- Home

- »

- Alcohol & Tobacco

- »

-

Canada Nicotine Pouches Market Size, Industry Report, 2030GVR Report cover

![Canada Nicotine Pouches Market Size, Share & Trends Report]()

Canada Nicotine Pouches Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tobacco-derived, Synthetic), By Flavor (Original/Unflavored, Flavored), By Strength (Light, Normal, Strong, Extra Strong), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-534-6

- Number of Report Pages: 92

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Canada Nicotine Pouches Market Trends

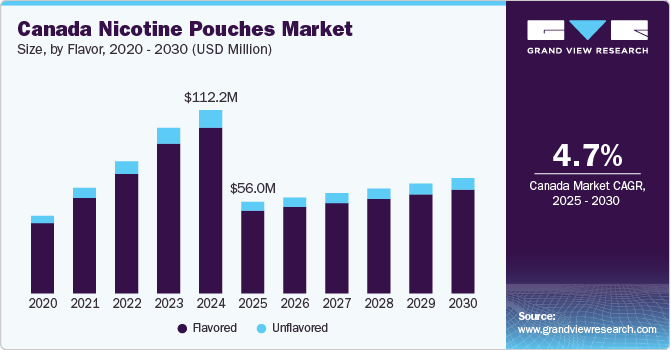

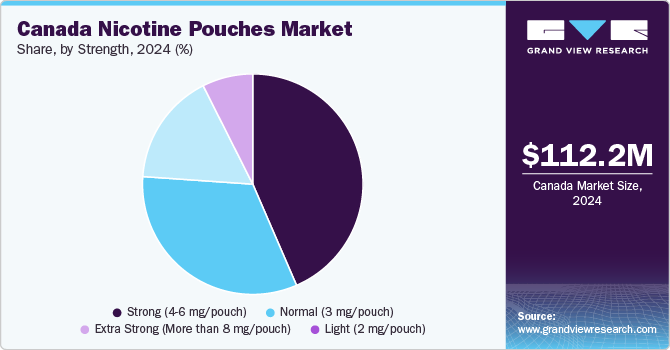

The Canada nicotine pouches market size was estimated at USD 112.2 million in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2030. The Canadian government’s strong focus on reducing smoking rates, coupled with a preference for discreet and non-invasive nicotine consumption methods, has contributed to the rising demand. In addition, the shift towards more regulated, non-combustible nicotine products, including the growing popularity of flavored and nicotine-strength options, has made nicotine pouches an attractive choice for Canadian consumers, particularly among younger populations looking for alternatives to smoking.

The nicotine pouches market in Canada is experiencing steady growth due to the increasing demand for alternative nicotine products, which are viewed as a healthier option compared to traditional smoking. Canada’s strong anti-smoking regulations and emphasis on reducing smoking prevalence have pushed consumers toward non-combustible alternatives, such as nicotine pouches. These products are particularly popular among smokers looking to quit or reduce their cigarette consumption. In addition, the discreet and convenient nature of nicotine pouches, which allow users to consume nicotine without the need for smoking or vaping, has made them an attractive choice, especially for younger, health-conscious individuals.

Moreover, the Canadian market is witnessing growing consumer acceptance of flavored nicotine pouches and varied nicotine strengths, which cater to a broad demographic with diverse preferences. As regulations around nicotine products become more standardized, manufacturers have an opportunity to expand their product offerings, attracting a wider range of customers. The market’s steady growth at a CAGR of 4.7% reflects the gradual shift towards these alternatives, although the pace of growth may be tempered by the country’s mature tobacco control policies and the presence of established competitors in the market. However, with the increasing focus on harm reduction and smoking cessation, the market for nicotine pouches in Canada is expected to continue expanding in the coming years.

Regulatory Insights

Guide to Nicotine Pouch Regulations in Canada: Key Compliance Requirements

Regulation Aspect

Requirements

Regulatory Body

- Nicotine pouches, designed for smoking cessation, have been approved for use in Canada since October 2023 and are regulated under the Food and Drugs Act.

Product Classification

- Nicotine pouches are classified as a tobacco products under the TVPA.

Taxation & Pricing

- Subject to federal excise duties

- Pricing is influenced by provincial tax rates.

Age Restrictions & Sales

- Minimum purchase age is 18 years in most provinces (19 in some)

- Sales are restricted to licensed retailers.

