- Home

- »

- Plastics, Polymers & Resins

- »

-

Canada Multilayer Flexible Packaging Market, Report, 2030GVR Report cover

![Canada Multilayer Flexible Packaging Market Size, Share & Trends Report]()

Canada Multilayer Flexible Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper, Aluminum Foil), By Product, By Layer Structure, By End Use, And Segment Forecasts

- Report ID: GVR-4-68039-980-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

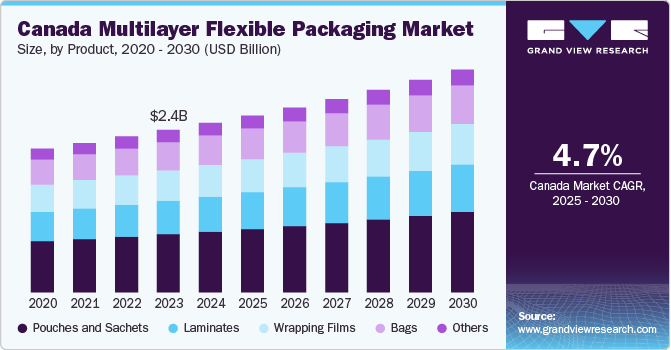

The Canada multilayer flexible packaging market size was estimated at USD 2.52 billion in 2024 and is expected to grow at a CAGR of 4.7% from 2025 to 2030.The increasing trend of packaged food consumption, coupled with the growing demand for recycled and sustainable packaging, is fueling the Canadian market growth.

The rapid growth of Canada's food and beverage industry is a primary driver for multilayer flexible packaging adoption. Major food manufacturers such as Maple Leaf Foods and Saputo have increasingly shifted toward flexible packaging solutions that offer superior barrier properties and extended shelf life. For example, stand-up pouches with multiple polymer layers are now commonly used for frozen vegetables, ready-to-eat meals, and dairy products, replacing traditional rigid packaging options.

Sustainability initiatives and environmental regulations have pushed the market toward more eco-friendly multilayer flexible solutions. Canadian companies are investing in recyclable multilayer structures and bio-based materials to align with the country's plastic waste reduction goals.

The e-commerce boom, accelerated by changing consumer behaviors, has created strong demand for lightweight and durable multilayer flexible packaging. These materials offer excellent protection during shipping while reducing transportation costs and carbon footprint. Companies such as Amazon Canada and Walmart Canada have specifically requested packaging designs that optimize space and provide adequate protection for their e-commerce operations, driving innovation in multilayer flexible materials.

Healthcare and pharmaceutical packaging requirements have also fueled market growth, particularly with the need for high-barrier protection and sterile packaging solutions. The COVID-19 pandemic highlighted the importance of reliable medical packaging, leading to increased adoption of multilayer flexible materials for medical devices, personal protective equipment, and pharmaceutical products.

Material Insights

Based on materials, the Canada multilayer flexible packaging industry is segmented into plastics, paper, and aluminum foil. Plastics dominated the overall market with a revenue market share of over 49.0% in 2024. Plastics are the most widely used material in the Canada multilayer flexible packaging industry due to their durability, versatility, and cost-effectiveness. They provide strong barrier properties against moisture, oxygen, and contaminants, making them ideal for food, pharmaceuticals, and consumer goods packaging.

Paper is gaining popularity in the Canada multilayer flexible packaging industry due to its eco-friendly nature. It is often used in combination with other materials to provide strength and an improved barrier while maintaining recyclability. Paper-based multilayer packaging is commonly found in applications like snacks, dry goods, and packaging for fresh produce.

Aluminum foil is a critical material in the multilayer flexible packaging industry due to its excellent barrier properties. It provides an impenetrable shield against light, moisture, oxygen, and other contaminants, making it ideal for perishable products, pharmaceuticals, and high-value goods. Aluminum foil is often combined with plastic layers to enhance flexibility while retaining its strong protective qualities, particularly for products requiring extended shelf life.

Product Insights

Based on product, the Canada multilayer flexible packaging industry is segmented into bags, pouches & sachets, wrapping films, laminates, and others. Pouches and sachets dominated the overall market with a revenue market share of over 35.0% in 2024. Pouches and sachets are one of the most versatile and popular products in multilayer flexible packaging. They are widely used for packaging small food items, beverages, sauces, personal care products, and pharmaceuticals. Their lightweight and flexible nature, combined with their ability to be resealed or provide single-use convenience, makes them attractive for manufacturers and consumers alike.

Laminates are composed of multiple layers of materials such as plastics, aluminum, and paper to offer enhanced barrier properties. They are used for products requiring superior protection, such as coffee, snacks, medical products, and cosmetics. Laminates offer excellent moisture and gas barriers, making them ideal for preserving the freshness and quality of the products inside.

