- Home

- »

- Consumer F&B

- »

-

Camel Milk Products Market Size, Industry Report, 2030GVR Report cover

![Camel Milk Products Market Size, Share & Trends Report]()

Camel Milk Products Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Plain, Flavored, Powder, Ice Cream, Fermented), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-430-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Camel Milk Products Market Summary

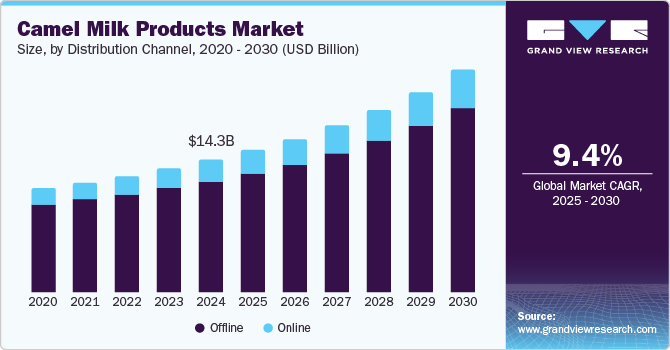

The global camel milk products market size was estimated at USD 14.30 billion in 2024 and is projected to reach USD 24.02 billion by 2030, growing at a CAGR of 9.4% from 2025 to 2030. The growth of this market is primarily driven by the growing awareness regarding the benefits provided by camel milk products, such as nutritional value, higher amounts of vitamins A and C, natural probiotic content, lower fat content, and others.

Key Market Trends & Insights

- Middle East & Africa dominated the global camel milk products market with a share of 58.9% in 2024.

- The U.S. camel milk products market held the largest revenue share in the North American region in 2024.

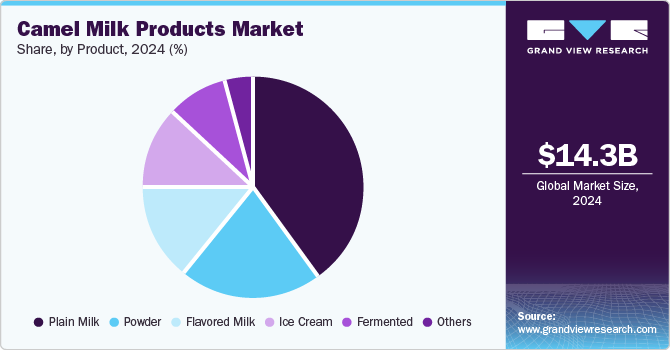

- By product, the plain milk segment held the largest market share of 40.5% in 2024.

- By distribution channel, the online distribution segment is anticipated to register the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 14.30 Billion

- 2030 Projected Market Size: USD 24.02 Billion

- CAGR (2025-2030): 9.4%

- Middle East & Africa: Largest market in 2024

The use of camel milk in the pharmaceutical industry to make supplements is also contributing to the growth of this market.

The absence of beta-casein and beta-lactoglobulin, two key allergens in cow's milk allergy found in many individuals, makes camel milk suitable for many customers. In addition, the presence of lactoferrin, bioactive peptides, and zinc in camel milk assists in treating numerous health issues, such as asthma, tuberculosis, and other gastrointestinal diseases. Furthermore, it comprises a protective protein, which provides immunological properties. Camel milk is often consumed fresh and plain; the surplus remains are usually stored in fermented form. The fermented version of camel milk has an extended shelf life and is largely preferred by consumers.

The demand from urban consumers has encouraged manufacturers to develop and deliver a diversified portfolio of products made from camel milk, such as ice cream, flavored milk, sweets, chocolates, and others. These products are priced slightly higher than traditional dairy products due to camels' lesser milk production capacity than cows, rich nutritional offerings, and higher demand than supply. In addition, limitations and regulations regarding the import of camel milk also influence the prices.

Product Insights

Plain milk dominated the global camel milk products industry, with the largest revenue share of 40.5% in 2024. The growing demand for pasteurized camel milk, increasing awareness regarding the benefits offered by the product, rising availability and accessibility, and low-fat contents are some of the key growth driving factors for this market. Effective distribution strategies implemented by the major companies, ease of availability, and growing efforts by marketers to educate customers are adding to the growth opportunities of this market.

The fermented segment is projected to experience the fastest CAGR from 2025 to 2030. The fermented form of camel milk is named differently in different regions worldwide. These include Suusac in Kenya, Gariss in Sudan, Chal in Turkmenistan, and Shubat in Kazakhstan. Fermented camel milk is mainly consumed for its nutritional value, distinguished taste, texture, and pleasant aroma.

Distribution Channel Insights

Based on distribution channel, the offline distribution segment accounted for largest revenue share of the global camel milk product industry in 2024. This is attributed to increasing demand for camel milk products from supermarkets, grocery stores, and other offline spots owing to convenience, ease of accessibility, and more. Brands prefer effective offline distribution strategies as presence in multiple stores of prominent retail organizations enhances brand visibility in the market. The presence of global and domestic retail businesses with a wide variety of offerings, availability in local stores, and enhanced engagements accomplished through offline distribution add to the growth opportunities of this market.