Marketing & Advertising

- Advertising prohibited in areas accessible to minors;

- marketing cannot appeal to youth.

Packaging & Labelling

- Packaging must include health warnings, be child-resistant, and disclose nicotine content.

Potential Future Regulations

- Prohibit NRTs in new and emerging formats, such as nicotine pouches, from being sold with flavors other than mint or menthol.

- Potential stricter flavor restrictions, higher taxes, and more limitations on marketing.

Consumer Insights

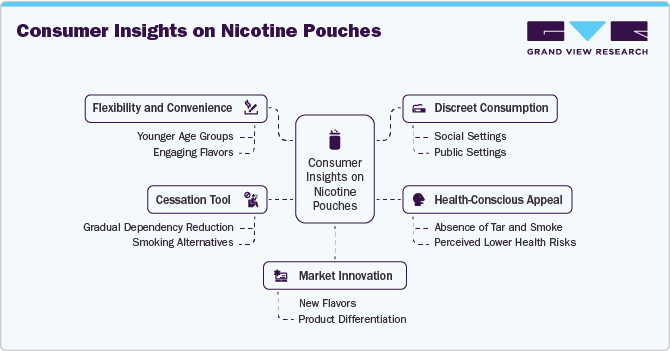

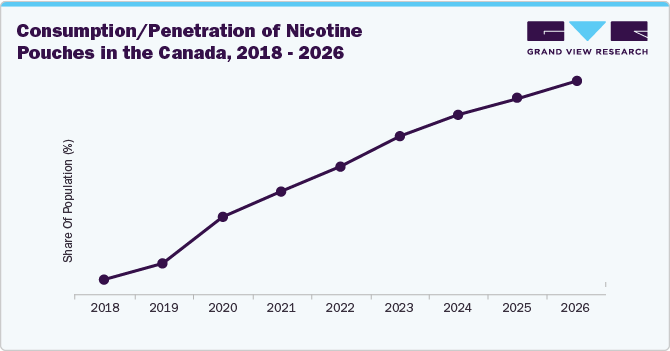

The consumption of nicotine pouches in Canada has been steadily growing in recent years. These tobacco free products offer a discreet and clean way to consume nicotine, leading to a rise in adoption among consumers.

Consumer insights into nicotine pouches reveal a growing preference for discreet, convenient alternatives to smoking. Many users, especially younger consumers, are drawn to the flexibility and privacy nicotine pouches offer, as they can be used in various settings without the harm of combustion. The wide range of flavors appeals to different tastes, making it more engaging for both new users and those looking to quit smoking.

Nicotine pouches are also increasingly seen as a smoking cessation tool, offering a less harmful way to consume nicotine. Consumers value their gradual reduction in nicotine dependency and their perceived lower health risks compared to traditional cigarettes. This demand has fueled innovation in flavors, strengths, and designs, leading to a dynamic and competitive market.

The nicotine pouches industry in the Canada is expected to experience significant growth, driven by increasing adoption and penetration among consumers. By 2025, it is projected that the penetration of nicotine pouches in the Canada will range between 0.5- 1%, resulting in the market reaching a value of USD 56.0 Million. However, ongoing regulatory scrutiny aimed at restricting access to minors (under 18) may slow the market’s growth.

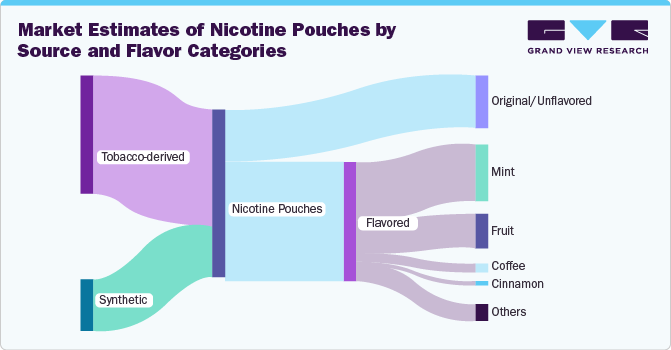

Product Insights

Tobacco-derived nicotine pouches accounted for 98.56% of the revenue share in Canada in 2024 due to the strong preference for familiar, traditional tobacco-derived products among consumers. These pouches offer a similar nicotine experience to smoking but without combustion, making them appealing to smokers seeking an alternative. In addition, regulatory frameworks and established consumer trust in tobacco-derived products contribute to their dominant market share. While synthetic nicotine pouches are growing in popularity, the longstanding presence and recognition of tobacco-derived pouches continue to drive their market dominance in Canada.

