system & blood lipids, fighting fatigue, and providing nutritional supplements, are anticipated to boost segment’s growth. The companies in the country are extensively involved in developing and launching new products in the market. For instance, in January 2020, Nestlé formed a joint venture with Burcon and Merit Functional Foods. This joint venture is expected to enhance Nestlé’s plant-based food & beverage products with functional plant proteins. Therefore, collaborations by the key companies with raw material suppliers inthe country are expected to drive new product launches in the market, which, in turn, are likely to contribute to functional food and functional beverage market growth over the forecast period.

The dietary supplements market is projected to grow at a CAGR of 9.1% from 2024 to 2030. Dietary supplements are manufactured products in the form of powder, capsules, tablets, and soft gels that are intended to supplement the traditional diet and are consumed orally.Growing health awareness among people is expected to boost the demand for dietary supplements. Increasing demand for health & wellness products is expected to further drive the market over the forecast period.

Application Insights

The weight management & satiety application held a revenue share of 20.5% in 2023. Increase in number of obese population in the country coupled with lack of physical activities is anticipated to boost segment’s growth. Hectic lifestyle and lack of proper diet is responsible for obesity and other diseases. In order to follow health and active lifestyle weight management plays a crucial role.

The men’s health nutraceuticals market is expected to grow at a CAGR of 15.6% from 2024 to 2030. Rise in number of male population and growing incidence of chronic disease, hearth attack and other diseases. Increasing demand for healthy life and diet in the region is anticipated to boost segment growth.

Key Canada Nutraceuticals Company Insights

Some of the key players operating in the market include Cargill, Incorporated, ADM, and DuPont de Nemours, Inc.

-

DuPont de Nemours, Inc. multinational conglomerate delivering a wide range of products and services to diverse industries with subsidiaries in over 70 countries and manufacturing units in around 40 countries. The company operates via five business segments, namely Nutrition & Biosciences, Electronics & Imaging, Transportation & Industrial, Safety & Construction, and Non-Core.

-

ADM is a public company and trades under the symbol ADM on the New York Stock Exchange (NYSE). The company operates through its four reportable segments, namely origination, carbohydrate solutions, oilseeds, and nutrition. Through its origination segment, the company procures, stores, processes, and transports agricultural commodities including corn, oilseeds, milo, wheat, rice, barley, and oats.

Nestlé, General Mills, Inc., and Innophos, Inc. some of the others participants in Canada nutraceuticals market.

-

Innophos, Inc. offers specialty ingredient solutions for health, food, nutrition, and industrial markets. It was founded in 2004 and has its headquarters in New Jersey, U.S. The company has its manufacturing operations across the U.S., Mexico, China, and Canada. It has its expertise in technology and science and formulates mineral, phosphate, botanical, and enzyme-based ingredients to offer affordable, tasty, and healthy food products to consumers.

-

General Mills, Inc. is a multinational producer and marketer of branded consumer products. It was incorporated in 1928 and is headquartered in Minnesota, U.S. As of 2019, the company manufactures its products in over 13 countries and markets them in more than 100 countries. The brand portfolio of the company comprises over 100 leading brands of the U.S.

Key Canada Nutraceuticals Companies:

- Cargill Incorporated

- ADM

- DuPont de Nemours, Inc.

- Nestlé

- General Mills, Inc.

- Innophos, Inc.

- W.R. Grace & Co.

- Amway Corp.

- Alva-Amco

- Avrio Health L.P

- Abbott Laboratories

- Pfizer Inc.

Recent Developments

-

In February 2020, ADM expanded the production of non-GMO soy protein concentrate in its Europoort facility, Netherlands, to meet the growing consumer demand for plant-based non-GMO proteins.

-

In January 2020, Nestlé acquired Zenpep to expand and strengthen its nutrition business, especially digestive nutrition segment.

Canada Nutraceuticals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.52 billion |

|

Revenue forecast in 2030 |

USD 14.03 billion |

|

Growth rate |

CAGR of 8.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ingredient, product, application |

|

Country scope |

Canada |

|

Key companies profiled |

Cargill Incorporated; ADM; DuPont de Nemours, Inc.; Nestlé; General Mills, Inc.; Innophos, Inc.; W.R. Grace & Co.; Amway Corp.; Alva-Amco; Avrio Health L.P; Abbott Laboratories; Pfizer Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Canada Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada nutraceuticals market report based on ingredient, product, and application:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Aloe vera

-

Amino acids

-

Botanical Ingredients

-

Ashwagandha

-

Curcumin

-

Ginseng

-

Hemp

-

Others

-

-

Cannabidiol (CBD)

-

Carbohydrates

-

Carnitine

-

Food Color

-

Carotenoids

-

Astaxanthin

-

Lutein

-

Lycopene

-

Other carotenoids (Zeaxanthin, Betacarotene)

-

-

Spirulina

-

Collagen

-

Colostrum

-

Cultures and fermentation starters

-

Dairy ingredients

-

Emulsifiers

-

Enzymes

-

Essential oils

-

Fat replacers

-

Fats and oils

-

Fibers

-

Flavors

-

Fruit and vegetable products

-

Glucosamine / Chondroitin

-

Isoflavones

-

Juices and concentrates

-

Krill

-

Lipids / Fatty Acids

-

Marine ingredients

-

Minerals

-

Calcium

-

Iron

-

Magnesium

-

Selenium

-

Others

-

-

Omega-3s

-

Marine Derived

-

Plant-derived

-

-

Prebiotics

-

Probiotics

-

Proteins

-

Sweeteners

-

Stevia

-

Monkfruit

-

Others (Honey, sucrose, fructose, etc.)

-

-

Vitamins

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin E

-

Vitamin K

-

-

Whey proteins

-

Other

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary supplements

-

Functional foods

-

Functional beverages

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Allergy & intolerance

-

Animal nutrition

-

Healthy ageing

-

Bone & joint health

-

Cancer prevention

-

Children's health

-

Cognitive health

-

Diabetes

-

Digestive / Gut health

-

Energy & endurance

-

Eye health

-

Heart health

-

Immune system

-

Infant health

-

Inflammation

-

Maternal health

-

Men's health

-

Nutricosmetics

-

Oral care

-

Personalized nutrition

-

Post Pregnancy and reproductive health

-

Sexual health

-

Skin health

-

Sports nutrition

-

Weight management & satiety

-

Women's health

-

Other

-

Frequently Asked Questions About This Report

b. The Canada nutraceuticals market size was estimated at USD 7.87 billion in 2023 and is expected to reach USD 8.52 billion in 2024.

b. The Canada nutraceuticals market is expected to grow at a compounded growth rate of 8.7% from 2024 to 2030 to reach USD 14.03 billion by 2030.

b. The functional foods held the share of 37.6% in 2023. Several benefits associated with functional foods such as regulating the immune system & blood lipids, fighting fatigue, and providing nutritional supplements, are anticipated to boost segment’s growth. The companies in the country are extensively involved in developing and launching new products in the market.

b. Some key players operating in the Canada nutraceuticals market include Cargill Incorporated; ADM; DuPont de Nemours, Inc.; Nestlé; General Mills, Inc.; Innophos, Inc.; W.R. Grace & Co.; Amway Corp.; Alva-Amco; Avrio Health L.P; Abbott Laboratories; Pfizer Inc.

b. Key factors that are driving the market growth include rising awareness of nutritional supplements among working professionals in Canada for maintaining the balanced nutrition in human body is expected to promote the consumption of dietary supplements. In addition, high adoption rates for herbal medicines among individuals in the Canada, on account of rising concerns over hazardous effects associated with conventional pharma drugs, are expected to contribute to the market growth over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."