- Home

- »

- Next Generation Technologies

- »

-

Canada Electric Vehicle Testing, Inspection, And Certification Market, Report, 2030GVR Report cover

![Canada Electric Vehicle Testing, Inspection, And Certification Market Size, Share & Trends Report]()

Canada Electric Vehicle Testing, Inspection, And Certification Market (2024 - 2030) Size, Share & Trends Analysis Report By Service Type (Testing, Inspection), By Sourcing Type, By Application, By Vehicle Type, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-320-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

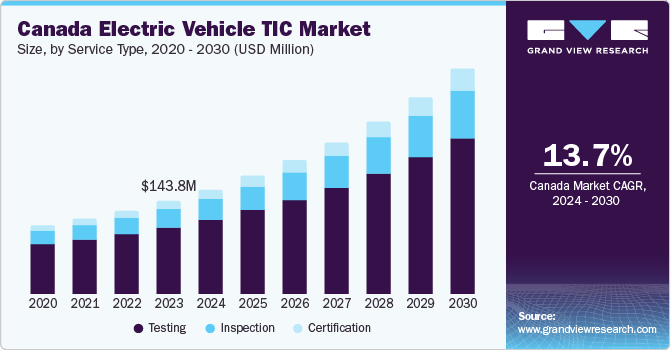

The Canada electric vehicle testing, inspection, and certification market size was estimated at USD 143.8 million in 2023 and is projected to grow at a CAGR of 13.7% between 2024 and 2030. The global race for a sustainable future has encouraged manufacturers and operators of electric vehicles (EVs) to emphasize testing, inspection, and certification services. A significant uptake in the adoption of EVs, along with heightened awareness of environmental sustainability, has solidified the position of TIC service providers in the North American region.

The Western Hemisphere country is likely to witness an increased focus on testing and inspection processes to bolster safety standards. Prominently, the penetration of battery electric vehicles and fuel cell electric vehicles has augured well for the market growth. With automakers investing in the production and development of EVs, demand for testing, inspection, and certification (TIC) services is poised to gain a foothold. Moreover, the incorporation of new testing facilities will encourage industry leaders to inject funds into the ecosystem.

Automakers make advancements in terms of connectivity technologies, battery and ADAS. It alludes to a promising future for the TIC service providers in Canada. A considerable stride taken in the development of EVs, charging stations and the introduction of favorable policies have empowered certification and testing of electric vehicles. Besides, Canada is likely to inject funds into laboratories with latest testing and inspection equipment and tools.

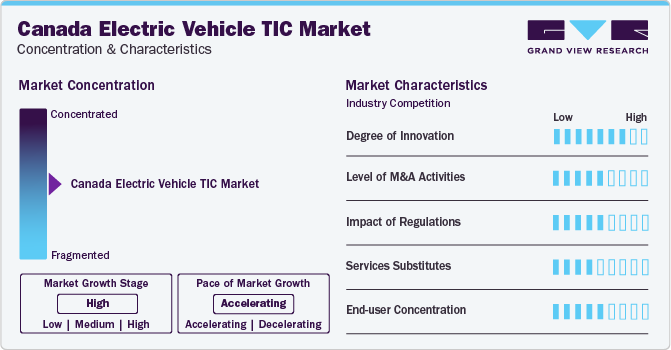

Market Concentration & Characteristics

Innovation has gained traction in TIC services as EV makers strive to replace more metal components with plastic to minimize weight, thereby minimizing transport emissions. Stakeholders are expected to count on quality infrastructure solutions to add competitiveness to the products and services. With a surge in the demand for EVs, technological advancements will be pronounced and foster innovation in the North America market.

The level of mergers and acquisitions is likely to be noticeable as companies and startups strive to gain a competitive edge. Prominently, vertical and horizontal mergers and acquisition strategies will receive an impetus to propel regional footprint, diversify products, and reduce OPEX. Strategies surrounding M&A activities allude to a focus on safe and sustainable infrastructure in the automotive sector.

Regulations are likely to have a notable influence on the business outlook as Canada spearheads the fight against climate change. In December 2022, the northern neighbor of the U.S. announced the new Electric Vehicle Availability Standard that mandates auto manufacturers and importers to meet annual zero-emission vehicle (ZEV) regulated sales targets. The target requires that 60% of new light-duty vehicles offered for sale be ZEVs by 2030. The standard is expected to ensure a rising supply of zero-emission vehicles for Canadians.

