Canada EV Electronics Testing, Inspection, And Certification Market Size, Share & Trends Analysis Report By Service Type, By Sourcing Type, By Application (Safety & Security, Connectors, EV Charging), By Vehicle Type, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

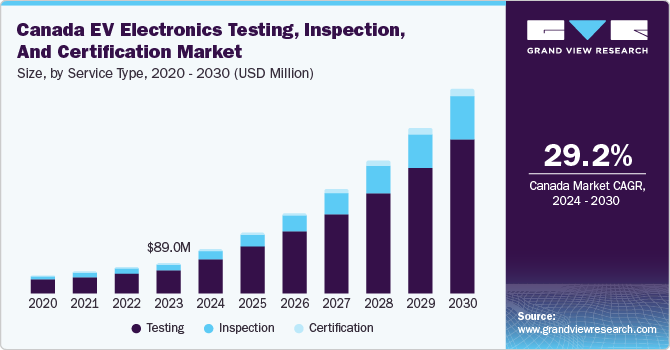

The Canada EV electronics testing, inspection, and certification market size was estimated at USD 89.0 million in 2023 and is projected to grow at a CAGR of 29.2% from 2024 to 2030. The rapid advancement in the automotive industry is propelling significant EV electronics testing, inspection, and certification (TIC) market growth. As automakers globally invest heavily in electric vehicle technology, the automotive sector in Canada is witnessing a surge in innovation, particularly in EV components such as high-voltage battery systems, advanced powertrains, and sophisticated control units with the help of global investments.

These advancements enhance the performance and efficiency of electric vehicles and also increase the complexity of their electronic systems. This complexity requires rigorous testing, inspection, and certification procedures to ensure the safety, reliability, and compliance of EV electronics with regulatory standards. Electric Vehicle Electronics TIC service providers in Canada are pivotal in addressing this demand, providing specialized testing services customized to the distinctive needs of electric vehicles.

The advancements in the automotive industry are driving significant changes in consumer preferences and market dynamics. There is a growing demand for cleaner and more sustainable transportation options as more consumers become aware of the environmental impact of traditional gasoline-powered vehicles. Electric vehicles, with their zero-emission capabilities, are considered as a feasible alternative. This change in consumer preferences is fueling the rapid expansion of the electric vehicle market in Canada, leading to a corresponding increase in the demand for Electric Vehicle Electronics TIC services. As consumers prioritize safety, reliability, and performance when considering electric vehicles, the role of TIC providers becomes paramount in ensuring that EV electronics meet stringent quality standards and regulatory requirements.

TIC services are crucial in enhancing transparency regarding the Total Cost of Ownership (TCO) of electric vehicles, serving environmentally conscious and financially savvy consumers. These services provide valuable insights into battery health, lifespan, maintenance needs, and fuel efficiency, empowering consumers to make informed decisions. Through data-driven assessments, consumers can evaluate the long-term financial implications of owning an electric vehicle, including potential fuel savings. This transparency increases consumer confidence and speeds up the adoption of electric vehicles in Canada, which resonates with the market's growing emphasis on sustainability and fiscal responsibility.

Market Concentration & Characteristics

The market is characterized by a high degree of innovation by advancements in technologies. The utilization of blockchain technology in the EV electronics TIC Market presents a significant opportunity for innovation and efficiency improvements in Canada. By employing blockchain, TIC service providers can strengthen the reliability, transparency, and safety of testing and certification procedures for electric vehicle electronics, simplifying the process and instilling confidence among stakeholders. Blockchain supports the secure and immutable recording of testing data, certification documents, and supply chain information, ensuring tamper-proof records and enhancing trust among stakeholders.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. For instance, in September 2022, Elements Material Technology completed the acquisition of NTS Technical Systems, an environmental simulation testing, inspection, and certification service provider. The acquisition was aimed at supporting clients throughout the product lifecycle by improving the company's capabilities in the crucial growth areas of connected cars, medical devices, and battery testing, thereby strengthening the company's position in the North American region.

In Canada, vehicles must comply with the Canadian Motor Vehicle Safety Standards (CMVSS), covering safety aspects such as crashworthiness and electronic systems, including those unique to electric vehicles. The Canadian Environmental Protection Act (CEPA) regulates vehicle emissions and pollution. Evolving regulations are likely to encourage electric vehicle adoption while addressing environmental concerns.

In-house testing facilities by electric vehicle manufacturers serve as direct substitutes for electric vehicle electronics TIC services, allowing internal testing and certification. While offering control and potential cost savings, they demand significant upfront investments in infrastructure and expertise.

Growing awareness of environmental issues motivates end users to choose electric vehicles over traditional vehicles powered by internal combustion engines. This shift in consumer preference towards eco-friendly transportation options drives the need for TIC services to verify the safety and performance of EV electronics. Rapid advancements in electric vehicle technology, including battery efficiency, range, and connectivity features, influence end users’ preferences. End users seek TIC services to ensure that the latest technologies meet regulatory standards and perform reliably.

