- Home

- »

- Pharmaceuticals

- »

-

Canada Legal Cannabis Market Size And Share Report, 2030GVR Report cover

![Canada Legal Cannabis Market Size, Share & Trends Report]()

Canada Legal Cannabis Market Size, Share & Trends Analysis Report By Source (Marijuana, Hemp), By Derivatives (CBD, THC), By Cultivation, By End-use (Medical, Recreational, Industrial), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-413-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Canada Legal Cannabis Market Trends

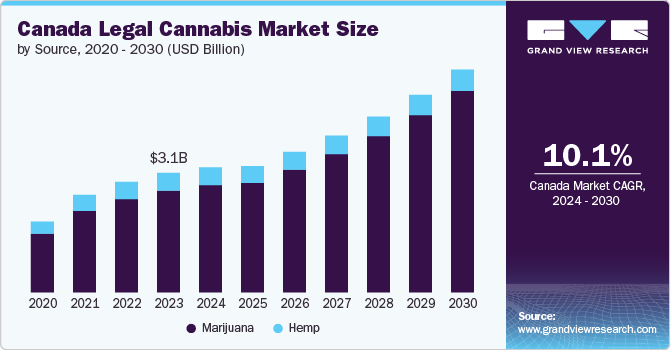

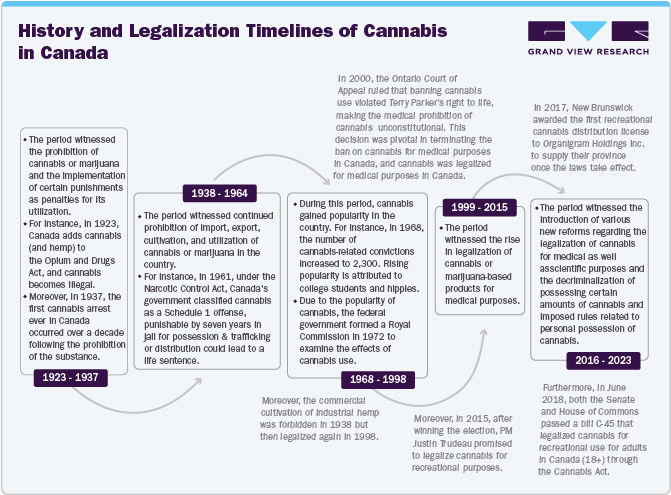

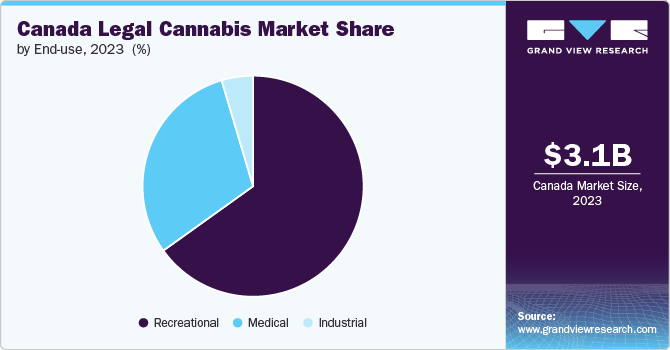

The Canada legal cannabis market size was valued at USD 3.10 billion in 2023 and is projected to grow at a CAGR of 10.1% from 2024 to 2030. Factors such as the federal legalization of cannabis, growing awareness of the health benefits of cannabis consumption, and the presence of a large number of market players in the country drive market growth. In October 2018, the Government of Canada federally legalized cannabis for medical and recreational purposes. Under the legalization, licensed production of cannabis is controlled by the federal government, and the provincial government controls the distribution and sale of cannabis. According to the government's annual Canadian Cannabis Survey, Canada's legally regulated cannabis industry captured more market share than the illicit market in 2023. In addition, the survey reported that 69% of individuals in Canada 'always' obtain cannabis from a licensed or legal source, 6% responded 'sometimes,' 10% responded 'mostly,' 6% responded 'rarely,' and 9% responded 'never.'

