- Home

- »

- Clothing, Footwear & Accessories

- »

-

Camping Tent Market Size, Share & Growth Report, 2030GVR Report cover

![Camping Tent Market Size, Share & Trends Report]()

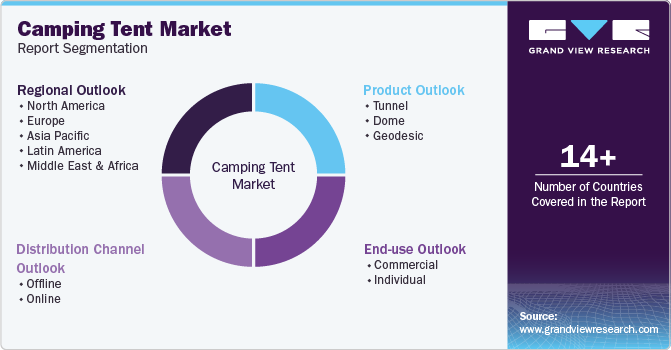

Camping Tent Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tunnel, Dome, Geodesic), By End-use (Commercial, Individual), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-194-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Camping Tent Market Summary

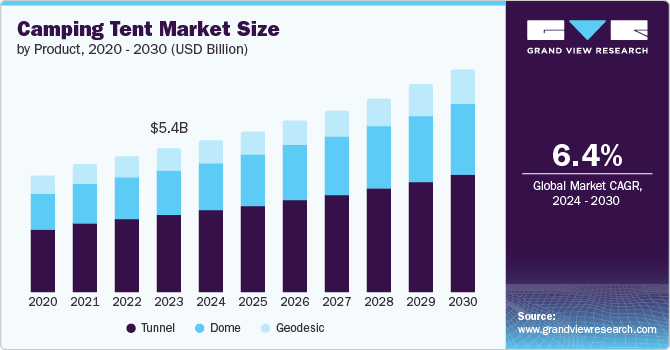

The global camping tent market size was valued at USD 5.40 billion in 2023 and is projected to reach USD 8.30 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. The increasing popularity of outdoor activities and extreme sports is a key driver for the market. Thus, the increased spending on extreme sports such as hiking, trekking, and mountain climbing has created a demand for convenient, flexible, and affordable shelter tents that can withstand harsh weather conditions such as hurricanes and snowfall.

Key Market Trends & Insights

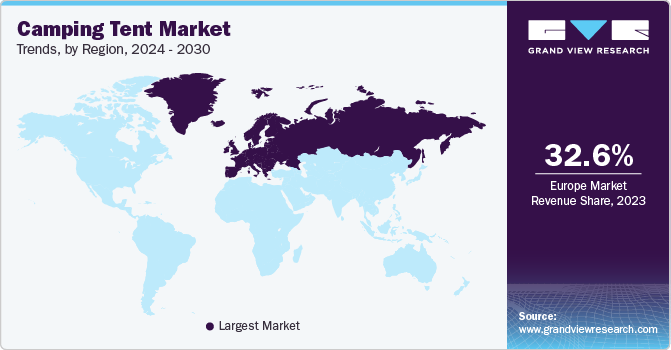

- Europe camping tent market held the highest market revenue share of 32.6% in 2023.

- The UK camping tent market is anticipated to grow significantly over the forecast period.

- By product, The tunnel segment dominated the market and accounted for a market revenue share of 54.0% in 2023.

- By end use, The individual segment accounted for the largest market revenue share in 2023.

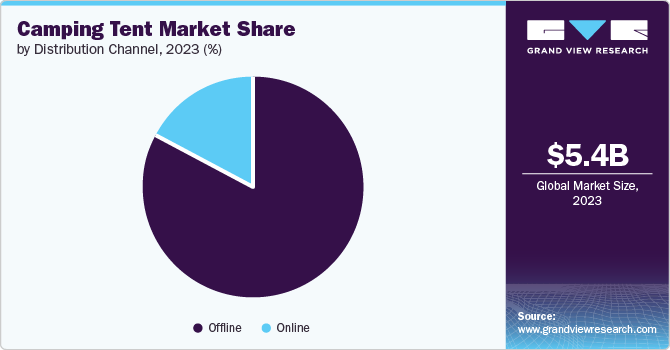

- By distribution channel, The offline segment dominated the market and accounted for a market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.40 Billion

- 2030 Projected Market Size: USD 8.30 Billion

- CAGR (2024-2030): 6.4%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Increased disposable income, growth in tent manufacturing, easy availability in online and offline formats, and a wide range of products to suit camping needs are expected to drive market growth. In addtion, increased consumer awareness of the mental and physical health benefits of spending time outdoors also raises the bar. Customization and personalization are rapidly becoming key determinants of consumer purchasing decisions across industries and the camping tent market.

With the diversity of customer needs and preferences, brands are moving away from the traditional one-size-fits-all approach. Several custom options are now offered to meet individual needs. These factors are anticipated to drive the market growth. Integration of smart technology into tent design. With the advent of the Internet of Things (IoT) and other technological advances, tents are no longer just simple structures. Modern tents include features like solar panels, a USB port for charging the device, and even Wi-Fi. Various companies are making such tents. In addition, these features enhance the overall camping experience, making it accessible, safe, and enjoyable. With this combination of technologies, campers can stay connected even in remote locations, ensuring safety and peace of mind. These factors contribute significantly to the camping tent market share.