Layer Structure Insights

Based on layer structure the market is segmented into 3 layers, 5 layers, 7 layers, and more than 7 layers. 3 layers dominated the overall market with a revenue market share of over 39.0% in 2024. The 3-layer structure in packaging typically consists of a core material sandwiched between two layers, offering basic protection and rigidity. These are often used for lightweight, low-cost packaging applications such as simple food products or consumer goods. The 3-layer configuration is effective for providing barrier properties against moisture and air, but its capabilities are generally limited to less demanding conditions.

A 5-layer structure offers enhanced functionality compared to the 3-layer variant, typically providing superior barrier properties for oxygen, moisture, and gases. This makes it suitable for more sensitive food products, pharmaceuticals, or personal care items.

End-use Insights

The market is segmented into food & beverages, automotive, pharmaceuticals, cosmetics & personal care, electrical & electronics, homecare, textiles & apparel, and agriculture & allied industries. The food & beverages segment accounted for the major revenue share of over 43.0% in 2024. The food & beverages segment encompasses the production, packaging, and distribution of edible goods and drinks. Rising consumer demand for ready-to-eat meals, convenience foods, and healthier options, coupled with the need for longer shelf life, are driving growth.

In the personal care and cosmetics sector, the growing importance of self-care and beauty trends, combined with the increasing preference for eco-friendly and premium packaging, are driving demand for multilayer flexible packaging market.

The pharmaceutical industry requires stringent packaging solutions to protect sensitive drugs and medical equipment from contamination, moisture, and physical damage. Packaging plays a key role in maintaining product efficacy and ensuring regulatory compliance, thus boosting the market growth.

Key Canada Multilayer Flexible Packaging Company Insights

The competitive environment of the Canada multilayer flexible packaging market is characterized by the presence of both global and regional players, with companies focusing on innovation and sustainability to gain market share. Major players such as Amcor plc, Berry Global Inc., and Sealed Air dominate the landscape, competing with smaller, specialized firms that offer custom solutions tailored to specific industries such as food, beverages, and healthcare. Regulatory frameworks promoting sustainability are also intensifying competition, encouraging the development of eco-conscious packaging products.

Key Canada Multilayer Flexible Packaging Companies:

- Amcor plc

- Glenroy, Inc.

- Berry Global Inc.

- Mondi

- Transcontinental Inc.

- Sonoco Products Company

- Winpak Ltd.

- Sealed Air

- Westrock Company

- Huhtamaki

- Uflex Limited

- Constantia Flexibles

Recent Developments

-

In February 2023, ProAmpac, a North American flexible packaging company, launched ProActive Recyclable, a new recyclable packaging product range. This new product range helps brands to meet the consumer demand for sustainable packaging.

-

In February 2023, Sealed Air acquired Liquibox for USD 1.15 billion, enhancing its position in the flexible packaging industry. This strategic move combines the strengths of both companies, particularly in sustainable packaging solutions for food, beverages, and consumer goods. The acquisition is expected to accelerate growth in Sealed Air's CRYOVAC brand Fluids & Liquids business, leveraging synergies from Liquibox's innovative Bag-in-Box technology.

Canada Multilayer Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.63 billion

Revenue forecast in 2030

USD 3.32 billion

Growth rate

CAGR of 4.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, layer structure, end use

Country Scope

Canada

Key companies profiled

Amcor plc; Glenroy, Inc.; Berry Global Inc.; Mondi; Transcontinental Inc.; Sonoco Products Company; Winpak Ltd.; Sealed Air; Westrock Company; Huhtamaki; Uflex Limited; Constantia Flexibles

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Multilayer Flexible Packaging Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Canada multilayer flexible packaging market report based on material, product, layer structure, and end-use:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper

-

Aluminum Foil

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bags

-

Pouches and Sachets

-

Wrapping Films

-

Laminates

-

Others

-

-

Layer Structure Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

3 Layers

-

5 Layers

-

7 Layers

-

More than 7 Layers

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food and Beverages

-

Pharmaceuticals

-

Automotive

-

Cosmetics and Personal Care

-

Homecare

-

Electricals and Electronics

-

Agriculture and Allied Industries

-

Textiles and Apparels

-

Frequently Asked Questions About This Report

b. The Canada multilayer flexible packaging market was estimated at USD 2.52 billion in the year 2024 and is expected to reach USD 2.63 billion in 2025.

b. The Canada multilayer flexible packaging market is expected to grow at a CAGR of 4.7% from 2025 to 2030, reaching USD 3.32 billion by 2030.

b. The pouches & sachets segments dominated the multilayer flexible packaging in Canada with a share of 35.70% owing to the increasing applications in the food and beverage industry.

b. The key market players in the Canada multilayer flexible packaging market include Amcor plc, Glenroy Inc., Berry Global Inc., Mondi Group, Transcontinental, Inc., Sonoco Products Company, WINPAK LTD., Sealed Air, WestRock Company, Huhtamaki Flexible Packaging, UFlex Limited, Constantia Flexibles.

b. The key driver for the multilayer flexible packaging market in Canada is the growing demand for packed food and its packaging, coupled with the demand for sustainable packaging products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.