Rising investments by public and private companies and favorable government initiatives are propelling market growth. For instance, in June 2024, Canopy Growth Corporation, a Canada-based cannabis company, introduced an at-the-market equity program (ATM) that allows the company to issue and sell up to USD 250 million of common shares from treasury from time to time in concurrent public offerings in Canada and the U.S. to improve the company’s financial position and facilitate growth.

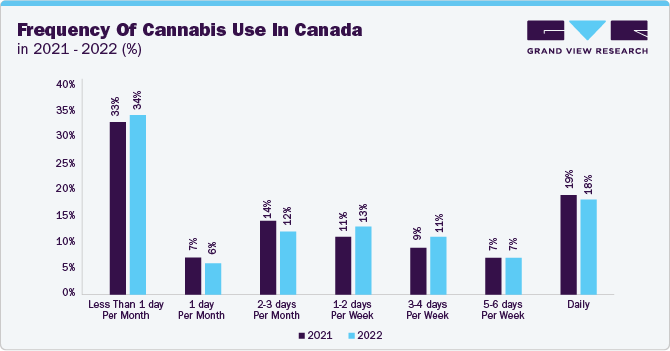

Furthermore, the positive consumer attitude toward cannabis consumption and the expansion of cannabis market players to cater to the rising demand for cannabis and cannabis-derived products boost the market growth. The following graph shows the frequency of cannabis use in Canada in 2021 to 2022,

In 2022, approximately 18% of individuals reported daily consumption of cannabis. Generally, in 2022, the frequency of cannabis consumption reported was not changed from 2021, except for individuals who reported consuming it 2 to 3 times a month, which decreased from 14% to 12%.

Moreover, multiple cannabis companies invest in R&D to incorporate AI in the cannabis cultivation process and launched an AI-based platform. For instance, in June 2024, PURPLEFARM, a cannabis company in Canada, collaborated with Santa Cruz, an artificial intelligence (AI) company, to optimize and automate its cultivation processes using the Neatleaf Spyder system. This system operates with a cable-based mechanism, scanning indoor-grown crops and collecting millions of data points. It continuously monitors a range of factors, including the height and health of each plant, and detects pest infestations, all within 24-hour cycles.

Moreover, the rise in the number of cannabis cultivators, processors, and distributors boosts the market growth. Following are some of the licensed cultivators, processors, and sellers in Canada,

Authorized Licensed Cultivators, Processors And Sellers Under The Cannabis Act

License holder

Province / territory

License(s)

Classes of cannabis the license holder is authorized to sell

to provincially/ territorially authorized distributors/retailers

to registered patients

0707430 B.C. Ltd.

British Columbia

Micro-Processing

Plants / Seeds

None

Micro-Cultivation

Dried / Fresh

N/A

0957102 BC Ltd. d.b.a. APOTHECARY BOTANICALS

British Columbia

Sale (Medical)

Plants / Seeds

Plants / Seeds

Processing

Dried / Fresh

Dried / Fresh

Cultivation

Extracts

Extracts

Edible

Edible

Topical

Topical

1000536880 Ontario Inc. d.b.a. 1809 Underground

Ontario

Sale (Medical)

Plants / Seeds

Plants / Seeds

Processing

Dried / Fresh

Dried / Fresh

Cultivation

N/A

N/A

1000544319 ONTARIO LTD.

Ontario

Sale (Medical)