Product Insights

The tunnel segment dominated the market and accounted for a market revenue share of 54.0% in 2023. These tents provide excellent wind protection, withstand high winds, and are likelier to go in groups. Innovators with high-energy fabrics. This tent offers plenty of headroom and gear, perfect for family camping or long trips. The trench tent design is generally stable, making it popular in harsh weather. Innovations such as inflatable panels instead of wood have made these tents more user-friendly. Manufacturers are adding advanced features to make these tents lighter and more durable, increasing the demand in this segment. For instance, In June 2024, Jack Wolfskin launched a new lightweight, permanent, and sustainable tent range. The collection featured 22 designs, including three tunnel tents made from 100% recycled, PFC-free fabrics.

The dome segment is expected to grow at a fastest CAGR during the forecast period. Due to key driving factors such as their versatility, dome tents are suitable for various outdoor activities, from casual camping to rugged trekking. They are generally easier and quicker to set up than other types, making them popular with many campers. In addition, dome tents are often compact and ideal for backpackers and hikers. Materials and curtain technology advances have made dome curtains more durable and weatherproof. The shape of the dome tent provides excellent stability against wind and other factors, which is significant for campers looking for reliable accommodation.

Additionally, the expansion of e-commerce and the wide range of online products has made it easier for consumers to purchase dome tents. Increased marketing and promotions by manufacturers and retailers raised awareness and interest in canopy dome tents. All these factors contribute to the dome segment, which is expected to increase in the camping tent market.

End-use Insights

The individual segment accounted for the largest market revenue share in 2023. The desire for personal adventure and self-discovery has fueled the growth of solo travel and camping. Individual tents are generally easy and quick to set up, making it easier for travellers to deal with their camping gear alone. The growing preference among solo backpackers and hikers for lightweight equipment is another factor fueling the segment's growth. Individual tents provide space and privacy, appealing to solo campers. The growing interest in outdoor activities and adventure sports has also led to a greater demand for personalized camping gear, driving the segment's growth.

The commercial segment is anticipated to register the fastest CAGR over the forecast period. The increasing popularity of extreme sports and tourism has led to a demand for commercial tents. The growing popularity of adventure tourism and outdoor recreational activities has led to a significant increase in the market for commercial camping services. The trend for "glamping" (glamorous camping) has increased, with many retailers offering luxurious and relaxing camping experiences that appeal to a wide range of consumers. In addition, outdoor spaces are used great for corporate leisure, team-building events, and festivals, which have encouraged the demand for large camps.

Distribution Channel Insights

The offline segment dominated the market and accounted for a market revenue share in 2023. Major companies focus on opening new stores to gain a competitive advantage. The company plans to increase the number of online stores to attract more customers in the region due to the exceptionally high-quality camping facilities offered. Consumers view these stores as trustworthy because they often provide expert advice and in-depth product knowledge. The variety of brands available and the opportunity to physically inspect the product go a long way to building customer confidence and increasing experiential sales in these stores. The ability of customers to try on curtains also boosts this segment. Various seasonal promotions and discounts increase sales in-store, driving growth in this segment.

The online segment is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. The rapid growth of e-commerce platforms has simplified the process for consumers to purchase camping tents online, providing a variety of options and competitive pricing. This convenience allows customers to browse and buy tents from the comfort of their homes. Enhanced delivery services and easy access to customer reviews, ratings, and detailed product descriptions empower consumers to make informed decisions, thereby increasing their confidence in online shopping. Furthermore, improved digital marketing strategies, such as targeted advertising and social media promotions, have expanded the visibility and reach of online camping tent products. Innovations in online marketing technologies, including virtual reality (VR) and augmented reality (AR), also enhance the shopping experience by allowing consumers to visualize camping and tent setups in virtual environments.

Regional Insights

The North American camping tent market held substantial market share in 2023. Innovations in tent materials, designs, and manufacturing techniques have revolutionized the camping experience by making tents more lightweight, durable, and user-friendly. Advanced materials like high-strength nylon, polyester, and proprietary blends enhance the durability and weather resistance of tents while significantly reducing their weight, which makes them easier to carry and transport. Cutting-edge design improvements, such as pre-attached poles, color-coded clips, and intuitive layout configurations, facilitate quick and effortless setup, allowing campers to pitch their tents in minutes. Enhanced weather resistance features, including improved waterproof coatings, sealed seams, and robust frame structures, ensure that tents can withstand harsh weather conditions, providing reliable protection against rain, wind, and UV rays.

U.S. Camping Tent Market Trends

The U.S. camping tent market is expected to grow rapidly during the forecast period. Growing awareness and demand for eco-friendly camping options are driving the camping tent market as consumers increasingly prioritize sustainability in their purchasing decisions. Consumers seek tents and camping gear from sustainable materials such as recycled fabrics, organic cotton, and biodegradable components. Additionally, they favor companies that implement environmentally responsible practices throughout their production processes, including reducing carbon emissions, minimizing waste, and using eco-friendly packaging.