The level of substitutes is likely to be moderate as the demand for specialized testing and certification services gains traction. In doing so, advanced approaches tailored to the attributes of battery technologies, electric propulsion system and charging infrastructure are likely to substitute traditional automotive testing methods. Some factors, including strong demand for adherence to rigorous environmental regulations and the need for high-voltage component safety could redefine the regional landscape.

End-users, including defense, automotive and aerospace, are slated to exhibit heightened demand for EV testing, inspection and certification services. To illustrate, the aerospace industry has exhibited notable traction for electric vehicles to bolster their sustainability quotient. Stakeholders are expected to inject funds to minimize the manufacturing and development costs of EVs vis-à-vis conventional vehicles.

Service Type Insights

The testing segment led the Canada electric vehicle TIC market, accounting for 71.6% of revenue share in 2023. The growth is partly attributed to the penetration of artificial intelligence machine learning technologies to propel testing methods. Moreover, investments in advanced test equipment will gain traction to boost faster time to market. For instance, Electromagnetic Compatibility (EMC) testing has become sought-after to help decide if EVs can function as intended and the testing can help adhere to regulations.

The certification segment is poised to depict a notable rise on the back of the demand for safety and cybersecurity certification services. Certification bodies are formulating new standards to assess critical aspects. Leading players are banking on over-the-air (OTA) software updates to underscore the security, safety, and performance of EVs. With Canada augmenting investment in EVs, the need for certification will be instrumental to boost brand position.

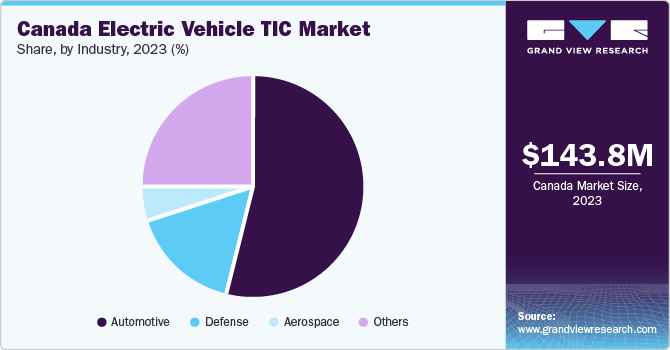

Industry Insights

The automotive segment is likely to contribute notably towards the Canada electric vehicle TIC market share during the forecast period, partly against the backdrop of the demand for plug-in hybrid electric vehicles (PHEVs) and BEVs. Predominantly, stakeholders have sought BEVs in light of growing charging infrastructure, improved performance, extended range, and cost reduction. In addition, a rise in EV production will accentuate the need for TIC services across Canada.

The defense segment witnessed an uptick on the heels of robust policies from the Department of National Defence (DND). For instance, DND had a bullish aim of having 50 percent of its fleet operating in Canada to be ZEVs by the end of 2023. The North American country has shown traction for EVs to reduce fuel consumption, environmental impact and maintenance costs. Testing and certifications will gain ground as the Canadian military contemplates electrifying vehicles.

Sourcing Type Insights

The in-house segment is poised to witness an upward growth trajectory, partly due to the demand to boost the efficiency, precision, and reliability of the testing processes. Canada may witness the penetration of TIC procedures internally to ensure EVs keep up with the most stringent standards. Automotive manufacturers are likely to bank on in-house sourcing to bolster customization, save costs, and foster flexibility.

The outsourced segment will grow against the backdrop of heightened demand from small automakers and companies that need more resources to invest in in-house services. Besides, modifications and updates of testing standards have encouraged stakeholders to count on outsourcing services. Predominantly, the penetration of third-party inspection services has prompted end-users to infuse funds into outsourced service providers.

Application Insights

The safety & security segment has gained ground following the surge in the production of EVs that are safe. Stakeholders are expected to invest in rigorous safety checks and testing to ensure the safety of the infrastructure and equipment fostering the EVs. Besides, regulatory bodies are investing in TIC services to ensure vehicles meet the required level of reliability, safety and quality.

The EV charging segment is expected to gain an impetus on the back of heightened demand to install charging points. In essence, testing during the development of the product could be pronounced as it will enable the reduction of the cost of re-working the final product (if it fails when tested) and bolster product efficiency. EV charging testing and certification will open opportunities with faster time to market and strong brand value.