Plants / Seeds

Plants / Seeds

Micro-Processing

Dried / Fresh

Dried / Fresh

Micro-Cultivation

N/A

N/A

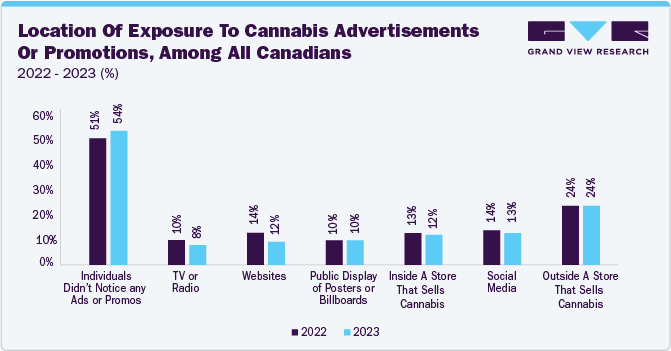

Furthermore, Canada has a federal Cannabis Act that guides those in the cannabis industry to advertise cannabis products to protect vulnerable (minor) populations. The University at Buffalo compared cannabis marketing policies in Canada and U.S. states. Canada has better cannabis advertising and marketing regulations. Furthermore, in the survey conducted by the Government of Canada, 24% of Canadians noticed cannabis advertisements outside of stores that sell cannabis in 2023. Thus, such a rise in cannabis advertisements boosts the adoption of cannabis and its related products.

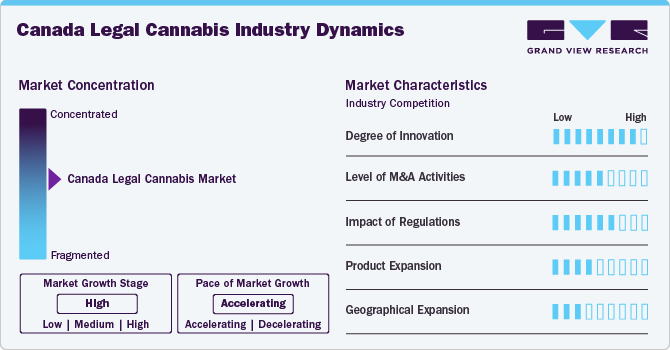

Market Concentration & Characteristics

The market for legal cannabis in Canada is characterized by a high degree of innovation owing to increasing product demand due to its health benefits, growing preference for cannabis extracts such as oils & tinctures, and ongoing clinical trials on the use of cannabis and its medicinal properties. For example, in February 2024, researchers at the University of British Columbia in Canada started a new clinical trial to explore the potential of cannabidiol as a treatment for bipolar depression.

Canada legal cannabis industry is characterized by a medium level of merger and acquisition (M&A) activity. Through M&A activity, companies can expand their product portfolio, strengthen their market position, and enter new territories. For instance, in March 2022, Aurora Cannabis Inc. acquired TerraFarma, Inc. (Parent company of Thrive Cannabis) to strengthen its position in the Canadian market.

The market is anticipated to witness significant growth owing to presence of a systematic regulatory framework for the cultivation and sale of cannabis. Federal, provincial, and territorial governments jointly oversee the cannabis regulation system. The Cannabis Act establishes a comprehensive regulatory framework to regulate the production, distribution, sale, and possession of cannabis throughout Canada. This includes stringent guidelines set by the Federal government for cannabis producers regarding growth and manufacturing and rules and standards for the cannabis industry. In addition, provinces and territories set rules to develop, implement, maintain, and enforce the protocols that manage the distribution and retail sale of cannabis.

Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position. For instance, in April 2024, Avicanna introduced a new version of its proprietary oral cannabidiol (CBD) formulation (RHO Phyto Micro Drop 10) to treat individuals suffering from seizures in Canada.

Market players are adopting this strategy to expand their market presence in different geographical regions. For instance, in June 2023, Canopy Growth Corporation partnered with VASCO Cannabis, Inc., a cannabis cultivator company, to increase the availability of its cannabis offerings across La Belle province.

Sources Insights

Based on source, marijuana dominated the market in 2023 and is anticipated to witness the fastest CAGR of 11.1% over the forecast period. Factors such as the growing adoption of marijuana products for medical purposes and changing consumer behavior toward recreational marijuana fuels the market growth. Furthermore, customers are adopting marijuana-derived skincare products to help lower sebum production, reduce redness, suppress itches, and reduce inflammation on a cellular level. These products also improve the skin's natural healing process and reduce the length of outbreaks, promoting the use of these products in Canada.