The online distribution segment is projected to experience the highest CAGR from 2025 to 2030. The growth of this segment is influenced by factors such as enhanced availability through quick commerce platforms and increased inclination towards online shopping, which ensures convenience, hassle-free experiences, and ease of use. In addition, services offered by the online platforms include free delivery, subscription advantages, enhanced customer assistance, and more.

Regional Insights

North America camel milk products market is projected to experience the highest CAGR in 2024. This is attributed to factors such as growing awareness regarding benefits associated with the product, enhanced product portfolios offered by the key companies, significant demand from urban consumers with healthy dietary preferences, alternatives offered by camel’s milk products for consumers with cow’s milk allergy, and more.

U.S. Camel Milk Products Market Trends

The U.S. camel milk products market held the largest revenue share of the North American camel milk products industry in 2024. This market is primarily influenced by factors such as the nutritional value offered by camel milk, ease of availability through stores, enhanced portfolios presented by the major market participants, and increasing awareness regarding the benefits associated with camel milk.

MEA Camel Milk Products Market Trends

Middle East and Africa dominated the global camel milk product market with a revenue share of 58.9% in 2024. This market is primarily driven by the presence of multiple countries that hold significant shares in the production of camel milk products. These include Kenya, Somalia, Saudi Arabia, Mali, Sudan, UAE, Chad, Ethiopia, Mauritania and others. The presence of multiple businesses in the region that produce several milk products using camel milk is also contributing to the growth of this market.

UAE dominated the regional camel milk industry with the largest revenue share in 2024. The factors that primarily influence the growth of this market include a higher share of demand, urbanization, increasing availability through offline and online distribution, the footprint of large enterprises working in the camel milk products market, and more.

Asia Pacific Camel Milk Products Market Trends

Asia Pacific held a significant share of the global camel milk industry in 2024. This market is mainly driven by the presence of Kazakhstan and India in the region. Demand from health-conscious consumers in the region, rise in availability and accessibility, and entry of prominent consumer goods or food and beverage industry participants in this market are projected to drive further growth.

China camel milk products market dominated the regional camel milk products market in 2024. This is attributed to factors such as growing demand from urban buyers, increasing awareness regarding the nutritional value and lower fat contents, ease of availability, and rising number of products launched by the key companies. Demand from the pharmaceutical industry also contributes to the growth of this market.

Key Camel Milk Products Company Insights

Some of the key companies in the global camel milk products industry include Desert Farms, Inc., Al Ain Farms, UK Camel Milk Ltd, Aadvik Foods, QCamel, and others. To address growing competition in the market, the major market participants have adopted strategies such as enhanced product portfolios, improved distribution strategy implementation, innovation, product differentiation, and more.

-

Al Ain Farms offers a wide range of products, such as milk, cheese, Laban, juices, camel milk, water, yogurts, and others. Its portfolio comprises low-fat and full-cream varieties in packaging sizes of 250ml, 500ml, and 1ltr.

-

Camelicious offers camel milk powder, flavored milk, fresh camel milk, ice cream, Laban, and UHT milk. Attractive packaging delivered in a convenient manner and different sizes, inclusion of locally applauded flavors such as cardamom and dates in portfolio offerings, and innovation are some of the key characteristics of Camelicious’ product line.

Key Camel Milk Products Companies:

The following are the leading companies in the camel milk products market. These companies collectively hold the largest market share and dictate industry trends.

- Camelicious

- Desert Farms, Inc.

- The Camel Milk Co. Australia Pty Ltd.

- Camilk

- CAMEL DAIRY SMITS (KAMELENMELKERIJ SMITS)

- Al Ain Farms

- Tiviski pvt Ltd.

- UK Camel Milk Ltd

- Aadvik Foods

- QCamel

- GCMMF (Gujarat Cooperative Milk Marketing Federation)

Recent Developments

-

In August 2024, AROYA Cruises, Cruise Saudi’s separate business unit, and Sawani, one of the dairy businesses, joined forces by signing a memorandum of understanding to offer Nougelato camel milk products on AROYA’s ships. The collaboration aims to enhance growth opportunities for the camel milk sector.

Camel Milk Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 15.36 billion

Revenue forecast in 2030

USD 24.02 billion

Growth rate

CAGR of 9.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; ANZ; Brazil; Argentina; South Africa; UAE

Key companies profiled

Camelicious; Desert Farms, Inc.; The Camel Milk Co. Australia Pty Ltd.; Camilk; CAMEL DAIRY SMITS (KAMELENMELKERIJ SMITS); Al Ain Farms; Tiviski pvt Ltd.; UK Camel Milk Ltd; Aadvik Foods; QCamel; GCMMF (Gujarat Cooperative Milk Marketing Federation)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Camel Milk Products Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global camel milk products industry report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Plain Milk

-

Flavored Milk

-

Powder

-

Ice Cream

-

Fermented

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

ANZ

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.