Europe Camping Tent Market Trends

Europecamping tent market held the highest market revenue share of 32.6% in 2023. Improved infrastructure for camping in Europe significantly boosts the appeal and accessibility of camping as a recreational activity. Many European countries have invested substantially in developing and maintaining camping sites, ensuring they are well-equipped with modern amenities such as clean restrooms, showers, cooking facilities, and electricity hookups. These enhancements make camping a more comfortable and convenient option for a broader range of people, including families, elderly campers, and those new to outdoor activities. Better access roads and clear signage improve the ease of reaching these sites, reducing travel stress and making remote and scenic locations more accessible. Investments in safety measures, such as enhanced security and first aid facilities, further contribute to driving the demand in Europe.

The UK camping tent market is anticipated to grow significantly over the forecast period. The availability of a diverse range of camping options significantly enhances camping's appeal to a broad spectrum of consumers. From traditional tents that offer a classic outdoor experience to high-tech shelters equipped with advanced features such as weather resistance, ventilation, and quick-setup technology, the market caters to various preferences and needs, driving the growth of the camping tent market.

Asia Pacific Camping Tent Market Trends

Asia Pacific camping tent market is anticipated to grow at fastest CAGR over the forecast period. Economic growth and rising disposable incomes in key Asia Pacific countries such as China, India, and Australia have significantly contributed to the expansion of the camping market. As these economies develop and the middle class grows, consumers have more financial flexibility to invest in leisure activities, including camping. Increased disposable income allows individuals and families to allocate funds towards high-quality camping gear and equipment, which enhances their outdoor experiences. This financial capability encourages more frequent and diverse outdoor recreational activities.

The influence of social media platforms, such as WeChat and Weibo, has played a significant role in promoting camping and outdoor activities in China. These platforms have become popular channels for people to share their camping experiences, photos, and recommendations, inspiring others to try camping and contributing to the growth of the camping tent market. Users on WeChat and Weibo can post about their camping trips, showcasing beautiful landscapes, camping gear, and tips for a successful camping experience. These posts often reach a broad audience, allowing individuals to discover new camping destinations, learn about different types of camping tents, and gather insights from others' experiences.

Key Camping Tent Company Insights

Some of the key industries participants include Hilleberg the Tentmake, JOHNSON OUTDOORS INC., The North Face, A VF Company, The North Face, A VF Company, and others.

-

Hilleberg the Tentmaker is a Swedish company known for producing comfortable and durable tents designed for extreme weather conditions. Their range includes lightweight backpacking tents, sturdy climbing tents and all-season tents. Hilleberg emphasizes innovation using advanced materials and quality. The company also offers connected camping gear, creating a complete outdoor experience.

-

Johnson Outdoors Inc. is a global outdoor recreation company which designs, manufactures and markets innovative products for camping. Key brands include Min Kota, Hummingbird and Jetboil, known for their high quality and functionality. The company is committed to creating sustainable outdoor experiences and enhancing outdoor experiences through technology and innovation. Johnson Outdoors operates in many countries, catering to outdoor enthusiasts around the world.

Key Camping Tent Companies:

The following are the leading companies in the camping tent market. These companies collectively hold the largest market share and dictate industry trends.

- AMG-Group

- Hilleberg the Tentmake

- JOHNSON OUTDOORS INC.

- The North Face, A VF Company

- Newell Brands

- Oase Outdoors ApS

- Big Agnes, Inc.

- Exxel Outdoors, LLC

- Simex Outdoor International GmBH

- The Coleman Company, Inc.

Recent Developments

-

In January 2024, URANG launched Hitch-Home, the world's first hitch-type air tent, on Kickstarter. This innovative camping tent aims to redefine outdoor adventures by providing a lightweight and ultra-practical camping solution. The Hitch-Home eliminates the struggles of traditional tent setups and offers a new level of camping comfort. It is designed to be easily attached to a vehicle's hitch, making it convenient to transport and set up.

-

In March 2024, TAXA Outdoors launched the latest models of their popular camping trailers, the 2024 Mantis and Woolly Bear, along with new rooftop tents. The 2024 Mantis, known for its innovative design and versatility, features upgraded interior amenities and enhanced off-road capabilities, making it ideal for adventurous travelers. TAXA introduced a line of rooftop tents designed to provide a comfortable and elevated camping experience, expanding their product offerings to cater to a broader range of outdoor enthusiasts.

Camping Tent Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.72 billion

Revenue forecast in 2030

USD 8.30 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; UAE

Key companies profiled

AMG-Group; Hilleberg the Tentmake; JOHNSON OUTDOORS INC.; The North Face; A VF Company; Newell Brands; Oase Outdoors ApS; Big Agnes; Inc.; Exxel Outdoors; LLC.; Simex Outdoor International GmBH; The Coleman Company; Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Camping Tent Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global camping tent market report based on product, distribution channel, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tunnel

-

Dome

-

Geodesic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Individual

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.