Active Industrial Hemp Licenses By Province

Province

Total Licenses

Alberta

142

British Columbia

104

Manitoba

73

New Brunswick

7

The hemp segment held a significant share in 2023 due to its applications in several industries, such as food and beverage, nutraceuticals, cosmetics, and pharmaceuticals. Foods fortified with CBD derived from hemp cover an extensive range of products such as supplements, nutritional powders, beverages, protein and nutrition bars, dairy and dairy alternative products, breakfast cereals, animal feed, and bakery items and snacks. Moreover, the rise in the issuing of industrial hemp licenses fuels market growth. The following are provided active industrial hemp licenses by province,

Derivatives Insights

Based on derivatives, the CBD segment dominated the market with a revenue share of 63.4% in 2023. The market growth is attributed to positive legislative policies, rising public awareness regarding CBD's health advantages, and the increased use of CBD oil in various end-use industries and medicinal sectors. CBD-based cosmetics brands such as Calyx Wellness, Delush, High On Love, KaliKare, Birch + Beauty, Fitish, Love Necta, and Emprise Canada are available in Canada.

However, the others segment is expected to witness the fastest growth over the forecast period. This segment includes terpenes, flavonoids, and other minor cannabinoids such as CBG, CBN, and THCV. Minor cannabinoids and terpenes offer various advantages in the treatment of various medical conditions, and new product launches by market players are propelling market growth. For instance, in March 2024, Tilray Brands, in collaboration with High Park Holdings, a pharmaceutical company, expanded its cannabis beverage portfolio with the launch of the Mollo brand, a cannabis-infused non-alcoholic seltzer featuring high cannabigerol (CBG) and minor cannabinoid content.

Cultivation Insights

Based on cultivation, the indoor cultivation segment held the largest market share of 53.5% in 2023 and is expected to witness the fastest growth over the forecast period. The liberalization of regulations and laws associated with cannabis cultivation is increasing its adoption. In Canada, under the Cannabis Act, adults can grow up to four cannabis plants per household. Indoor cultivation refers to growing cannabis in an enclosed area, which could be a tent, room, or designated area mimicking nature. There are many market players in the country who cultivate cannabis indoors. For example, Aurora Cannabis Inc. has a cannabis indoor cultivation facility of 943,000 square feet in Alberta.

The outdoor cultivation segment is expected to grow lucratively over the forecast period. Outdoor cultivation eliminates the need for expensive growing equipment, reducing the overall cost of the operation due to the ready availability of a natural environment that provides the necessary factors for cannabis plants to grow. There has been an increase in the establishment of outdoor cultivation farms, contributing to the expansion of the segment. Moreover, according to the government of Canada, 63.2 million square feet of outdoor area are licensed for cannabis production.

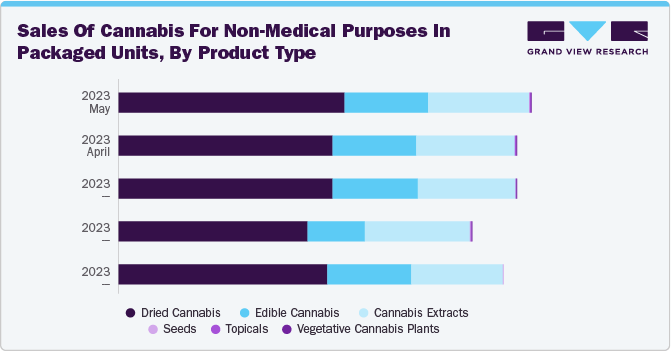

End-use Insights

Based on end use, the recreational use segment dominated the market with a revenue share of 65.1% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Factors such as the increasing adoption of cannabis vape pens and consumption of cannabis in the form of smoking and consuming it in the form of foods & beverages are fueling the segment growth. The sales of cannabis for non-medical purposes in Canada are as follows,