Vehicle Type Insights

The battery electric vehicle (BEV) segment will witness an upward growth trajectory against the backdrop of surging penetration of environmentally friendly transportation. End users are likely to seek comprehensive testing and certification services to adhere to industry standards. Furthermore, battery testing laboratories are expected to gain ground, largely due to the demand for batteries and the responsibility for manufacturing safe and high-quality battery (products).

The fuel cell electric vehicle (FCEV) segment is poised to gain ground on the back of the infusion of funds into zero-emission transportation solutions. Moreover, rigorous testing and certification have become pivotal for the integration of hydrogen fuel cells and addressing concerns about transportation, storage, and utilization. Investments in FCEVs are likely to help Canada meet its emission targets effectively.

Key Canada Electric Vehicle Testing, Inspection, And Certification Company Insights

Some of the leading players operating in the market include DEKRA SE, TÜV Rheinland, Bureau Veritas, Intertek Group plc and SGS Société Générale de Surveillance SA. They are likely to focus on organic and inorganic strategies to underpin their strategies in the regional landscape.

-

In May 2023, Innovative Solutions Canada (ISC) offered funding with DND to underpin the prototype testing of hybrid e-drive systems (to be retrofitted into current military vehicles.

-

In May 2023, TÜV Rheinland exhorted that its employees conducted around 400,000 industrial inspections worldwide and tested around 300,000 products in 2022.

-

In November 2022, DEKRA asserted that green hydrogen would play a “key role” in combating climate change and exhorted the creation of a hydrogen economy and establishing a comprehensive regulatory framework to ensure the safe adoption of the technology.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In March 2022, the Government of Canada and Ontario inked a USD 15 billion project between Stellantis N.V and LG Energy Solutions to manufacture EV batteries.

-

In September 2023, Quebec announced investment of USD 514.5 million to add 116,700 public chargers to Quebec’s public network.

Key Canada Electric Vehicle Testing, Inspection, And Certification Companies:

- Bureau Veritas

- DEKRA SE

- Element Materials Technology

- Intertek Group plc

- iASYS Technology Solutions

- SGS Société Générale de Surveillance SA

- TÜV SÜD

- TÜV Rheinland

- UL LLC

Recent Developments

-

In January 2023, Bureau Veritas developed an EV charging team and injected funds to propel EV charging deployments globally.

-

In September 2022, Aurora Capital Partners announced the completion of the sale of National Technical Systems to Element Materials Technology Group.

Canada Electric Vehicle Testing, Inspection, And Certification Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 161.7 million

Revenue forecast in 2030

USD 348.7 million

Growth rate

CAGR of 13.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type; sourcing type; application; vehicle type; industry

Key companies profiled

Bureau Veritas; DEKRA SE; Element Materials Technology; Intertek Group plc; iASYS Technology Solutions; SGS Société Générale de Surveillance SA; TÜV SÜD; TÜV Rheinland; UL LLC

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Canada Electric Vehicle TIC Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Canada electric vehicle TIC market based on service type, sourcing type, application, vehicle type, and industry.

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Testing

-

Battery Testing

-

Electric E-Motor Testing

-

Electromagnetic Compatibility (EMC) Testing

-

Component Testing

-

-

Inspection

-

Certification

-

-

Sourcing Type Outlook (Revenue, USD Million, 2017 - 2030)

-

In-House

-

Outsourced

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Safety & Security

-

Connectors

-

Communication

-

EV Charging

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

BEV

-

PHEV

-

FCEV

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Aerospace

-

Defense

-

Others

-

Frequently Asked Questions About This Report

b. The global Canada electric vehicle testing, inspection, and certification market size was estimated at USD 143.8 million in 2023 and is expected to reach USD 161.7 million in 2024.

b. The global Canada electric vehicle testing, inspection, and certification market is expected to grow at a compound annual growth rate of 13.7% from 2024 to 2030 to reach USD 348.7 million by 2030.

b. The testing segment dominated the Canada electric vehicle TIC market with a share of 71.6% in 2023. The growth is partly attributed to the penetration of artificial intelligence, machine learning technologies to propel testing methods.

b. Some key players operating in the Canada electric vehicle TIC market include Bureau Veritas; DEKRA SE; Element Materials Technology; Intertek Group plc; iASYS Technology Solutions; SGS Société Générale de Surveillance SA; TÜV SÜD; TÜV Rheinland; UL LLC

b. Key factors driving the growth of the Canada electric vehicle TIC market include a significant uptake in EV adoption and heightened awareness of environmental sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.