Service Type Insights

Based on service type, the testing segment led the market with the largest revenue share of 76.7% in 2023. The segment's growth is attributed to the increasing adoption of electric and hybrid vehicles. The segment's growth is characterized by the integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) to enhance testing accuracy and efficiency. AI and ML algorithms are utilized for precise data analysis, enabling the identification of patterns and irregularities in testing processes. In addition, cloud-based testing platforms are emerging, providing manufacturers with accessibility to resources, facilitating seamless data sharing, and enabling collaborative efforts among engineers across different locations.

The certification segment is projected to grow at a significant CAGR during the forecast period. There is a growing emphasis on safety and cybersecurity certification, driven by the increasing complexity of electric vehicles (EVs) and their interconnected nature. Certification bodies are actively developing new standards to assess these aspects, ensuring the safety and security of EVs on Canadian roads. Moreover, there is a rising demand for over-the-air (OTA) software updates in Canada to enhance EV performance, safety, and security. Moreover, certification standards for OTA updates are evolving to meet the specific requirements of the Canadian EV market.

Sourcing Type Insights

Based on sourcing type, the in-house segment led the market with the largest revenue share of 57.0% in 2023. When automakers conduct TIC in-house, they retain complete control over the process, from developing test procedures to executing tests, ensuring that EVs meet the highest standards of quality and safety. Major players in the Canadian automotive industry are significantly driving market growth through new strategic initiatives aimed at enhancing in-house TIC capabilities. By investing in in-house testing facilities and expertise, these companies aim to streamline the certification process and improve the efficiency of bringing EVs to market.

The outsourced segment is predicted to grow at a significant CAGR during the forecast period. Outsourced TIC providers offer specialized expertise and services essential for testing and certifying electric vehicles (EVs) to the highest standards. This approach is advantageous for smaller automakers and companies that may need more resources to invest in in-house TIC capabilities. Outsourced TIC providers in Canada play a crucial role in supporting the EV industry by offering comprehensive testing and certification services tailored to the unique needs of EV manufacturers. These providers possess the necessary expertise, equipment, and facilities to conduct thorough testing and ensure compliance with regulatory requirements in Canada to enhance EV performance, safety, and security. Moreover, certification standards for OTA updates are evolving to meet the specific requirements of the Canadian EV market.

Application Insights

Based on application, the EV charging segment led the market with the largest revenue share of 55.1% 2023. This growth is primarily driven by the increasing adoption of electric vehicles, which necessitates a corresponding expansion of EV charging infrastructure to meet the rising demand. Governments are playing a crucial role through policies and incentives aimed at promoting EV adoption and supporting the development of charging infrastructure, including subsidies, tax incentives, and mandates for charging station installations. Furthermore, ongoing advancements in charging technology, coupled with the expansion of charging networks by operators and stakeholders, are enhancing the accessibility, efficiency, and convenience of EV charging, thus contributing to the broader shift towards cleaner transportation options.

The connectors segment is predicted to grow at a significant CAGR during the forecast period. This growth is primarily fueled by the rapid expansion of the EV market in Canada, driving demand for components essential to EV functionality, including connectors. Connectors serve an essential role in EVs, facilitating the transmission of power and data between various components such as batteries, electric motors, and charging systems. Furthermore, technological advancements in connector design are enhancing performance, reliability, and efficiency, catering to the unique requirements of electric vehicles, such as high-voltage and high- current applications. These advancements maintain the safety, durability, and functionality of connectors, fueling their adoption in EVs and driving demand for TIC services. TIC services ensure connector compliance with these standards, assuring manufacturers, suppliers, and consumers regarding the integrity and safety of EV systems.

Vehicle Type Insights

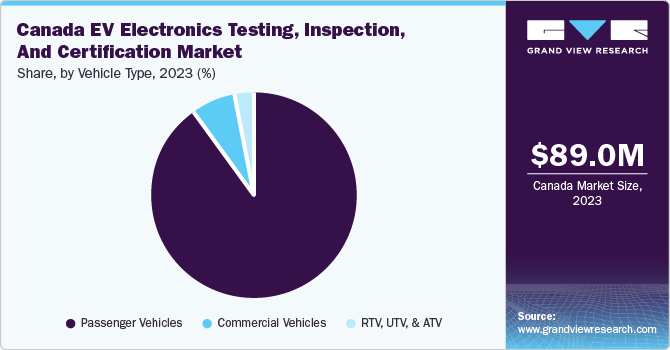

Based on vehicle type, the passenger cars segment led the market with the largest revenue share of 85.6% in 2023. The increasing demand for electric cars fuels this growth, necessitating stringent TIC services to ensure compliance with safety and regulatory standards. As electric vehicles gain traction, particularly in Canada, there's a corresponding surge in the demand for EV-related TIC services, covering components such as batteries, charging systems, and overall vehicle safety. Government initiatives and regulations aimed at promoting electric vehicle adoption further drive the segment's growth, compelling manufacturers to meet standards and consumers to embrace electric mobility.