The medical use segment held a significant market share in 2023. Cannabis is used on a large scale for the treatment of chronic pain and mental disorders, such as anxiety & sleep disorders. The application of cannabis for medical use is increasing as the demand for cannabis & cannabis-based products is increasing. However, government programs strictly regulate medical cannabis distribution, and therefore, suppliers must maintain the required quality of products. In addition, over the years, the medical application of cannabis has witnessed major growth, as the number of scientific studies supporting its benefits in the treatment of various diseases has increased.

Key Canada Legal Cannabis Company Insights

Key participants in the Canada legal cannabis market are focusing on developing innovative business growth strategies such as product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Canada Legal Cannabis Companies:

- Canopy Growth Corporation

- Charlotte's Web, Inc.

- Aurora Cannabis Inc.

- Tilray Brands

- The Cronos Group

- Jazz Pharmaceuticals, Inc.

- Organigram Holding, Inc.

- Maricann, Inc.

- Isodiol International, Inc

- Sundial Growers

Recent Developments

-

In March 2023, Canopy Growth introduced six new beverage flavors. Under the Deep Space brand, the company announced Canada's first cannabis-infused beverage with naturally occurring caffeine. The company also launched four flavors under the Tweed brand for springtime.

-

In April 2023, Aurora Cannabis Inc. partnered with Strainprint and announced the launch of the tracking program through Strainprint App. The tracking program is designed for Aurora patients to keep a track of their medical cannabis journey.

Canada Legal Cannabis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.25 billion

Revenue forecast in 2030

USD 5.79 billion

Growth rate

CAGR of 10.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, derivatives, cultivation, end-use

Country scope

Canada

Key companies profiled

Canopy Growth Corporation, Charlotte's Web, Inc., Aurora Cannabis Inc., Tilray Brands, The Cronos Group, Jazz Pharmaceuticals, Inc., Sundial Growers, Organigram Holding, Inc., Maricann, Inc., Isodiol International, Inc

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Legal Cannabis Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Canada legal cannabis market report on the basis of source, derivatives, cultivation, end use, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Marijuana

-

Flowers

-

Oil And Tinctures

-

-

Hemp

-

Hemp Oil

-

Industrial Hemp

-

-

-

Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Cultivation

-

Greenhouse Cultivation

-

Outdoor Cultivation

-

-

Derivatives Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD

-

THC

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Use

-

Cancer

-

Chronic Pain

-

Depression and Anxiety

-

Arthritis

-

Diabetes

-

Glaucoma

-

Migraines

-

Epilepsy

-

Multiple Sclerosis

-

AIDS

-

Amyotrophic Lateral Sclerosis

-

Alzheimer’s

-

Post-Traumatic Stress Disorder (PTSD)

-

Parkinson's

-

Tourette’s

-

Others

-

-

Recreational Use

-

Industrial Use

-

Frequently Asked Questions About This Report

b. The Canada legal cannabis market size was estimated at USD 3.10 billion in 2023 and is expected to reach USD 3.25 billion in 2024.

b. The Canada legal cannabis market is expected to grow at a compound annual growth rate of 10.1% from 2024 to 2030 to reach USD 5.79 billion by 2027.

b. By derivatives, the CBD segment dominated the market with a revenue share of 63.4% in 2023. The market growth is attributed to positive legislative policies, rising public awareness regarding CBD's health advantages.

b. Some key players operating in the market include Canopy Growth Corporation, Charlotte's Web, Inc., Aurora Cannabis Inc., Tilray Brands, The Cronos Group, Jazz Pharmaceuticals, Inc., Sundial Growers, Organigram Holding, Inc., Maricann, Inc., Isodiol International, Inc

b. Factors such as the federal legalization of cannabis, growing awareness of the health benefits provided by cannabis consumption, and the presence of a large number of market players in the country drive market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."