Canada Functional Foods & Natural Health Products Market Size, Share & Trends Analysis Report By Product (Dairy Products, Fats & Oil), By Application, By Ingredients, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-986-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

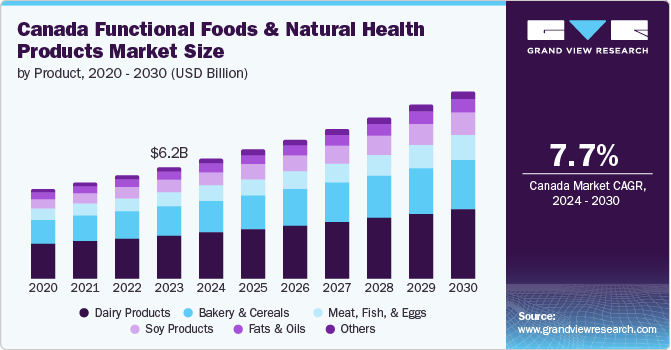

The Canada functional foods & natural health products market size was valued at USD 6.23 billion in 2023 and is projected to grow at a CAGR of 7.7% from 2024 to 2030. Increasing health awareness among consumers is significantly driving the demand for functional foods and natural health products in Canada. As more individuals become conscious of their health and wellness, they actively seek products that offer benefits beyond basic nutrition, such as fortified foods, dietary supplements, and herbal products that support overall well-being.

Moreover, maintaining a healthy lifestyle through diet and nutrition can prevent chronic diseases, enhance quality of life, and reduce healthcare costs in the long term. It has led to market growth for functional foods and natural health products that cater to health-conscious consumers, promoting a preventative and holistic approach to health management.

Canada's aging population is a major driver for the increased demand for age-related health products. As the number of elderly individuals rises, so does the need for products specifically addressing age-related health concerns such as cardiovascular health, bone density, and cognitive function. These consumers are particularly focused on improving their longevity and overall quality of life, which propels the demand for natural health products that offer targeted benefits. According to the Canadian Institute for Health Information, Over the next 20 years, Canada's senior population, those aged 65 and older, is expected to grow by 68%, significantly impacting the demand for age-related health products.

The rise of e-commerce platforms has significantly transformed the accessibility and market reach of functional foods and natural health products in Canada. Online shopping has made it convenient for consumers to explore and purchase diverse health products from the comfort of their homes, transcending geographical limitations and offering a more comprehensive selection than traditional brick-and-mortar stores. This digital shift has enabled health-conscious consumers to easily find and compare products, read reviews, and make informed purchasing decisions. Major retail chains and health food stores are expanding their in-store and online offerings of functional foods and natural health products, ensuring that these items are more readily available and accessible to a broader audience.

Product Insights

Dairy products dominated the market and accounted for a share of 38.5 % in 2023. The growing demand for probiotics is significantly shaping the functional dairy products market in Canada, as consumers increasingly recognize the benefits of probiotics for gut health. Functional dairy products like yogurt and kefir have become particularly popular due to their ability to support digestive health and enhance the immune system. There is a notable rise in the demand for lactose-free and dairy alternative options, driven by consumers with lactose intolerance or specific dietary preferences. This shift is expanding the market for specialized functional dairy products, including lactose-free milk, cheese, and yogurt, which cater to a wider audience seeking the health benefits of dairy.

Soy products segment is expected to witness growth at 9.1 % CAGR. Soy products are rich in protein, essential amino acids, vitamins, and minerals, making them a popular choice for health-conscious consumers. According to a report by Medical News in January 2023, consuming soy products can significantly reduce the levels of LDL cholesterol, commonly referred to as "bad" cholesterol, by up to 4%.

Ingredient Insights

Dietary fibers accounted for the largest market revenue share of 32.2% in 2023. Canadian dietary guidelines underscore the critical role of fiber in maintaining a balanced diet. These guidelines are reinforced through public health campaigns and educational initiatives designed to enhance consumer awareness of the numerous health benefits associated with dietary fiber, including improved digestive health, reduced risk of chronic diseases, and effective weight management. Regulatory mandates by health authorities require explicit labeling of fiber content on food products, enabling consumers to make well-informed dietary choices. This regulatory transparency fosters consumer confidence and stimulates the market for fiber-enriched products as individuals increasingly seek foods that support their health and wellness objectives, hence driving the growth of the segment.

The vitamins segment is expected to grow at the fastest CAGR of 9.1% during the forecast period. The increasing awareness of vitamins' importance in preventing nutritional deficiencies is a significant driver in Canada's functional foods market. Consumers recognize vitamins as crucial for maintaining overall health and preventing chronic diseases. This awareness is reinforced by robust public health campaigns and educational initiatives, which empower individuals to make informed decisions about their health and dietary choices. There is a rising demand for vitamin-enriched functional foods that provide specific nutritional benefits, reflecting a broader trend toward proactive health management among consumers.