The RTV, UTV & ATV segment is predicted to grow at a significant CAGR during the forecast period. The segment's growth is fueled by the rising demand for outdoor recreational activities that have spurred interest in off-road vehicles such as Recreational Terrain Vehicles (RTVs), Utility Terrain Vehicles (UTVs), and All-Terrain Vehicles (ATVs). In addition, manufacturers are continuously innovating, introducing advanced features to enhance performance, safety, and comfort, making these vehicles increasingly appealing to consumers. Moreover, the expanding applications of Recreational Off-Highway Vehicles (ROVs) beyond recreation into sectors such as agriculture, forestry, and construction broaden their market potential.

Country Insights

The EV electronics testing, inspection, and certification (TIC) market in Canada is driven by its national goals to achieve 100% zero-emission vehicle sales by 2040. The federal government is actively supporting the growth of both upstream materials production and downstream development of electrified vehicle assembly within the country. This includes efforts to attract leading global battery manufacturers, indicating a strategic push towards establishing Canada as a key player in the evolving EV ecosystem. Through a combination of industry expansion, innovative projects, and supportive policies, Canada is positioning itself as a prominent player in the global transition toward sustainable transportation.

Key Canada EV Electronics Testing, Inspection & Certification Company Insights

Key Canada EV electronics TIC companies include Applus+, Bureau Veritas, and CSA Group Testing & Certification Inc. These companies are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in January 2024, UL Solutions partner with Hyundai Mobis, manufacturer, and supplier of automotive parts. The partnership will focus on developing and evaluating electric vehicle batteries. The two companies will collaborate in North America. UL Solutions is an engineering services provider. Hyundai Mobis North America is an affiliate of Hyundai Mobis.

Key Canada EV Electronics Testing, Inspection & Certification Companies:

- Applus+

- Bureau Veritas

- CSA Group Testing & Certification Inc.

- DEKRA

- DNV

- Element Materials Technology.

- Intertek Group plc

- National Research Council of Canada

- SGS SA

- UL LLC

Recent Developments

-

In July 2023, TÜV SÜD subsidiary TÜV SÜD America Inc. officially opened an electric vehicle environmental laboratory in Auburn Hills in the U.S. state of Michigan as part of the company’s commitment to driving excellence in electric vehicles, including batteries, components, and system solutions

-

In June 2023, General Motors (GM) partners with Tesla to expand electric vehicle (EV) charging access in North America. The collaboration will allow GM EV drivers to use Tesla Superchargers by 2025. This will be achieved by integrating the North American Charging Standard (NACS) connector design into GM EVs. GM is also working on expanding its own charging network. Tesla and GM believe this collaboration is a big step towards making EVs more convenient and appealing to consumers

-

In April 2022, Element Materials Technology acquired Energy Assurance (EA); a leading independent battery testing operator based in Gainesville in the U.S. state of Georgia. The acquisition was aimed at expanding Element Materials Technology’s testing capabilities, allowing it to offer even more comprehensive services for batteries and battery-powered products leveraging EA’s impressive infrastructure for testing, utilizing over 3,000 cycling channels and more than 200 environmental chambers

Canada EV Electronics Testing, Inspection & Certification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 128.9 million |

|

Revenue forecast in 2030 |

USD 598.2 million |

|

Growth rate |

CAGR of 29.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service type, sourcing type, application, vehicle type |

|

Country scope |

Canada |

|

Key companies profiled |

Applus+; Bureau Veritas; CSA Group Testing & Certification Inc.; DEKRA; DNV; Element Materials Technology; Intertek Group plc; National Research Council of Canada; SGS SA; and UL LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Canada EV Electronics Testing, Inspection & Certification Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Canada EV electronics testing, inspection, and certification (TIC) market report based on service type, sourcing type, application, and vehicle type.

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Testing

-

Battery Testing

-

Electric E-motor Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Component Testing

-

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Million, 2017 - 2030)

-

In-house

-

Outsourced

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Safety and Security

-

Connectors

-

Communication

-

EV Charging

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

RTV, UTV, & ATV

-

Frequently Asked Questions About This Report

b. The CCanada EV electronics testing, inspection, and certification market size was estimated at USD 89.0 million in 2023 and is expected to reach USD 128.9 million in 2024.

b. The Canada EV electronics testing, inspection, and certification market is expected to grow at a compound annual growth rate of 29.2% from 2024 to 2030, reaching USD 598.2 million by 2030.

b. The testing segment led the market in 2023, accounting for over 76% of the overall revenue. The segment's growth is attributed to the increasing adoption of electric and hybrid vehicles. It is also characterized by the integration of advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) to enhance testing accuracy and efficiency.

b. Some key players operating in the Canada EV Electronics TIC market include Applus+; Bureau Veritas; CSA Group Testing & Certification Inc.; DEKRA; DNV; Element Materials Technology.; Intertek Group plc; National Research Council of Canada; SGS SA; and UL LLC.

b. Key factors that are driving the Canada EV Electronics TIC market growth include the rapid advancement in the automotive industry, consumer awareness of environmental issues and demand for electric vehicles, and infrastructure development for electric vehicle charging.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."