The synthetic nicotine pouches market in Canada is expected to grow at a CAGR of 13.2% from 2025 to 2030, due to increasing consumer interest in alternatives to traditional tobacco-derived products. Synthetic nicotine offers a similar nicotine experience without the use of tobacco, which appeals to health-conscious users and those seeking nicotine products with fewer regulatory restrictions. In addition, the growing variety of flavors and product innovations in synthetic nicotine pouches are attracting a broader consumer base, further fueling market growth. As awareness of synthetic nicotine benefits grows, it is likely to gain significant market share in the coming years.

Flavor Insights

Flavored nicotine pouches accounted for a revenue share of 90.38% in 2024, as they cater to a wide range of consumer preferences, making the nicotine experience more enjoyable and appealing. The variety of flavors, including mint, fruit, and dessert options, not only attracts long-time nicotine users but also entices those seeking alternatives to smoking. Flavored pouches are often perceived as a more pleasant and customizable option, driving their dominance in the market.

The original/Unflavored nicotine pouches market is expected to grow at a CAGR of 5.2% from 2025 to 2030, due to the increasing demand for a more straightforward, authentic nicotine experience. Many consumers prefer the simplicity and directness of unflavored pouches, which offer a familiar and no-frills alternative to flavored options. This trend is particularly prominent among users who are transitioning from traditional smoking or those who desire a more natural nicotine intake without added flavors. As awareness of healthier alternatives to smoking continues to rise, unflavored nicotine pouches are gaining popularity among a more health-conscious demographic.

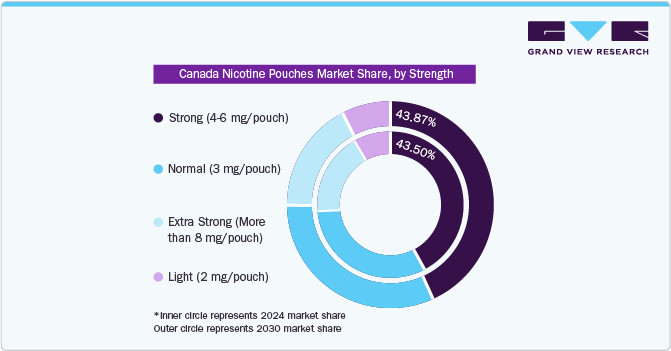

Strength Insights

Strong (4-6 mg/pouch) strength nicotine pouches accounted for a revenue share of 43.50% in 2024 as they cater to a significant portion of consumers who seek a more potent nicotine experience without resorting to traditional smoking. These users are typically long-term nicotine consumers who require higher doses to satisfy their cravings. The strong pouches strike a balance between providing sufficient nicotine content and offering a discreet, convenient alternative to smoking, making them particularly appealing to both current smokers trying to quit and nicotine enthusiasts who prefer a stronger effect. This demand for stronger options has helped drive their market share in Canada.

Normal (3 mg/pouch) nicotine pouches are anticipated to grow with a CAGR of 5.5% from 2025 to 2030, due to their balanced nicotine strength, which appeals to a wide range of consumers. This strength is suitable for both new users who are transitioning from smoking and existing users looking for a moderate nicotine dose. The increasing preference for alternatives to smoking, coupled with the growing awareness of the reduced harm associated with nicotine pouches, makes this segment attractive to health-conscious consumers. As more people seek an alternative to cigarettes, the moderate nicotine pouch category is positioned to experience steady growth.

Distribution Channel Insights

Sales of nicotine pouches through offline channels accounted for a revenue share of 92.00% in 2024, due to the strong presence of brick-and-mortar retail outlets like convenience stores, gas stations, and tobacco shops, where consumers can easily access these products. The traditional shopping experience remains the preferred method for many customers, especially for those who prefer immediate purchases and instant product availability. Furthermore, offline sales are more prominent in regions where online retail infrastructure for nicotine products is less developed or regulated, leading to a dominant share of physical stores in the overall market.