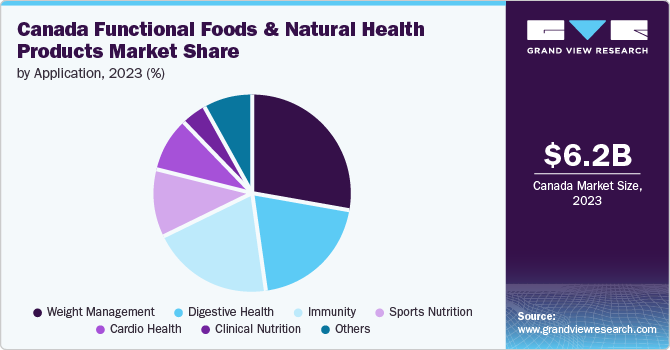

Application Insights

The weight management segment dominated the market in the year 2023. Canada has seen a concerning rise in obesity rates in recent years, leading to increased consumer demand for functional foods that can aid in weight management. Canadians are seeking out products that can help them control their calorie intake, boost their metabolism, or promote feelings of fullness and satiety, aligning with their goals of weight loss or maintenance.

The functional foods, which may include ingredients like fiber, protein, probiotics, or bioactive plant compounds, are viewed as a potential tool to help address the obesity epidemic through dietary means, without the side effects associated with conventional weight loss drugs. According to the 2022 Lancet study, Canada has a relatively high global ranking for obesity, placing 50th for men and 104th for women. The study also found concerning rates of childhood obesity, with Canada ranking 80th for girls and 94th for boys. These rankings underscore the need for comprehensive strategies to address the obesity epidemic in Canada, particularly among children and youth.

The sports nutrition segment is expected to witness fastest growth during the forecast period. The growing demand for sports nutrition products among working professionals and athletes in Canada is a key driver of the functional foods market. These health-conscious consumers are increasingly seeking out specialized supplements and functional foods to support their fitness goals and overall wellbeing. The sports nutrition segment offers a diverse array of product formats, including powders, liquids, capsules, and tablets, allowing consumers to conveniently incorporate these products into their daily routines.

Key Canada Functional Foods & Natural Health Products Company Insights

Some of the key companies in the Canada functional foods & natural health products marketinclude General Mills Inc., Herbalife, Nestlé SA.

-

General Mills Inc. offers a diverse range of products tailored to Canadian consumers. The company's portfolio includes dairy products like Yoplait Yogurt and Liberté Kefir, which provide probiotics and calcium for digestive and bone health. General Mills also offers cereal and granola products such as Nature Valley Granola Bars, which provide whole grains, fiber, and protein for sustained energy, and Cheerios Cereal, fortified with vitamins and minerals and heart-healthy oats. The company also includes baking mixes like Betty Crocker Muffin Mixes, enriched with nutrients like calcium and vitamin D, and Bisquick Pancake and Baking Mix, which offers a convenient source of whole grains.

-

Nestlé SA offers a diverse portfolio of functional food and natural health products tailored to Canadian consumers. Nestlé's products include dairy-based items like milk drinks, spreads, and yogurts rich in essential nutrients, vitamins, and minerals. The company also provides cereal and granola products fortified with beneficial compounds like fiber and whole grains.

Key Canada Functional Foods & Natural Health Products Companies:

- General Mills Inc.

- Nestlé SA

- Kellogg Company

- Mondelez International

- Hearthside Food Solutions LLC

- Mars, Incorporated

- Herbalife

- Bellring Brands, Inc

- Caveman Foods LLC

- 1440 Foods

Recent Developments

-

In March 2024, Bellring Brands, Inc. launched a ready-to-drink high-protein shake named Cookie Dough through one of its brands, Premier Proteins. It can be consumed along with breakfast or as a snack in the afternoon. It requires no baking, and considering the health-conscious consumer base, ingredients are used.

-

In August 2023, ConCordix Inc., a Vitux group food manufacturing company, entered the Canadian food market by opening a production facility in Canada. This set-up will mainly produce smart chews, which are consumed as dietary supplements for immune support and vitamin deficiencies.

Canada Functional Foods & Natural Health Products Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 10.48 billion |

|

Growth Rate |

CAGR of 7.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2020 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, ingredient, application |

|

Country scope |

Canada |

|

Key companies profiled |

General Mills Inc.; Nestlé SA; Kellogg Company; Mondelez International; Hearthside Food Solutions LLC; Mars Incorporated; Herbalife; Bellring Brands, Inc; Caveman Foods LLC; 1440 Foods |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Canada Functional Foods & Natural Health Products Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the Canada functional foods & natural health products market report based on product, application and ingredient:

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Bakery & Cereals

-

Dairy Products

-

Meat, Fish, & Eggs

-

Soy Products

-

Fats & Oils

-

Others

-

-

Application Outlook (Revenue, USD Million, 2020 - 2030)

-

Sports Nutrition

-

Weight Management

-

Immunity

-

Digestive Health

-

Clinical Nutrition

-

Cardio Health

-

Others

-

-

Ingredients Outlook (Revenue, USD Million, 2020 - 2030)

-

Carotenoids

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Vitamins

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."