Sales of nicotine pouches through online channels are not expected to grow. The lack of expected growth in online sales of nicotine pouches in Canada is primarily due to new regulations that will limit the sale of these products to offline channels, particularly pharmacies. Under these new rules, nicotine pouches will only be legally available for sale through physical retail outlets such as pharmacies, eliminating the option for online purchases. This shift in regulation is designed to ensure better control over the distribution of nicotine products, including age verification and product safety, which makes offline channels the dominant sales avenue going forward.

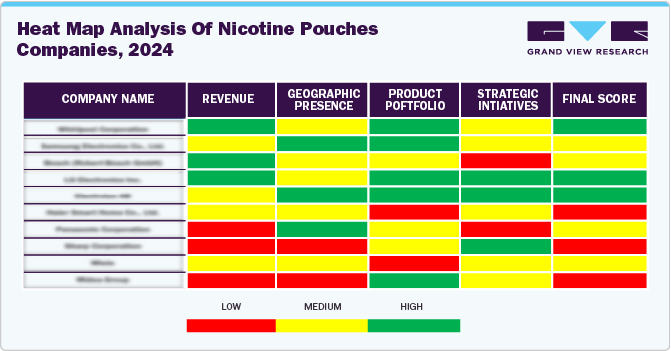

Key Canada Nicotine Pouches Company Insights

The nicotine pouch market in Canada is driven by a mix of established tobacco giants and specialized brands focused on smokeless nicotine alternatives. These companies lead the market by utilizing strong brand recognition, innovative product offerings, and extensive distribution networks.

As consumer demand for discreet, tobacco free nicotine products grows, the market has become increasingly competitive, with major players continually enhancing product strength, flavor variety, and overall user experience.

With continued market growth, both global and emerging local brands are expected to compete for market share, targeting health conscious individuals and those looking to reduce or quit traditional smoking.

Key Canada Nicotine Pouches Companies:

- British American Tobacco (BAT)

- Philip Morris International (PMI)

- Imperial Brands

- Japan Tobacco International (JTI)

- Blissnic

- Rogue Nicotine Pouches

- Dryft

Recent Developments

-

In July 2023, Zonnic nicotine pouches, produced by Imperial Tobacco, were approved for sale in Canada in July 2023. Initially categorized as a natural health product for nicotine replacement therapy (NRT) and not subject to a legal minimum age for purchase, these pouches were widely available at many corner stores. However, following a successful national campaign led by the Canadian Lung Association, regulations were changed, and as of August 28, 2024, stricter rules were introduced.

Canada Nicotine Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 56.0 million

Revenue forecast in 2030

USD 70.5 million

Growth rate (revenue)

CAGR of 4.7% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, strength, distribution channel

Country scope

Canada

Key companies profiled

British American Tobacco (BAT); Philip Morris International (PMI); Imperial Brands; Japan Tobacco International (JTI); Blissnic; Rogue Nicotine Pouches; Dryft

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Nicotine Pouches Market Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Canada nicotine pouches market report on the basis of product, flavor, and strength and distribution channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco derived

-

Synthetic

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

Mint

-

Fruit

-

Coffee

-

Cinnamon

-

Other Flavors

-

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light (2 mg/pouch)

-

Normal (3 mg/pouch)

-

Strong (46 mg/pouch)

-

Extra Strong (More than 8 mg/pouch)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Pharmacies

-

Others

-

-

Frequently Asked Questions About This Report

b. The Canada nicotine pouches market size was estimated at USD 112.2 million in 2024 and is expected to reach USD 56.0 million in 2025.

b. The Canada nicotine pouches market is expected to grow at a compounded growth rate of 4.7% from 2025 to 2030 to reach USD 70.5 million by 2030.

b. Tobacco-derived nicotine pouches accounted for 98.56% of the revenue share in Canada in 2024 due to the strong preference for familiar, traditional tobacco-derived products among consumers. These pouches offer a similar nicotine experience to smoking but without combustion, making them appealing to smokers seeking an alternative.

b. Some key players operating in the market include British American Tobacco (BAT); Philip Morris International (PMI); Imperial Brands; Japan Tobacco International (JTI); Blissnic; Rogue Nicotine Pouches; and Dryft

b. The Canadian government’s strong focus on reducing smoking rates, coupled with a preference for discreet and non-invasive nicotine consumption methods, has contributed to the rising demand. Additionally, the shift towards more regulated, non-combustible nicotine products, including the growing popularity of flavored and nicotine-strength options, has made nicotine pouches an attractive choice in Canada.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.